Affordability: Commute Times & Interest Rates

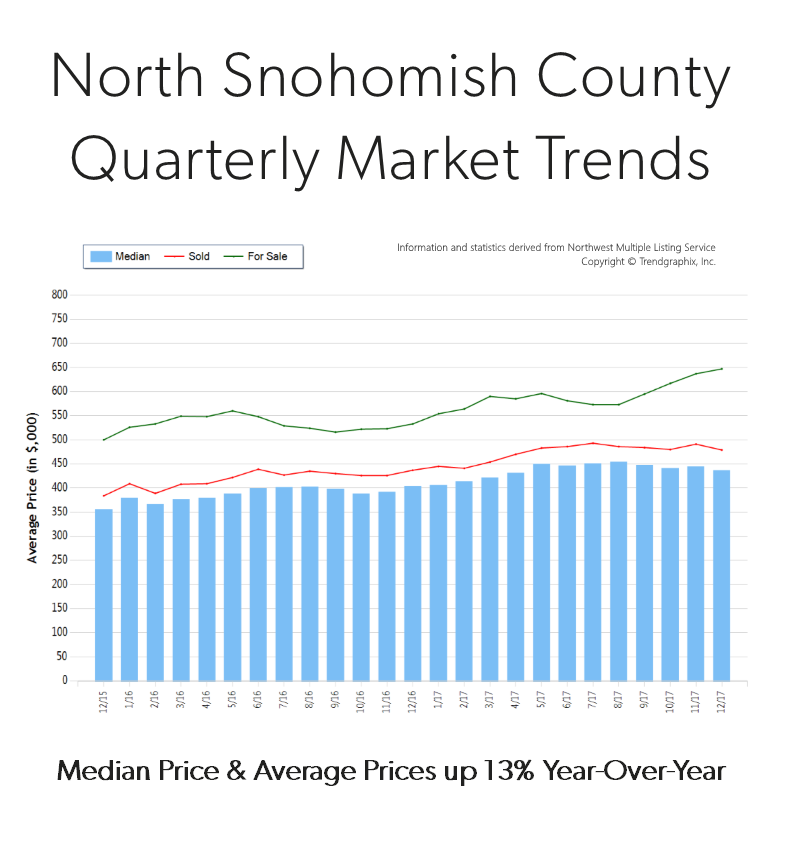

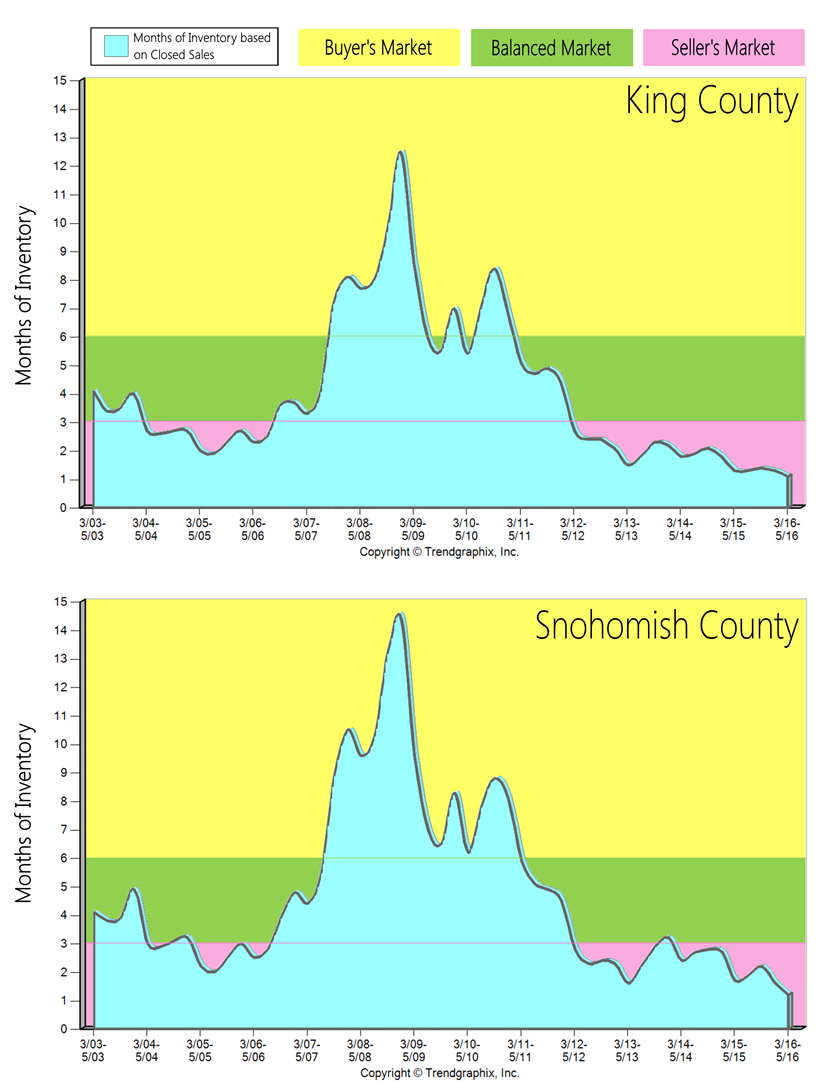

These graphs illustrate the brass tacks of affordability between King and Snohomish Counties, measured by the average monthly payment. Most recently in September, the average monthly payment was 35% higher in King County compared to Snohomish County. What is fascinating, though, is comparing today’s average monthly payment to peak monthly payments back in 2007! In King County, monthly payments are currently 21% less than during the peak, and in Snohomish County, 36% less. That is a lot of saved monthly overhead. Note that this has everything to do with today’s historical interest rates, as average prices are higher now than in 2007. When one buys or refinances a house, they are not only securing the property, but securing the rate for the life of the loan.

These graphs illustrate the brass tacks of affordability between King and Snohomish Counties, measured by the average monthly payment. Most recently in September, the average monthly payment was 35% higher in King County compared to Snohomish County. What is fascinating, though, is comparing today’s average monthly payment to peak monthly payments back in 2007! In King County, monthly payments are currently 21% less than during the peak, and in Snohomish County, 36% less. That is a lot of saved monthly overhead. Note that this has everything to do with today’s historical interest rates, as average prices are higher now than in 2007. When one buys or refinances a house, they are not only securing the property, but securing the rate for the life of the loan.

Close proximity to the work place and affordability is often near the top of a buyer’s list of preferred features. 2016 has continued to be a year when commute times to major job centers widened the price divide between key market areas in the greater Seattle area. Over the last 12 months, the average sales price for a single-family residential home in the Seattle Metro area was $696,000! In south Snohomish County (Everett to the King County line), the average sales price for a single-family residential home was $471,000 – 48% less than Seattle Metro. Further, if you jump across Lake Washington to the Eastside, the average sales price for a single-family residential home was $881,000 – 27% more than Seattle Metro!

The “drive to qualify” mentality has been proven by the pending sales rate in south Snohomish County over the last 12 months. Pending sales are up 7% complete year-over-year, whereas in Seattle Metro pending sales are down 1%, and down 2% on the Eastside. We believe this is a result of affordability, more inventory choices in south Snohomish County, new construction options, lower taxes, strong school district choices, and manageable commute times. Newer transit centers and telecommuting have also opened up doors to King County’s little brother to the north as well. If you are curious about possible commute times, you can search for properties on our website based on commutes times, which is a feature provided by INRIX Drive Time. Also, we track the market in several ways, so if the graphs here are interesting to you, any of our agents would be happy to provide additional information relative to your specific neighborhood. Please contact us anytime, as it is our goal to help keep you informed and empower you to make strong real estate decisions.

It’s an Amazing Time to be a Seller!

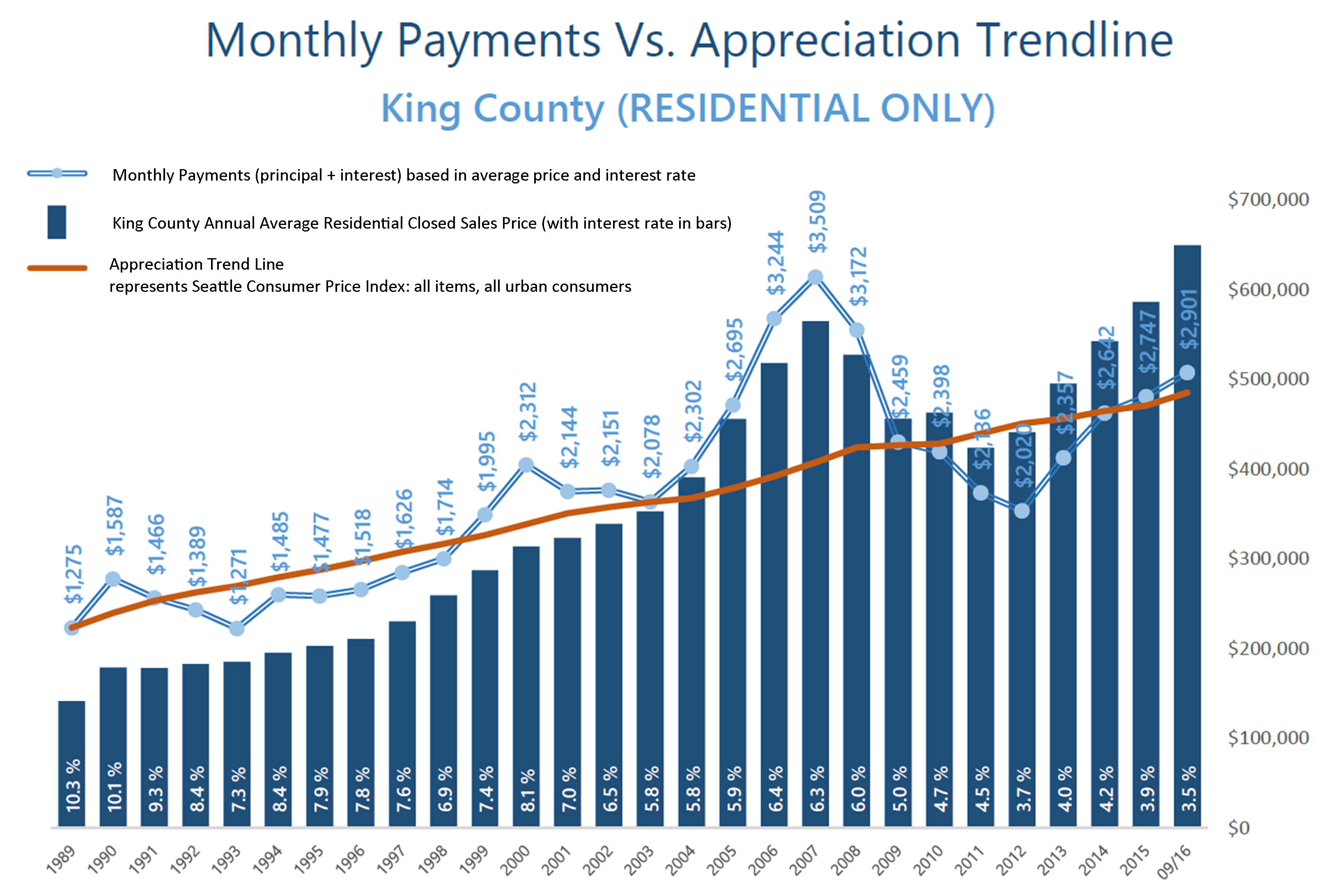

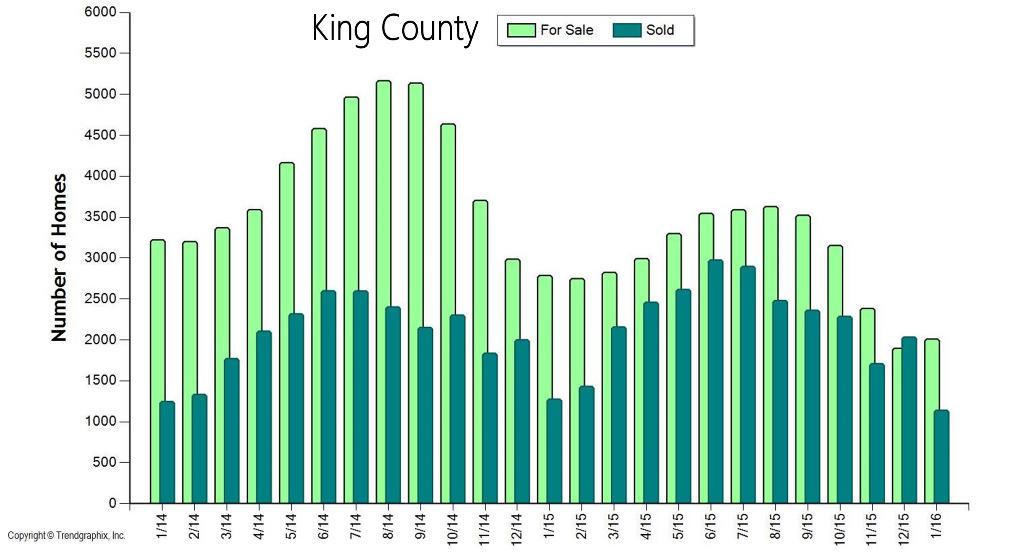

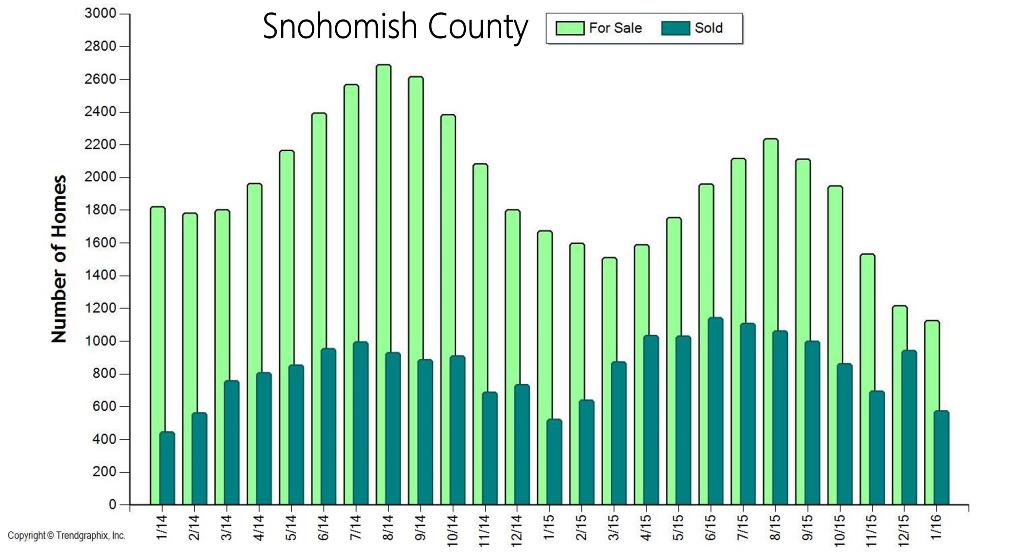

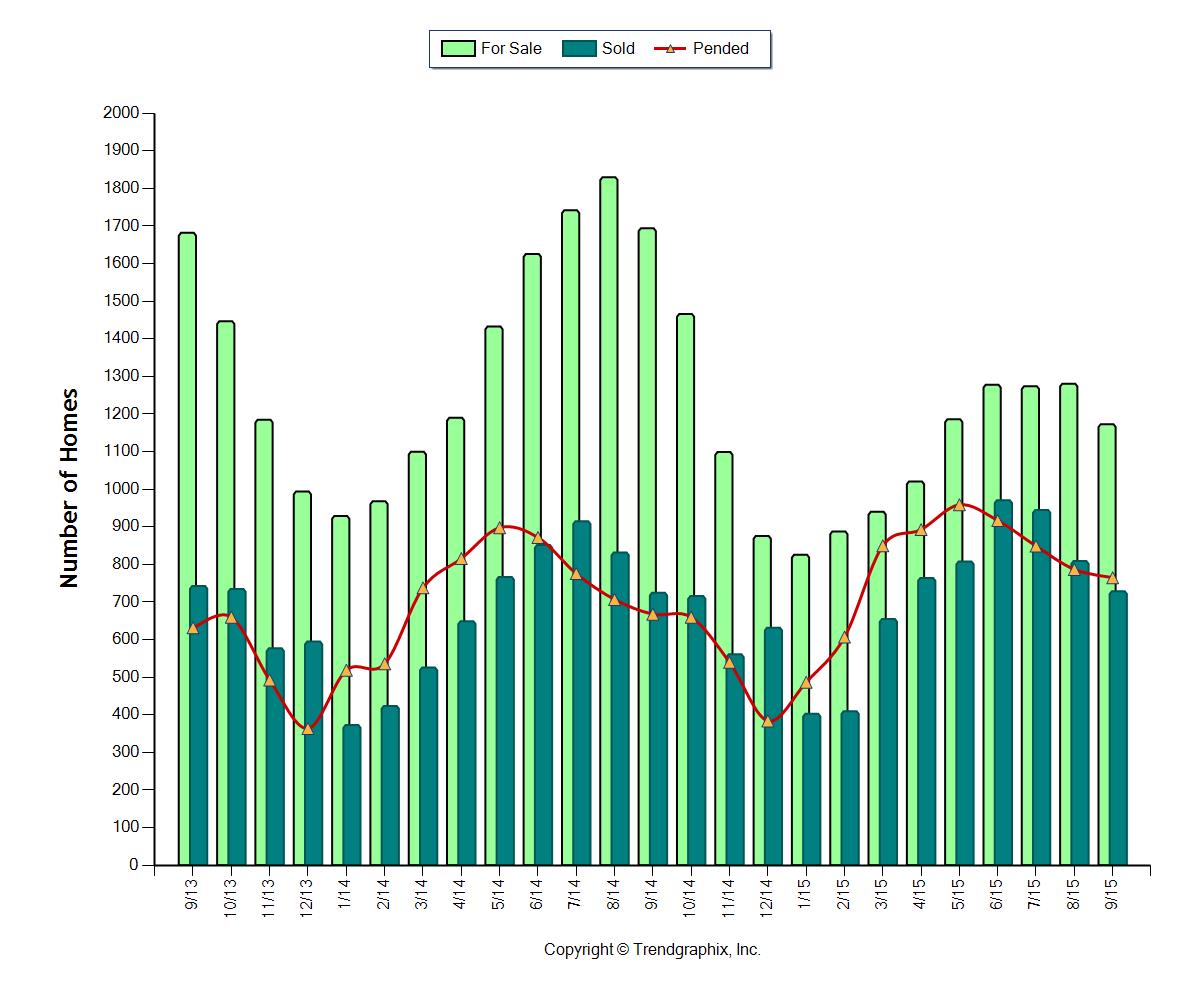

The two graphs here illustrate the amount of homes for sale and the amount of homes sold over the past two years in King and Snohomish Counties. This gives us a good look at the simple principle of supply and demand.  We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

If you have any curiosities or questions regarding the value of your current home or purchase opportunities, please contact any of our agents. It is always our goal to help keep you informed on all things real estate, and help you manage these investments.

How Much is Your Home Worth?

A Look at Local Home Value Growth Since 2012

Since 2012, home values have grown by around 10% each year, resulting in substantial return in pricing. Below are some examples of actual homes sold in 2012 and again in 2015 that were not remodeled or significantly improved in between sales. These examples show the return in home values that we have experienced since the economic downturn. We pulled these examples to show you actual pound-for-pound market data versus the statistical percentages often quoted in market updates. We think these examples are pretty telling and quite exciting!

As you can see in the current economic update from Matthew Gardner, inventory has been a challenge. Many folks have been waiting for their current home values to return in order to make big moves involving their retirement, upgrading homes, investing or even buying a second home. If you are one of those people, we hope these examples provide you insight on the increase in home values and how they might pertain to you. As we head into the New Year, if you'd like a Comparable Market Analysis (CMA) on your home so you have a better understanding of your home's value, any one of our agents would be happy to do that. This would be an important component in charting your 2016 financial goals, and what a great time of year to gather that information.

3 bedroom 3200 sq ft Edmonds home: |

|

|

|

Sold in August 2012

|

Sold in July 2015

|

$185,050 INCREASE IN HOME VALUE: 32%! |

|

4 bedroom 2100 sq ft Bothell home: |

|

|

|

Sold in February 2012

|

Sold in February 2015

|

$114,872 INCREASE IN HOME VALUE: 36%! |

|

3 bedroom 1400 sq ft Shoreline home: |

|

|

|

Sold in June 2012

|

Sold in March 2015

|

$102,250 INCREASE IN HOME VALUE: 33%! |

|

3 bedroom 1800 sq ft Lynnwood home: |

|

|

|

Sold in December 2011

|

Sold in May 2015

|

$95,000 INCREASE IN HOME VALUE: 43%! |

|

We are currently working on more examples in surrounding communities… check out our Price Appreciation Study for more. And contact any one of our agents for a Comparable Market Analysis on your home.

Housing Demand Defined

What defines a housing market? We have had many different markets over the years that have been defined by certain identifiable factors. Will the last person leaving Seattle- turn out the lights, do you remember that billboard from 1971? Or the global housing boom of 2005-2007 that was driven by sub-prime credit lending options (which no longer exist, thank goodness!). Our current market is defined by strong demand and low inventory – the basic economic principle of supply and demand – Economics 101! A market with 0-3 months of inventory is a seller's market, 4-6 a balanced market and 6+ months a buyer's market. The route of the 2007-2011 economic down-turn, where months of available inventory favored buyers and was as high as 13 months, seems like ancient history. Since the Summer of 2012, months of inventory has favored sellers in both King and Snohomish counties, with an average of two months of available inventory between the two counties over the last three years. There is a market divergence going on between King and Snohomish County due to some unique factors each county possesses.

What defines a housing market? We have had many different markets over the years that have been defined by certain identifiable factors. Will the last person leaving Seattle- turn out the lights, do you remember that billboard from 1971? Or the global housing boom of 2005-2007 that was driven by sub-prime credit lending options (which no longer exist, thank goodness!). Our current market is defined by strong demand and low inventory – the basic economic principle of supply and demand – Economics 101! A market with 0-3 months of inventory is a seller's market, 4-6 a balanced market and 6+ months a buyer's market. The route of the 2007-2011 economic down-turn, where months of available inventory favored buyers and was as high as 13 months, seems like ancient history. Since the Summer of 2012, months of inventory has favored sellers in both King and Snohomish counties, with an average of two months of available inventory between the two counties over the last three years. There is a market divergence going on between King and Snohomish County due to some unique factors each county possesses.

First, King County's lack of inventory has been drastic. Year-to-date, it has hovered at one month of available inventory, which means that each month we are nearly selling out of homes! This is due to the fact that demand is high and inventory is down. In the last 12 months, Seattle has had 27% less homes for sale than the previous 12 months, and closed sales are up 6%. In fact, Auction.com just named Seattle the number one housing market in the nation. This is due to the city's large technology sector driving employment, low interest rates and an increase in household formation. The housing premium in Seattle is rooted in shorter commute times to job centers, high walk scores and hip urban centers. The premium is real though, with the median home price over the last 12 months in Seattle reaching $528,000 – up 13% from the previous 12 months.

In Snohomish County inventory is still tight, with an average of two months of available inventory this year. Inventory has been somewhat supported by new construction and improved equity levels for re-sale properties. The median home price over the last 12 months was $347,000 – 34% less than Seattle. Median price growth is up 9% complete year-over-year.

What should we expect going forward into 2016? In both counties there was an increase in inventory in the third quarter. This is a promising indicator that folks are feeling more comfortable coming to market due to price increases after a booming spring market and healthier overall economic environment. Where this market is different from the bubbly market of 2007 are the drivers of the strong local economy, low interest rates and job growth, versus the unsustainable lending standards of the sub-prime loan movement. I believe we will see more homes come to market, especially as we head into the spring 2016 market. Folks are ready to move on to what is next for them, and recouped prices are enabling those choices. This increase will be welcomed as it will provide more options for buyers and will start to temper price growth, which is a good thing.

Where this market has gotten a bit tricky, is where one goes once their home sells. The low inventory has made this challenging, but with any market challenge you find creative and strategic ways to maneuver through and find success for your clients. Windermere has a great Bridge Loan product to utilize, temporary moves have solved these transitions, and longer closings with seller rent-backs have also been widely used to help make seamless transitions. This an exciting market to participate in, and creative strategy is the name of the game. Please contact one of our agents if you would like to know more about the current market conditions and how they relate to your bottom line and lifestyle decisions.

Market Update – Q3 2015

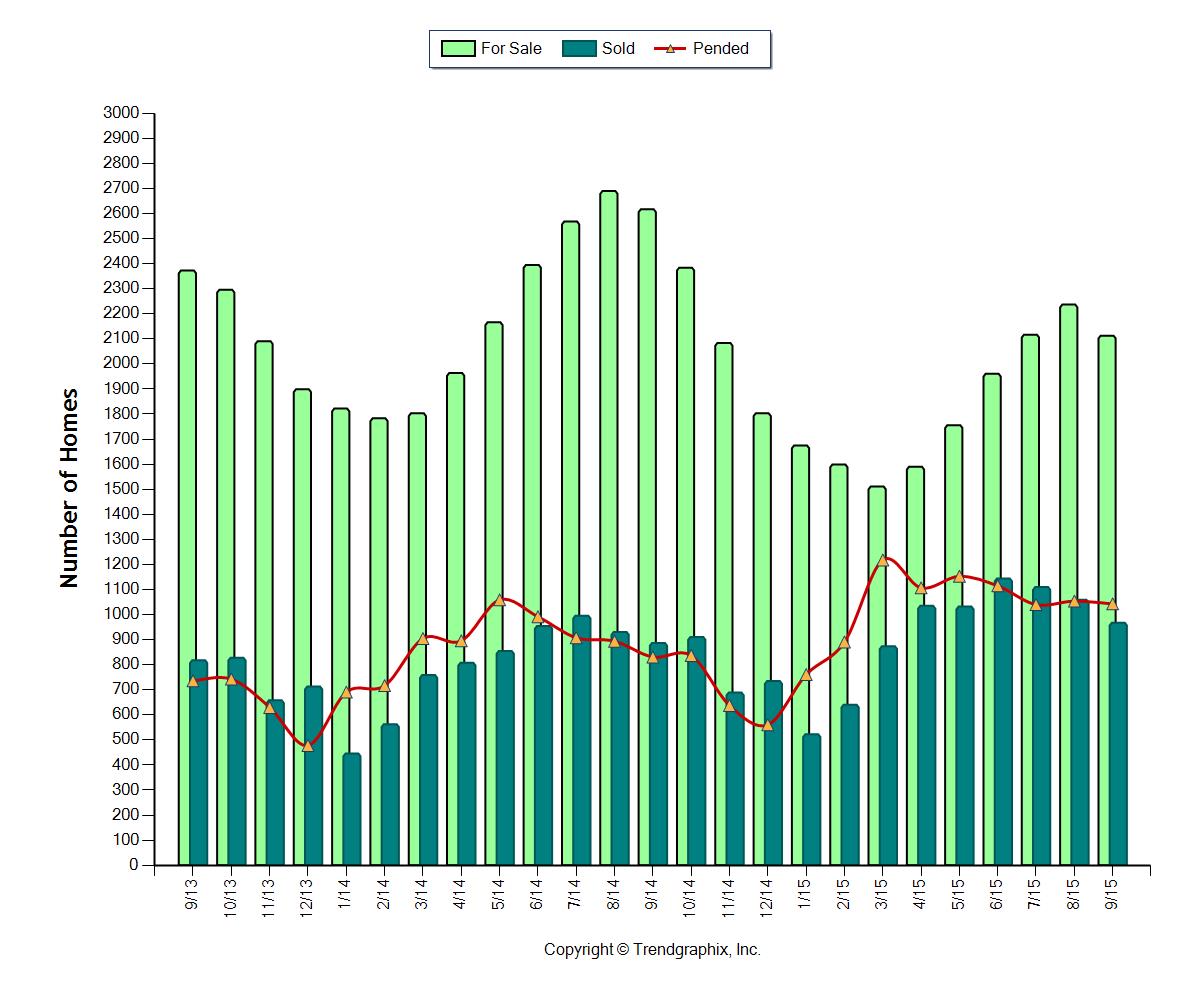

Snohomish County

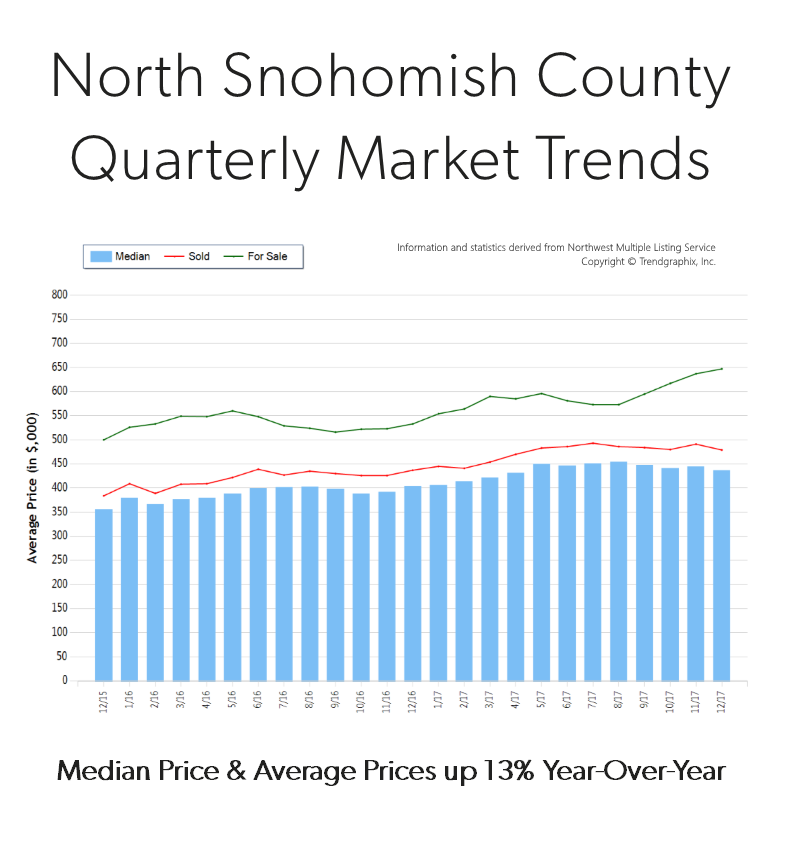

Seasonal patterns are returning after the market’s fall and recovery

The graph above shows a two-year history of the market, where we have clearly seen a surge of inventory from March to August. In fact we saw a 48% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 1% from the year prior, all while closed sales were up 18%! Months of Inventory based on pending sales has held steady at an average of two months over the last year. Due to demand outweighing supply we continue to see above-normal price growth, with both median and average prices up 9% complete year-over-year.

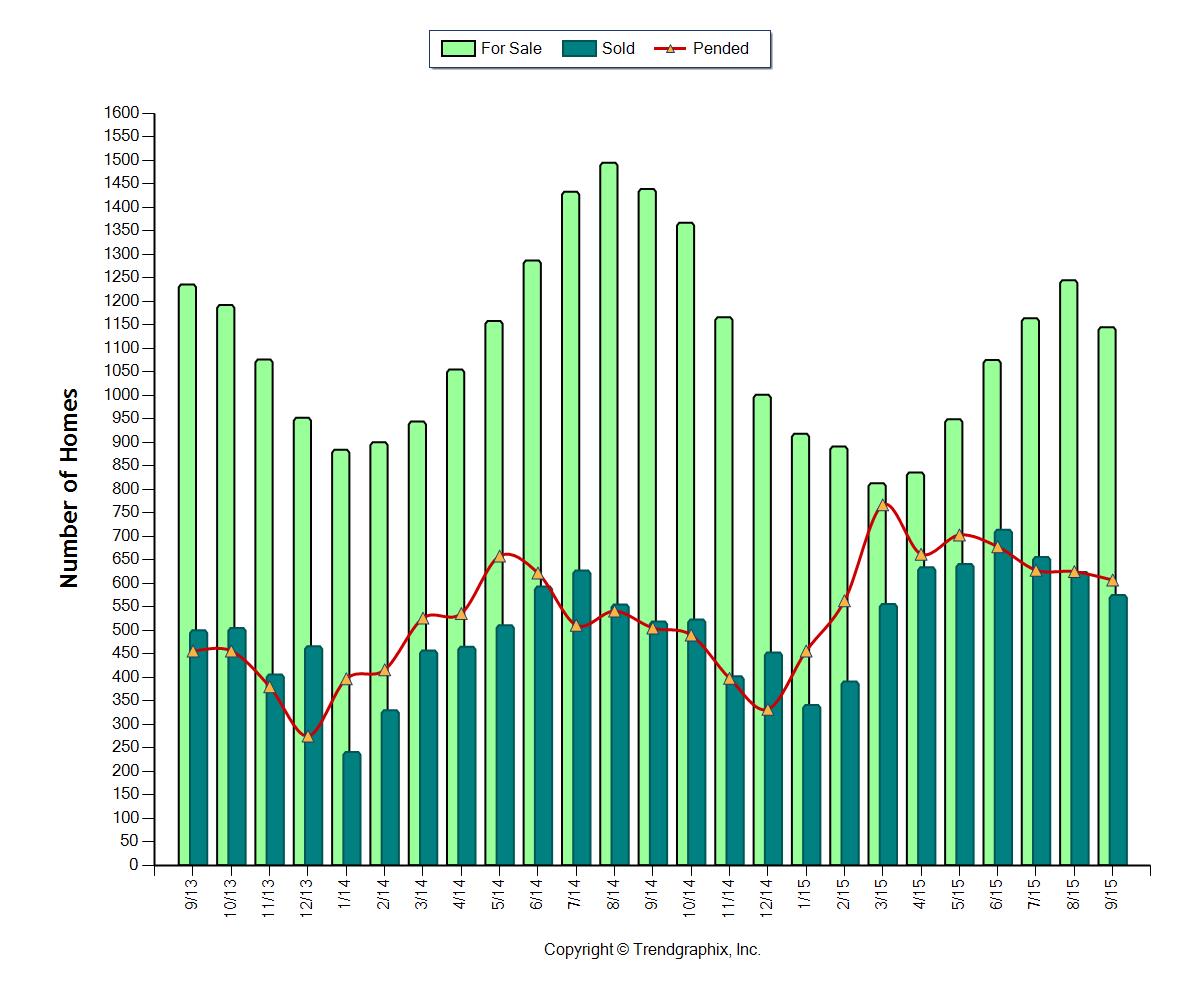

South Snohomish County

Seasonal patterns are returning after the market’s fall and recovery

You can see in the graph above a clear surge of inventory came to market from March to August. In fact we saw a 53% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 5% from the year prior, all while closed sales were up 19%! Months of Inventory based on pending sales has held steady at an average of two months over the last year. Due to demand outweighing supply we continue to see above-normal price growth, with both median and average prices up 9% complete year-over-year.

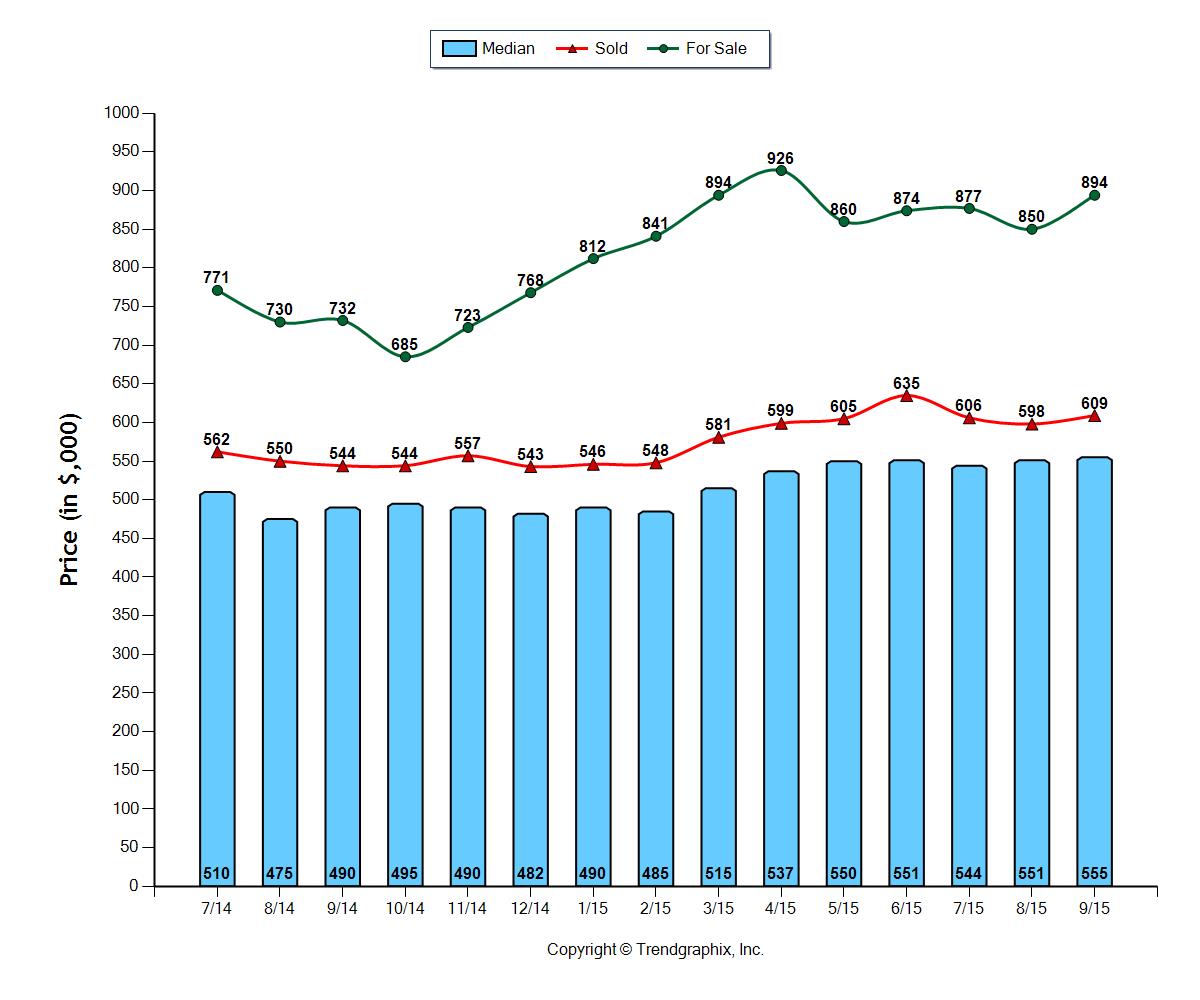

North King County

Price increases are strong due to high demand and low inventory

All indicators, such as sold median price, sold average price and sold price per square foot point to a 10% increase in prices complete year-over-year. The median price in North King County this September was $555,000 and the average was $609,000. Average days on market have shrunk to as low as 22 days this last month, and the list to sale price ratio was 101%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested one month after a small surge of additional inventory in the third quarter.

Eastside

Seasonal patterns are returning after the market’s fall and recovery

The graph above shows a two-year history of the market, where we have clearly seen a surge of inventory from February to August. In fact we saw a 44% increase in inventory during this time period. While that is a welcome increase, inventory growth was down 45% from the year prior, all while closed sales were up 10%! Months of Inventory based on pending sales has held steady at an average of 1.5 months over the last year. Due to demand outweighing supply we continue to see above normal price growth, with both median and average prices up 9% complete year-over-year.

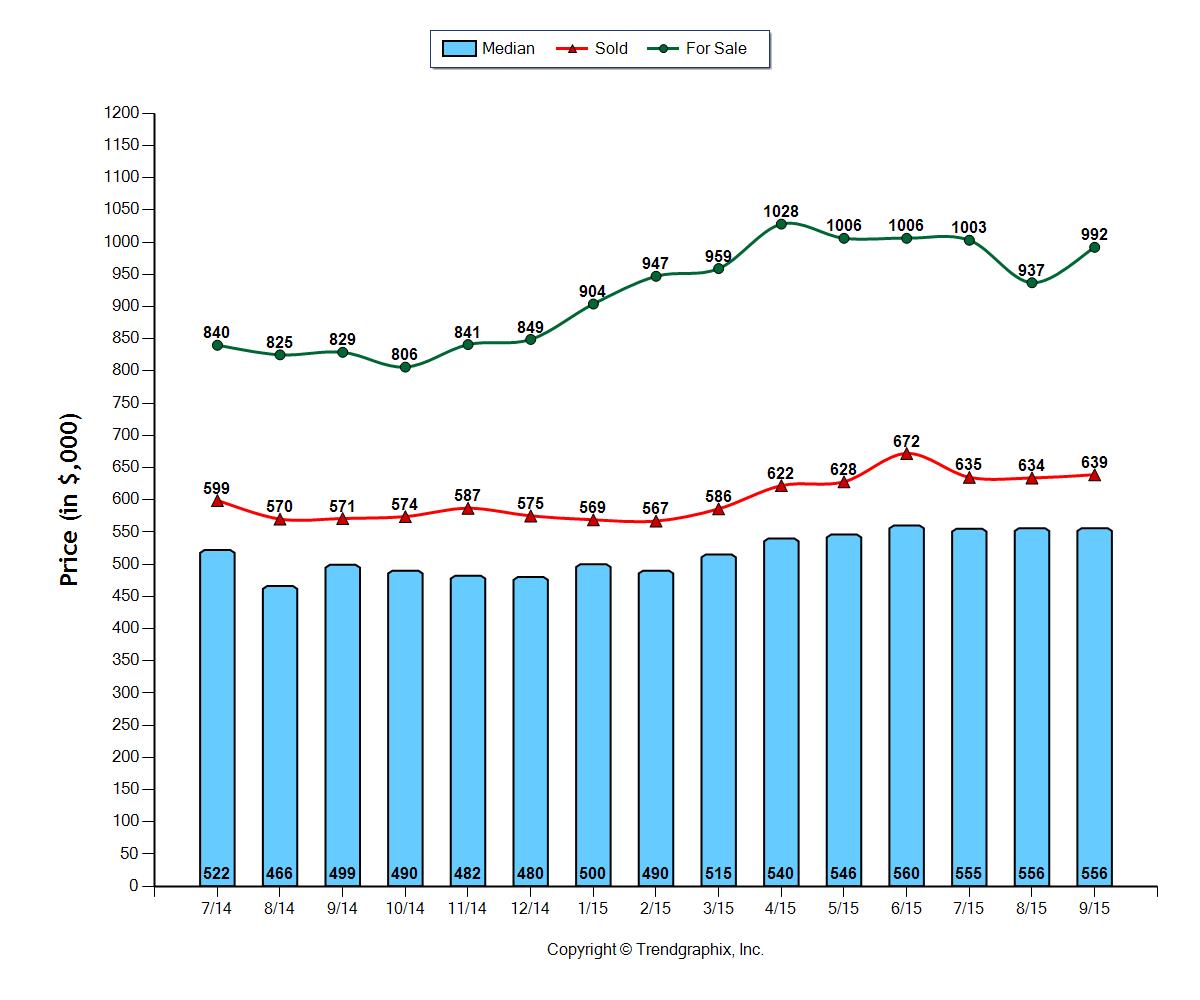

Seattle Metro

Price increases are strong due to high demand and low inventory

All indicators, such as sold median price, sold average price and sold price per square foot point to an 11% increase in prices complete year-over-year. The median price in the Seattle Metro area this September was $556,000 and the average was $639,000. Average days on market have shrunk to as low as 22 days this last month, and the list to sale price ratio was 101%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested one month after a small surge of additional inventory in the third quarter.

South King County

Price increases are strong due to high demand and low inventory

All indicators point to strong price increases with median price up 11%, average price up 8% and average price per square foot up 8% complete year-over-year. The median price in South King County this September was $335,000 and the average was $358,000. Average days on market have shrunk to as low as 36 days this last month, and the list to sale price ratio was 99%. Lack of supply and high demand is the gas in this market’s engine. Months of inventory based on pending sales finally crested 1.5 months after a small surge of additional inventory in the third quarter.

This is only snapshots of the trends in our area. Please contact one of our agents if you would like further explanation of how the latest trends relate to you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link