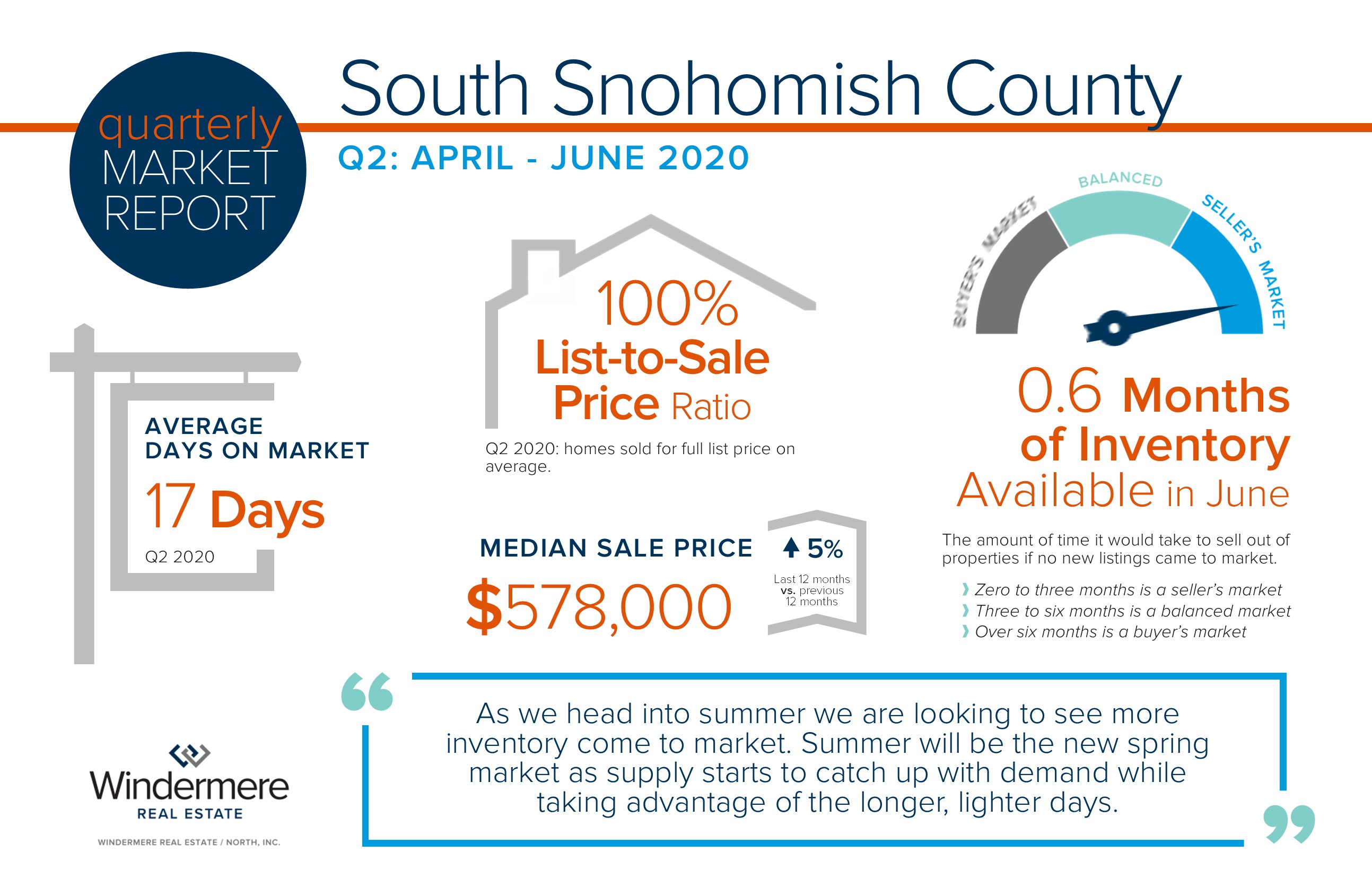

South Snohomish County Quarterly Market Trends – Q2 2020

The real estate market performed very well in the second quarter despite the changing and challenging environment due to the COVID-19 health crisis. Our industry has been considered essential and required to operate with strict protocols in place to help protect the safety of buyers, sellers, brokers, and service providers. The ability to still do business helped sales churn during what would have been our busiest season, spring market.

Interest rates remain at the lowest levels we have ever seen, creating strong buyer demand and providing plentiful audiences for listings. The biggest challenge we saw in the second quarter was a lack of sufficient housing inventory for buyers to choose from, especially in the lower to medium price ranges. Understandably, would-be sellers were delayed in coming to market and some even stepped aside to survey their safety and motivation. This led to a 26% decrease in new listings in the second quarter vs. the same quarter last year. All the while, pending sales were only down 7%, illustrating the demand in comparison to supply.

This classic supply and demand scenario has helped maintain price appreciation. With only 0.6 months of available inventory based on pending sales, the median price is up 5% complete year-over-year. As we head into summer, we are looking to see more inventory come to market. Summer will be the new spring market as supply starts to catch up with demand while taking advantage of the longer, lighter days.

These are unprecedented times and there are many questions and concerns. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

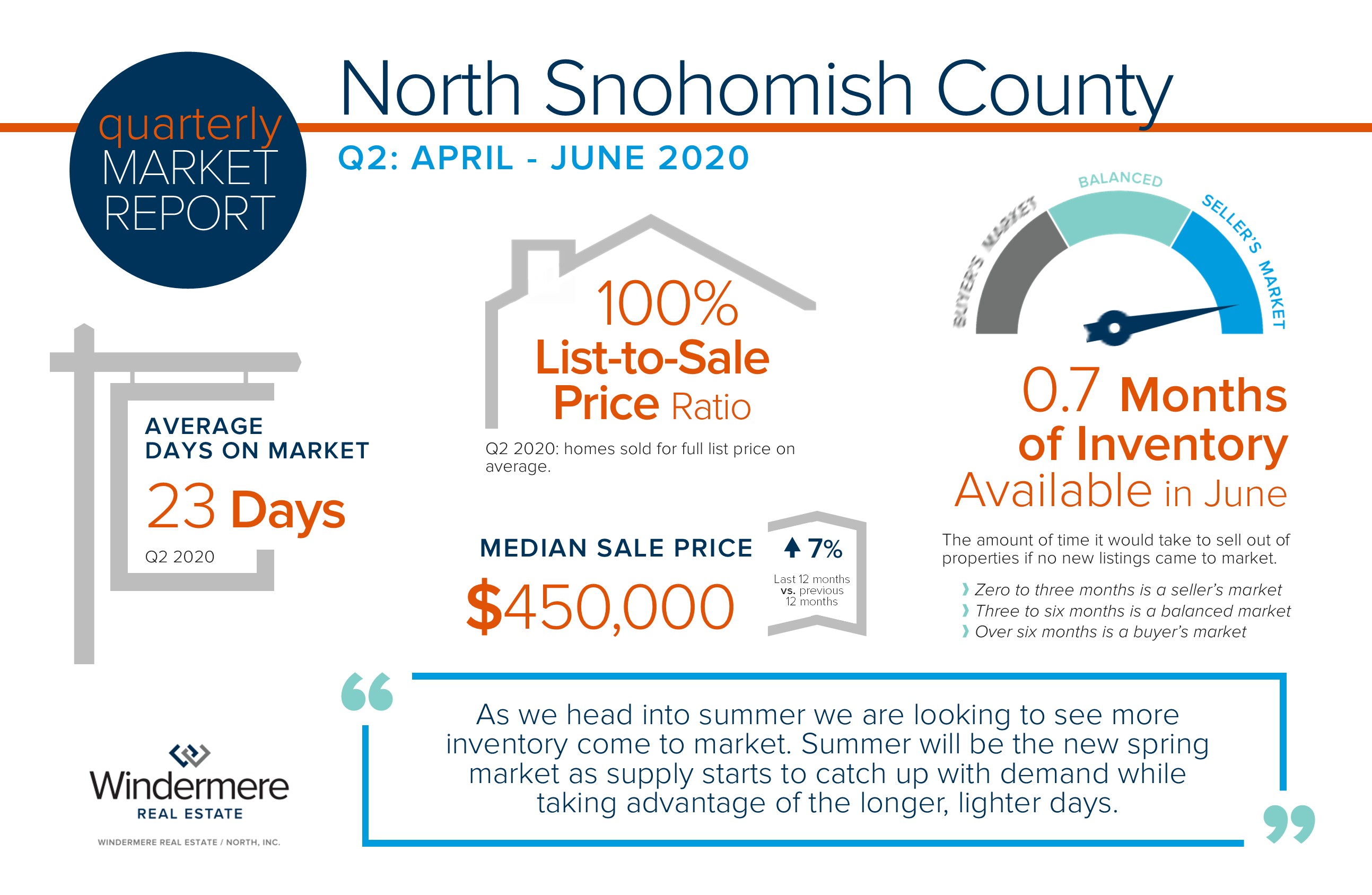

North Snohomish County Quarterly Market Trends – Q2 2020

The real estate market performed very well in the second quarter despite the changing and challenging environment due to the COVID-19 health crisis. Our industry has been considered essential and required to operate with strict protocols in place to help protect the safety of buyers, sellers, brokers, and service providers. The ability to still do business helped sales churn during what would have been our busiest season, spring market.

Interest rates remain at the lowest levels we have ever seen, creating strong buyer demand and providing plentiful audiences for listings. The biggest challenge we saw in the second quarter was a lack of sufficient housing inventory for buyers to choose from, especially in the lower to medium price ranges. Understandably, would-be sellers were delayed in coming to market and some even stepped aside to survey their safety and motivation. This led to a 21% decrease in new listings in the second quarter vs. the same quarter last year. All the while, pending sales were only down 1%, illustrating the demand in comparison to supply.

This classic supply and demand scenario has helped maintain price appreciation. With only 0.7 months of available inventory based on pending sales, the median price is up 7% complete year-over-year. As we head into summer, we are looking to see more inventory come to market. Summer will be the new spring market as supply starts to catch up with demand while taking advantage of the longer, lighter days.

These are unprecedented times and there are many questions and concerns. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

Currently Gathered Micro-Data Illustrating Summer is the New Spring Market

Since the onset of the COVID-19 pandemic reaching our region, I quickly shifted to updating you more frequently with information to help you stay informed on the real estate market. Since mid-March, I have been committed to gathering high-frequency data (micro-data) to help illustrate “Where We Are Now” and have provided this newsletter bi-monthly vs. monthly. I felt this was important as real estate is typically our biggest investment and the pandemic has certainly had its economic impact.

I have also closely followed Windermere’s Chief Economist Matthew Gardner, and Economist Steve Harney of Keeping Current Matters. They have both been knowledgeable guides and source their micro-data from various credible sources to help determine their conclusions. Check out Matthew’s latest video update below about the real estate market in relation to COVID-19.

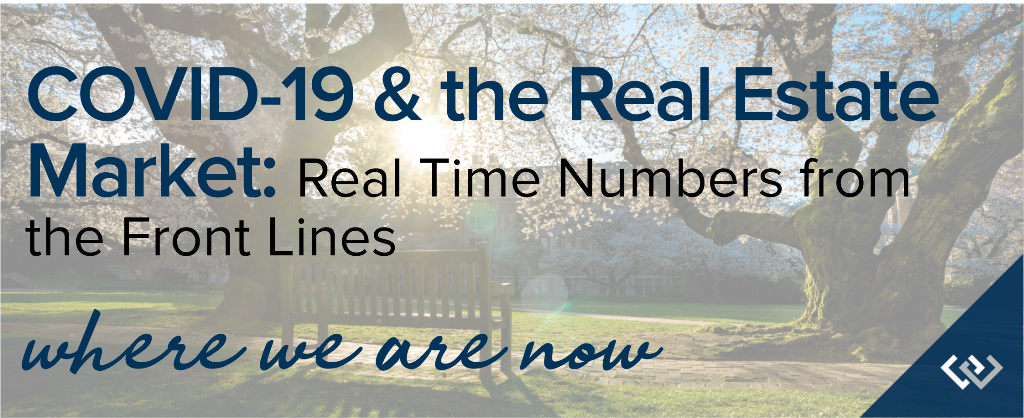

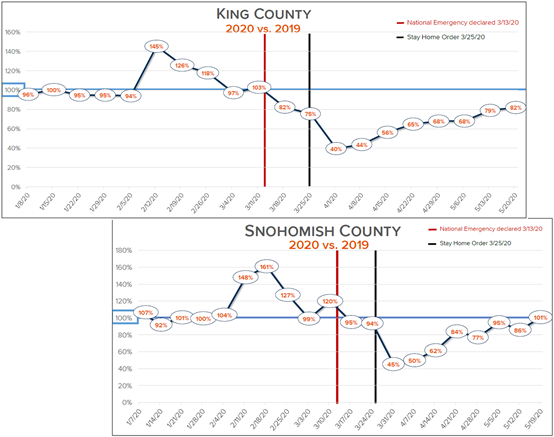

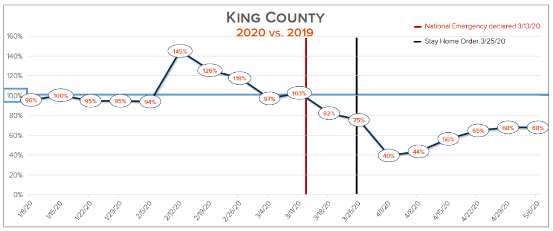

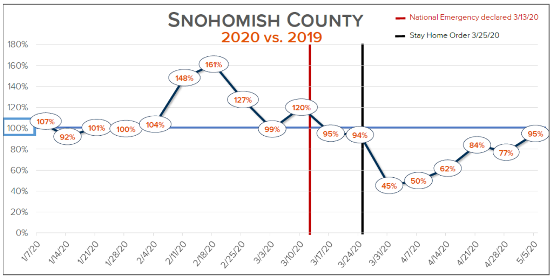

The graphs below are a new data set I’ve been studying on a weekly basis. They compare the number of pending sales reported each week to the same week in 2019, which was another stellar year for our local real estate market. 2020 was outpacing 2019 when the National Emergency was declared and then dropped significantly once the Stay Home Orders were put in place in late March.

April stalled, and rightfully so: pending sales were down as people retreated into their homes and started new routines, such as working from home. As we ventured into May however, things changed. From mid-May until now, pending sales activity in both counties has started to reach or outpace 2019 numbers.

Spring is typically our peak season for real estate sales, and what is being made clear is that the historically-active spring market has now shifted to summer. As we come off the Summer Solstice and head into the warmer months, we are seeing tons of buyers out in the marketplace and a limited supply of available inventory. This combination has helped prices maintain, and in some areas appreciate.

One set of micro-data that is illustrating increased buyer demand is the uptick in mortgage applications. Last week, mortgage applications were up 20% over the same week last year. Note this is for purchase loans, not refinances. With the lowest rates we have ever seen in history it is no surprise that buyers are motivated to go secure a home with the lowest debt service ever!

Last week, the micro-data set of the recorded home-showing appointments displayed a 51% increase in showings over 2019! This is measured by comparing key box access compared to the same week last year. Demand certainly paused in the spring, but was not eliminated; it was being deferred to the summer. As we have reported from the beginning, this is a health crisis, not a housing crisis.

Our biggest challenge as we head into the peak summer months is the available inventory. We entered into 2020 with tight inventory to begin with, and COVID-19 has had a profound impact on the number of homes coming to market. We are expecting some homes to wait until the health crisis has passed, and others will be delayed by 45-60 days. Homes take time to prepare for market, and contractors and handy-persons were all at home in April, pushing prep time out to later spring/early summer for those ready to come to market.

We expect to see an increase in new listings as we head into July and August, which will be welcomed after a 40% deficit compared to 2019. Mortgage applications, historical interest rates, industries in our region that are thriving, and entering into Phase 2 are all micro-data sets that indicate strong buyer demand for the second half of 2020.

Unemployment numbers are also an important micro-data point to keep an eye on. Since the Stay Home Orders, initial unemployment claims have dropped significantly, but continued claims are maintaining. We anticipate the continued claims to reduce as more and more people return to work after being furloughed. Not all of those jobs will be recovered, indicating our greatest need for recovery.

The last three months have been an incredible journey helping people safely navigate the real estate market. Some folks just want to know that their nest egg is safe, and some are making actual moves. When COVID-19 hit there was a ton of uncertainty, we weren’t sure how this would play out in regards to housing. Since we went into this with a very formidable economy and housing values, we have sustained, and in some areas we are thriving. It has been remarkable to watch and be a part of. I am grateful every day that this is not the housing crash of 2008 all over again.

If you are curious about the value of your home in today’s market or are considering a move, please reach out. The interest rates are unbelievable and will greatly benefit those who take advantage of them. I am committed to safe business practices and follow all of the protocols put in place, which include mask-wearing, proper social distancing, and sanitizing. It is my goal to help keep my clients informed and empower strong, safe decisions, especially during unprecedented times. Thank you for your trust; I am honored to be your trusted advisor.

SHRED EVENT

NEW DATE! We are partnering with Confidential Data Disposal for our 9th year; providing you with a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

⯈ Saturday, July 18th, 10AM to 2PM

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 20 file boxes per visitor.

⯈ We will also be collecting non-perishable food and cash donations to benefit Concern for Neighbors food bank. Donations are not required, but are appreciated. Hope to see you there!

⯈ This is a no-contact, drive-through event. We ask that you stay in your vehicle and unlock your trunk or car door so that we can unload your boxes. We will be taking all proper precautions to keep everyone safe, including wearing PPE, maintaining distance, and using CDC-recommended disinfectants.

**This is a Paper-Only event. No x-rays, electronics, recyclables, or any other materials.

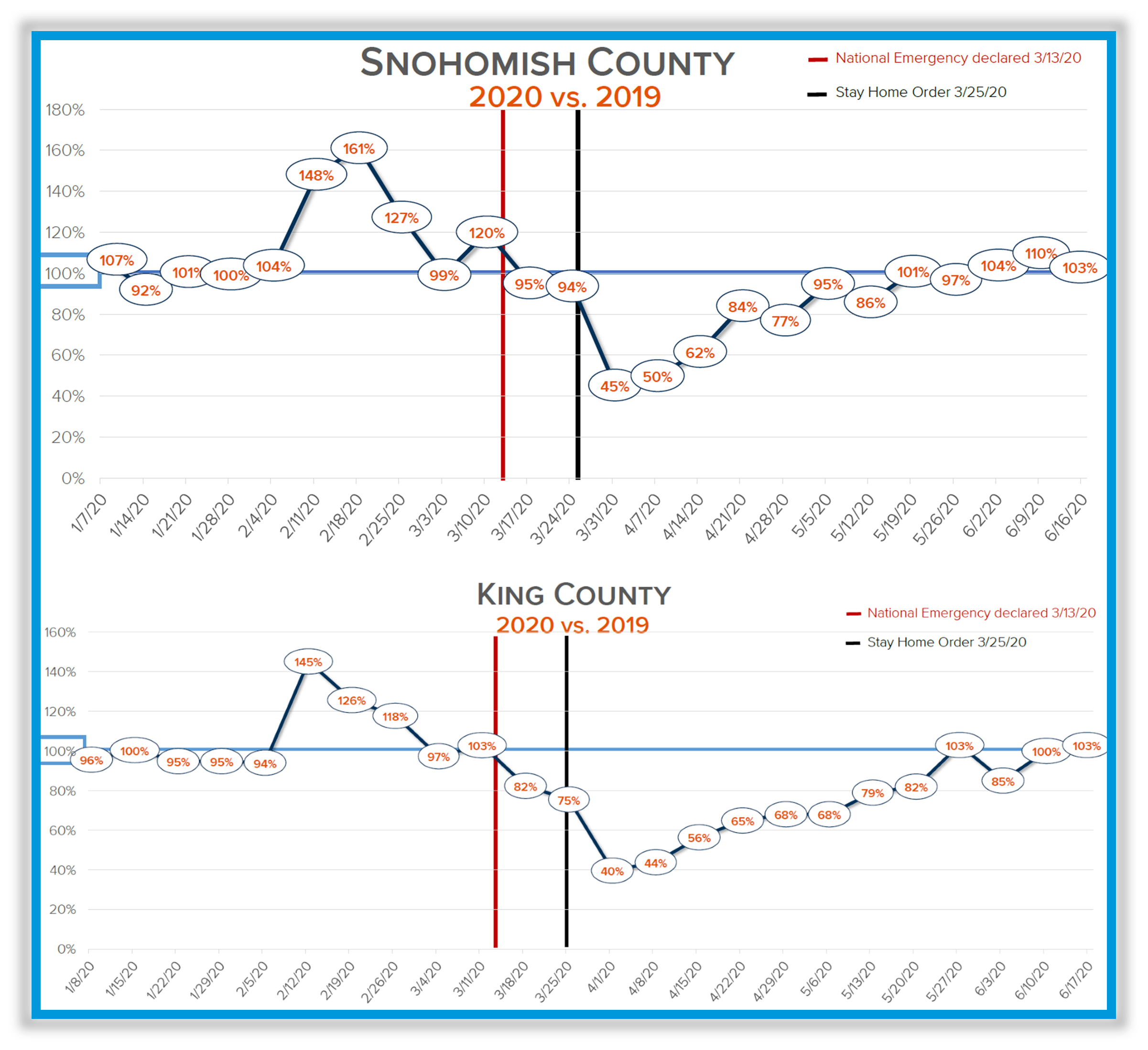

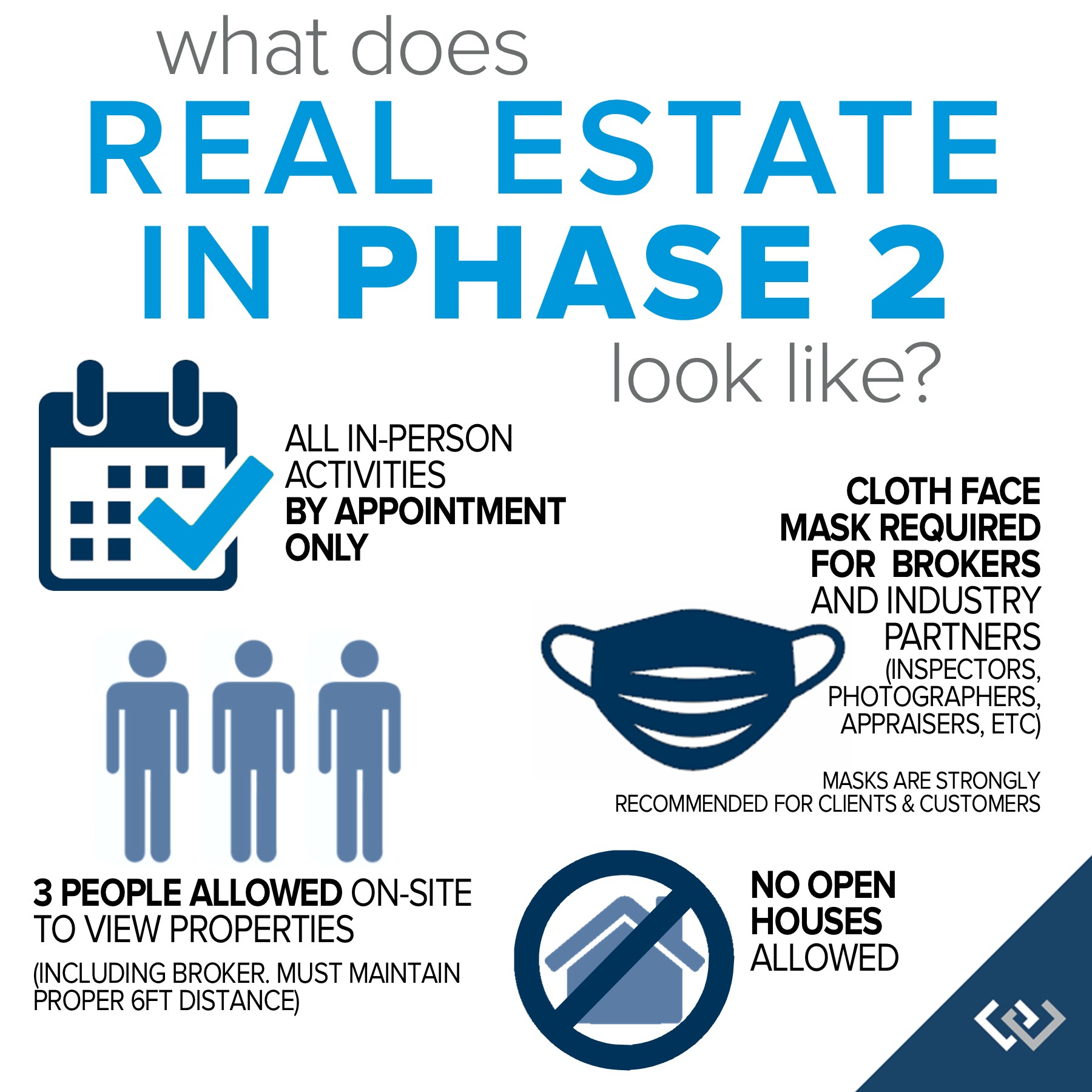

Real Estate in Phase 2

As we transition into Phase 2 in our region, we have been allowed to expand our activities to best serve our clients in the safest way possible.

- Our office has re-opened: 9am-3pm daily.

- All in-person activities are by-appointment only. This includes showing homes and meeting at the office.

- Real Estate Brokers and industry partners (inspectors, photographers, appraisers, etc) are required to wear a cloth face mask at all times. *Due to the Governor’s statewide mask mandate, clients and customers are now also required to wear face masks as well.

- Three people are allowed on-site to view properties.

- Open houses or any such public viewing of homes are not allowed.

What is Happening with Home Prices?

What is Happening with Home Prices?

It is without question we are living in one of the most unique times in all of our lives. Who would have thought we’d experience living life during a global pandemic? Beyond staying safe, adjusting daily habits, and navigating a changing economy, I’ve kept a very close eye on the housing market. With Windermere’s Chief Economist, Matthew Gardner as one of my guides, I am happy to report that housing has been a bright light in the economy during a very challenging time.

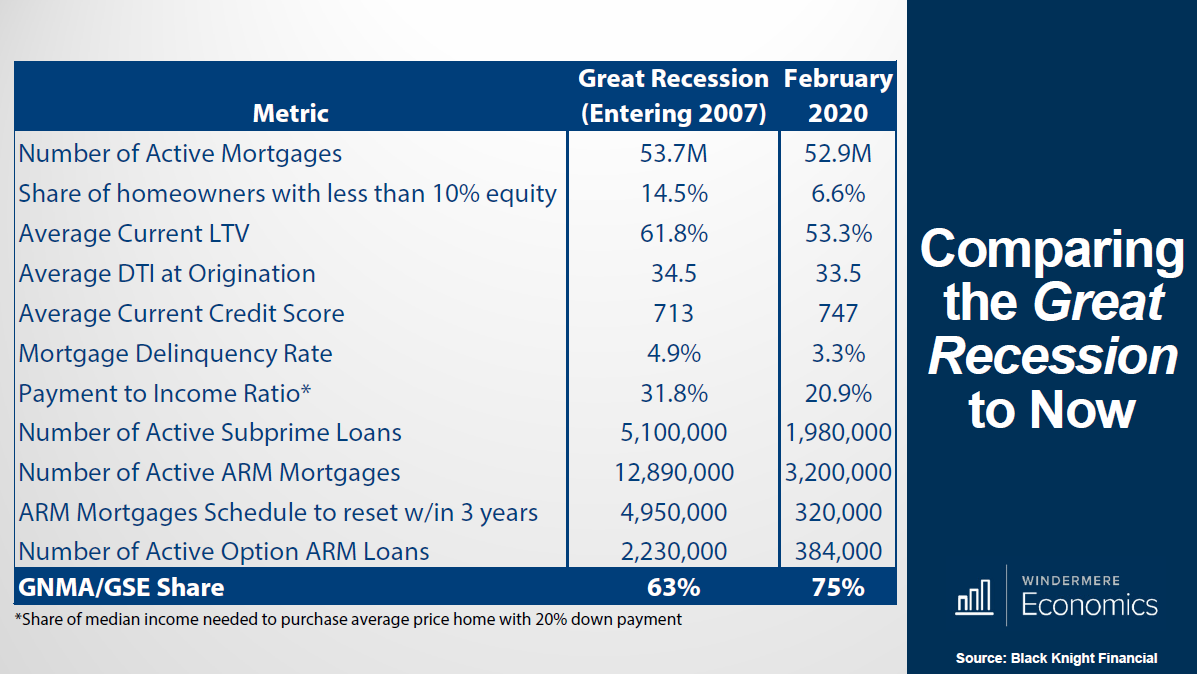

May unemployment numbers settled around 13%, an improvement over April, but still far from the 5% we started out with at the beginning of 2020. We are also embarking on our second quarter of retraction in GDP which is the textbook definition of a recession. Many experts are predicting a V-shaped recovery and I’d venture to say that we are currently at the bottom of the V.

With stay-at-home orders being lifted or eased depending on what part of the country you live in, we are starting to see jobs come back. Conversely, we are also seeing some industries thrive, but we will also witness some businesses be required to pivot to remain relevant or go away altogether. For example, tech is thriving and aerospace is not. The reorganization and re-prioritizing that is occurring will be impactful to many, some positive and some challenging.

In our region of the country, we entered into this pandemic with a thriving economy and a strong housing market. In January it was predicted that we would see a year-over-year price appreciation of around 5%. This health crisis will slow that level of appreciation, but we are not expecting losses.

Spring is typically our busiest time in the market with many sellers coming to market and buyers shopping in order to land in their new home by summer and the start of the fall school season. COVID-19 and the associated limitations in our daily activities along with employment disruption created a slowdown in our typical spring market. The largest impact has been the amount of available inventory to choose from. Amazingly, the housing market has continued to hum along with many buyers still eager to purchase. Inventory is down 40% year-over-year and buyer demand is strong, creating a frenzy in some price ranges and neighborhoods.

According to Joel Kan, Economist for the Mortgage Bankers Association mortgage applications are on the rise and up 5% from the same time last year. Summer is looking to be the re-invented spring market as our country starts to re-open. Interest rates are the lowest they have ever been, which is encouraging buyers to act and creating a good-sized audience for sellers.

Below is a video where Matthew speaks to his predicted trajectory for home prices as we travel through the second half of 2020 and beyond. Also, note below the latest statistic for both King and Snohomish Counties for the month of May.

It is always my goal to report real-time numbers from the front lines and do my best to explain what is happening. I choose to look at the numbers in tight snippets week-by-week and also dig deep on year-over-year numbers. Right now, we are reporting growth from March and starting to return to the same amount of activity that we saw at the same time last year. We must keep a close eye on unemployment figures and mortgage forbearance reporting, both of which are improving but still have a ways to go.

It is my goal to help keep my clients informed and empower strong decisions by studying the stats and reporting my day-to-day observations. Please reach out if you or someone you know has questions or concerns. These are unprecedented times and knowledge is one of your most powerful tools. I am honored to be your trusted advisor.

Congrats Class of 2020!

The class of 2020 deserves a huge congratulations! The milestone of finishing elementary school, junior high, high school or college is always worth noting, but this class is extra-special!! They have navigated distance learning and missed out on the proper celebrations, but they’ve shown resilience and finished strong. The world is proud of you and so am I!

A heartfelt thank you to all the teachers, administrators and staff that helped guide all the students this school year! Distance learning is not for the faint of heart and the teachers are amongst the heroes during this challenging time!

Will COVID-19 Impact Where People Want to Live?

Will COVID-19 Impact Where People Want to Live?

Will COVID-19 Impact Where People Want to Live?

Recently, Matthew Gardner, Windermere’s Chief Economist released a video about the effects COVID-19 is having and/or could have on consumer tendencies in real estate. There seems to be quite the paradigm shift happening due to health reasons, appreciating simpler schedules, and the new phenomenon of many people working from home. Along with Matthew, Leading Real Estate Companies of the World and Keeping Current Matters are reporting similar indicators due to COVID 19.

The Flight to the Suburbs: Many buyers are listing more open space and less density as one of their top features when looking for a new home. The larger yards and separation from neighbors found in the suburbs versus urban areas are appealing for health reasons, due to the need to socially distance. Higher density buildings and townhouses found in-city were more appealing due to shorter commute times, but the newfound option to work from home has encouraged some buyers to venture out and consider commute times as less of a factor when choosing where they want to live.

Many high-tech employers such as Amazon, Google, and Facebook have extended the work-from-home option until the end of 2020 despite the phasing to get businesses re-opened. Companies like Twitter told some employees they could work from home indefinitely. This will have some buyers in these types of jobs capitalizing on suburban living, which is typically less expensive than in-city living and includes larger homes and yards. Look at the weekly stats for both King and Snohomish counties below. This compares the number of pending sales per week this year versus the same week last year, and the more suburban and affordable area of Snohomish County is thriving!

Return of the McMansion: Millennials had already begun looking at the suburbs as they embarked on crossing the threshold of big life events such as getting married and starting a family. Now, with more people working from home and desiring more space, the larger square footage homes are becoming more appealing.

This affords more flex spaces for at-home offices, especially if more than one adult is working from home. Space to enjoy hobbies and passions such as an in-home yoga or craft studio or in-home gym are predicted to be popular. Further, private outdoor spaces are a hit, such as fire pits, play areas for children, and outdoor entertaining space which encourages recreation and distancing.

Second-Home Market Boom: With air travel severely reduced, the desire to have a second home within driving distance has increased. Many people’s commitments have simplified and their dreams have shifted to accommodate more down-time closer to home. The change of scenery a lake, beach, or mountain property provides along with space to distance is quickly becoming in-demand. The use of homes like this versus large travel budgets could make a comeback, especially if future rental income is considered. Overall, we have seen an increased value put on local access to nature to decompress and down-shift.

Single-Family Residential Rentals vs. Apartment Rentals: Again this comes back to density versus open space. Renters also desire more room, and some are also working from home, so they may opt for a single-family home over an apartment building with shared space. There could also be a push for college students to prefer renting a single-family home instead of living in a dorm, increasing the rental value of such investment properties in college towns.

Check out the video below to hear Matthew’s entire take on all of these possible changes in how and where we want to live based on COVID 19 and the life lessons were are learning as we navigate this new way of life. What I can tell you is that the real estate market is moving! Activity has seen a large uptick since the first of May, and in many areas and price points we are lacking available inventory to meet the buyer demand.

If you are curious how these new trends and the state of current real estate market relates to your personal needs and dreams, please reach out. It is my goal to help keep my clients informed and empower storing decisions, especially during these unique times. Be well!

I am excited to share some updates from the Martha Perry Veggie Garden in Snohomish, WA! We have already purchased the vegetable starts to help support the Snohomish Garden Club, and have begun planting for the harvest. My office is working in socially distant groups, broken up by nine groups working over three weeks to get this acre of produce in the ground. By using starts instead of seeds we will be able to provide the harvest sooner and for longer throughout the season.

This is all possible thanks to your generosity! Our office raised $8,000 in under two weeks to benefit local food banks through our Neighbors in Need Program powered by the Windermere Foundation. A portion of that money was earmarked for this garden project and replaced our annual Community Service Day project that was done for the last four years in a large group of 50 people. This will provide local food banks with thousands of pounds of fresh produce throughout the summer and early fall and will be especially meaningful during this challenging time. Check out some of our first groups getting to work, making it possible for those in need to enjoy fresh produce instead of only non-perishable foods via the local food banks.

Are we keeping pace with 2019: A Look at Weekly Sales Activity Amid the Stay at Home Orders

There have been a lot of questions that I have encountered about the stability of the housing market due to the global health crisis of COVID-19. I have kept close track of the statistics and daily activity in our market in order to help keep my clients well informed. Inventory levels remain very tight and buyer demand has started to return since the Stay Home Orders were put in place.

There have been a lot of questions that I have encountered about the stability of the housing market due to the global health crisis of COVID-19. I have kept close track of the statistics and daily activity in our market in order to help keep my clients well informed. Inventory levels remain very tight and buyer demand has started to return since the Stay Home Orders were put in place.

Interest rates are at the lowest point they have ever been, providing amazing opportunities for both buyers and sellers. Interest rates continue to fuel buyer demand and create an audience for home sellers. Recently, rates were as low as 3.33%, which is historic.

Below is a chart that shows the amount of weekly pending sales in 2020 in relation to the weekly pending sales during the same week in 2019.

In King County, you can see that we started the year off with activity similar to the robust year of 2019. In February 2020, there were more sales, but that was due to “Snowmageddon” in February 2019. March 2020 started off in concurrence with 2019, but once the Stay Home Orders were put in place there was a dramatic and expected drop in pending sales activity.

When the Stay at Home Orders were first put in place, showings were not allowed, causing a legitimate pause in transactions. The following week, the orders were adjusted to allow for showings and since then the amount of pending sales has increased each week. Protocols for showings include only two people in the home at one time, by appointment only, while practicing 6-foot social distancing.

These protocols, along with virtual showings and many different digital tools using video, have helped buyers and sellers safely come together in transactions. Agents are getting creative in order to best serve their buyers and sellers during this unique time. This has helped quell demand brought on by interest rates and the many industries still thriving despite recent unemployment numbers. See this video from Matthew Gardner regarding the latest unemployment report and his forecast.

Snohomish County followed the same initial pattern as King County, but has seen a quicker return to 2019 sales levels. This is due in part to the more affordable price points in Snohomish County compared to King. In fact, the days on market for closed sales in April 2020 were quicker by 34% at 21 days, and the list-to-sale price ratio was up 1% to 101% over April 2019. Additionally, the median price is up 3% complete year-over-year. In King County, the median price was up 1% complete year-over-year and days on market quicker by 41% at 17 days, and a flat list-to-sale price ratio of 101%.

Tight inventory started in January and continued due to sellers holding off coming to market amid COVID-19. Available inventory is currently not meeting the buyer demand in the market, especially in the lower to middle price ranges. The higher price points have been affected by the increased cost to obtain a jumbo loan, but are still seeing movement. We anticipate more homes coming to the market as we enter into the different phases Washington State has planned to reopen the economy and remain as safe as possible.

For some, now is the right time to sell, and for some it will be later down the road. The timing, safety, and comfort all need to be assessed along with the market data. What I’m pleased to report is that our market is not crashing. In fact, it is adapting! We will most likely find a balance as we head into the remainder of Q2 and start Q3. Many jobs are set to return as the phases unfold. Unlike the 2008 Great Recession, this is a health crisis, not a housing crisis; see this video from Matthew Gardner on this topic. The numbers are telling that story and so is the recent activity.

I strive for excellence when it comes to educating my clients, especially during these historic times that have created uncertainty. I am committed to providing accurate data and real-time information. Please reach out if you’d like to discuss this information and how it relates to your investment and lifestyle. It is simply my goal to help keep you informed and empower strong decisions. Be well!

We couldn’t have done it without you! Thanks to your generosity, we have surpassed our fundraising goal to benefit local food banks. The Windermere Foundation is matching every dollar up to $3,500, so we will be able to give a total of $7,500 to help feed our neighbors in need.

A portion of this money will go towards buying vegetable starts for the Martha Perry Veggie Garden, which will provide thousands of pounds of fresh produce to local food banks through the summer. Our office will soon get to work helping plant those starts along with the Snohomish Garden Club. We will be in small groups practicing proper social distancing over the course of several days in order to efficiently and safely get this acre of land planted. The rest of the funds will go to the Volunteers of America, who will stretch every dollar to its fullest extent throughout many food banks and food pantries across the county.

This is a portion of a larger fundraiser throughout the Windermere network. The funds are still being counted, but the total amount being given to local food banks is currently over $600,000!

Thank you!

Are we Headed Towards a Repeat of the 2008 Housing Meltdown?

Are we Headed Towards a Repeat of the 2008 Housing Meltdown?

The pressure the COVID-19 global pandemic is putting on the economy is a reality. As a real estate broker, I take great pride in having the honor of being your trusted advisor when it comes to your investment in the housing market and protecting the value of your home. I have been asked several times, “Is this the Great Recession all over again?”

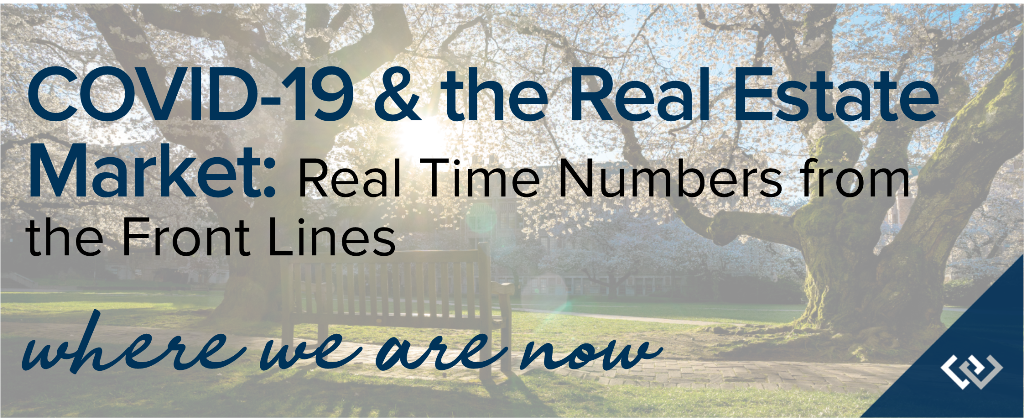

At Windermere, we have continued to rely on the expertise of Matthew Gardner, Windermere’s Chief Economist. Above is a chart he shared from Black Knight Financial comparing the housing market as we headed into this global health crisis versus the start of the Great Recession in 2007. Below is an 11-minute video going over the chart line by line. I urge you to watch the video and key in to his expertise versus what you might hear in the media. Matthew predicted the Great Recession and does not shy away from heeding the truth, even if it is not great news. I trust him and I hope you do too.

Bottom line, we are heading into this economic challenge with a much more formidable foundation based on more stringent lending practices, higher equity levels, and we are anticipating a shorter 1-2 year V-shaped recovery, compared to the long U-shaped recovery of the 5-year Great Recession. In fact, we have seen pending sales rise over the last three consecutive weeks, some even with multiple offers. Every neighborhood and every price-point has its own story. Please reach out with any questions or concerns. It is my goal to help keep you informed and empower strong decisions.

We’re on a mission to help our local food banks keep their shelves stocked during this uncertain time. For every dollar our office raises, the Windermere Foundation is matching up to $3,500 through May 5th! This is a part of a total of $250,000 in matching funds from the Windermere Foundation, with the goal to give $500,000 to food banks across the areas that Windermere serves.

The need has never been greater, so we’re partnering with the trusted Volunteers of America (VOA) of Snohomish County, who know how to stretch every dollar to its fullest extent and successfully manage many of the food banks and food pantries across the county. In addition, a portion of the total raised will go towards buying vegetable starts for the Martha Perry Veggie Garden (MPVG) managed by the Snohomish Garden Club (SGC) – which will supply local food banks with thousands of pounds of fresh produce throughout the summer and early fall.

Our team of agents at Windermere North will be planting close to an acre of starts on behalf of the VOA at the MPVG with the SGC the end of May into early June in small groups practicing proper social distancing. We have done this project for three years as a larger group and we are thrilled to creatively get it done this year. Food Banks have always coveted fresh produce and this effort will be more meaningful than ever this year.

If you are able to give, any amount will help make an impact and directly benefit our Neighbors in Need: gf.me/u/xy7ikd

Thank you!!

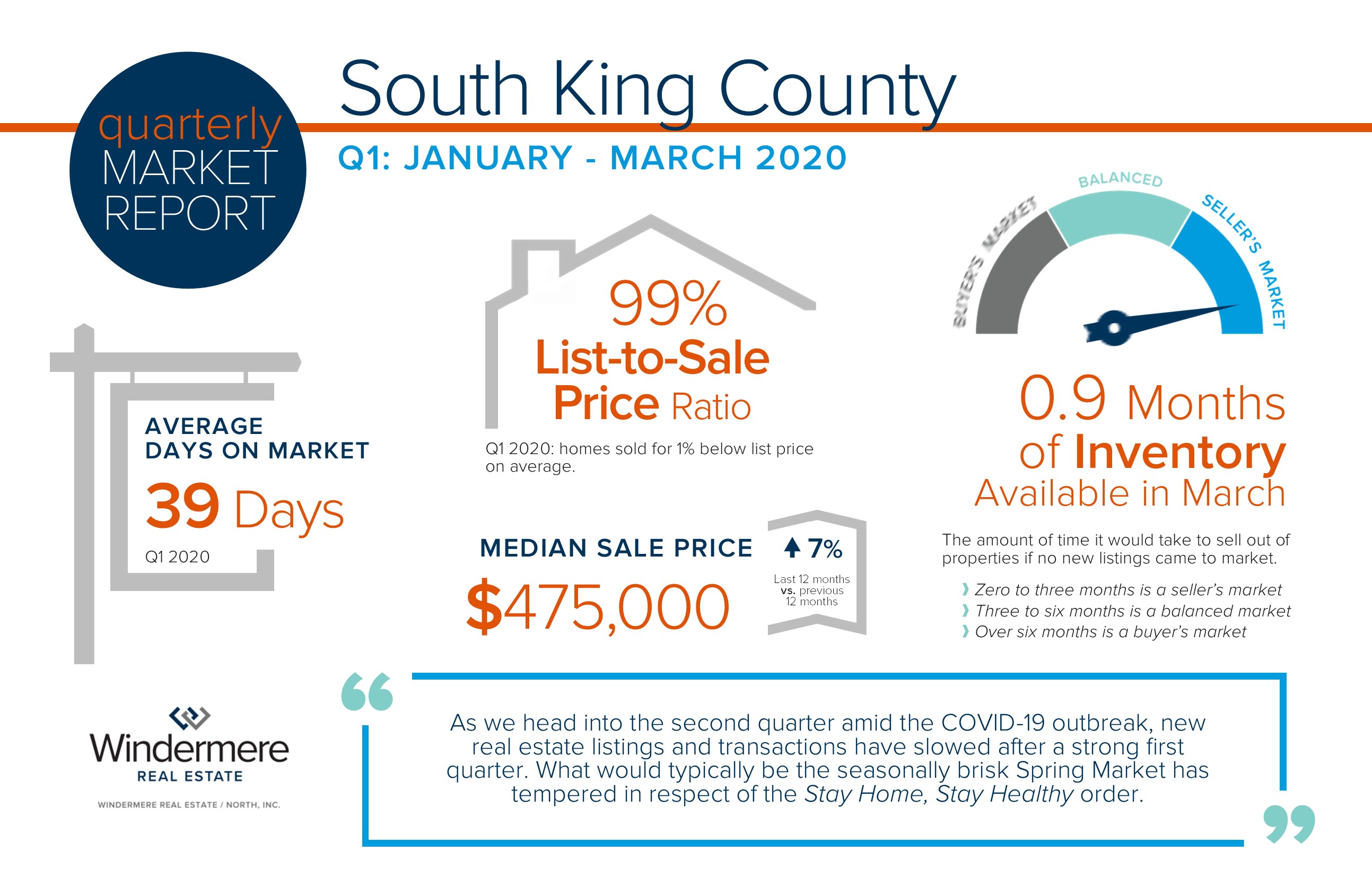

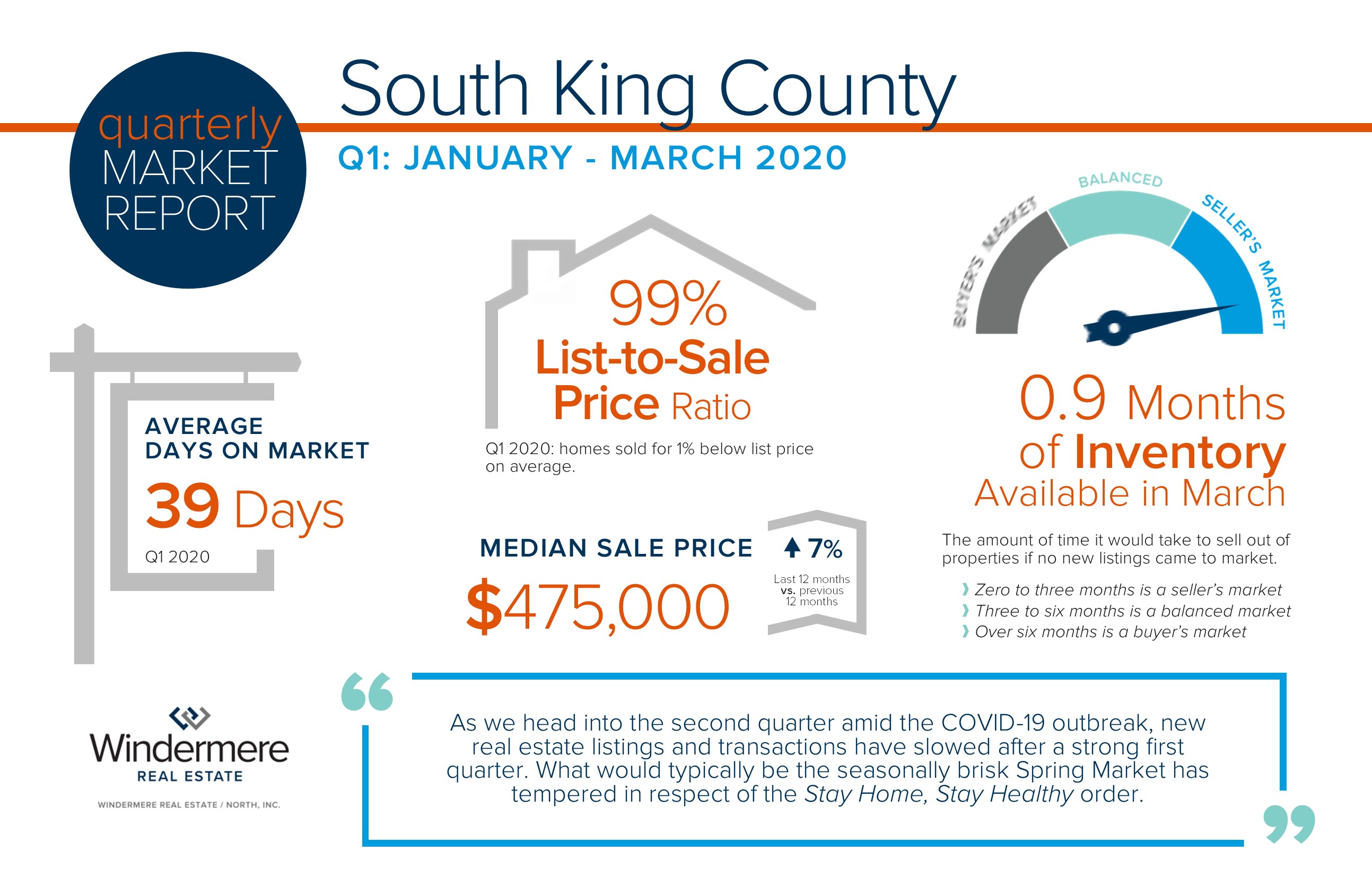

South King County Quarterly Market Trends – Q1 2020

As we head into the second quarter amid the COVID-19 outbreak, new real estate listings and transactions have slowed after a strong first quarter. What would typically be the seasonally brisk Spring Market has tempered in respect of the Stay Home, Stay Healthy order.

During this time, some sellers are still coming to market and there are motivated buyers carefully viewing and purchasing homes. I’m happy to report that sellers are maintaining their home sale values through these negotiations. We anticipate pent-up demand for both sellers and buyers once the orders are lifted, and see the summer season becoming the new spring for real estate and a more normal second half of 2020, bearing control of the virus. We also look forward to many jobs returning once the orders are lifted. We are fortunate to be in the Greater Seattle Area, as many industries such as tech and biotech will hold small businesses on their shoulders once their workers return to the brick and mortar locations.

Prior to the outbreak, we anticipated complete year-over-year price growth to be 4-6%. That has been adjusted to 1-3% due to this health crisis. Another important element to consider is equity levels: 43% of homeowners in King County have more than 50% equity in their home.

These are unprecedented times and there are many questions and concerns. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

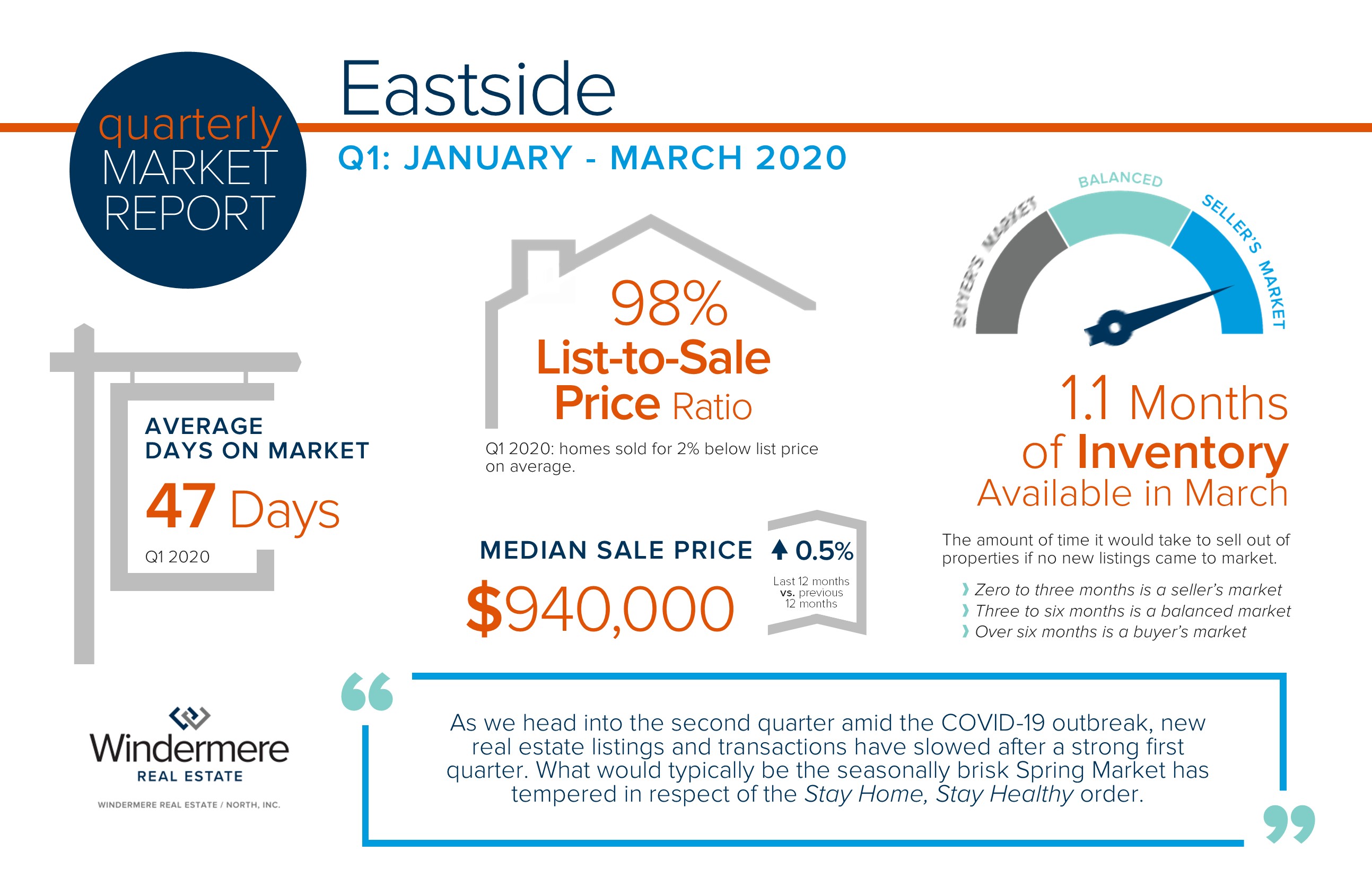

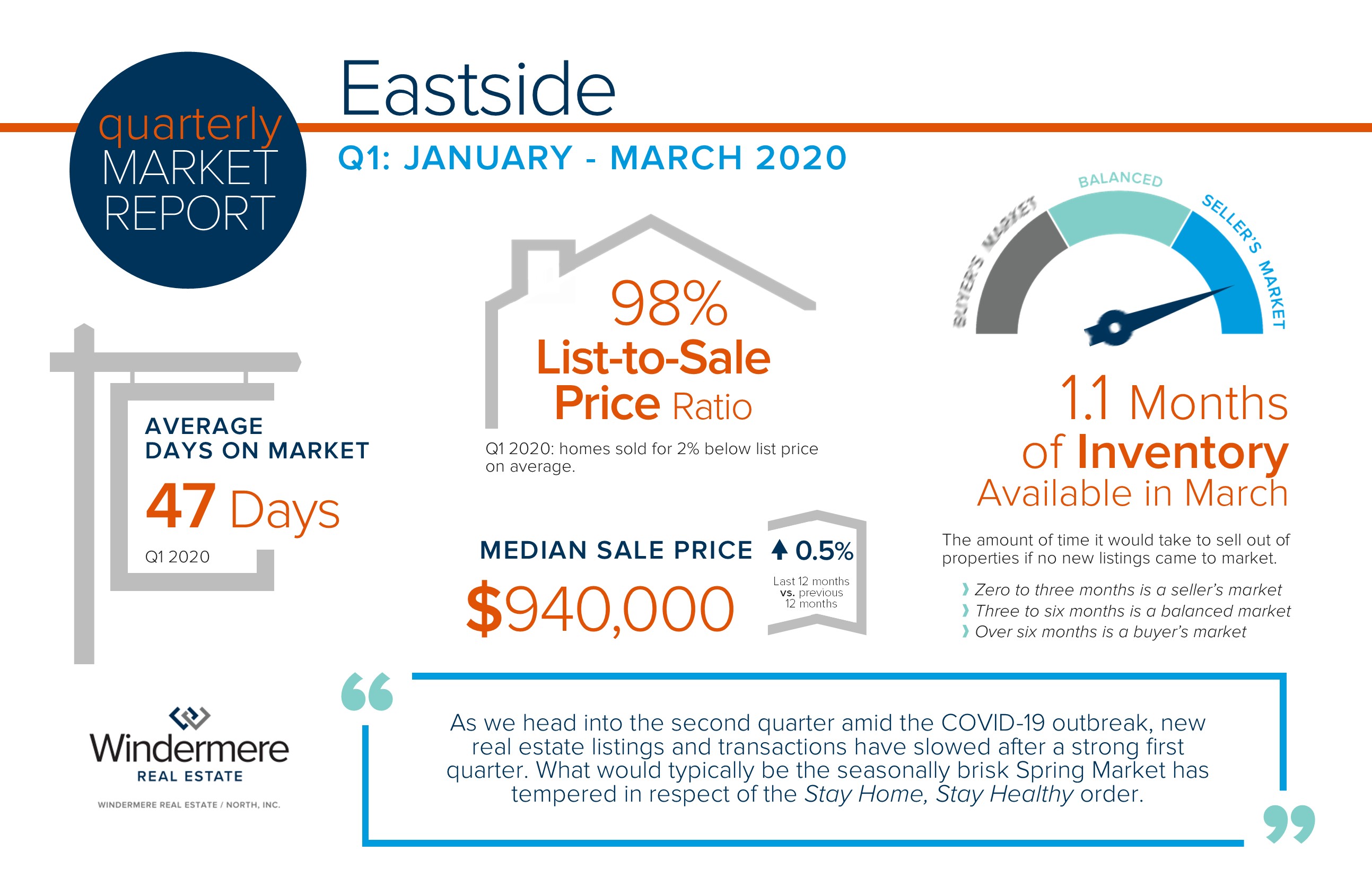

Eastside Quarterly Market Trends – Q1 2020

As we head into the second quarter amid the COVID-19 outbreak, new real estate listings and transactions have slowed after a strong first quarter. What would typically be the seasonally brisk Spring Market has tempered in respect of the Stay Home, Stay Healthy order.

During this time, some sellers are still coming to market and there are motivated buyers carefully viewing and purchasing homes. I’m happy to report that sellers are maintaining their home sale values through these negotiations. We anticipate pent-up demand for both sellers and buyers once the orders are lifted, and see the summer season becoming the new spring for real estate and a more normal second half of 2020, bearing control of the virus. We also look forward to many jobs returning once the orders are lifted. We are fortunate to be in the Greater Seattle Area, as many industries such as tech and biotech will hold small businesses on their shoulders once their workers return to the brick and mortar locations.

Prior to the outbreak, we anticipated complete year-over-year price growth to be 4-6%. That has been adjusted to 1-3% due to this health crisis. Another important element to consider is equity levels: 43% of homeowners in King County have more than 50% equity in their home.

These are unprecedented times and there are many questions and concerns. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link