Quarterly Market Trends: North King County

Q4 2017

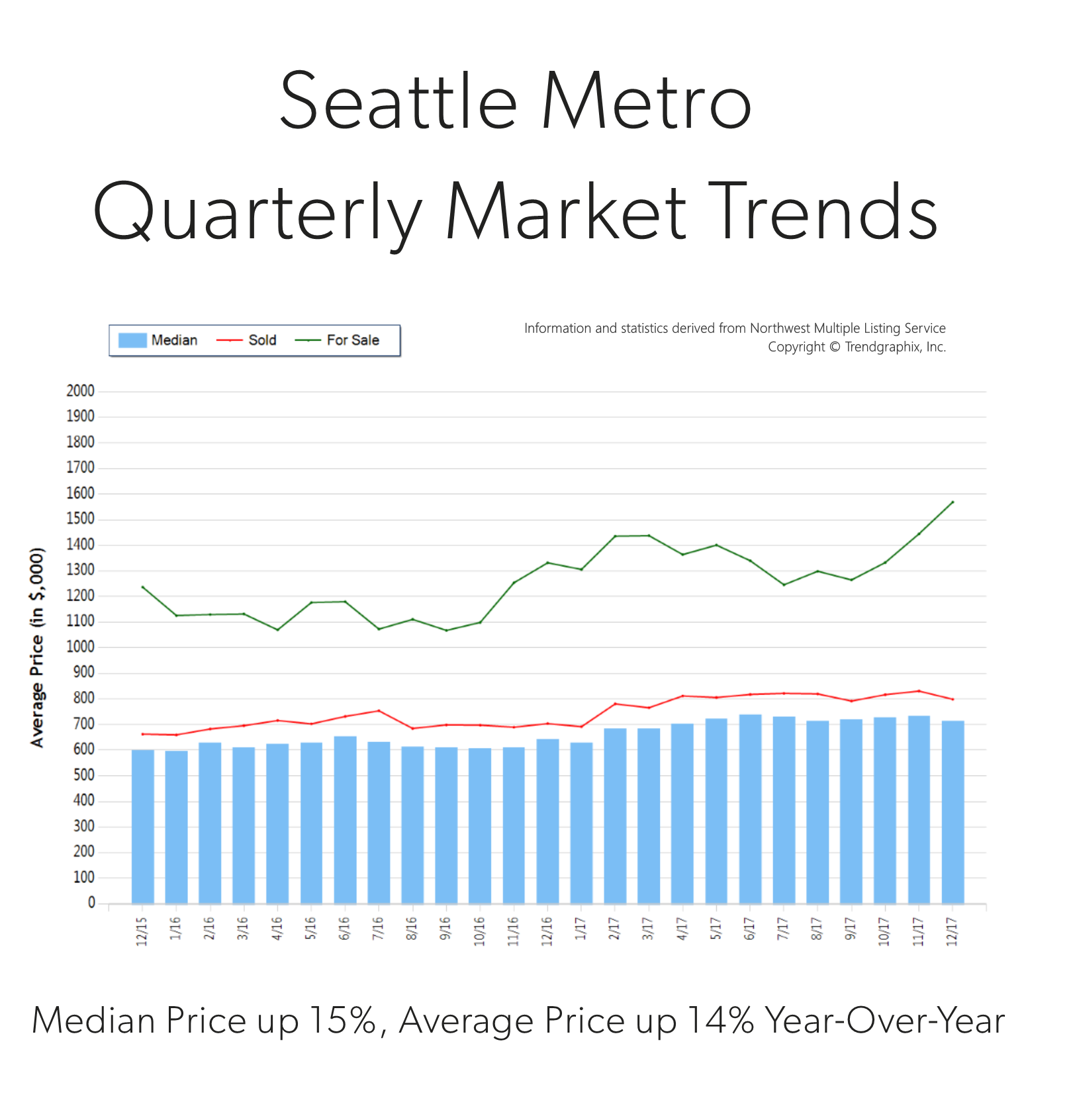

Price growth was particularly strong in 2017! Median and average prices were up 14% over 2016. Median price in 2017 landed at $715,000 and the average at $787,000. The average amount of days it took to sell a house in 2017 was 17 days, which is 19% faster than 2016. The average list-to-sale price ratio over the last year was 104%, with the spring months as high as 107%! In 2017, inventory growth continued to be a challenge, with a 4% decrease in new listings compared to 2016. Even with inventory limitations there were a near equal amount sales! This phenomenon illustrates strong buyer demand and a need for more listings.

Price growth was particularly strong in 2017! Median and average prices were up 14% over 2016. Median price in 2017 landed at $715,000 and the average at $787,000. The average amount of days it took to sell a house in 2017 was 17 days, which is 19% faster than 2016. The average list-to-sale price ratio over the last year was 104%, with the spring months as high as 107%! In 2017, inventory growth continued to be a challenge, with a 4% decrease in new listings compared to 2016. Even with inventory limitations there were a near equal amount sales! This phenomenon illustrates strong buyer demand and a need for more listings.

Demand for north King County real estate has grown due to close proximity to job centers while maintaining a neighborhood feel. Over the last year, north King County was 41% more expensive than south Snohomish County and 77% over south King County. Historically low interest rates continue to drive the market as well, they have helped offset the increase in prices. Sellers are enjoying great returns due to this phenomenon and buyers are securing mortgages with minor debt service.

This is only a snapshot of the trends in north King County; please contact us if you would like further explanation of how the latest trends relate to you.

Market Update – Q3

Inventory levels providing more choices for buyers; is the market starting to stabilize?

As we head into the fall and winter months after an incredibly eventful spring and summer, available inventory levels are starting to ease. It is still a seller’s market (3 months of inventory or less) in most areas, but one that is providing buyers increased options. The increase in available inventory is due to pent-up seller demand starting to come to market. The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! Additionally, lending requirements remain stringent and down payments are bigger, unlike the dreaded bubble market we experienced in 2007/2008. Educated pricing and sound condition is what will drive a buyer’s interest in a home. As the market stabilizes, it will be important for consumers to partner with a broker who closely follows the market to help them make informed decisions and develop winning strategies.

Read below for market details from Snohomish County down through south King County.

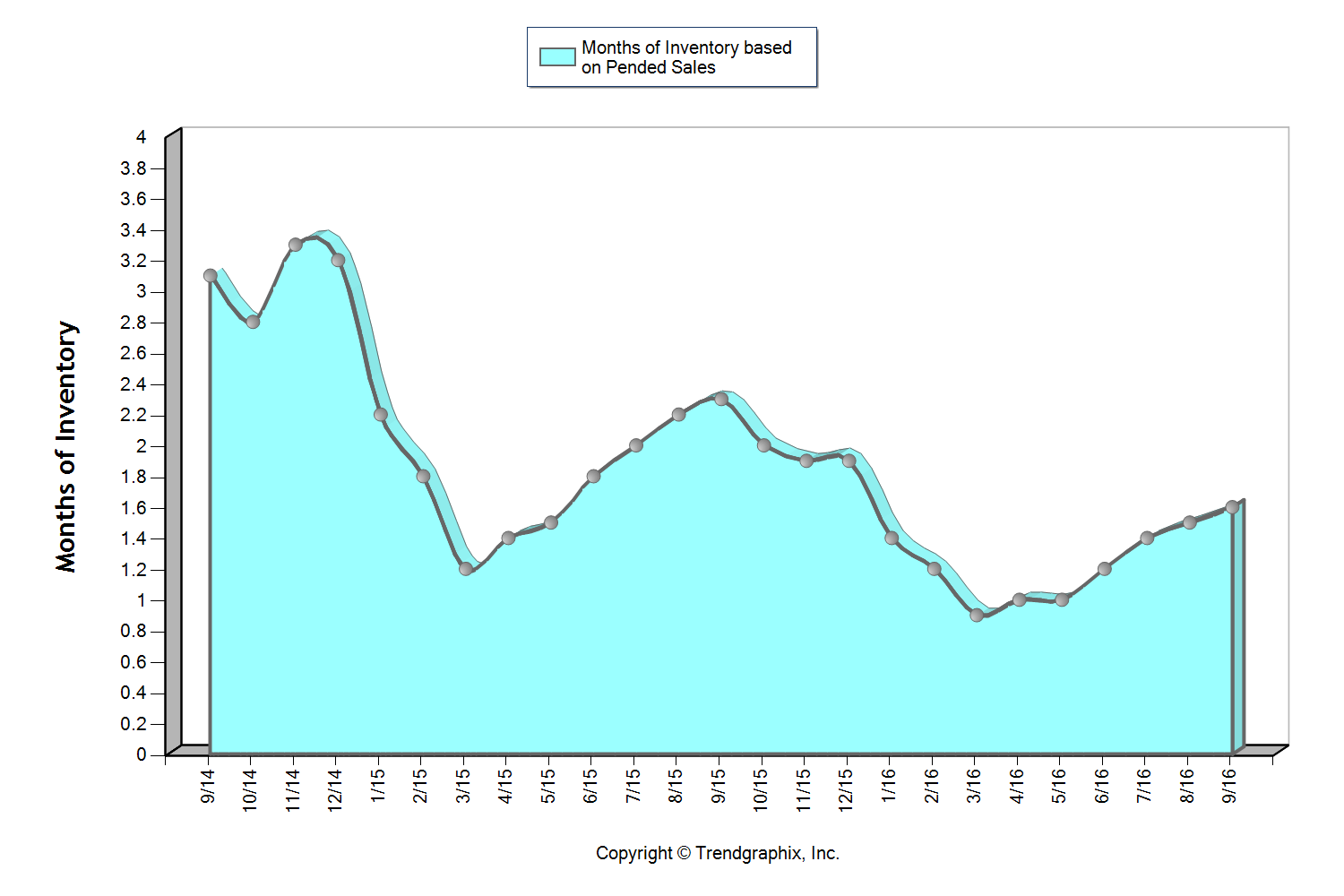

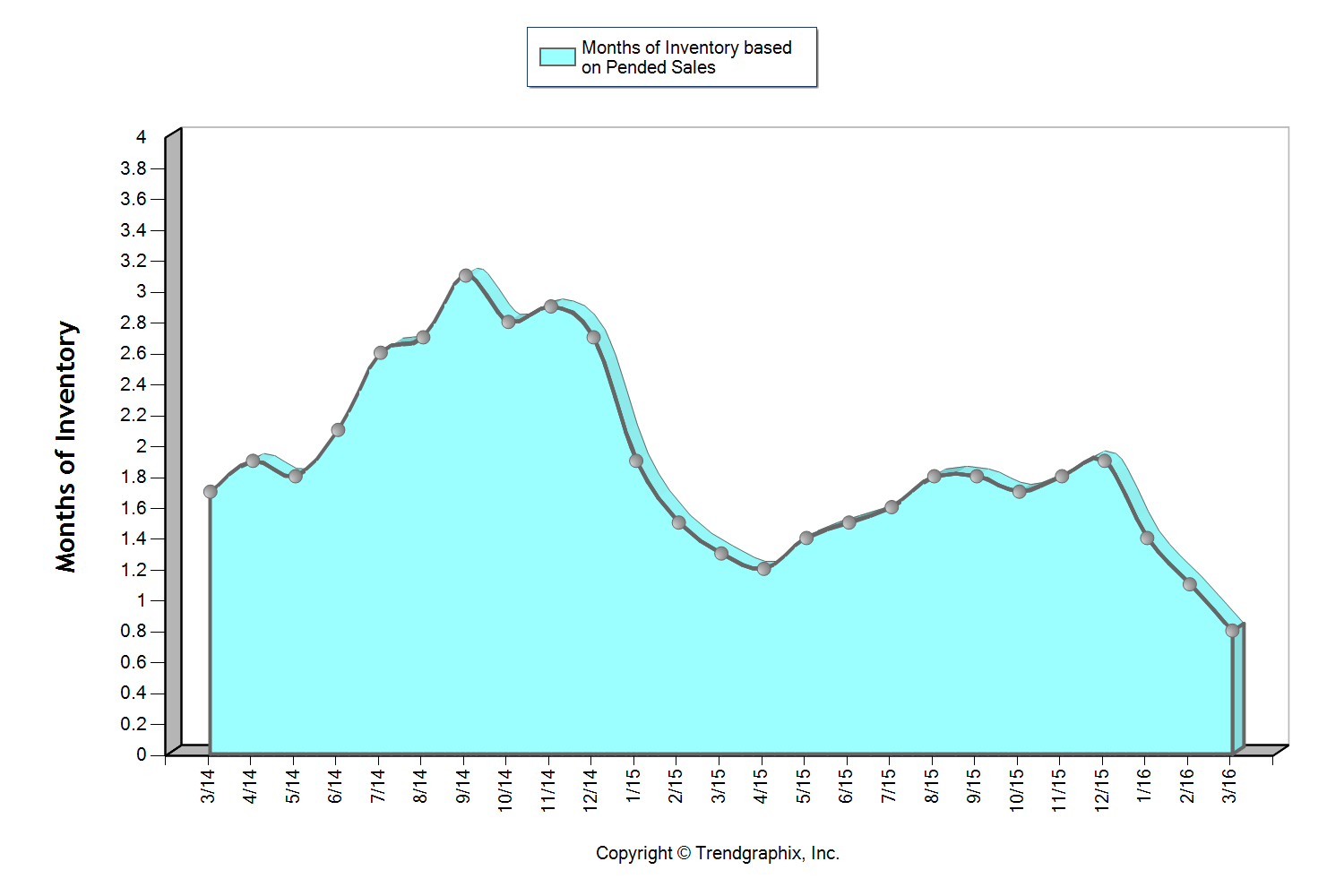

This graph shows that we currently sit at 1.6 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is providing buyers increased options. The average cumulative days on market reached 28 days in September, which was up 8% over August. Median price peaked in August at $401,000 and settled at $397,000 in September after hovering between $380,000 and $400,000 since April. For the first time since February, the average list to sale price ratio was 99% after sitting at 100-101% over the last six months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown just over 20% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

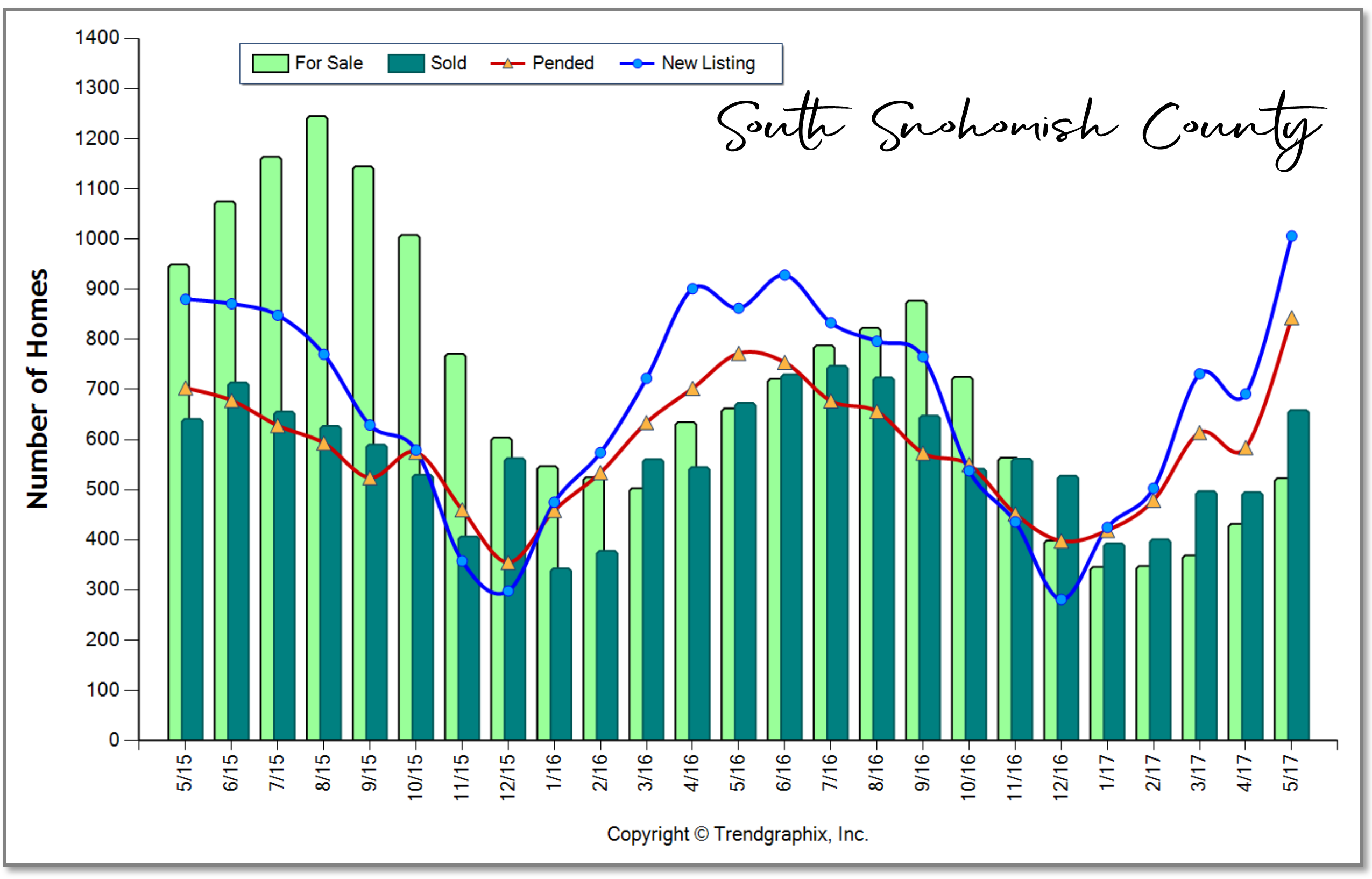

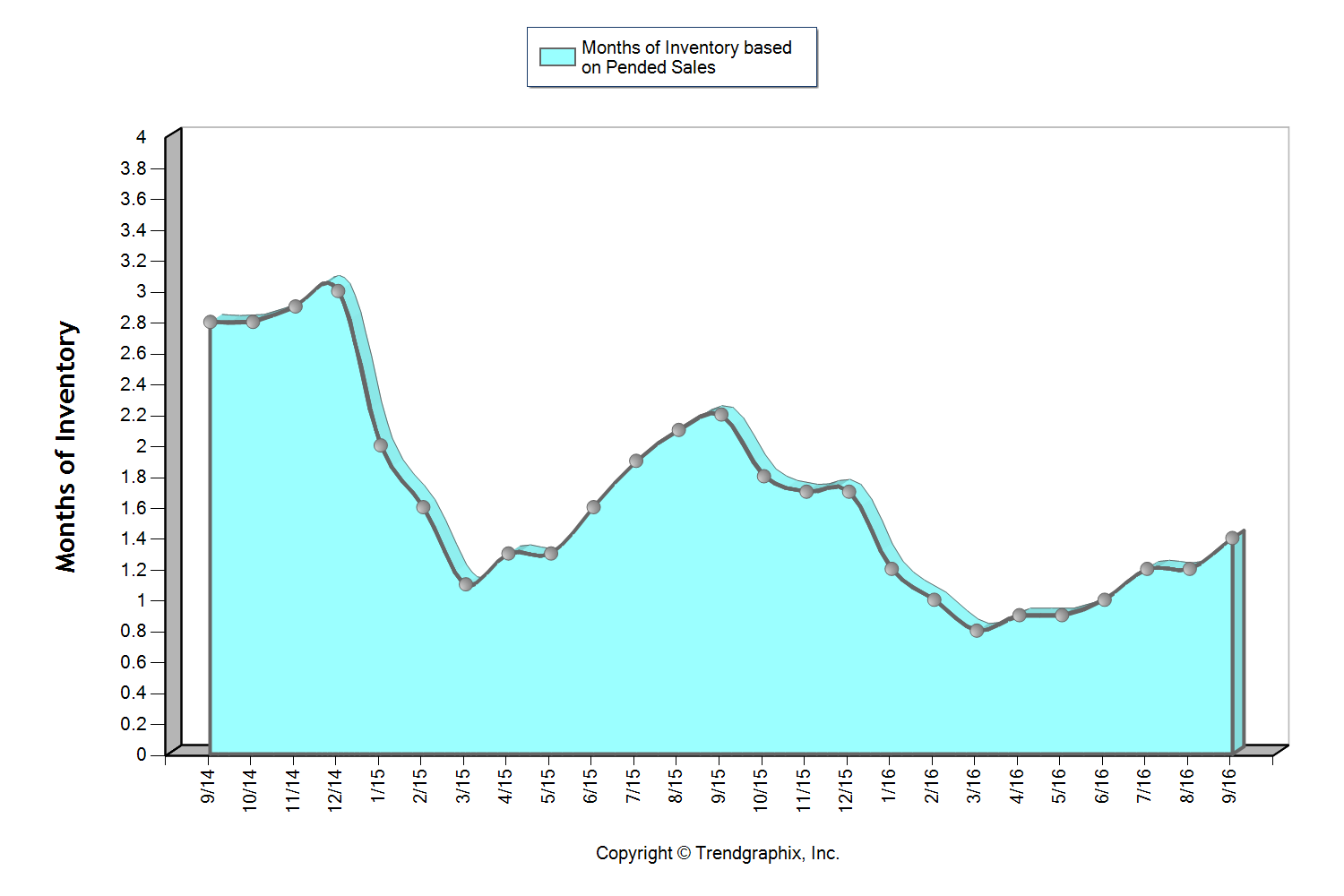

This graph shows that we currently sit at 1.4 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (three months or less), but one that is providing buyers increased options. The average cumulative days on market reached 24 days in September, which was up 14% over August. Median price peaked in August at $453,000 and settled at $440,000 in September after hovering between $440,000 and $450,000 since March. For the first time since February, the average list to sale price ratio was 99% after sitting at 100-101% over the last six months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown just over 20% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

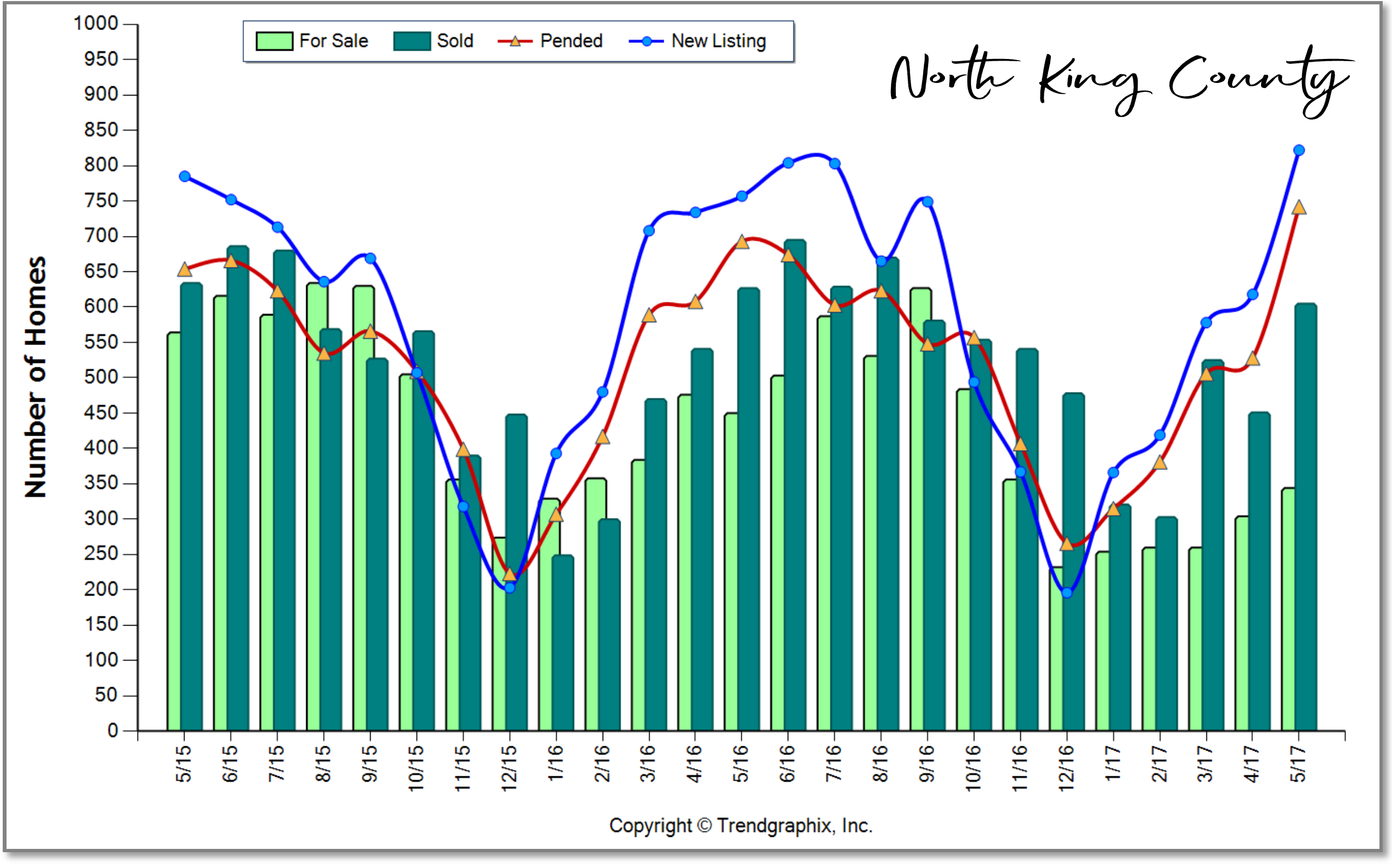

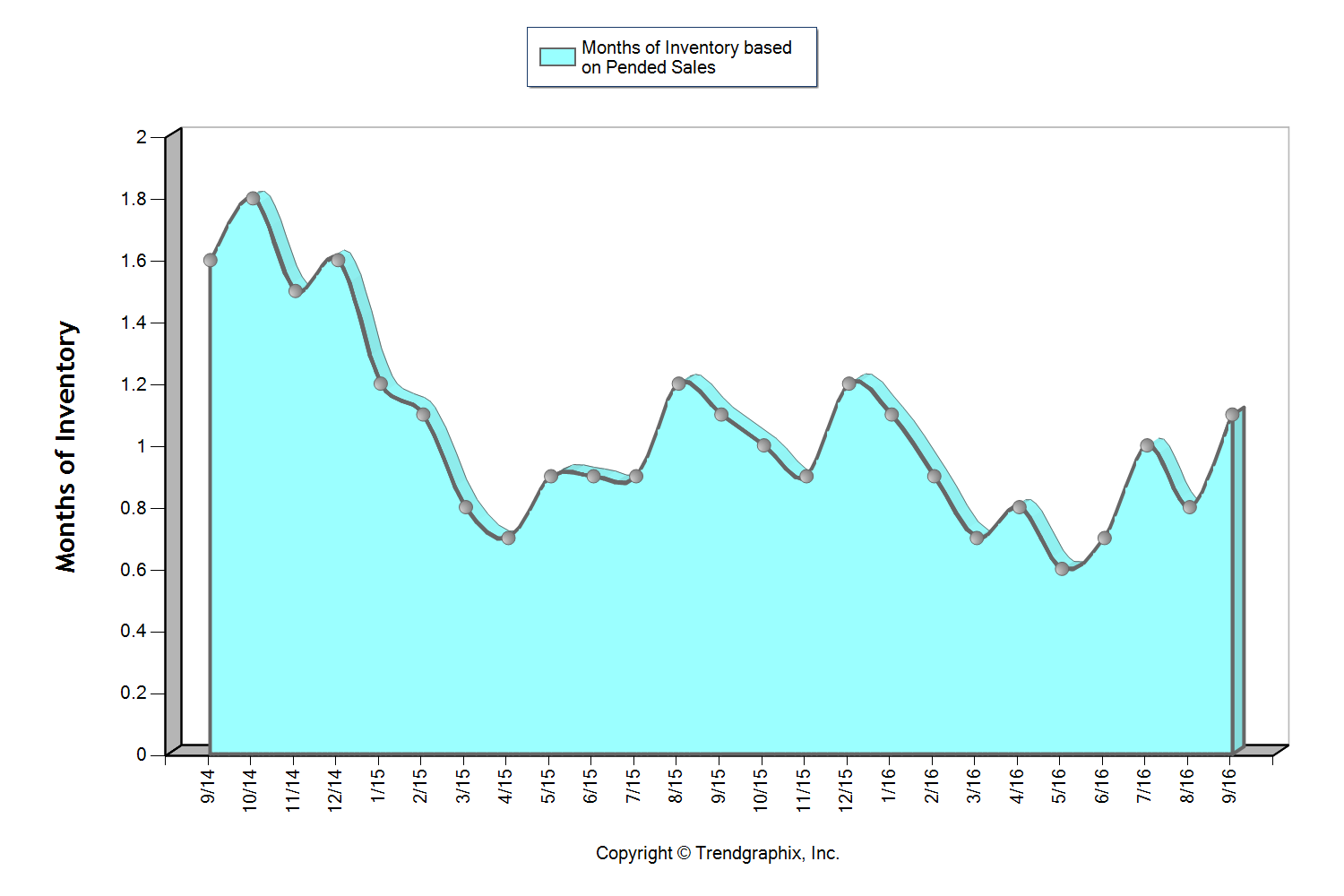

This graph shows that we currently sit at 1.1 months of inventory based on pending sales, which is the highest level we have seen since January! It is certainly still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. In fact, we saw a 13% jump in new listings month-over-month. The average cumulative days on market reached 20 days in September, which was up 18% over August. Median price peaked in June at $650,000 and settled at $600,000 in September after hovering between $605,000 and $650,000 since March. In June, there were 95% more home sales above $1M over September. For the first time since February, the average list to sale price ratio was 101% after sitting at 102-104% over the last seven months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 21% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

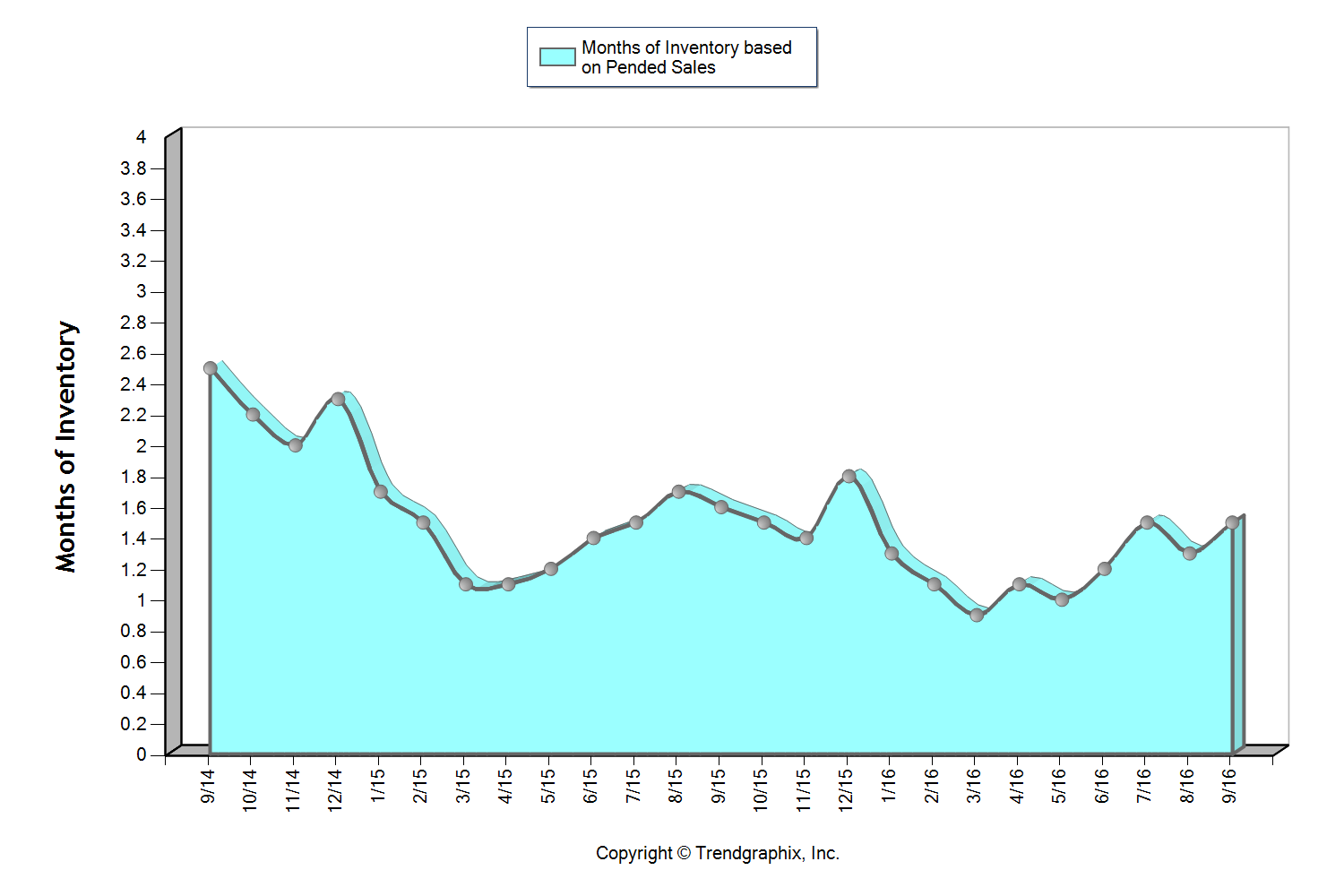

This graph shows that we currently sit at 1.5 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. The average cumulative days on market reached 31 days in September which was up 24% over August. Median price peaked in August at $770,000 and settled at $750,000 in September after hovering between $737,000 and $770,000 since March. In June, there were 18% more home sales above $1M over September. Over the last two months, the average list to sale price ratio was 99% after sitting at 101-102% over the five months prior.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 25% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.1 months of inventory based on pending sales, which is the highest level we have seen since January! It is certainly still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. In fact, we saw a 16% jump in new listings month-over-month. The average cumulative days on market reached 21 days in September, which was up 31% over August. Median price peaked in June at $650,000 and settled at $605,000 in September after hovering between $608,000 and $650,000 since March. In June, there were 23% more home sales above $1M over September. For the first time since February, the average list to sale price ratio was 101% after sitting at 102-104% over the last seven months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 22% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

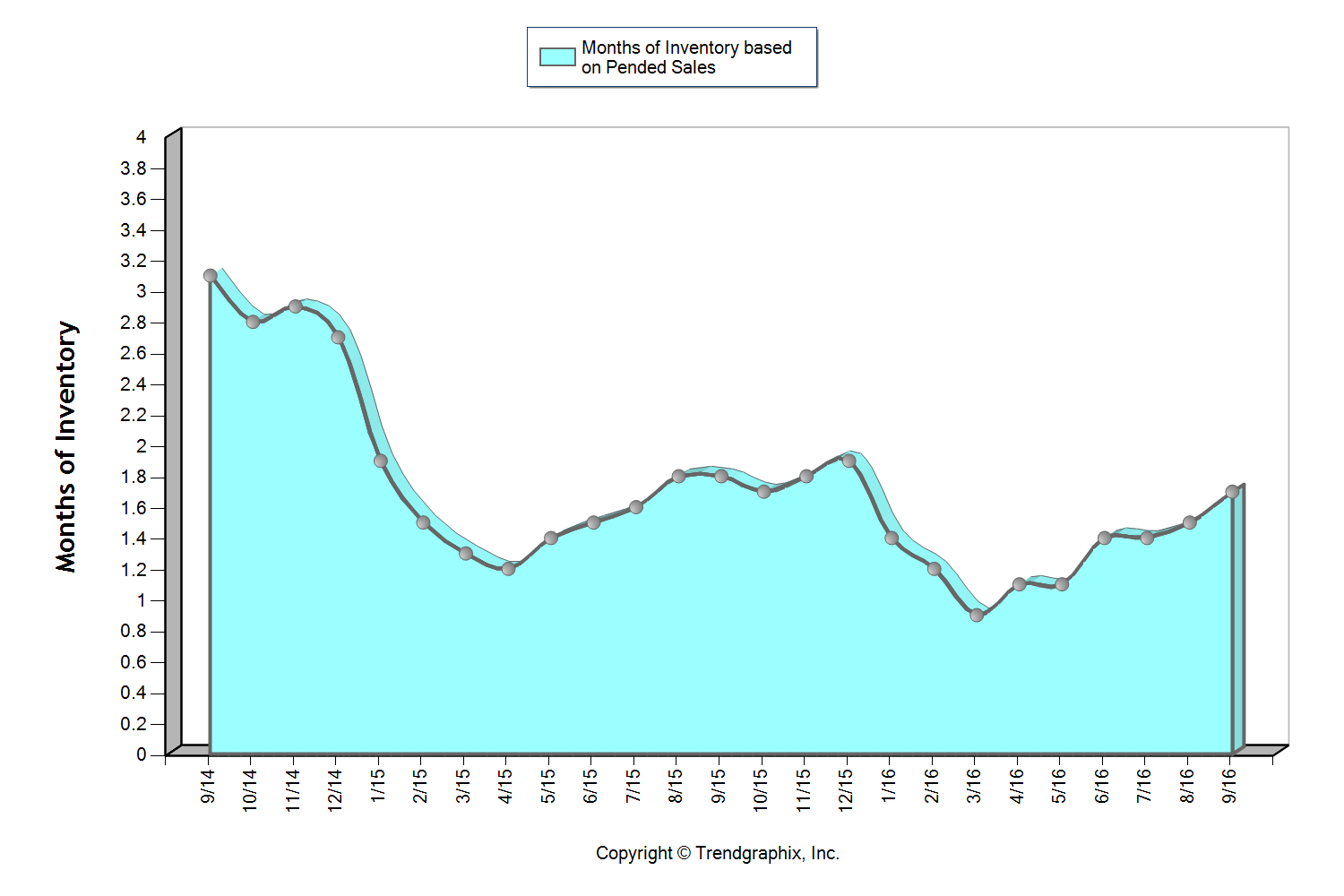

This graph shows that we currently sit at 1.7 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is providing buyers increased options. The average cumulative days on market reached 27 days in both August and September, which was up 23% over July. Median price peaked in June at $371,000 and settled at $360,000 in September after hovering between $350,000 and $371,000 since March. For the first time since March, the average list to sale price ratio was 99% in August and September after sitting at 100-101% the prior four months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 16% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

These are only snapshots of the trends in our area; please contact one of our agents if you would like further explanation of how the latest trends relate to you.

Market Update – Q1 2016

The 2016 real estate market is off to an extreme start! Strong buyer demand due to our flourishing job market and historically low interest rates are the driving force behind this market. Buyers often find themselves competing due to multiple offers which require seller-centric terms in order to win. Prices have continued to grow over the last two years, putting sellers in a very favorable equity position, freeing them up to make the moves they have been waiting for. Additional inventory would help slow price growth and make it less competitive for buyers, creating positive outcomes for everyone. Lending requirements remain stringent, unlike the past “up” market which created the bubble we experienced in 2008.

Scroll down for more details about the first quarter market in Snohomish County, south Snohomish County, north King County, the Eastside, Seattle Metro and south King County.

Snohomish County

More inventory is needed to quench buyer demand as we head into spring and summer.

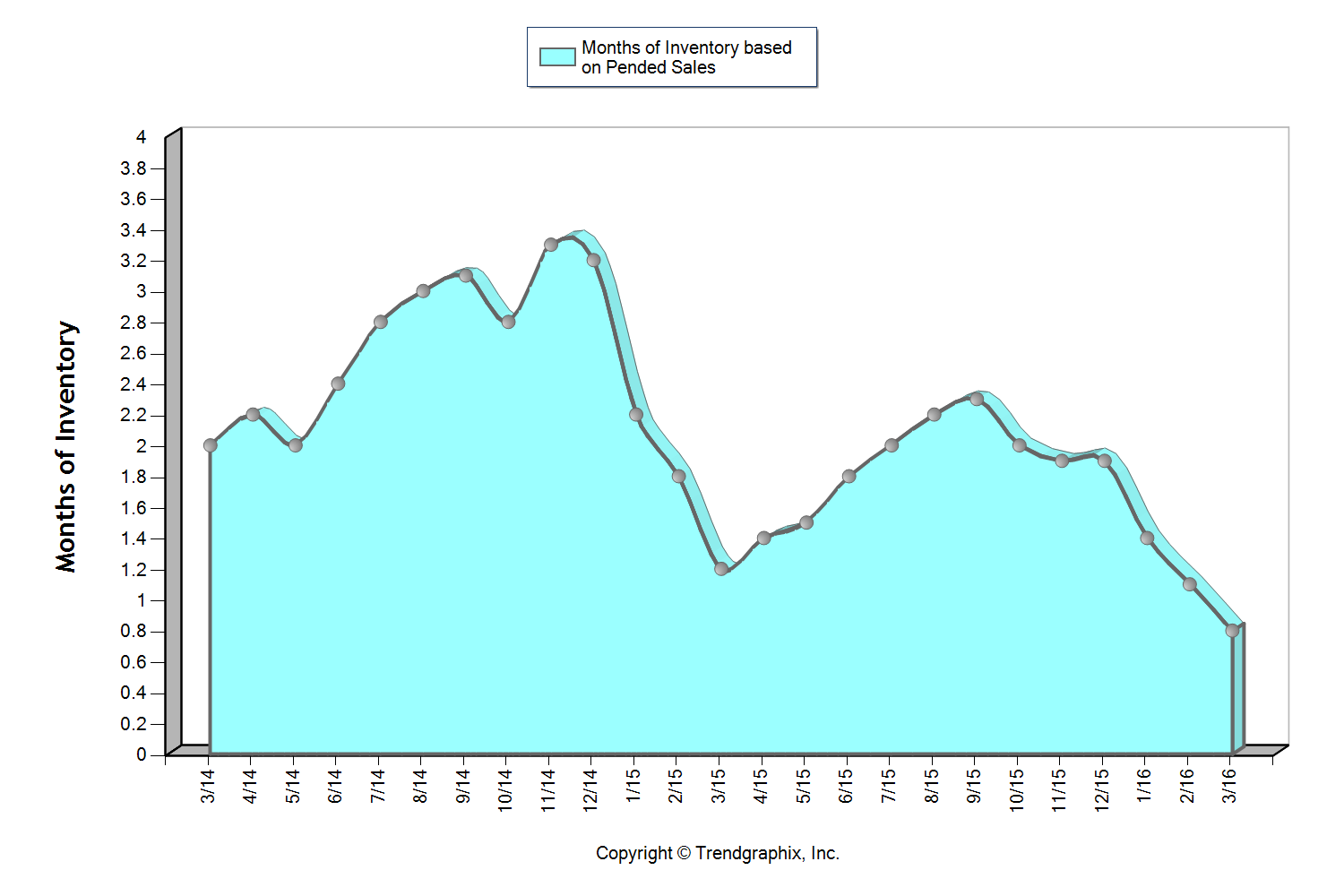

Snohomish County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.4 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.8 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 5% and 4% respectively in March over February! The good news is that new listings were up 25% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

South Snohomish County

More inventory is needed to quench buyer demand as we head into spring and summer.

South Snohomish County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.2 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.7 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 5% in March over February! The good news is that new listings were up 27% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

North King County

More inventory is needed to quench buyer demand as we head into spring and summer.

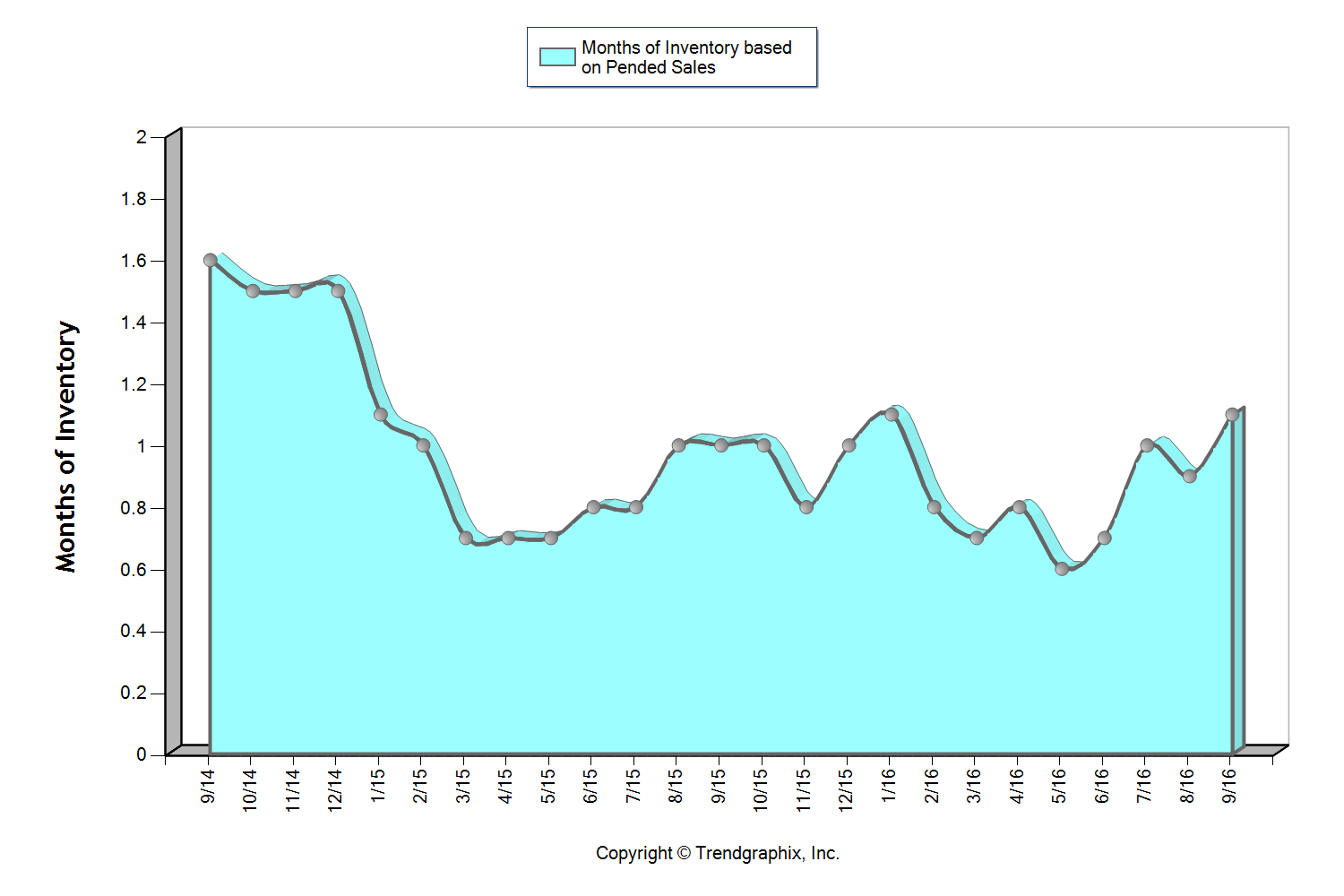

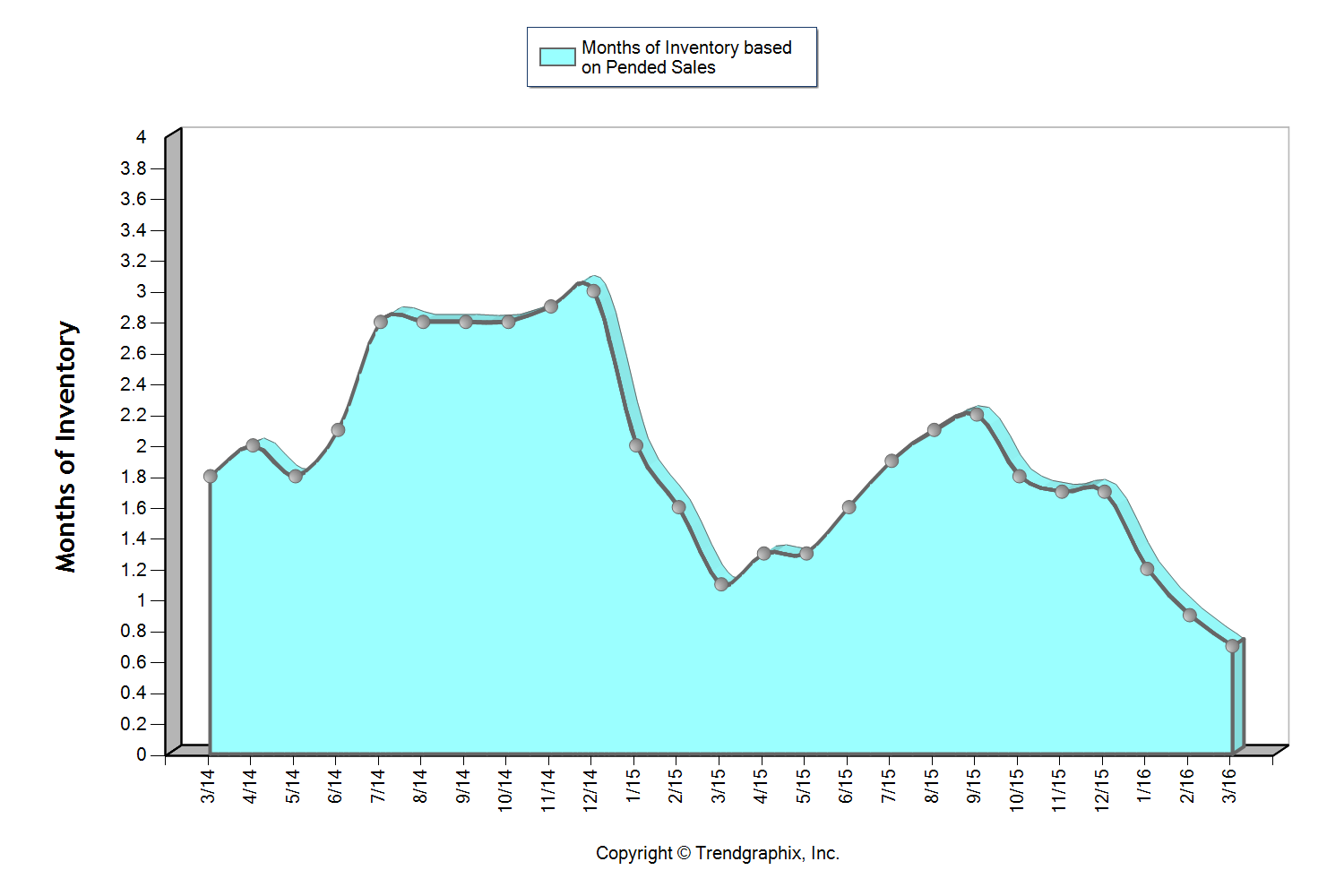

North King County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.1 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.6 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, the average price was up 2% in March over February! The good news is that new listings were up 49% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

Eastside

More inventory is needed to quench buyer demand as we head into spring and summer.

The Eastside ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.3 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.9 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 4% in March over February! The good news is that new listings were up 43% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

Seattle Metro

More inventory is needed to quench buyer demand as we head into spring and summer.

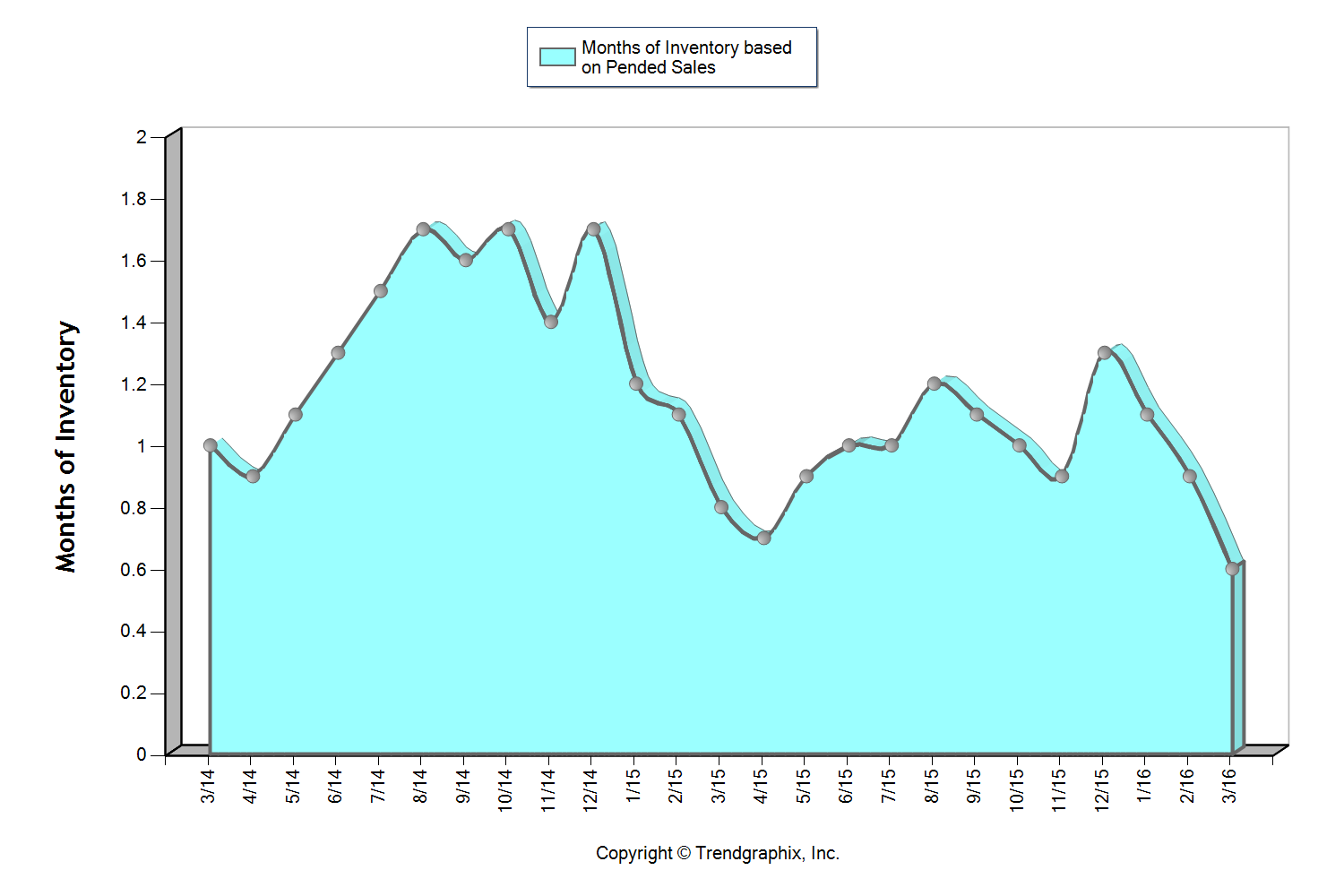

The Seattle Metro area ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.1 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.6 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 3% in March over February! The good news is that new listings were up 47% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

South King County

More inventory is needed to quench buyer demand as we head into spring and summer.

South King County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.4 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.8 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 6% and 3% respectively in March over February! The good news is that new listings were up 39% in that same time frame. We hope to see that trend continue as we head into spring, as the buyer demand is there to absorb it and it is needed to slow price growth.

This is only snapshots of the trends in our area. Please contact one of our agents if you would like further explanation of how the latest trends relate to you.

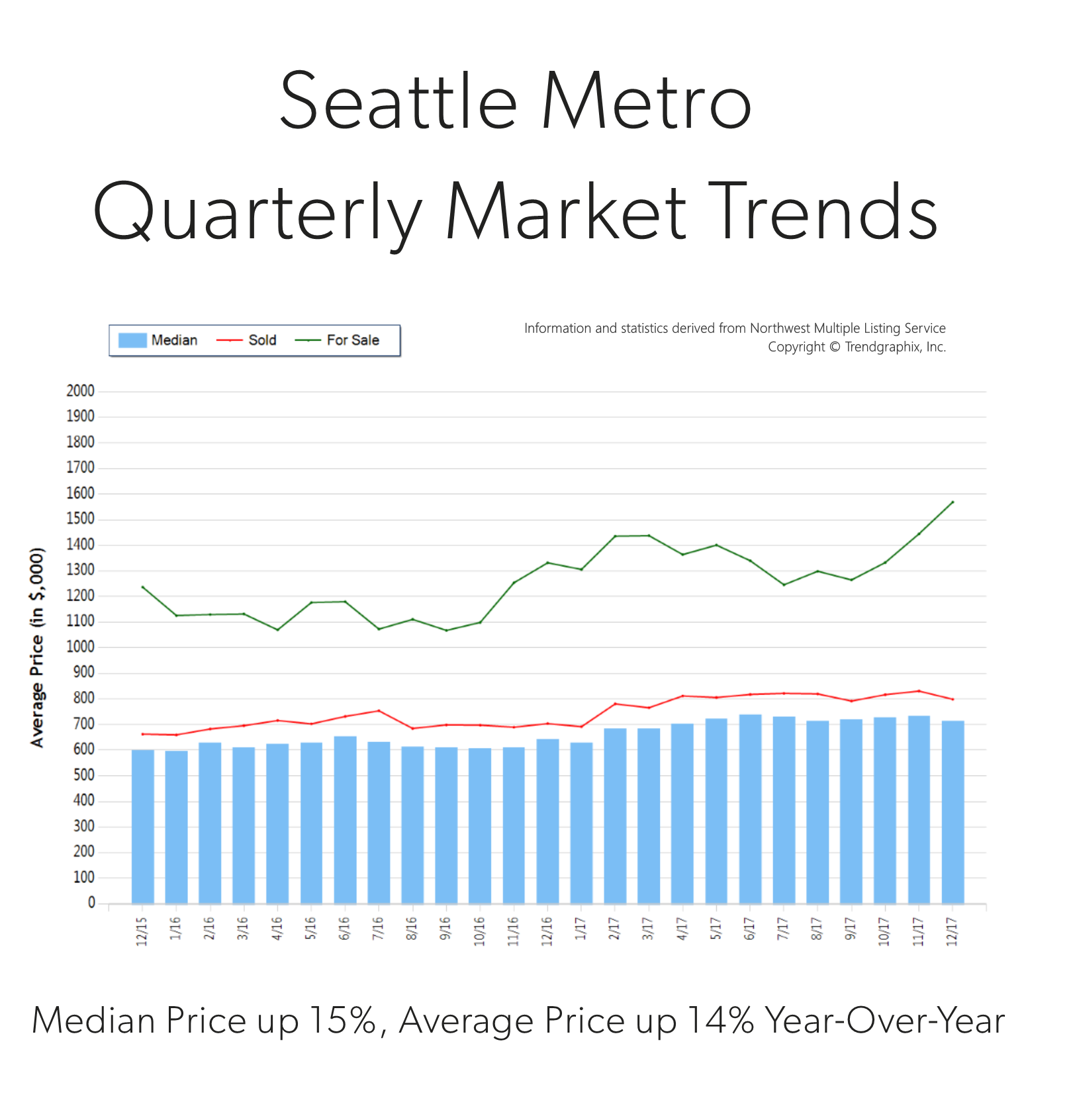

It’s an Amazing Time to be a Seller!

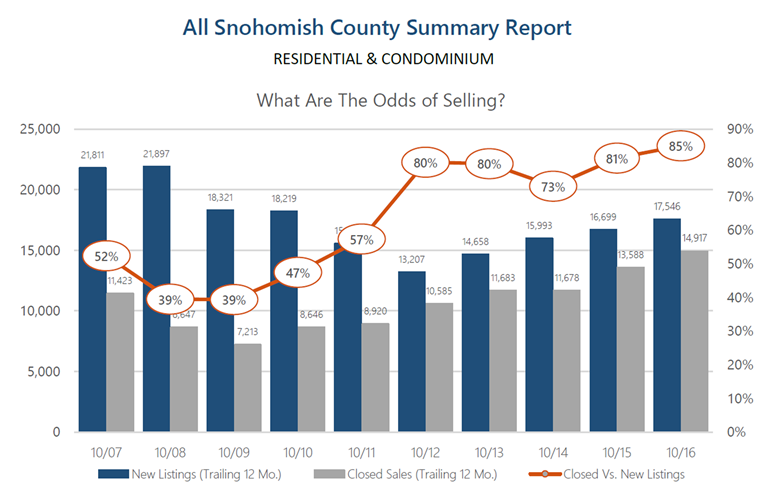

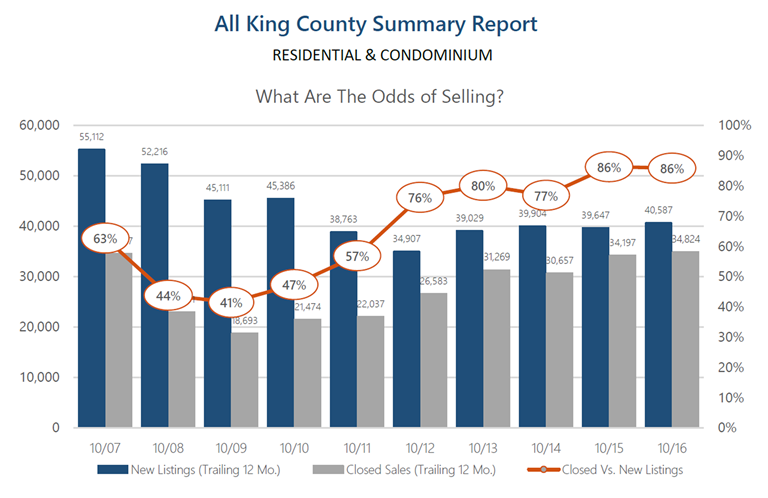

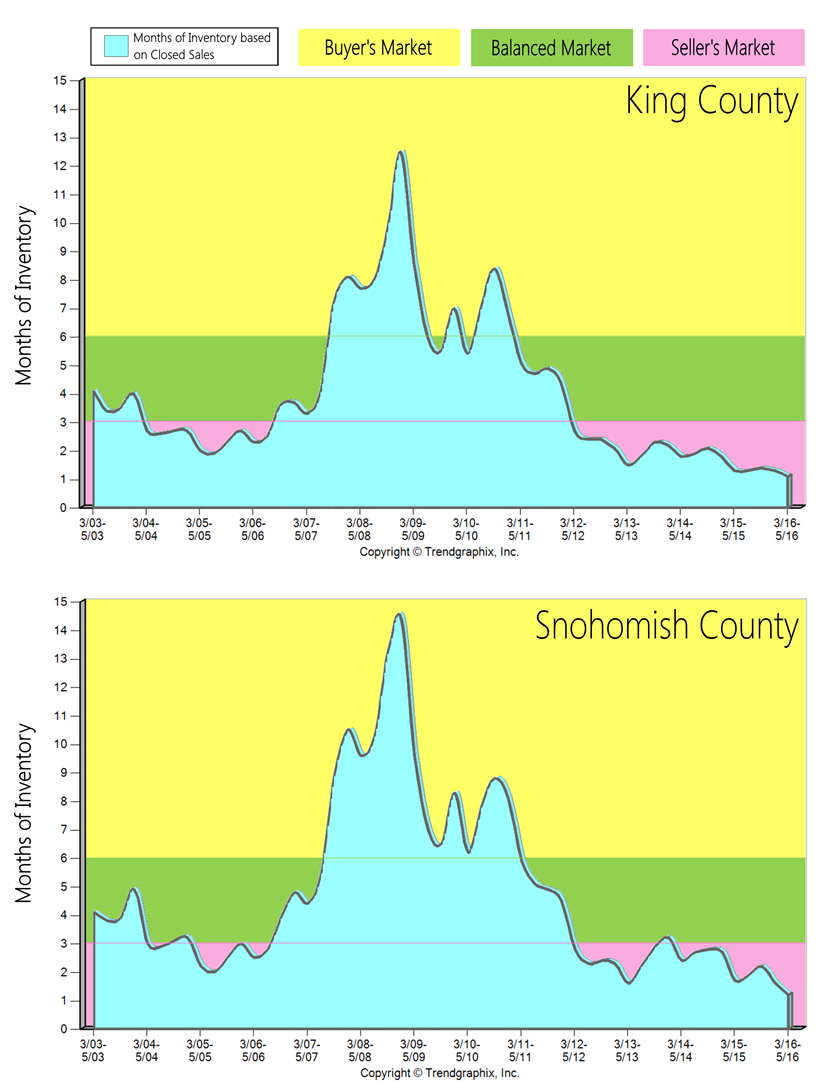

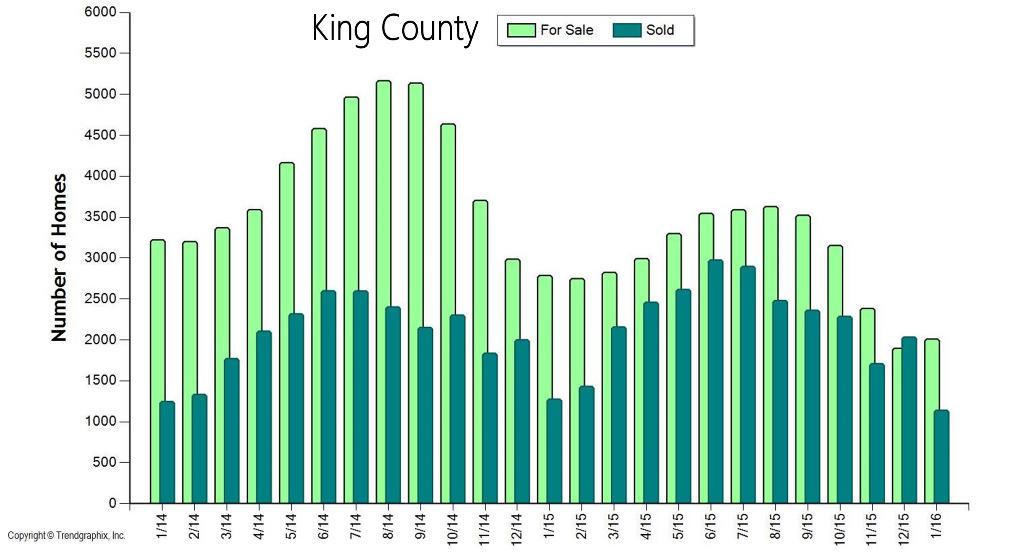

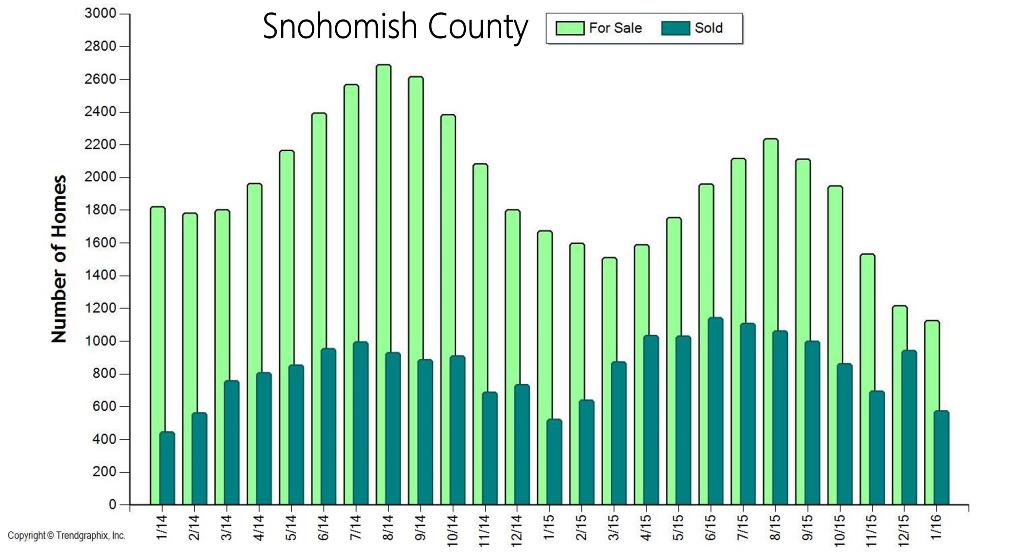

The two graphs here illustrate the amount of homes for sale and the amount of homes sold over the past two years in King and Snohomish Counties. This gives us a good look at the simple principle of supply and demand.  We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

If you have any curiosities or questions regarding the value of your current home or purchase opportunities, please contact any of our agents. It is always our goal to help keep you informed on all things real estate, and help you manage these investments.

Home Price Affordability Driven by Commute Times

Close proximity to the work place is often near the top of a buyer’s list of preferred features. 2015 proved to be the year that commute times to major job centers widened the price divide between key market areas in the Greater Seattle area. Seattle proper has always been more expensive than its neighboring suburbs, but the most current prices tell a tale of two different markets. In 2015 the average sales price for a single-family residential home in the Seattle Metro area was $632,000! In South Snohomish County (Everett to the King County line) the average sales price for a single-family residential home in 2015 was $433,000 – 46% less than Seattle Metro. Further, if you jump across Lake Washington to the Eastside, the average sales price for a single-family residential home in 2015 was $787,000 – 19% more than Seattle Metro! In December, pending sales in Snohomish County were up 12% and closings were up 29%, whereas in King County pending sales were down 9% and closings were up only 4%. We believe this is a result of more inventory choices in Snohomish County, as well as lower prices, new construction, lower taxes, strong school district options and manageable commute times. Newer transit centers and telecommuting have also opened up doors to King County's little brother to the north.

If you are curious about possible commute times, you can search for properties here on our website based on commute times, which is a feature provided by INRIX Drive Time. No matter which neighborhood you are interested in learning about in either King or Snohomish County, any of our agents would be happy to provide a 2015 re-cap of that market. 2015 was an outstanding year in real estate and we are looking for that to continue in 2016. We hope to see more homes coming to market due to the market's strong price position, which should help to increase inventory levels, in turn helping temper price growth and giving buyers more options.

If you are curious about possible commute times, you can search for properties here on our website based on commute times, which is a feature provided by INRIX Drive Time. No matter which neighborhood you are interested in learning about in either King or Snohomish County, any of our agents would be happy to provide a 2015 re-cap of that market. 2015 was an outstanding year in real estate and we are looking for that to continue in 2016. We hope to see more homes coming to market due to the market's strong price position, which should help to increase inventory levels, in turn helping temper price growth and giving buyers more options.

How Much is Your Home Worth?

A Look at Local Home Value Growth Since 2012

Since 2012, home values have grown by around 10% each year, resulting in substantial return in pricing. Below are some examples of actual homes sold in 2012 and again in 2015 that were not remodeled or significantly improved in between sales. These examples show the return in home values that we have experienced since the economic downturn. We pulled these examples to show you actual pound-for-pound market data versus the statistical percentages often quoted in market updates. We think these examples are pretty telling and quite exciting!

As you can see in the current economic update from Matthew Gardner, inventory has been a challenge. Many folks have been waiting for their current home values to return in order to make big moves involving their retirement, upgrading homes, investing or even buying a second home. If you are one of those people, we hope these examples provide you insight on the increase in home values and how they might pertain to you. As we head into the New Year, if you'd like a Comparable Market Analysis (CMA) on your home so you have a better understanding of your home's value, any one of our agents would be happy to do that. This would be an important component in charting your 2016 financial goals, and what a great time of year to gather that information.

3 bedroom 3200 sq ft Edmonds home: |

|

|

|

Sold in August 2012

|

Sold in July 2015

|

$185,050 INCREASE IN HOME VALUE: 32%! |

|

4 bedroom 2100 sq ft Bothell home: |

|

|

|

Sold in February 2012

|

Sold in February 2015

|

$114,872 INCREASE IN HOME VALUE: 36%! |

|

3 bedroom 1400 sq ft Shoreline home: |

|

|

|

Sold in June 2012

|

Sold in March 2015

|

$102,250 INCREASE IN HOME VALUE: 33%! |

|

3 bedroom 1800 sq ft Lynnwood home: |

|

|

|

Sold in December 2011

|

Sold in May 2015

|

$95,000 INCREASE IN HOME VALUE: 43%! |

|

We are currently working on more examples in surrounding communities… check out our Price Appreciation Study for more. And contact any one of our agents for a Comparable Market Analysis on your home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link