Market Update – Q3 2015

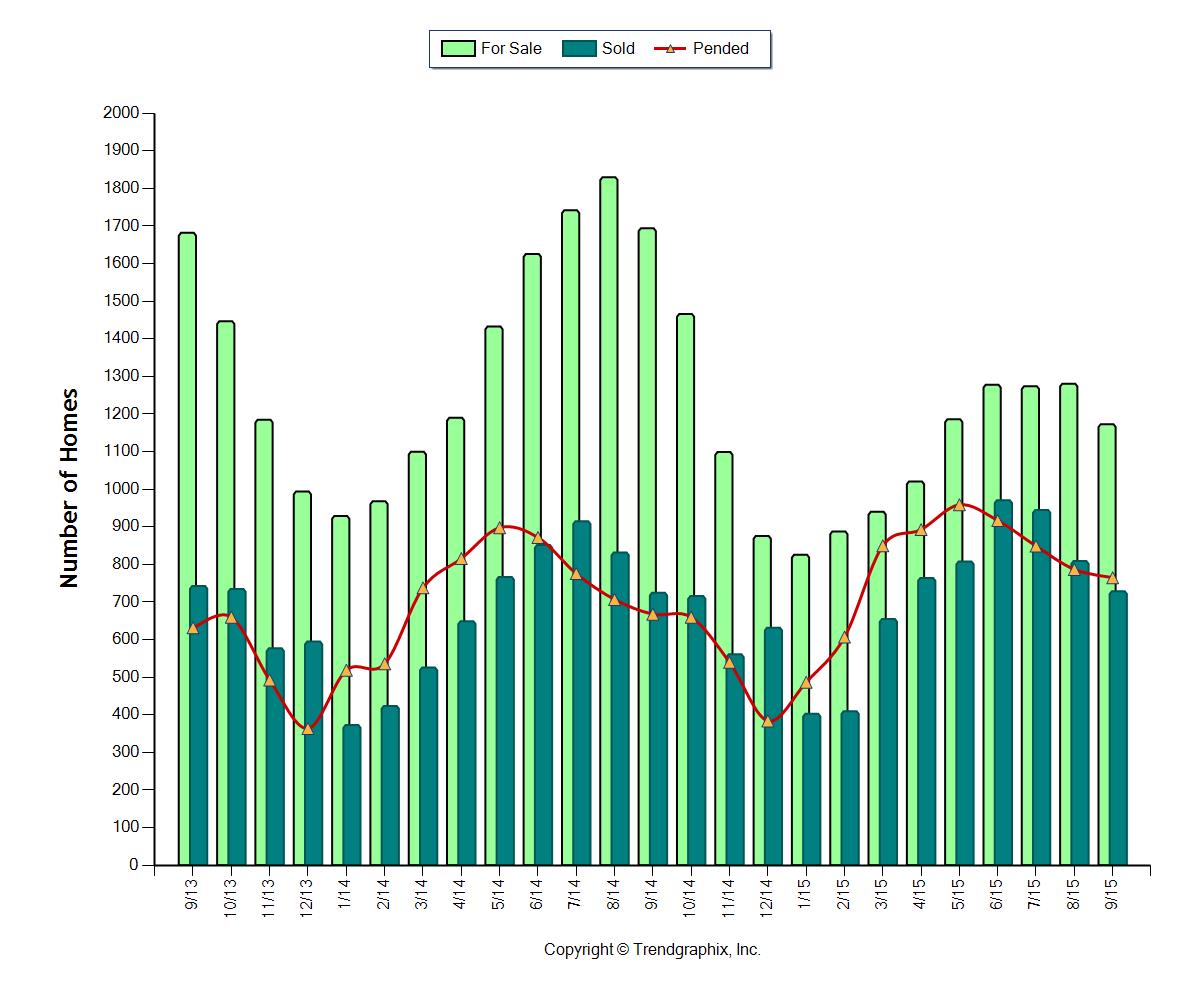

Snohomish County

Seasonal patterns are returning after the market’s fall and recovery

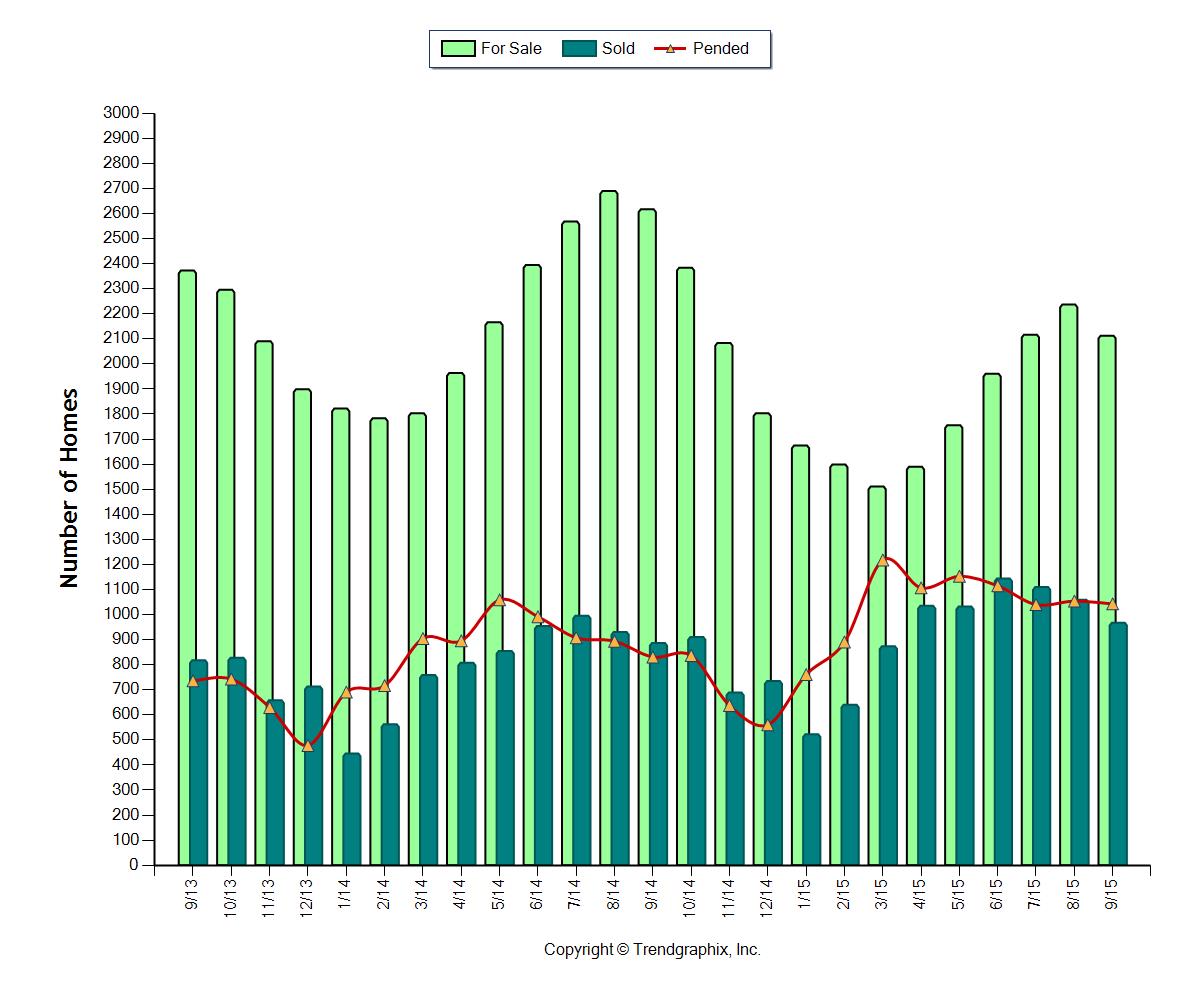

The graph above shows a two-year history of the market, where we have clearly seen a surge of inventory from March to August. In fact we saw a 48% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 1% from the year prior, all while closed sales were up 18%! Months of Inventory based on pending sales has held steady at an average of two months over the last year. Due to demand outweighing supply we continue to see above-normal price growth, with both median and average prices up 9% complete year-over-year.

South Snohomish County

Seasonal patterns are returning after the market’s fall and recovery

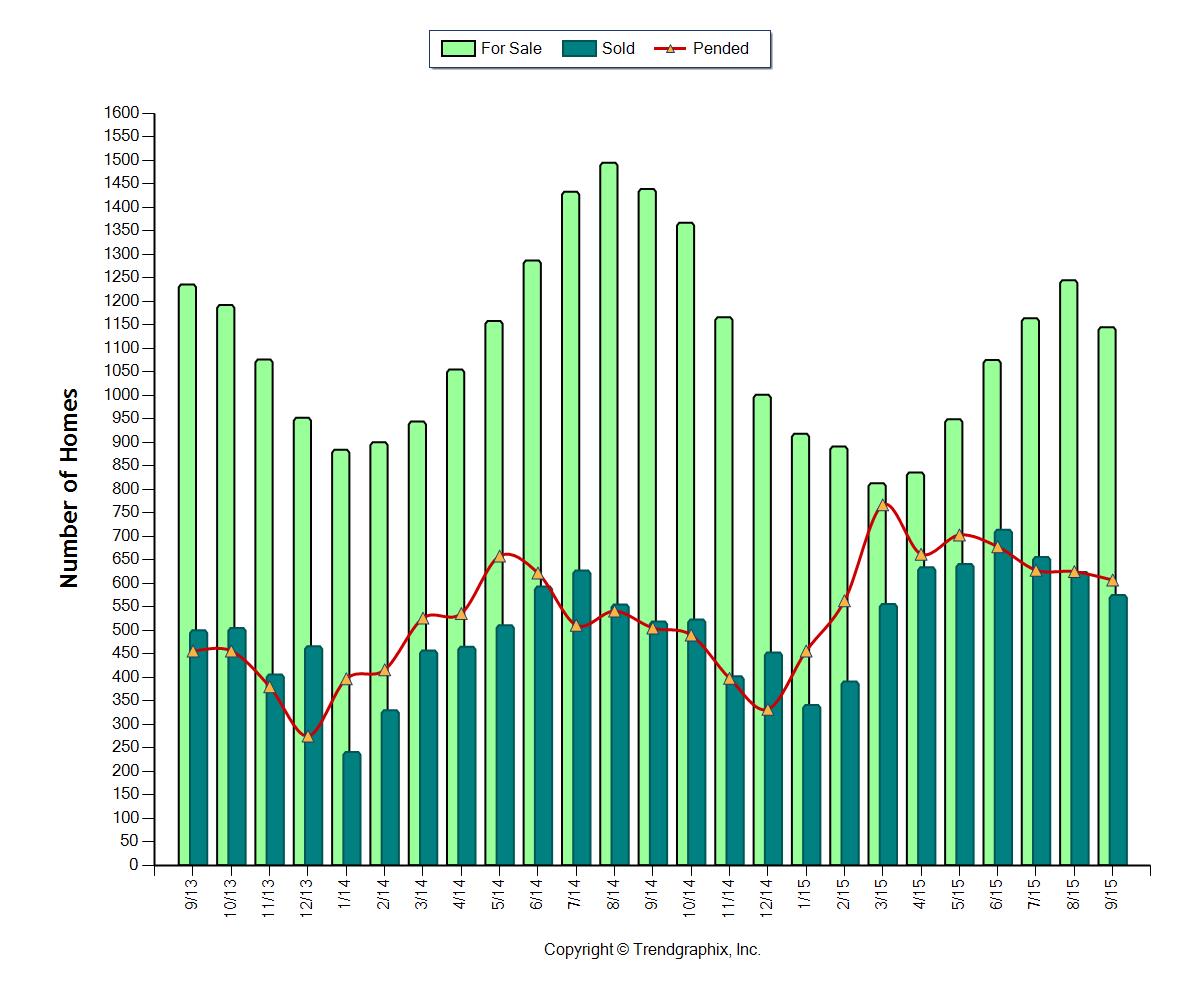

You can see in the graph above a clear surge of inventory came to market from March to August. In fact we saw a 53% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 5% from the year prior, all while closed sales were up 19%! Months of Inventory based on pending sales has held steady at an average of two months over the last year. Due to demand outweighing supply we continue to see above-normal price growth, with both median and average prices up 9% complete year-over-year.

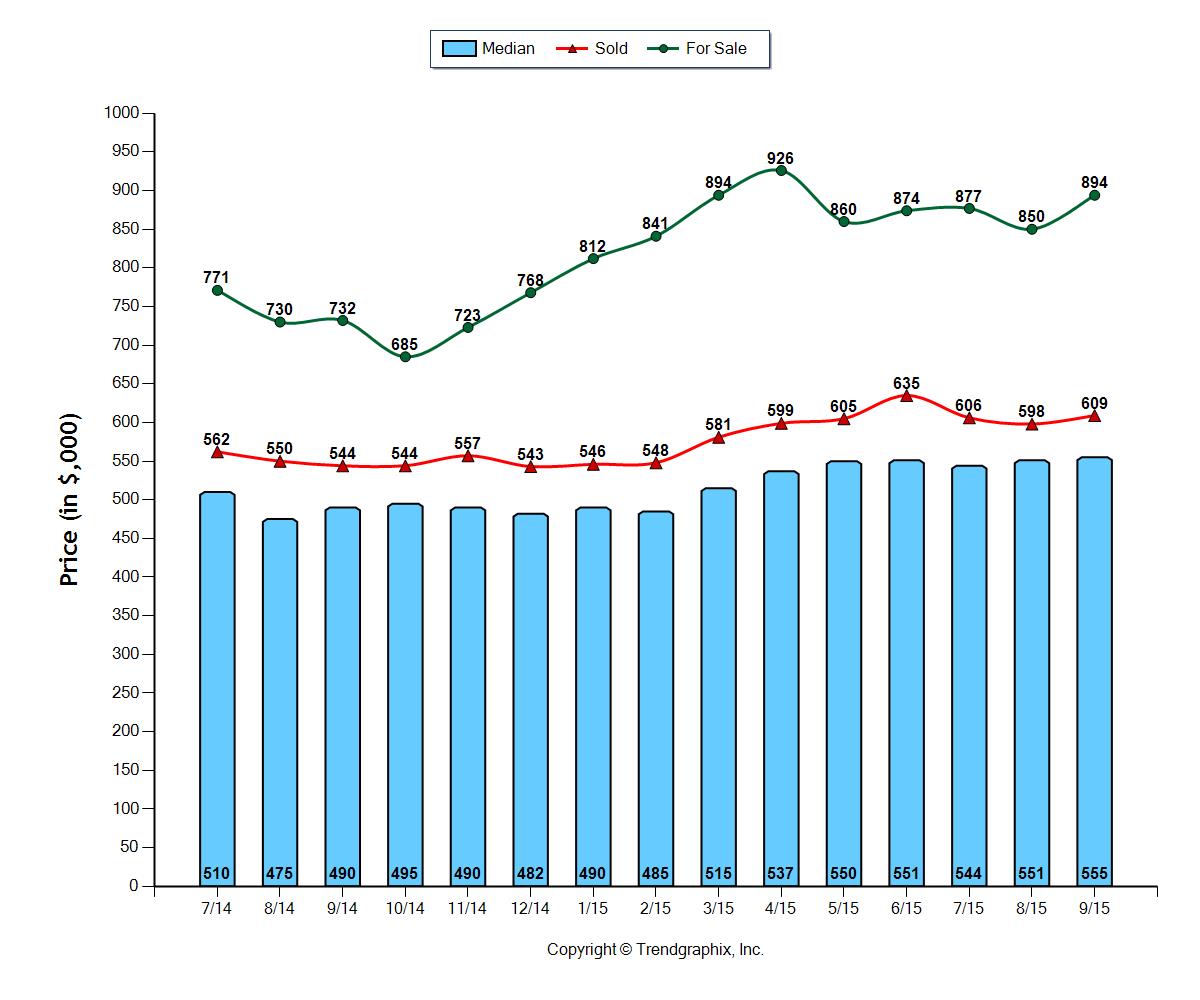

North King County

Price increases are strong due to high demand and low inventory

All indicators, such as sold median price, sold average price and sold price per square foot point to a 10% increase in prices complete year-over-year. The median price in North King County this September was $555,000 and the average was $609,000. Average days on market have shrunk to as low as 22 days this last month, and the list to sale price ratio was 101%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested one month after a small surge of additional inventory in the third quarter.

Eastside

Seasonal patterns are returning after the market’s fall and recovery

The graph above shows a two-year history of the market, where we have clearly seen a surge of inventory from February to August. In fact we saw a 44% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 45% from the year prior, all while closed sales were up 10%! Months of Inventory based on pending sales has held steady at an average of 1.5 months over the last year. Due to demand outweighing supply we continue to see above normal price growth, with both median and average prices up 9% complete year-over-year.

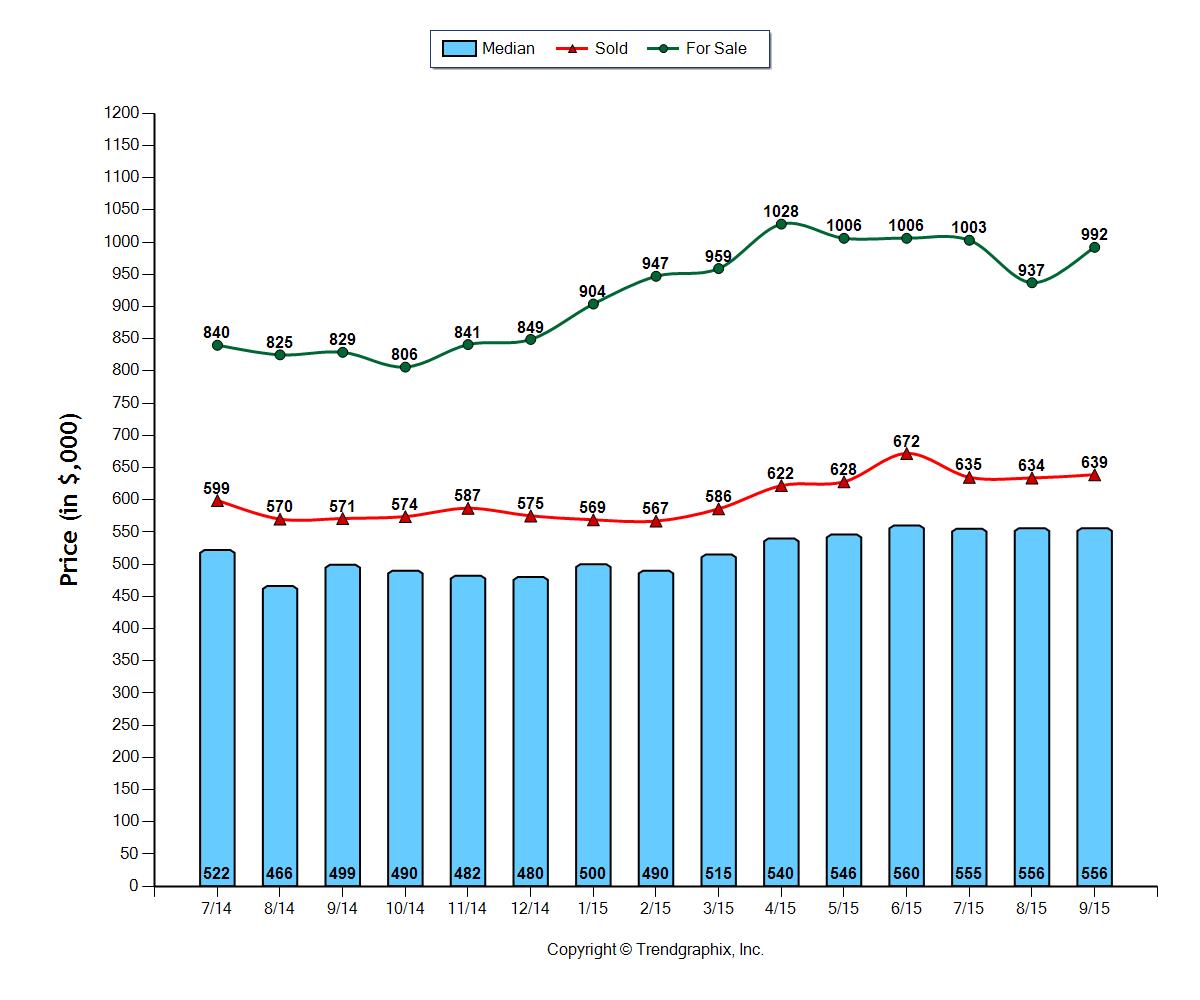

Seattle Metro

Price increases are strong due to high demand and low inventory

All indicators, such as sold median price, sold average price and sold price per square foot point to an 11% increase in prices complete year-over-year. The median price in the Seattle Metro area this September was $556,000 and the average was $639,000. Average days on market have shrunk to as low as 22 days this last month, and the list to sale price ratio was 101%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested one month after a small surge of additional inventory in the third quarter.

South King County

Price increases are strong due to high demand and low inventory

All indicators point to strong price increases with median price up 11%, average price up 8% and average price per square foot up 8% complete year-over-year. The median price in South King County this September was $335,000 and the average was $358,000. Average days on market have shrunk to as low as 36 days this last month, and the list to sale price ratio was 99%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested 1.5 months after a small surge of additional inventory in the third quarter.

This is only snapshots of the trends in our area. Please contact one of our agents if you would like further explanation of how the latest trends relate to you.

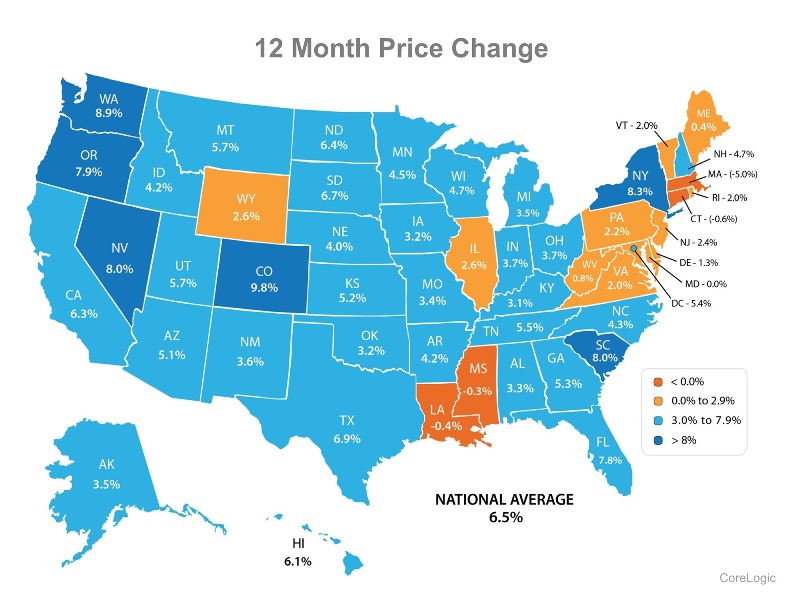

A Check-up on Prices & Appreciation

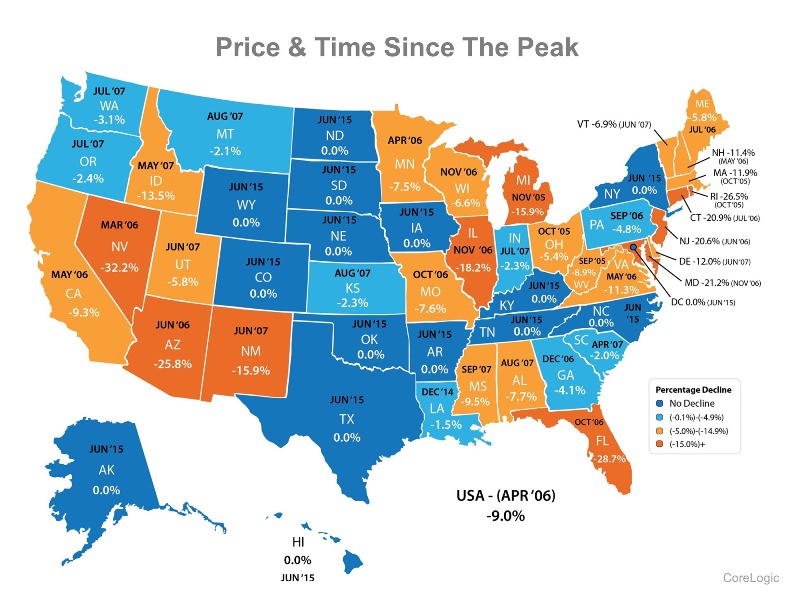

As we finish up the 2015 summer selling market and head into fall it is a good time to take a look at where we are at regarding appreciation. The two maps below are from CoreLogic, a global real estate data analytic company. According to the top map, Washington has seen 8.9% in appreciation over the last 12 months. When I pull those same numbers for King county the appreciation rate is 8.5% and Snohomish county is 9.2%. Appreciation has continued to be strong, but it has tempered a bit compared to the previous year, which is a good thing. The biggest driver of the strong appreciation rates is high demand and low inventory. Our robust local economy has provided a lot of opportunity for buyers, and they are out there with force. Inventory levels continue to not provide enough selection to support the amount of buyers in the market. If you look at the map on the bottom you will see how today's price levels relate to peak prices from 2006/2007. Washington State is 3.1% from the peak, which means that many folks are at healthy equity levels. Surprisingly, not everyone knows this, and I think that is why we may not be seeing the amount of inventory that would better support the demand in the market and would slow appreciation levels to more traditional (and sustainable) rates of 3-5% a year.In fact, according to a Fannie Mae survey 23% thought they were in negative equity positions when only 9% where. Further, only 37% surveyed thought they had less than 20% equity when 69% actually did! Those are big discrepancies that could be crippling to a productive decision on what to do with your real estate. If you or someone you know is ever curious about your equity position please do not hesitate to contact us to get a clear picture. Any of our agents would be happy to do a comparative market analysis (CMA) for you to help keep you informed on your biggest asset, your home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link