South Snohomish County Quarterly Market Trends – Q4 2020

The 2020 real estate market was a bright spot in the economy and the fourth quarter finished strong, with the median price up 12% complete year-over-year. Interest rates started the year just over 3.5% and ended the year under 3%! The long-term average rate is 7.9%, putting into perspective the massive advantage for homebuyers which has created feverish demand for available homes. Even though new listings were down by 6% in 2020, low interest rates helped drive a 3% increase in closed sales.

Pandemic-driven moves were spurred by folks working from home, taking early retirement, and in some cases responding to job loss. Remote working eliminated the need to have a home close to work which encouraged people to flee to the suburbs. Eliminating the commute and the desire for larger spaces with outdoor enjoyment quickly moved to the top of peoples’ wish lists. The last 8 years of positive price growth has led to formidable seller equity, enabling early retirement for some and/or the opportunity to liquidate and recover from the negative effects in some employment industries.

We expect rates to stay low in 2021 and with many Millennials coming of age there will continue to be large amounts of homebuyers eagerly waiting for fresh inventory. Ending the year at 0.3 months of inventory is essentially ground zero for selection, putting home sellers in the driver’s seat for now. I will continue to keep you updated throughout 2021 as we navigate these unique times. It is my goal to help keep my clients informed and empower strong decisions; please reach out if I can help.

Goal Setting with Self-Compassion

We all know that there is no magic in the first day or month of the year, and yet we are all drawn to the idea of new beginnings. A fresh start. And so with 2020 finally put to bed, many of us are setting goals for this fresh, new year.

The topic of new year’s resolutions or goals can be a polarizing one. The fact that most people give up on or forget about their resolutions within a month or two is a widely known fact. So is it better to avoid setting goals entirely? Should we make broad, unrealistic resolutions knowing they won’t last, just to feel like we’re doing something?

If we set goals simply because we feel like we should, or because we are wishing for change in our lives, there is little chance they will be accomplished. There must be a deep-rooted reason for setting a goal so that there is lasting motivation to achieve it. They must be attainable. And we must have grace for ourselves for when we inevitably fall off the wagon.

I have put together a few thoughts to consider during this first month of 2021:

Give Yourself Grace

Arguably the most important aspect of goal setting, and for many, the most difficult. We are all going to mess up at some point. Forget to do the thing we decided to do. Skip a day. Sleep in.

The big question is – do we let our guilt paralyze us from getting back on track? Do we slip into self-pity and frustration, losing sight of our desired outcome? Enter grace. Self-compassion.

There are three important aspects to self-compassion:

- Be mindful (instead of identifying with the problem). For example, be mindful of the fact that you are struggling with exercising regularly, instead of seeing yourself as a failure at exercise.

- Connect with other people (instead of isolating yourself). For example, realize that you are probably not the only one who struggles with exercise. Talk about your struggle with people who love and support you.

- Be kind to yourself (instead of being judgmental). For example, try saying to yourself “I forgive myself for my shortcomings, and I will try again.”

Self-compassion means applying the same understanding and kindness we have for other people to ourselves. Because everyone is worthy of compassion.

Goals > Resolutions

Words matter. A resolution is a firm decision to do or not do something. A goal is the object of a person’s effort.

Setting a goal provide us with a direction to follow. Goals require intention, planning and action, but they are less rigid than all-or-nothing resolutions. Often when we are shooting for a goal, even if we do not achieve exactly what we aimed for, we will still end up closer to it than when we started. Progress in the right direction is every bit as important as hitting that goal.

Is it Necessary?

When everyone around us is making changes and launching new things, it is easy to get swept up in the feeling of needing to do something. Before making any decisions or setting goals, ask yourself if it really needs to change. Or do you just want to feel like you’re doing something?

Often, change is needed. Other times, we would be better off sticking to what we are already doing. Part of the goal-setting process should always include serious thought and research on the things in your life or business that genuinely require change or movement.

Consider the Impact

Once we have decided that something does, indeed need to change, it is important to spend some time thinking about the impact that this change will have. How will it make you feel? What will it bring to your life?

This gives us something to hold on to when we are wavering down the road. Hold tight to the feeling or the outcome this change will make in your life and keep coming back to that when things are hard.

Break it Down

Everyone’s heard this advice before, but it’s incredibly important to break our goals down into manageable bite-size pieces. Setting broad goals will inspire frustration and discouragement when they aren’t achieved. Small, specific goals are more doable, keeps us from getting overwhelmed, and each little “win” provides motivation to keep going.

If you’ve already set your 2021 goals, I invite you to reflect on what you have set, why you have set them, and how you can show self-compassion in 2021. Remember that it isn’t about changing things to fit the perfect “mold”, but figuring out what it is we really want to do. Let’s make changes in a sustainable way that allows us space to be kind to ourselves along the way.

A new year is a great opportunity to set goals and work towards change. But really, any day is an opportunity. What are you working towards today?

December 2020 Newsletter – Helping our Neighbors in Need

As 2020 comes to a close, we pause to take inventory for what we are thankful for and look for opportunities to give back to those in need. We would typically be hosting our annual Santa Photo Event around this time, but this year we are pivoting to this very important food drive. The global pandemic and the effect it has had on the economy have increased the amount of people in our community that are food insecure. We are closing out the year with our fourth food drive to help support our Neighbors in Need.

As 2020 comes to a close, we pause to take inventory for what we are thankful for and look for opportunities to give back to those in need. We would typically be hosting our annual Santa Photo Event around this time, but this year we are pivoting to this very important food drive. The global pandemic and the effect it has had on the economy have increased the amount of people in our community that are food insecure. We are closing out the year with our fourth food drive to help support our Neighbors in Need.

Please consider stopping by my office from December 9th through the 16th from 9 am-3 pm to drop off food or cash donations. There will be carefully placed food bins just outside of our suite door and box for cash donations. If you can’t make it to my office, you can also make a donation to our GoFundMe fundraiser. We will deliver the bounty to the Concern for Neighbors Food Bank in time for the holidays.

Together we can make a difference and help keep the cupboards full this holiday season for our Neighbors in Need.

Thank you & Happy Holidays!

Newsletter, November 2020 – Inventory, Equity & Experts: Laying Fact Over Fact to Find the Truth in the Housing Market.

It is important that we pay attention to the data when measuring the health of the housing market. There are a lot of feelings and media influences that can play into one’s opinion of the housing market. I choose to focus on three things: inventory, equity levels, and the experts. This has been and will continue to be my guide in order to be a valuable aid to my clients. To quote Peter Kann, former publisher of the WSJ, “truth is attainable by laying fact upon fact”.

Inventory levels nationally and in our region continue to be historically low. In fact, national inventory levels are at 2.7 months of inventory, and are the lowest they have been since the National Association of Realtors (NAR) started to report them in 1982. There are only approximately 1.2 million single-family homes for sale across the nation. In King County, inventory levels sat at 0.8 months in September and only 0.4 months in Snohomish County. A seller’s market is defined by 0-3 months of inventory, and finding our region with less than one month has us operating in an extreme seller’s market!

The combination of scarce inventory and the lowest interest rates in history has led to above-average price growth year-over-year. Nationally, the single-family median home price is up 15% this September compared to the previous September. In King County, it is up 13%, and in Snohomish County up 14%. It is also important to measure complete year-over-year data. Taking just one month of data and comparing it to the same month a year ago definitely tells a story, but by taking the average of the last 12 months and comparing it to the previous 12 months, you get a more accurate picture of overall growth. It is important to look at both in order to analyze long-term and real-time trends. We must also consider the sustainability of such extreme price growth.

The complete year-over-year price growth percentages temper compared to just looking at the month of September. In King County, the single-family median price is up 5% complete year-over-year and up 8% in Snohomish County. This takes into consideration the stall we saw in the market when the pandemic hit, along with the less extreme inventory environment we started 2020 with. Looking at the data one way gives us the big picture and looking at the most recent data tells the story of what is happening now in comparison to a snapshot one year ago. Pricing is still an art in a seller’s market and even though we are seeing historically low inventory levels, it is certainly possible to over-price and miss the mark for a great outcome.

The multi-family market which includes condominiums is also seeing price growth, but not as strong as single-family. There seems to be a trend with more people working from home and retiring who want to obtain larger interior spaces and room for outdoor enjoyment. The suburbs and smalls towns are gaining a ton of traction with commute-times being lower on the list of considerations. However, the surge of first-time buyers coming into the market due to Millennials coming of age and the historically low interest rates has the multi-family market in growth mode as well.

Nationally, multi-family (which includes condo) inventory sits at four months of inventory, which is a balanced market. In King County, there are two months of available inventory and in Snohomish County 0.7 months. King County’s condo market has seen a larger flood of available inventory, with folks transferring equity to single-family homes in the suburbs and exiting the city. Both counties’ condo markets are still experiencing year-over-year price growth, but due to density in certain areas, price analysis should be studied by the specific building and location. The ability to eliminate commutes by working from home has taken the shine off of condo price affordability as some buyers are opting to purchase a single-family home further out, resulting in a similar monthly payment.

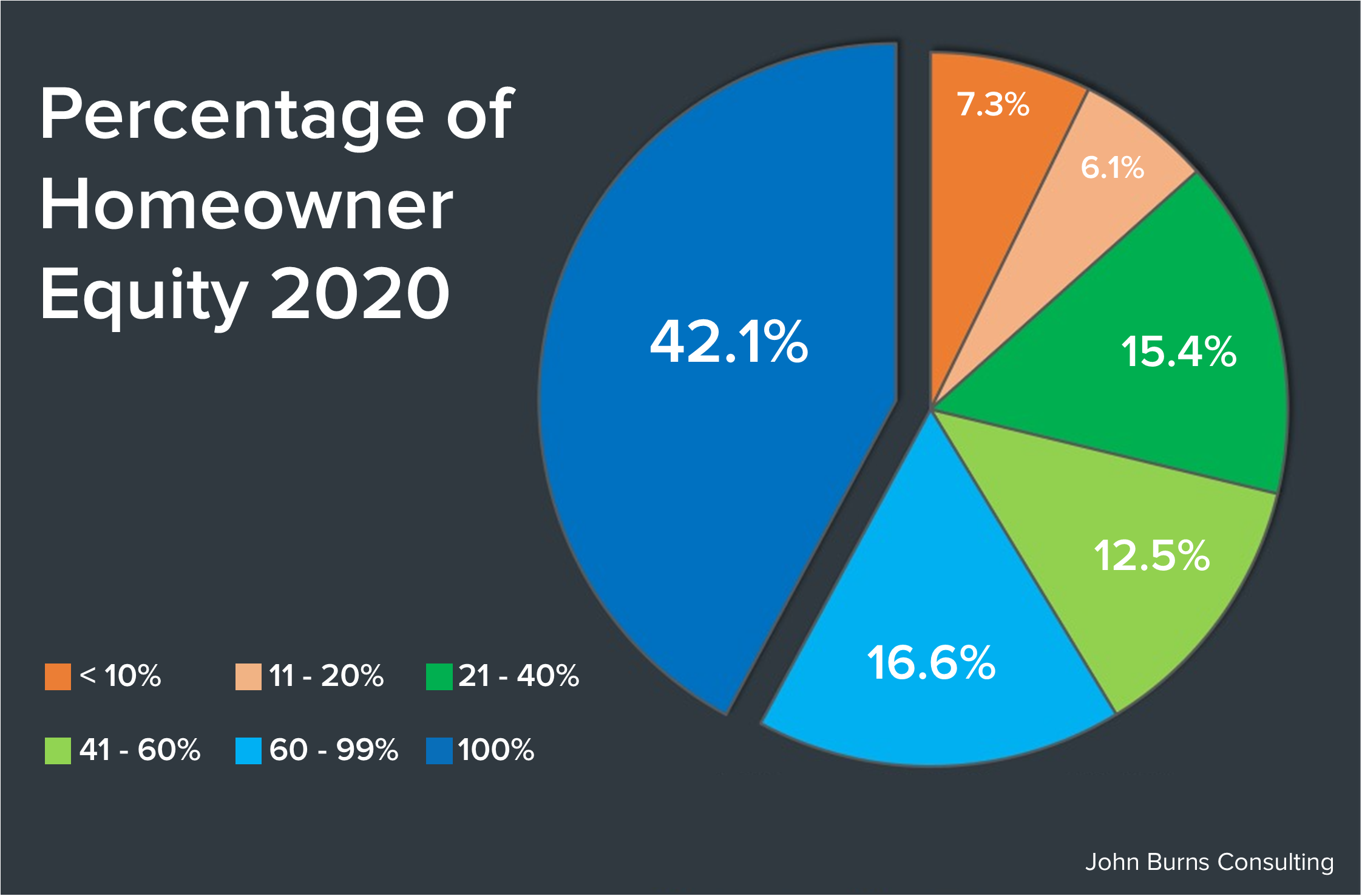

Equity levels across our nation are formidable. 42% of homeowners own their home free-and-clear and 58% of homeowners have 60% equity or more! Unlike the Great Recession of 2008 that was centered on housing, we are experiencing quite the opposite. With unemployment still an important issue, some homeowners will utilize their positive equity position to help relieve financial pressure as they pivot to an alternative career path and/or geographic location. Housing will be a tool for some to navigate the economic uncertainty the pandemic has caused.

Equity levels across our nation are formidable. 42% of homeowners own their home free-and-clear and 58% of homeowners have 60% equity or more! Unlike the Great Recession of 2008 that was centered on housing, we are experiencing quite the opposite. With unemployment still an important issue, some homeowners will utilize their positive equity position to help relieve financial pressure as they pivot to an alternative career path and/or geographic location. Housing will be a tool for some to navigate the economic uncertainty the pandemic has caused.

The experts I continue to follow are Matthew Gardner, Windermere’s Chief Economist, and David Childers and Steve Harney from Keeping Current Matters. Along with following their well-researched and thoughtful insights I am committed to studying the local monthly, weekly, and daily statistics that represent our local real estate market.

Trends can vary from one neighborhood to the next or from one type of product to another. It is my mission to position myself as an expert in order to serve my clients, by digging deep into the local data, discerning, and reporting back the truth. The strategy of layering fact upon fact is my guide to help develop the most successful outcome possible for my clients.

As always, it is my goal to help keep my clients informed in order to empower strong decisions, especially during these unique times. Please reach out if you need some help, want to satisfy a curiosity, or have a friend in need of some solid real estate guidance. In the meantime, please check out the video below featuring Matthew’s latest update including three recent data points that tell a story about the housing market. Be well!

As the Official Real Estate company of the Seattle Seahawks, Windermere donates $100 to Mary’s Place for every home game Hawks tackle. During last Sunday’s game we raised another $4,200, bringing our total to $140,500.

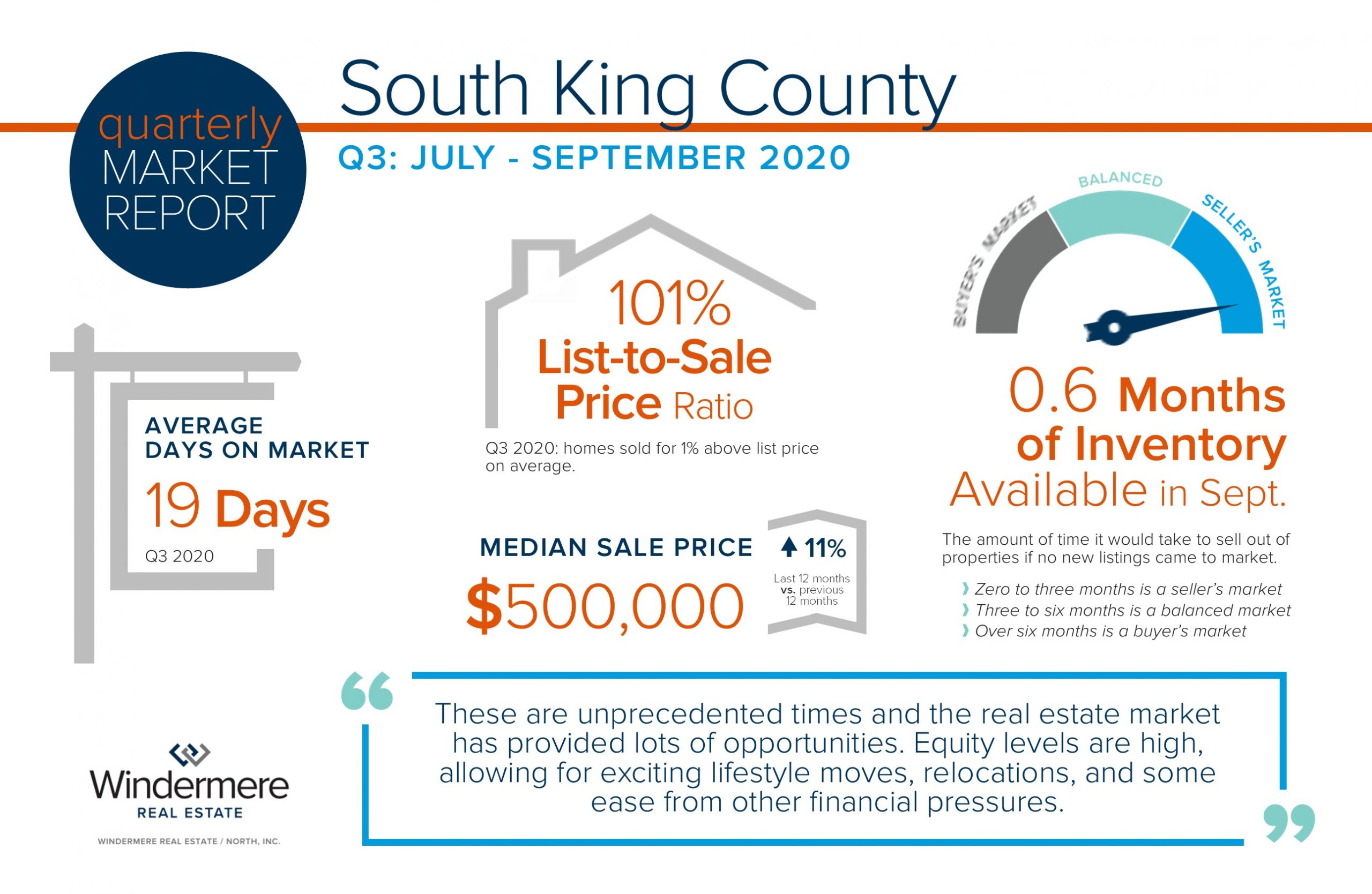

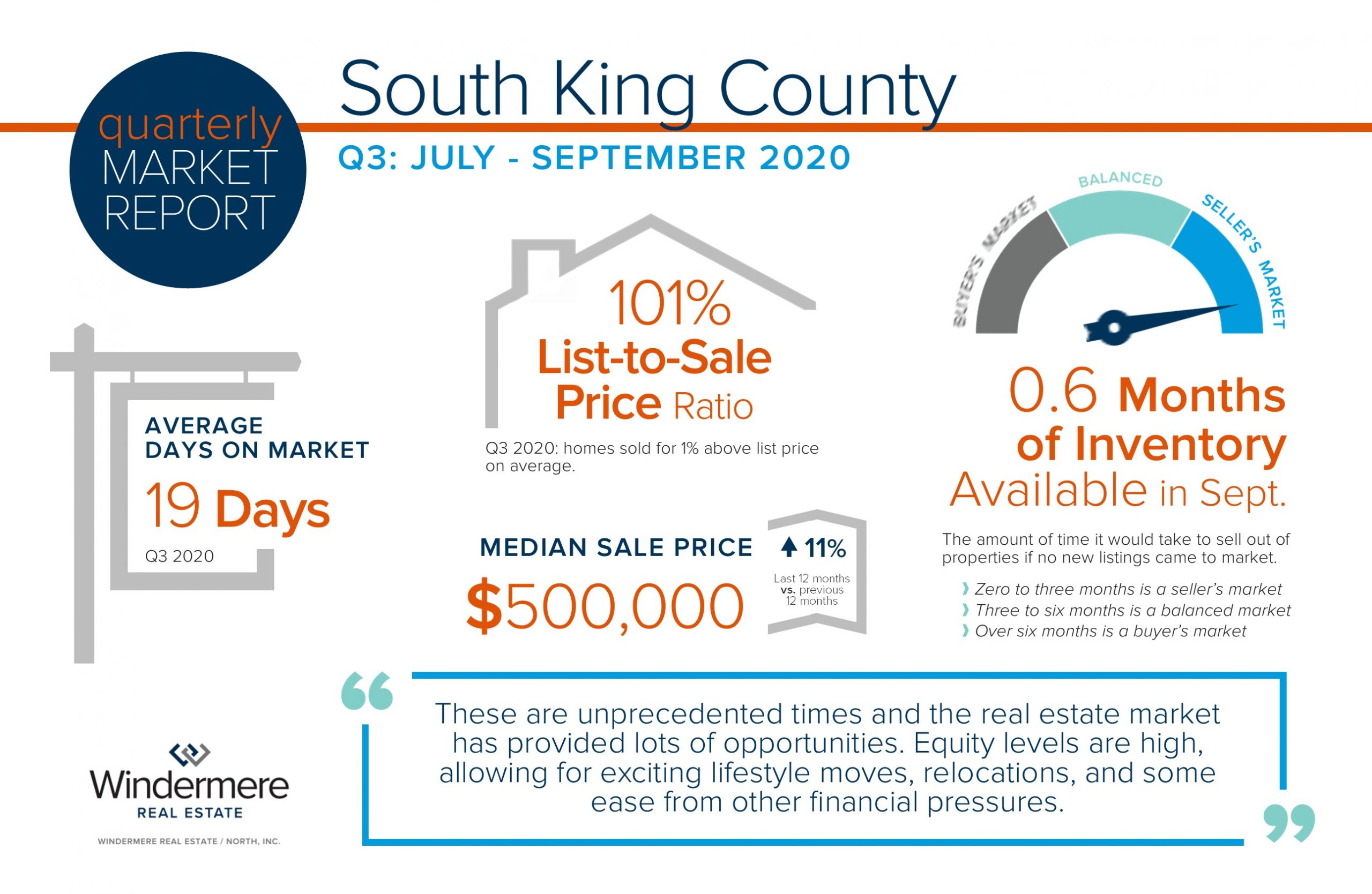

South King County Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low, hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 55% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has amped up price appreciation. With only 0.6 months of available inventory based on pending sales, the median price is up 11% complete year-over-year.

Inventory is down due to the high absorption rate which resulted in many sales. There was a delay in homes coming to market in the spring, but the summer months got us within 5% of the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in just 2% fewer sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

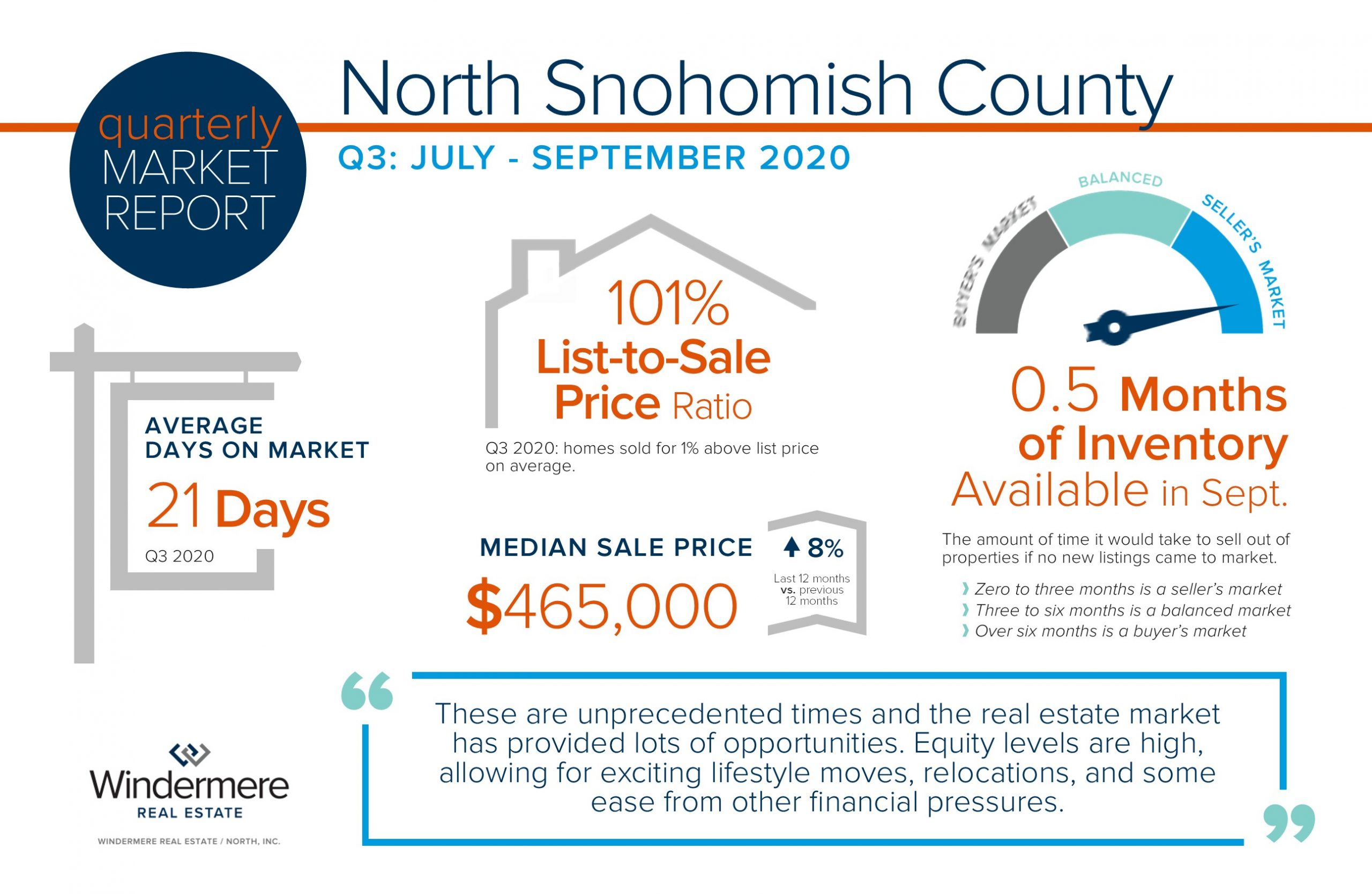

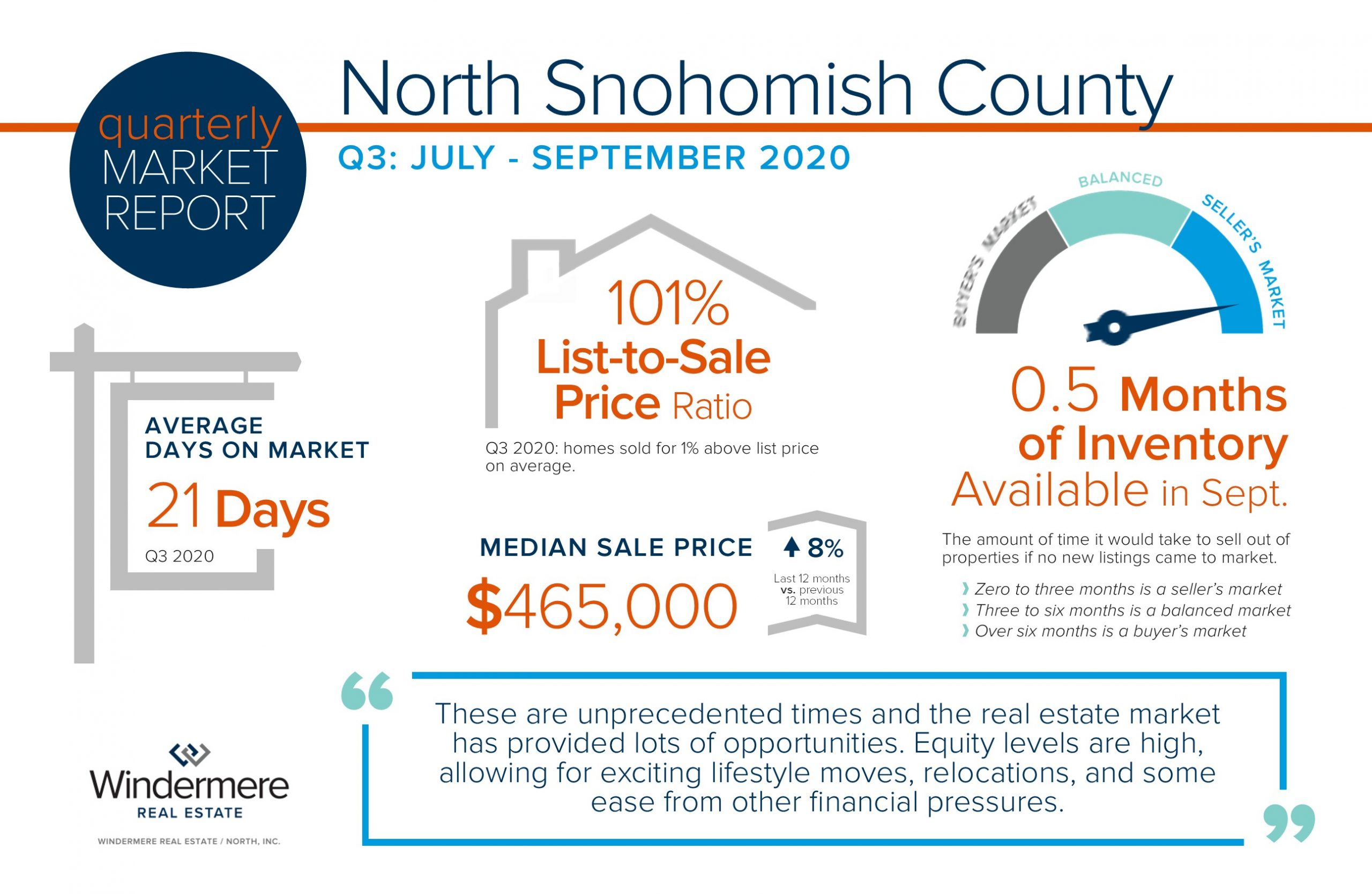

North Snohomish County Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low, hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 55% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has amped up price appreciation. With only 0.5 months of available inventory based on pending sales, the median price is up 8% complete year-over-year.

Inventory is down due to the high absorption rate. There was a delay in homes coming to market in the spring, but the summer months finally caught us up with the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in 6% more sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

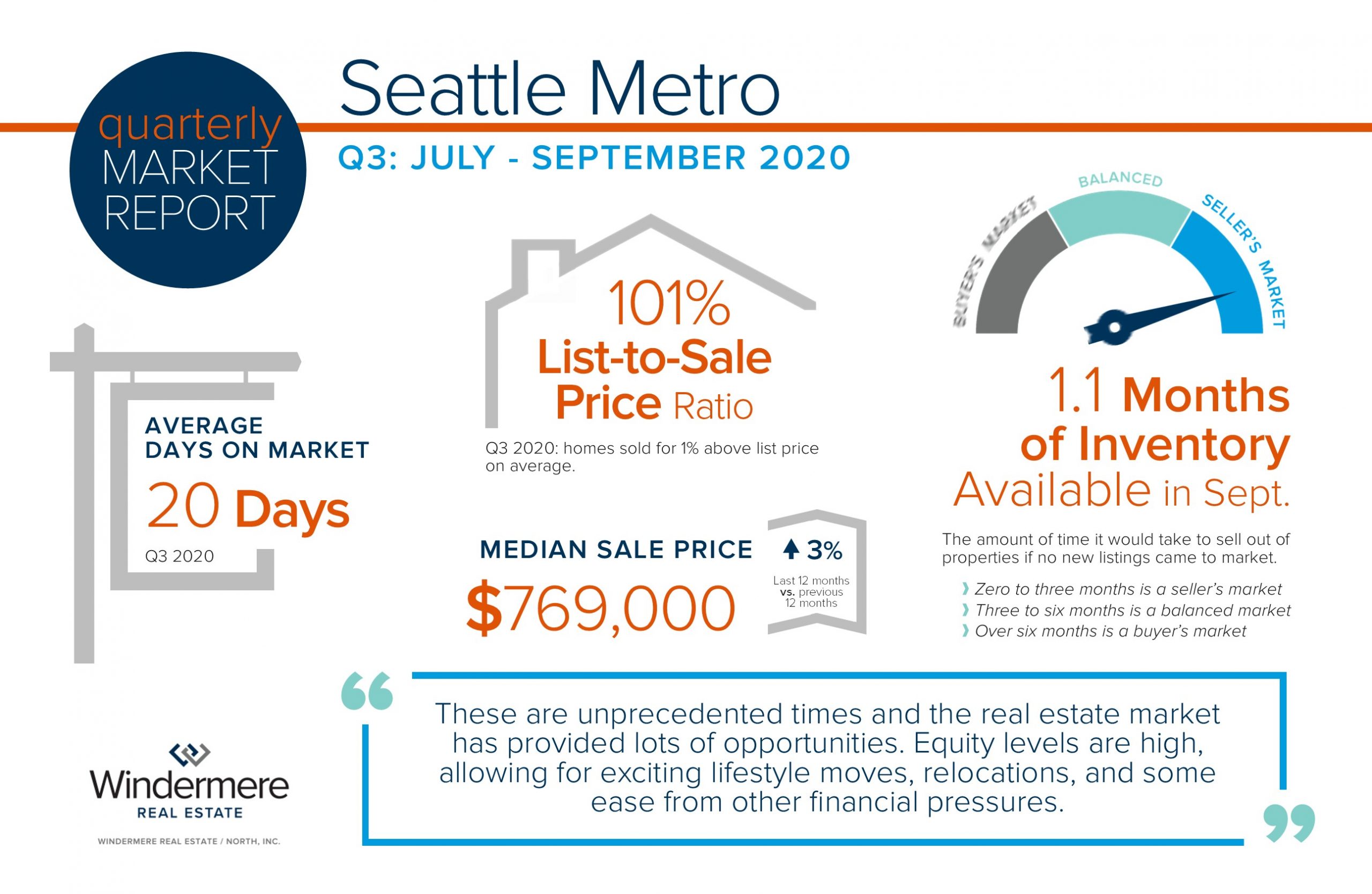

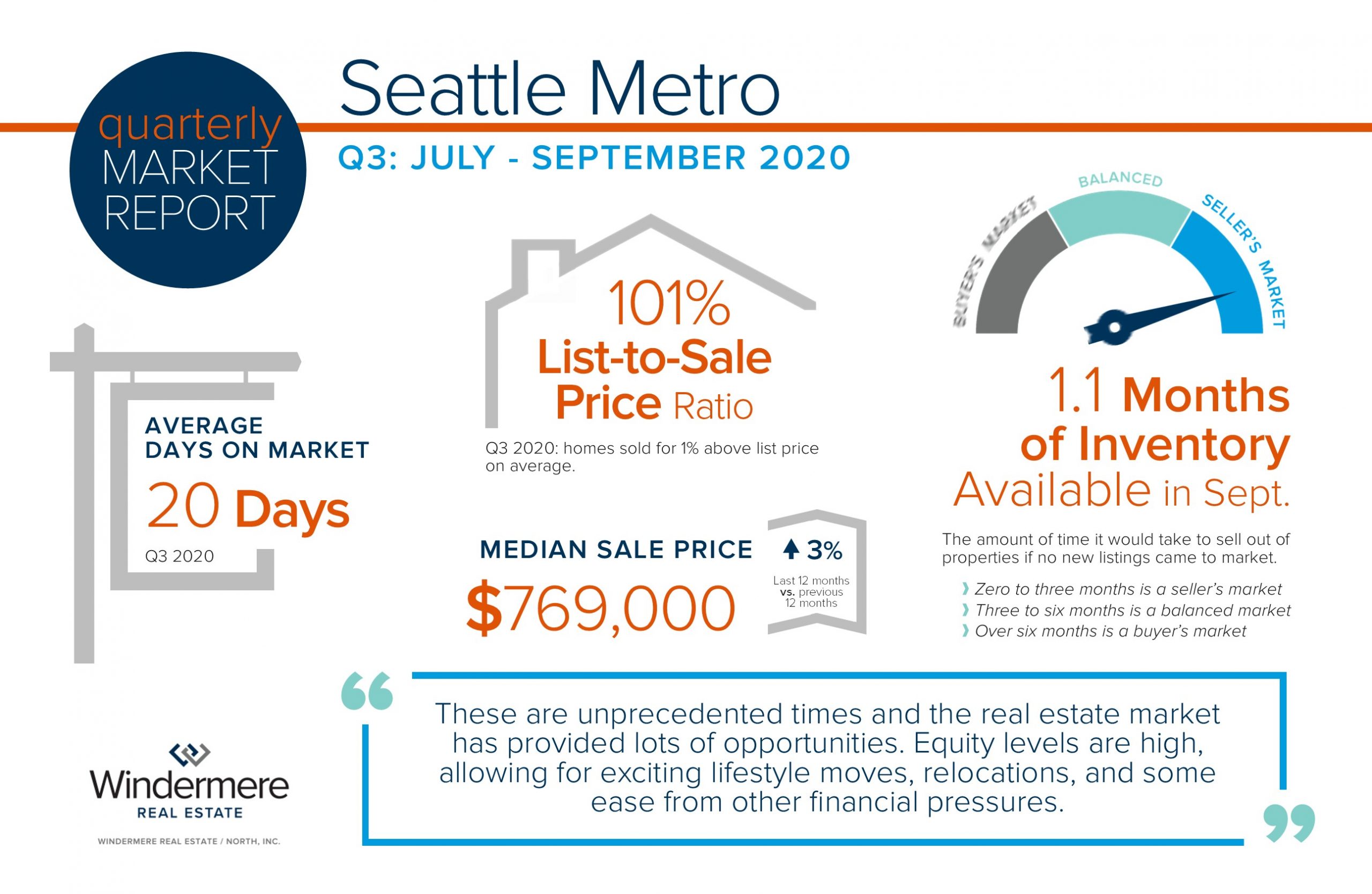

Seattle Metro Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low, hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 17% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has maintained price appreciation. With only 1.1 months of available inventory based on pending sales, the median price is up 3% complete year-over-year.

Inventory is down due to the high absorption rate which resulted in many sales. There was a delay in homes coming to market in the spring, but the summer months got us equal with the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in 10% more sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

Eastside Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low, hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 58% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has amped up price appreciation. With only 0.6 months of available inventory based on pending sales, the median price is up 6% complete year-over-year.

Inventory is down due to the high absorption rate which resulted in many sales. There was a delay in homes coming to market in the spring, but the summer months got us within 12% of the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in only 4% fewer sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

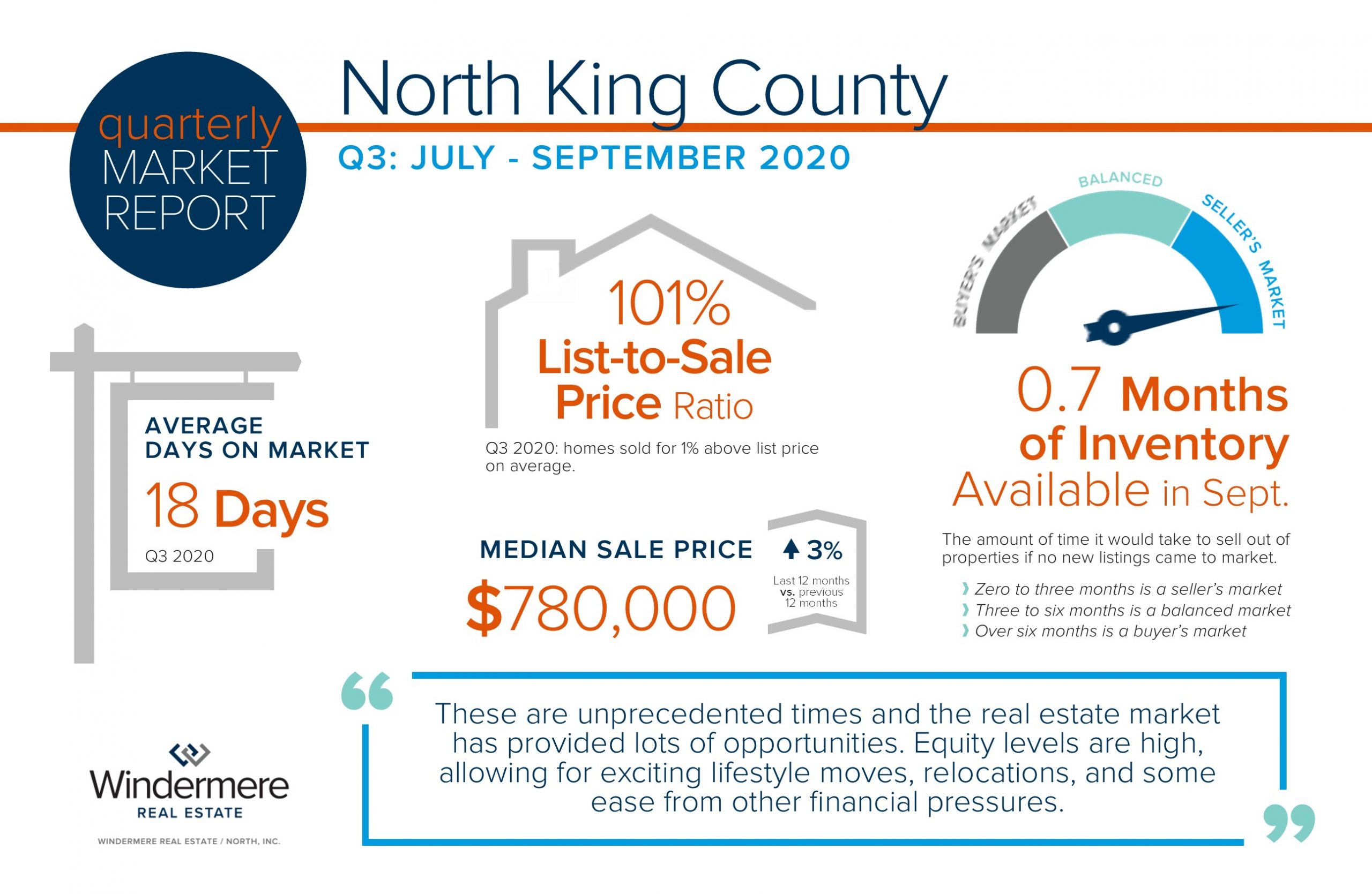

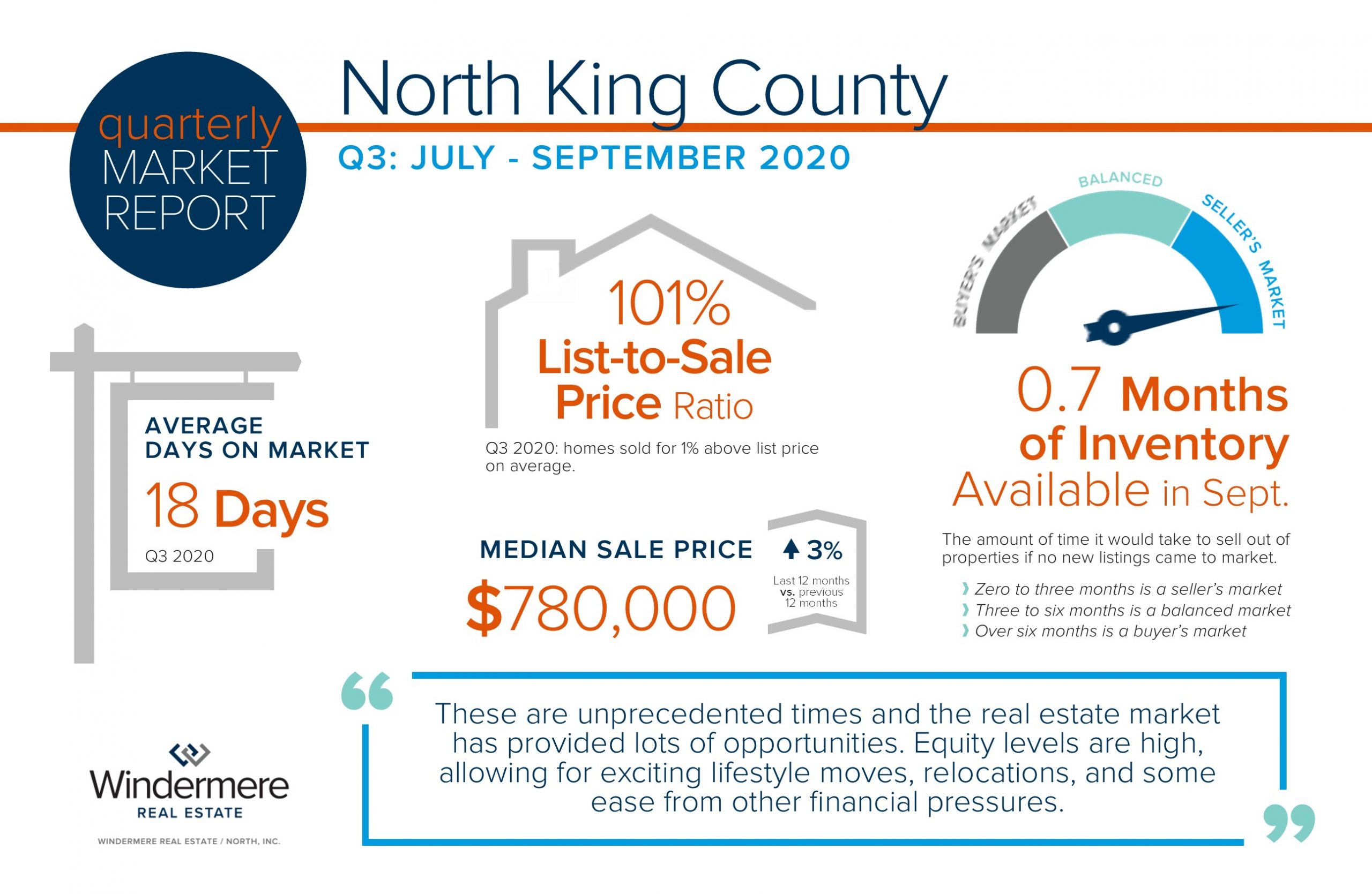

North King County Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low, hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 45% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has maintained price appreciation. With only 0.7 months of available inventory based on pending sales, the median price is up 3% complete year-over-year.

Inventory is down due to the high absorption rate which resulted in many sales. There was a delay in homes coming to market in the spring, but the summer months got us within 6% of the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in 6% more sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

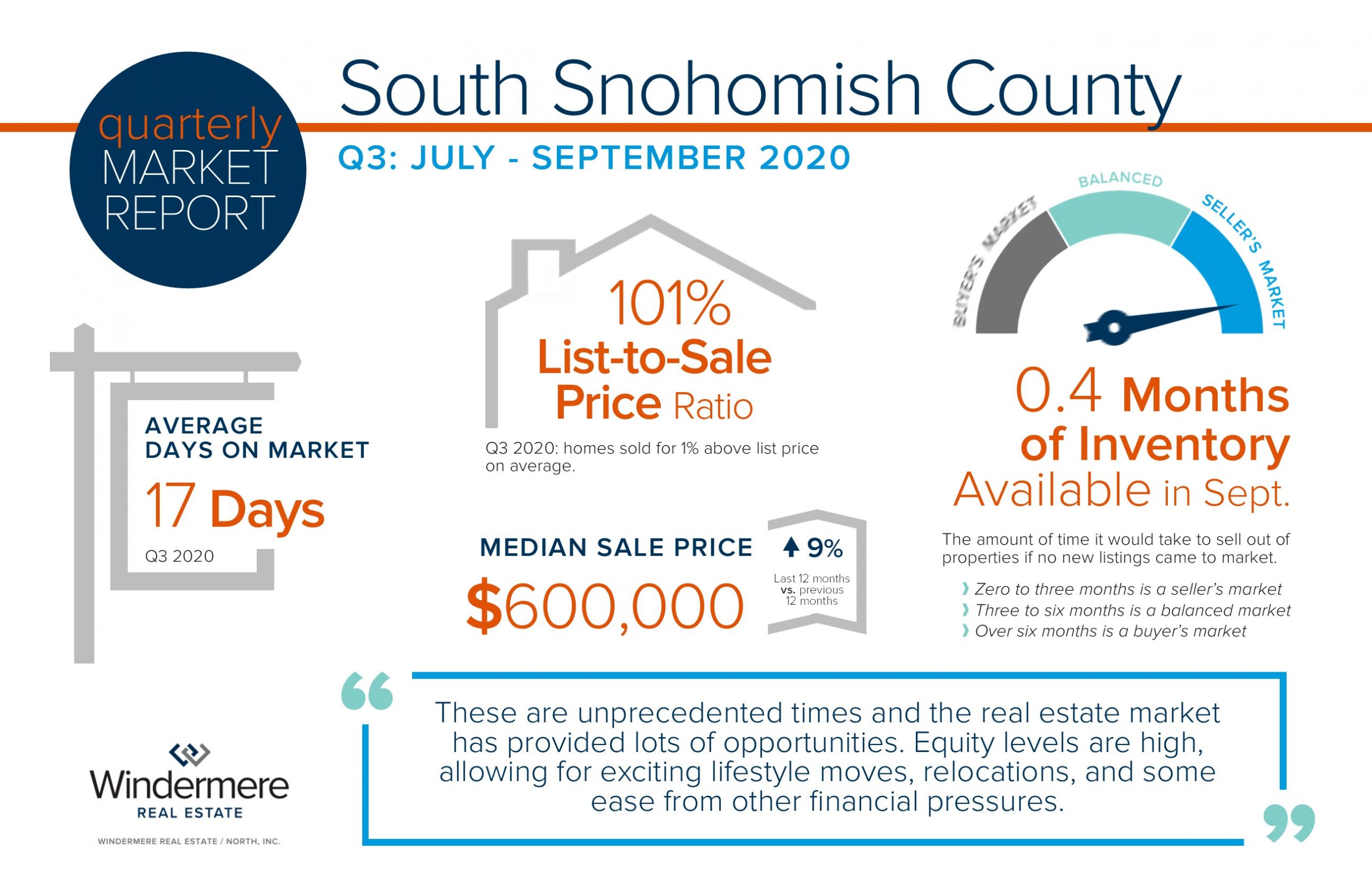

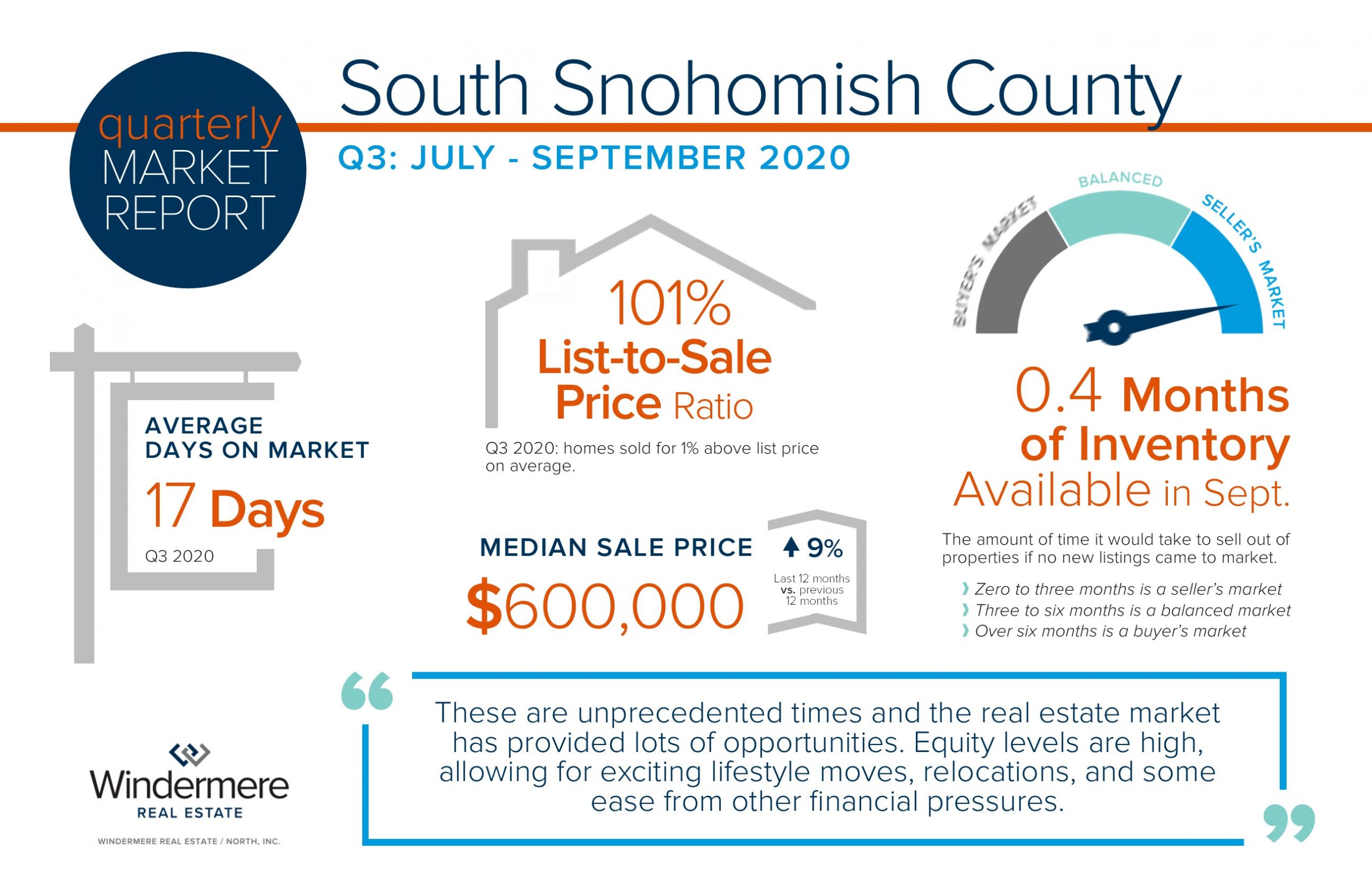

South Snohomish County Quarterly Market Trends – Q3 2020

The real estate market continued to positively perform in the third quarter, and is the bright light in the economy during the COVID-19 health crisis. The protocols in place that have helped protect the safety of the community have recently been expanded to allow small group open houses to help address the demand in the market.

Interest rates remain historically low hovering around 3% and creating robust buyer demand and a competitive marketplace. Coupled with available inventory being down 72% complete year-over-year, the third quarter saw many home sales escalate in price due to multiple offers. This perfect storm of supply and demand has amped up price appreciation. With only 0.4 months of available inventory based on pending sales, the median price is up 9% complete year-over-year.

Inventory is down due to the high absorption rate which resulted in many sales. There was a delay in homes coming to market in the spring, but the summer months got us within 10% of the previous year’s number of new listings. The influence of interest rates, along with many people making big lifestyle moves due to working from home, Baby Boomers retiring, and the younger generations transitioning their work and family statuses have resulted in only 3% fewer sales complete year-over-year.

These are unprecedented times and the real estate market has provided lots of opportunities. Equity levels are high, allowing for exciting lifestyle moves, relocations, and some ease from other financial pressures. It is my goal to help keep my clients informed and empower strong decisions, now more than ever. Please reach out if you’d like to discuss your real estate goals and how they relate to your lifestyle and bottom line. Be well!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link