Don’t Wait for a Disaster to Build Your Emergency Kit

Two Weeks Ready: Be Prepared. Build Kits. Help Each Other.

The first few days after a disaster are often the most critical. Government and essential services may not be available right away, depending on the circumstances. It is imperative to have a plan in place for such a time, and be ready to act on your own.

Washington’s biggest disaster threat is from earthquakes. Washington State’s Emergency Management Division advises that we take precautions to be on our own for at least 2 weeks. Take a look at their Two Week Ready Brochure (PDF) that outlines the basics necessary for your emergency kit. While it is important to get ready, don’t feel like you have to do it all at once. The list of necessities is long, so take a look at the agency’s year-long prep plan. You will also find information on pet preparedness, as well as the agency’s Drop, Cover, and Hold Earthquake Scenario map.

Windermere and the Seahawks are Back for Another Season to #TackleHomelessness!

All of us at Windermere are very excited to kick off our third season as the Official Real Estate Company of the Seattle Seahawks!

Once again, our #tacklehomelessness campaign is front-and-center, with the Windermere Foundation donating $100 for every Seahawks home-game tackle during the 2018 season to YouthCare, a Seattle-based non-profit organization that has been providing services and support to homeless youth for more than 40 years. Over the last two years, the Seahawks helped us raise over $66,000 through our #tacklehomelessness campaign, and this year we are looking forward to raising even more money – and awareness – for this important cause.

Our partnership with the Seahawks and YouthCare fits perfectly with the mission of the Windermere Foundation which is to support low-income and homeless families in the communities where we have offices. Through the #tacklehomelessness campaign, we hope to be able to do even more.

Back to School Basics

The first day of school sneaks up so fast… summer is here and then gone in a flash! Use these helpful tips to start getting settled into a new routine for fall, before life gets hectic.

Start talking about it. New teacher, new classmates, new schedules can all create some anxieties with kids. Start talking about school a few weeks before the first day. Talk about practical things like what the new schedule will be like, but also make sure to address their feelings and concerns about the upcoming year.

Start talking about it. New teacher, new classmates, new schedules can all create some anxieties with kids. Start talking about school a few weeks before the first day. Talk about practical things like what the new schedule will be like, but also make sure to address their feelings and concerns about the upcoming year.

Go back to school shopping early. The store aisles are currently packed with school supplies. Take advantage of your summer schedule to shop while the store isn’t as busy and the supplies haven’t been picked through. Don’t forget to buy extras for homework time or the winter re-stock that inevitably happens in January.

Determine how your child will get to and from school and practice the route.

Ease back into the scheduled days. When you and your kids are used to lazy mornings and staying up late, it can be incredibly difficult to shift to the early morning school bus rush. To ease the transition, start 7-10 days before school starts, and shift bedtimes and wake-up times gradually. Every day, start their bedtime routine 10-15 minutes earlier and wake them up 10-15 minutes earlier until they’re back on track. And don’t forget to readjust your bedtime schedules, too!

Re-set eating habits. When school starts, your student’s eating patterns need to maintain a high level of energy throughout the day. Implementing a routine for breakfast, lunch and snacks is just as important as their sleeping patterns. Begin this transition 7-10 days before school starts as well.

Sync your calendars. Add the school calendar to your personal/family calendar, so important dates like parent-teacher night aren’t missed.

Set rules for after school. After-school time and activities such as TV, video games, play time, and the completion of homework should be well-thought out in advance. Talk about the rules (and consequences) for these before school starts.

The Windermere Foundation Partners with Pearl Jam & Seahawks

August 8th-10th will be an exciting time in Seattle. Pearl Jam, Seattle’s own original grunge band will be hosting two shows at Safeco Field on August 8th and 10th, and the Seattle Seahawks kick off their preseason schedule at Century Link on August 9th. Besides providing great entertainment for music and football fans, both of these events will give back to the community.

August 8th-10th will be an exciting time in Seattle. Pearl Jam, Seattle’s own original grunge band will be hosting two shows at Safeco Field on August 8th and 10th, and the Seattle Seahawks kick off their preseason schedule at Century Link on August 9th. Besides providing great entertainment for music and football fans, both of these events will give back to the community.

The two Pearl Jam shows have been coined The Home Shows as Seattle is Pearl Jam’s home town; but more importantly, proceeds from both shows will be donated to organizations such as Mary’s Place, the YMCA and The Mockingbird Society to help fight homelessness. These organizations have programs in place that are helping to improve the homeless crisis in our city. The Windermere Foundation has partnered with Pearl Jam and their Vitalogy Foundation and joined other organizations such as Alaska Airlines, Nordstrom, Tom Douglas, and The Bill and Melinda Gates Foundation to help sponsor these two benefit shows.

The Windermere Foundation has always been rooted in working towards overcoming homelessness and helping families and children get back on their feet. The Home Shows aligned with the Windermere Foundation’s mission, making it a natural fit for this partnership. Check out this video of Mike McCready, Pearl Jam’s guitarist serenading Windermere for our partnership.

On August 9th, the Seattle Seahawks kick off their pre-season schedule which also kicks off the Windermere Foundation’s third year of partnering with the Seattle Seahawks to Tackle Homelessness. For every defensive tackle that takes place at a regular season home game, the Windermere Foundation will donate $100 towards Youth Care, an organization that helps youth struggling with homelessness or transitional living.

Thanks to the generosity of Windermere agents, staff, franchise owners, and the community, the Windermere Foundation has proudly donated a total of $920,351 so far this year to non-profit organizations that provide services to low-income and homeless families. This brings the total amount of money that the Windermere Foundation has raised since 1989 to over $36 million.

Each Windermere office has its own Windermere Foundation fund account that they use to make donations to organizations in their local communities. Our office recently sent 24 low-income children to YMCA’s Camp Orkila and Camp Colman with funds that we raised. These kids will enjoy a life changing week of summer camp, meeting new friends and experiencing the outdoors. These experiences would not be possible without the support of our clients. For each transaction that Windermere closes, the Windermere agent involved donates a portion of their commission to the Windermere Foundation. Thank you for your support of our business; it helps make the Windermere Foundation possible!

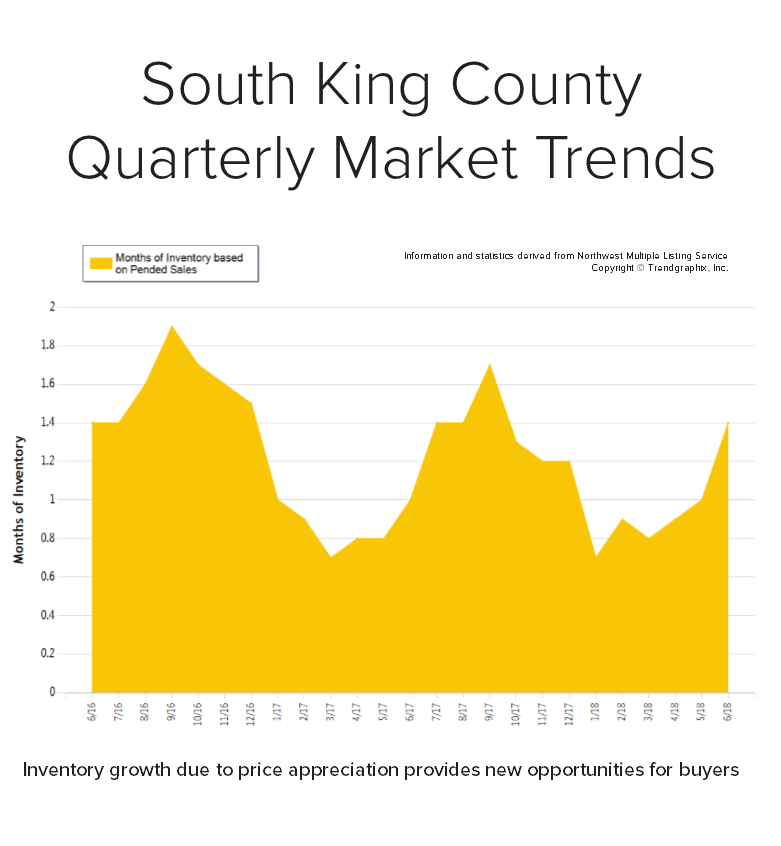

Quarterly Reports: Q2 South King

Q2: April 1 – June 30, 2018

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade!

Price appreciation has created this phenomenon, motivating many people to make big moves with their equity. In fact, prices are up 13% year-over-year. We currently sit at 1.4 months of inventory based on pending sales. This more-equal balance of homes for sale compared to the first quarter has created great opportunities for buyers, finally! While it is still a seller’s market, it has eased up a bit. The average days on market in June was 15 days and the average list-to-sale price ratio was 101%.

South King County real estate has been an affordable option compared to “in-city” real estate. In fact, the median price in June was 75% higher in Seattle Metro. Sellers are enjoying great returns due to buyers choosing to lay down roots in our area, and buyers are securing mortgages with minor debt service due to low interest rates. The easing of inventory is a welcome change and is helping to temper price growth.

This is only a snapshot of the trends in south King County; please contact me if you would like further explanation of how the latest trends relate to you.

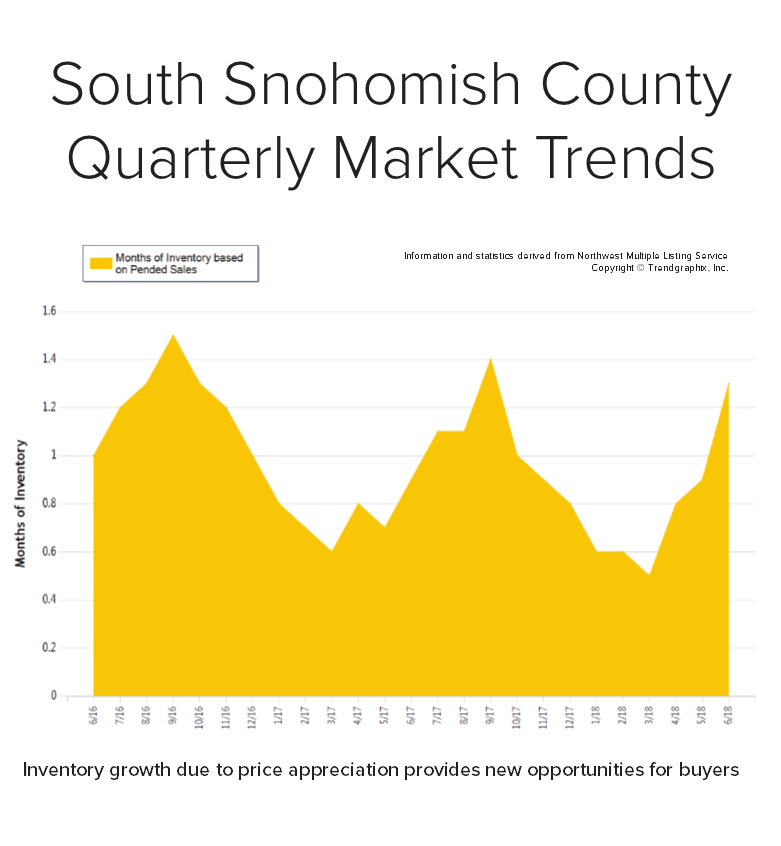

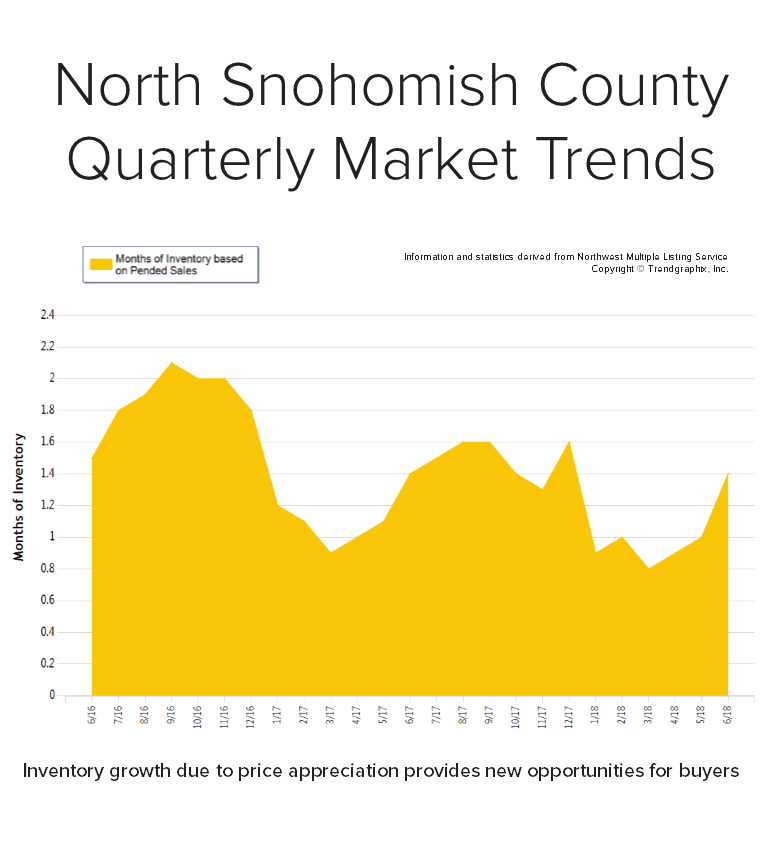

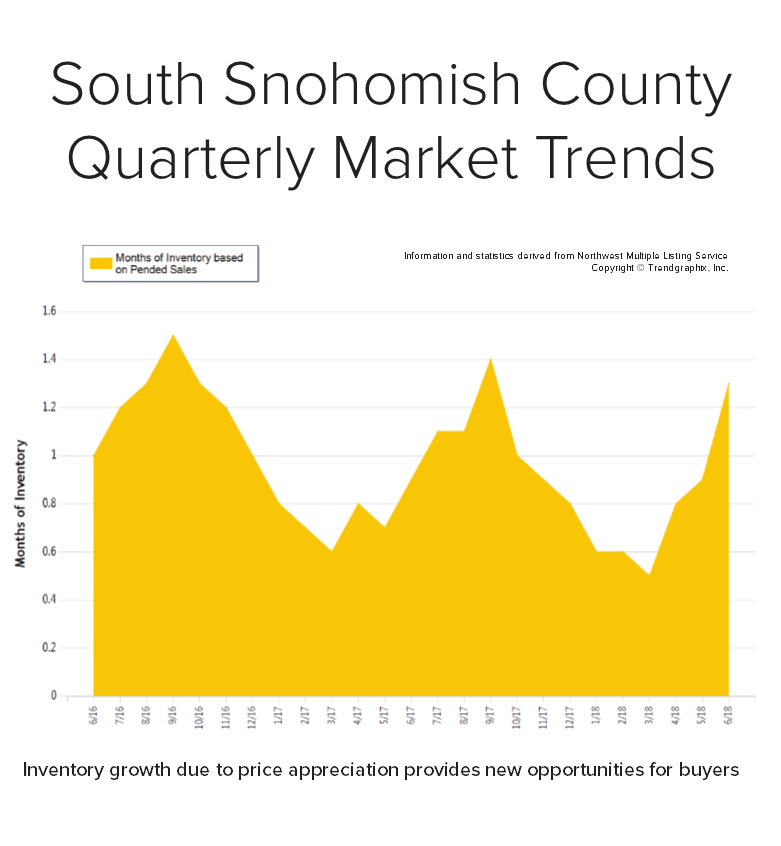

Quarterly Reports: Q2 North Snohomish

Q2: April 1 – June 30, 2018

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade!

Price appreciation has created this phenomenon, motivating many people to make big moves with their equity. In fact, prices are up 11% year-over-year. We currently sit at 1.4 months of inventory based on pending sales. This more-equal balance of homes for sale compared to the first quarter has created great opportunities for buyers, finally! While it is still a seller’s market, it has eased up a bit. The average days on market in June was 21 days and the average list-to-sale price ratio was 101%.

North Snohomish County real estate has been an affordable option compared to “in-city” real estate. In fact, the median price in June was 86% higher in Seattle Metro. Sellers are enjoying great returns due to buyers choosing to lay down roots in our area, and buyers are securing mortgages with minor debt service due to low interest rates. The easing of inventory is a welcome change and is helping to temper price growth.

This is only a snapshot of the trends in north Snohomish County; please contact us if you would like further explanation of how the latest trends relate to you.

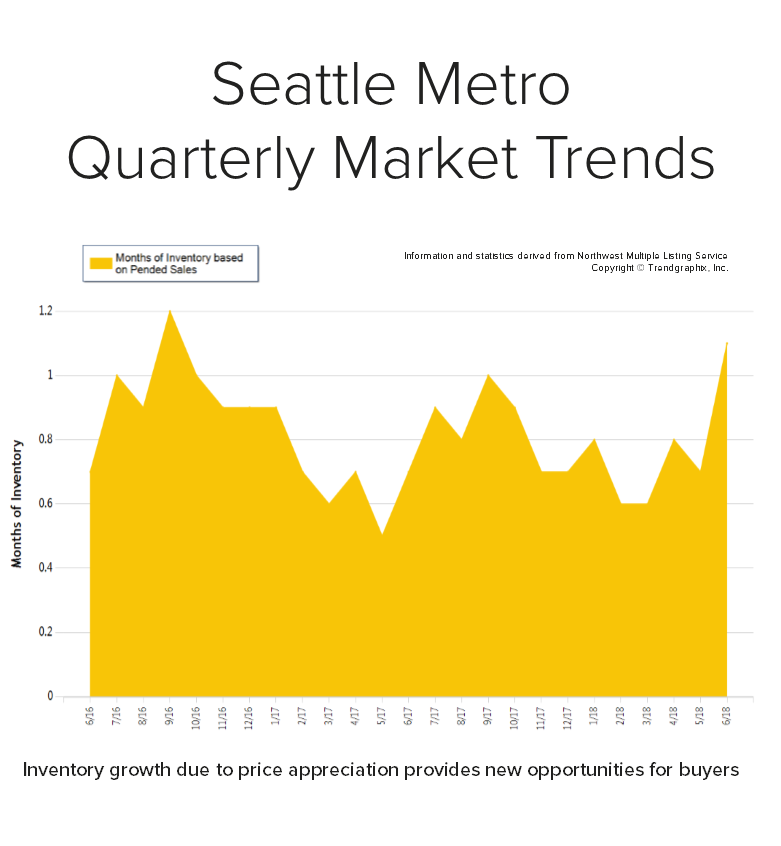

Quarterly Reports: Q2 Metro

Q2: April 1 – June 30, 2018

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade!

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade! Price appreciation has created this phenomenon, motivating many people to make big moves with their equity. In fact, prices are up 15% year-over-year. We currently sit at 1.1 months of inventory based on pending sales. This more-equal balance of homes for sale compared to the first quarter has created great opportunities for buyers, finally! While it is still a seller’s market, it has eased up a bit. The average days on market in June was 15 days and the average list-to-sale price ratio was 102%.

Seattle Metro real estate has a very high premium due to close-in commute times and vibrant neighborhoods. In fact, the median price in June was $800,000. Sellers are enjoying great returns due to buyers choosing to lay down roots in our area, and buyers are securing mortgages with minor debt service due to low interest rates. The easing of inventory is a welcome change and is helping to temper price growth.

This is only a snapshot of the trends in the Seattle Metro area; please contact us if you would like further explanation of how the latest trends relate to you.

Quarterly Reports: Q2 Eastside

Q2: April 1 – June 30, 2018

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade!

Price appreciation has created this phenomenon, motivating many people to make big moves with their equity. In fact, prices are up 11% year-over-year. We currently sit at 1.5 months of inventory based on pending sales. This more-equal balance of homes for sale compared to the first quarter has created great opportunities for buyers, finally! While it is still a seller’s market, it has eased up a bit. The average days on market in June was 19 days and the average list-to-sale price ratio was 101%.

Eastside real estate has a very high premium due to close-in commute times, great neighborhoods and strong school districts. In fact, the median price in June was $980,000. Sellers are enjoying great returns due to buyers choosing to lay down roots in our area, and buyers are securing mortgages with minor debt service due to low interest rates. The easing of inventory is a welcome change and is helping to temper price growth.

This is only a snapshot of the trends on the Eastside; please contact us if you would like further explanation of how the latest trends relate to you.

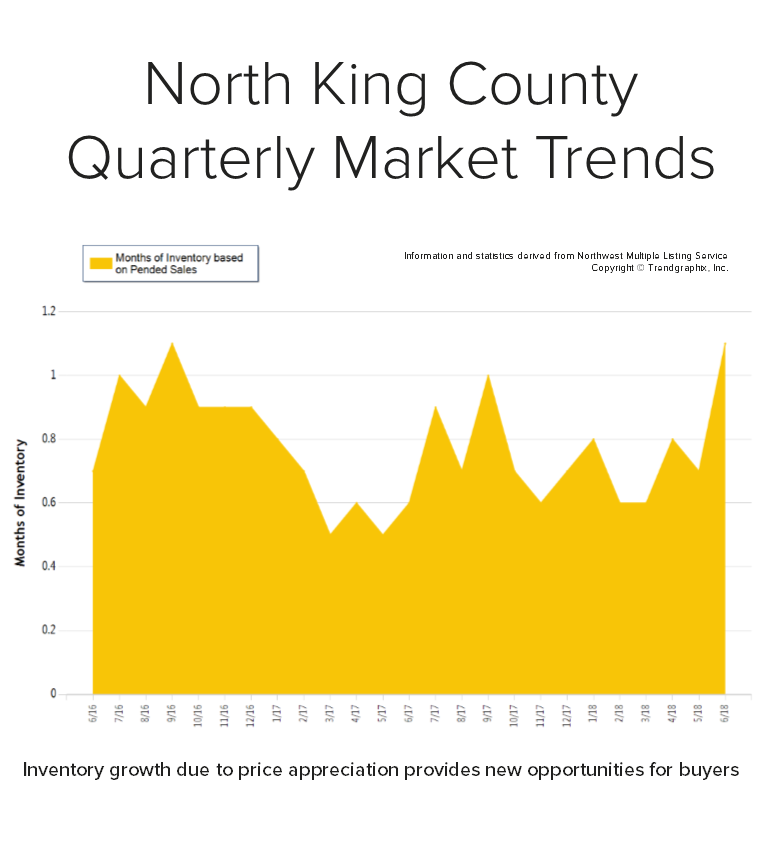

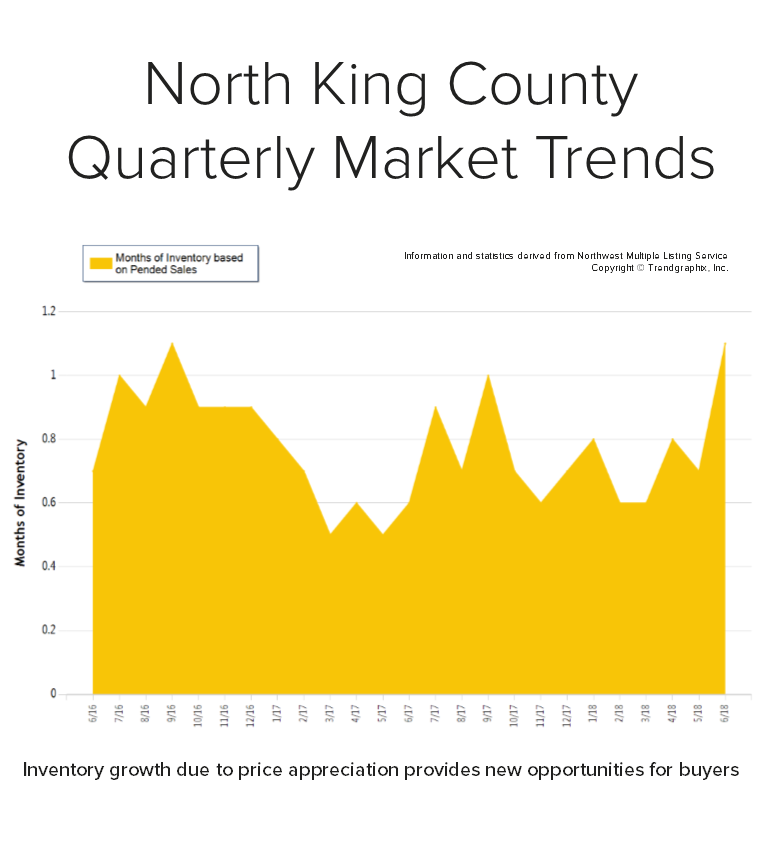

Quarterly Reports: Q2 North King

Q2: April 1 – June 30, 2018

As we head into the summer months we are seeing a healthy jump in inventory in our area. In May, we saw the biggest jump in new listings in a decade!

Price appreciation has created this phenomenon, motivating many people to make big moves with their equity. In fact, prices are up 13% year-over-year. We currently sit at 1.1 months of inventory based on pending sales. This more-equal balance of homes for sale compared to the first quarter has created great opportunities for buyers, finally! While it is still a seller’s market, it has eased up a bit. The average days on market in June was 16 days and the average list-to-sale price ratio was 103%.

North King County real estate has a very high premium due to close-in commute times and vibrant neighborhoods. In fact, the median price in June was $800,000. Sellers are enjoying great returns due to buyers choosing to lay down roots in our area, and buyers are securing mortgages with minor debt service due to low interest rates. The easing of inventory is a welcome change and is helping to temper price growth.

This is only a snapshot of the trends in north King County; please contact us if you would like further explanation of how the latest trends relate to you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link