What is the State of the Condominium Market in the Greater Seattle Area?

We often speak about the Single Family Residential (SFR) market, but we thought it would be interesting to take a deep dive into the Condominium (condo) market in the Greater Seattle area. Condos can provide a more affordable option and have grown in popularity as SFR home prices have gone up.

Much like the SFR market the condo market has been inventory starved. In fact, condo inventory is down 31% in both King and Snohomish Counties complete year-over-year. While inventory has shrunk sales have increased! In King County, sales are up 14% over the last twelve months compared to the previous twelve months, and up 23% in Snohomish County. These figures indicate quite a bit of demand for this product. The good news is new listings are slighting increasing, with 3% more new listings in King County and 7% in Snohomish County. This increase in new listings is due to some new construction, condo development, and more and more re-sale owners regaining their equity position and making moves.

Much like the SFR market the condo market has been inventory starved. In fact, condo inventory is down 31% in both King and Snohomish Counties complete year-over-year. While inventory has shrunk sales have increased! In King County, sales are up 14% over the last twelve months compared to the previous twelve months, and up 23% in Snohomish County. These figures indicate quite a bit of demand for this product. The good news is new listings are slighting increasing, with 3% more new listings in King County and 7% in Snohomish County. This increase in new listings is due to some new construction, condo development, and more and more re-sale owners regaining their equity position and making moves.

Prices are on the rise too! An important aspect to measure in regards to condos is price per square foot, and in King County the price per sq. ft. is up 20% complete year-over-year and up 12% in Snohomish County, which is a big jump. The average cost per square foot in King County in July 2016 was $413 per square foot, and $207 in Snohomish County. This illustrates the affordability difference between both counties, which is why the increase in sales in Snohomish County is markedly up. Condos provide a more affordable option for buyers, and if one is looking to land in Snohomish County, condos can be the most affordable housing purchase option available.

The good news for condo sellers is that days on market are down by 40% in King County, and 31% in Snohomish County. In July, the average days on market was 16 days in King County and 19 days in Snohomish County. The average sale price in July in King County was $446,000 and $291,000 in Snohomish County – up 17% and 12% respectively. Months of inventory is tight in both markets, sitting at one month of available inventory, meaning that if no new inventory came to market we would sell out of condos in one month!

There has been some new condo development, and that has been swooped up quickly, especially buildings going up in the downtown urban core. In fact, according to the recently released Washington State Condominium Report, the median price for a new condo in Seattle was $683,590 – just under Los Angeles and well under San Francisco.

So what does all of this mean? The condo market is much like the SFR market in regards to demand, price appreciation and the affordability divide between King and Snohomish Counties. It is a great market for sellers to realize a positive return and buyers who can't afford or don't want the maintenance of a SFR can find opportunity with condos. If you or anyone you know would like more information on the Greater Seattle condo market, please contact any one of our agents. It is always our goal to help keep you informed.

Many Factors to Consider When Choosing to Rent vs. Own

*The amount of time you need to own your home in order for owning to be a superior financial decision.

There has been a lot of talk lately about the cost of living in the Greater Seattle area. Whether it has to do with home prices or rental rates the story is the same: it is becoming more and more expensive by the month. With rising rental rates, historically low interest rates, and home prices on the rise, the advantage of buying vs. renting has become clear for folks that have a down payment saved, good debt to income ratios and strong credit. In fact, Seattle is now the 10th most expensive city to rent in the country according to a new study from Zumper.com. The average monthly rental price for a one-bedroom apartment in the city of Seattle is $1,740! Snohomish County has seen an increase in apartment growth and rising rental rates as well. Currently, the breakeven horizon in the Greater Seattle area (the amount of time you need to own your home in order for owning to be a superior financial decision versus renting) is 1.6 years according to Zillow research.

There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. One of the biggest factors is interest rates! Currently, the rate for a 30-year fixed, conventional, conforming loan is hovering around 3.5%. That is amazingly and historically low, making the advantage of securing a mortgage huge. What is nice about having a mortgage is that the payment stays the same over the term of the loan. With renting, rates can be increased at any time, and you are paying down someone else's asset, not your own. Owning gives the homeowner control over their overhead while getting to make their house their home. What is also so great about owning is that once you have hit the breakeven horizon, every month that ticks away thereafter is building your nest egg in value. Did you know that American homeowners’ net worth is 36 times the amount of renters? The long term benefits of owning are abundant. These are important factors to consider for everyone, but especially the younger folks that are enjoying the benefits of Seattle’s attractive job market and competitive wages.

Where folks are having to compromise most due to affordability is commute times and settling in less urban neighborhoods. Some people, mainly millennials, have not been willing to give up living in the more core urban neighborhoods that have high walk scores and shorter commute times. That should be apt to change as rents are rising fastest in those areas. The advantages of moving out a little further and securing a home will start people on the track of building long term wealth. If you or anyone you know is currently renting and is considering a change, please let us know, as we would be happy to get your questions answered to help you make an informed decision.

Market Update – Q1 2016

The 2016 real estate market is off to an extreme start! Strong buyer demand due to our flourishing job market and historically low interest rates are the driving force behind this market. Buyers often find themselves competing due to multiple offers which require seller-centric terms in order to win. Prices have continued to grow over the last two years, putting sellers in a very favorable equity position, freeing them up to make the moves they have been waiting for. Additional inventory would help slow price growth and make it less competitive for buyers, creating positive outcomes for everyone. Lending requirements remain stringent, unlike the past “up” market which created the bubble we experienced in 2008.

Scroll down for more details about the first quarter market in Snohomish County, south Snohomish County, north King County, the Eastside, Seattle Metro and south King County.

Snohomish County

More inventory is needed to quench buyer demand as we head into spring and summer.

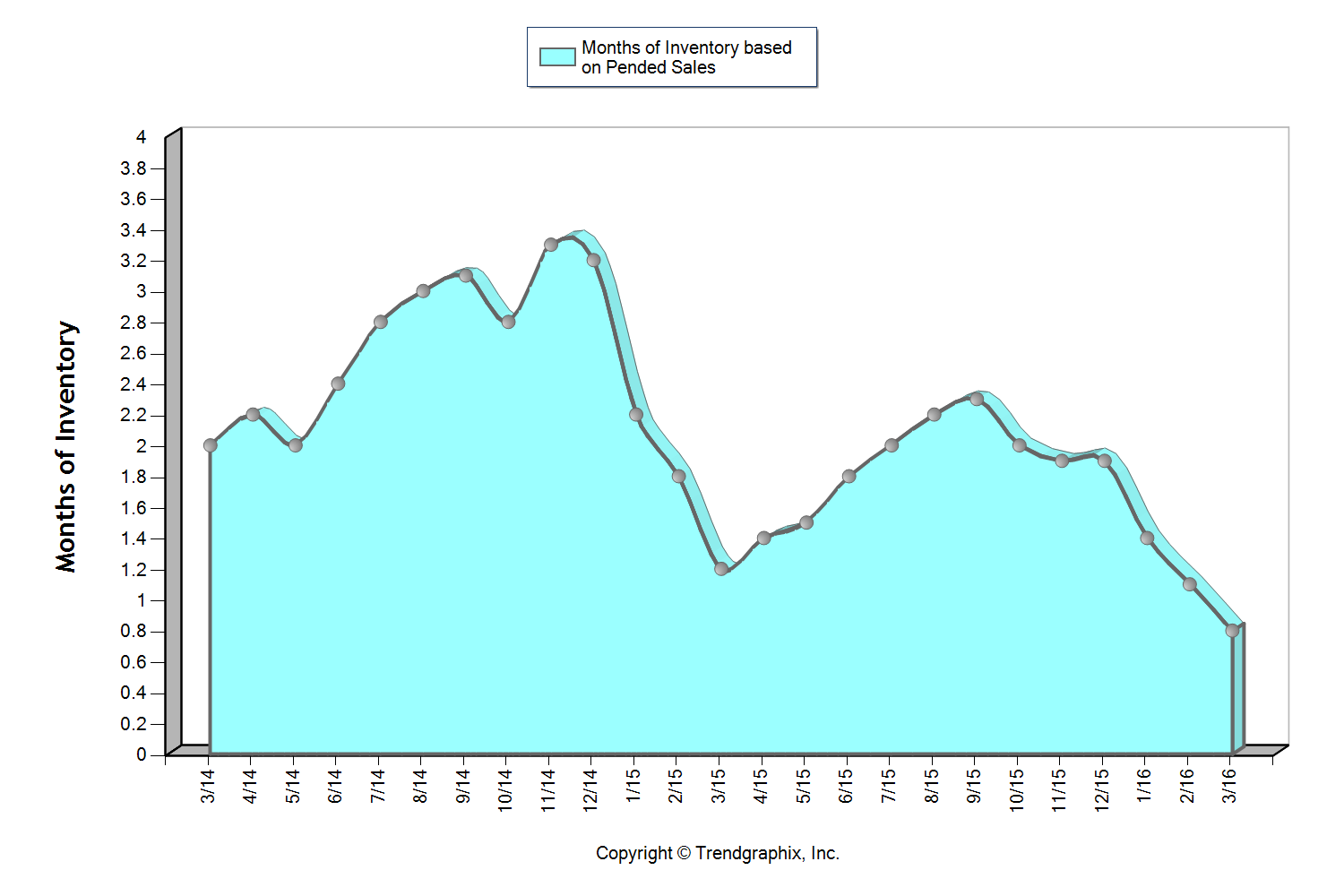

Snohomish County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.4 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.8 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 5% and 4% respectively in March over February! The good news is that new listings were up 25% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

South Snohomish County

More inventory is needed to quench buyer demand as we head into spring and summer.

South Snohomish County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.2 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.7 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 5% in March over February! The good news is that new listings were up 27% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

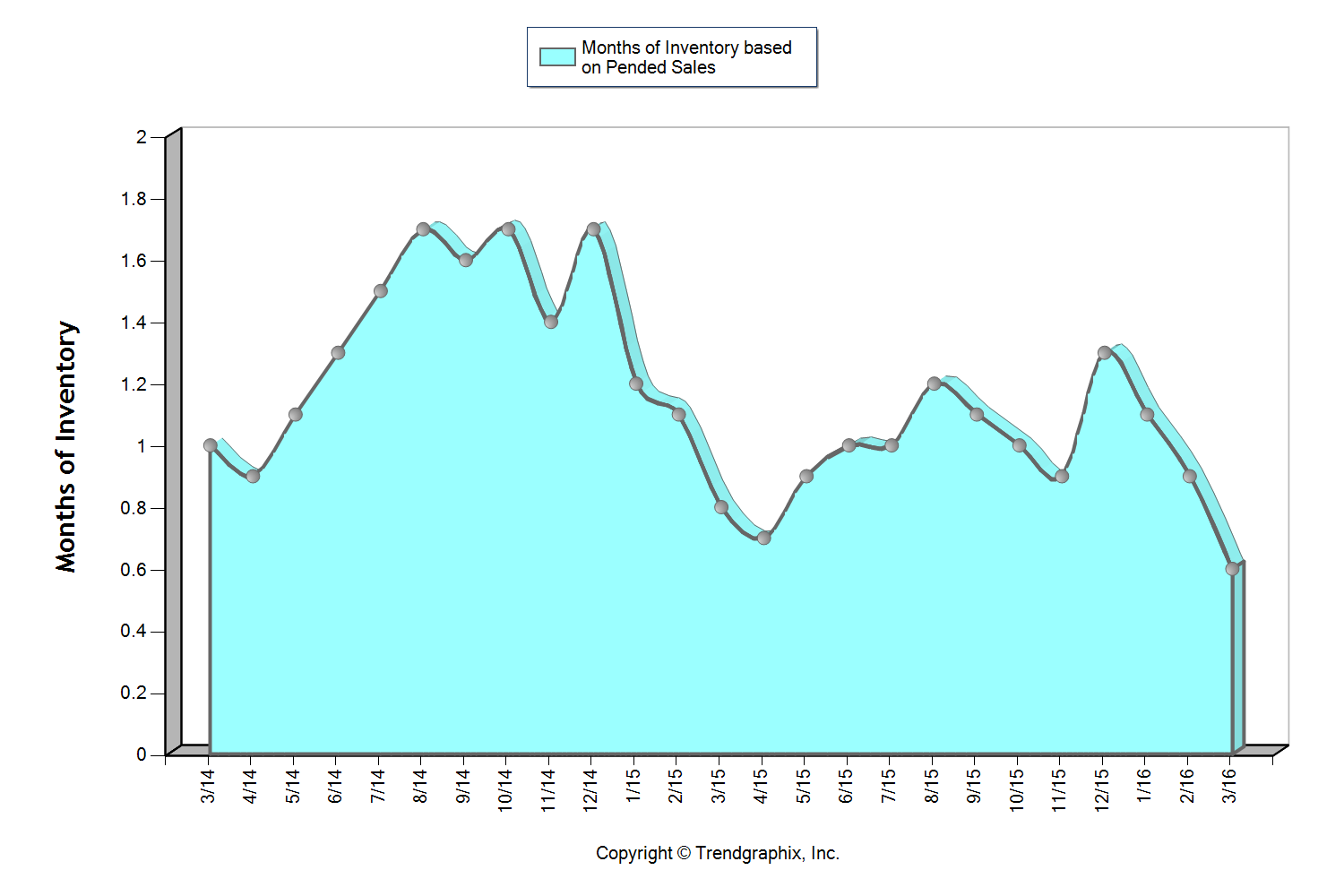

North King County

More inventory is needed to quench buyer demand as we head into spring and summer.

North King County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.1 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.6 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, the average price was up 2% in March over February! The good news is that new listings were up 49% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

Eastside

More inventory is needed to quench buyer demand as we head into spring and summer.

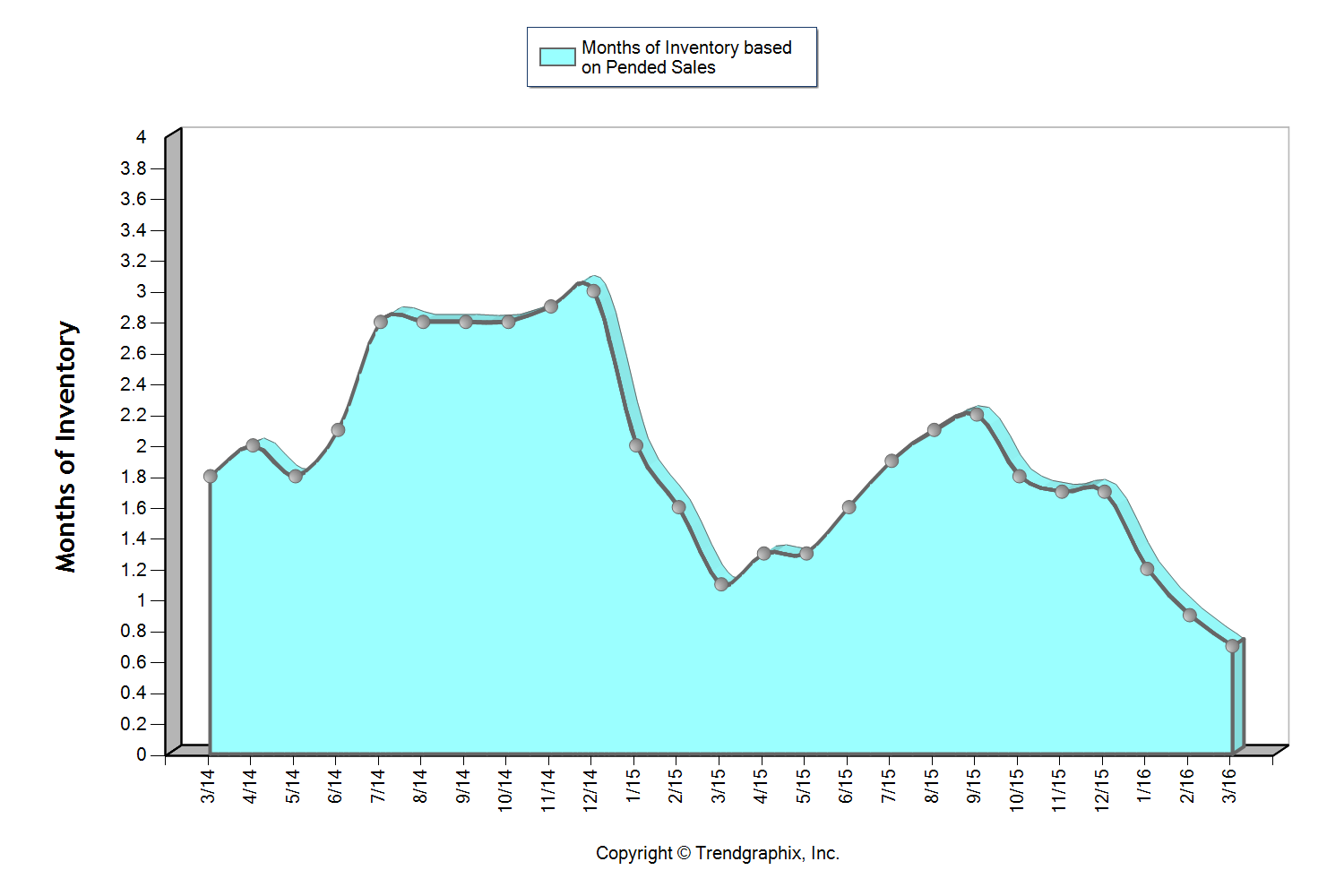

The Eastside ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.3 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.9 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 4% in March over February! The good news is that new listings were up 43% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

Seattle Metro

More inventory is needed to quench buyer demand as we head into spring and summer.

The Seattle Metro area ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.1 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.6 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 3% in March over February! The good news is that new listings were up 47% in that same time frame. We hope to see that trend continue as we head into spring as the buyer demand is there to absorb it and it is needed to slow price growth.

South King County

More inventory is needed to quench buyer demand as we head into spring and summer.

South King County ended 2015 with a larger-than-seasonally-normal surge of closed sales, leaving us with only 1.4 months of inventory based on pending sales to start the year, which is not much! The first quarter saw a frenzy of buyer activity but only a small trickle of new inventory, leaving us with only 0.8 months of inventory heading into the second quarter. This has caused days on market to shrink and list-to-sale price ratios to rise. These conditions are very favorable to sellers. In fact, average and median prices were up 6% and 3% respectively in March over February! The good news is that new listings were up 39% in that same time frame. We hope to see that trend continue as we head into spring, as the buyer demand is there to absorb it and it is needed to slow price growth.

This is only snapshots of the trends in our area. Please contact one of our agents if you would like further explanation of how the latest trends relate to you.

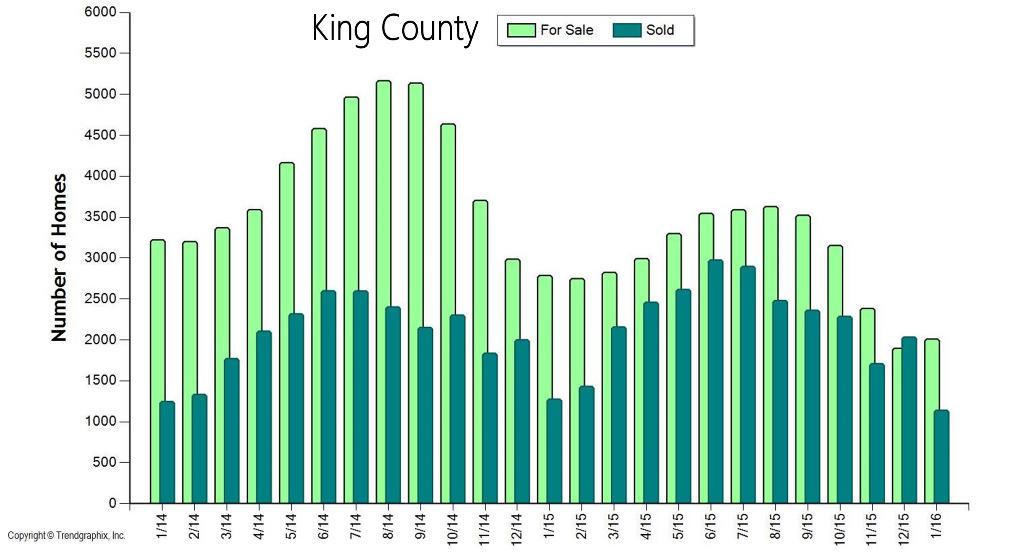

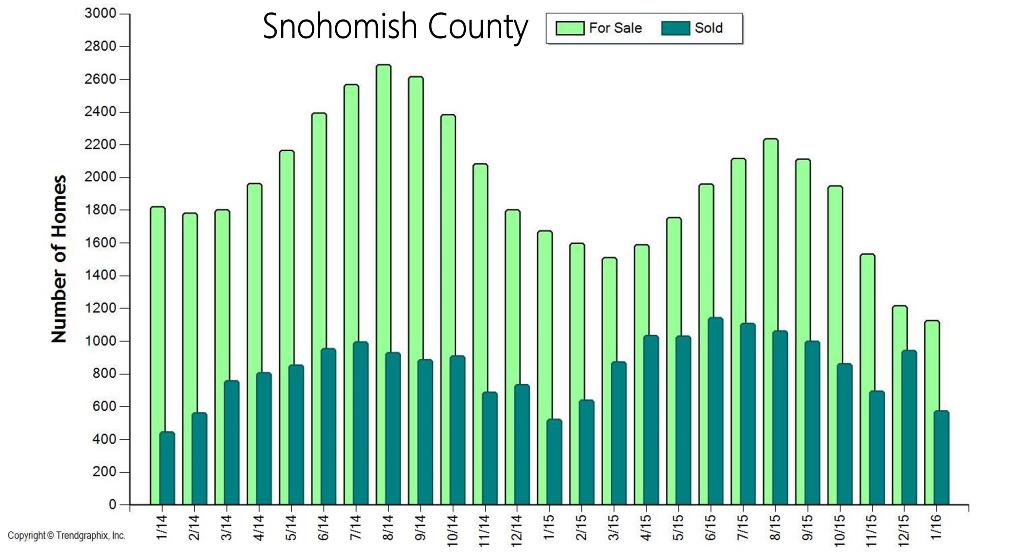

It’s an Amazing Time to be a Seller!

The two graphs here illustrate the amount of homes for sale and the amount of homes sold over the past two years in King and Snohomish Counties. This gives us a good look at the simple principle of supply and demand.  We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

We are currently experiencing one of the strongest Seller's markets in recent history. A Seller's market is defined by having three or less months of available inventory. Currently, King County has 1.2 months of inventory based on pending sales and Snohomish County 1.3. Where this particular Seller's market is unique is that it is not only a shortage of inventory creating this environment, but very high buyer demand as well. Our local job market is thriving, so much so that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. Couple the healthy local economy with still historically low interest rates and the audience for homes that come to the market is huge! Multiple offers are very common and prices are increasing.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

In order to get a better understanding of the market conditions we dug a little deeper and were quite surprised. We looked into the amount of new listings that came to market this January, assuming that there would be a huge deficit of new listings – we were wrong! In King County there were only 111 less listings (-4%) that came to market this January compared to last January, and only 16 less listings (-1%) in Snohomish County. Yes, fewer homes are coming to market, but the high buyer demand has eaten up any inventory carryover month-to-month, leaving us with 30% less homes to choose from compared to the year prior – hence the very low months of inventory. We are coming close to selling out of homes each month and new inventory is required to create more market. It is sort of mind blowing! The good news is, if you look at the graphs above you will see a seasonal uptick in inventory in the Spring and Summer months, and that is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the Spring increase in listings will enjoy a larger audience due to less competition. If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, communication and market knowledge is what sets a highly capable selling agent apart and is required to prevail.

If you have any curiosities or questions regarding the value of your current home or purchase opportunities, please contact any of our agents. It is always our goal to help keep you informed on all things real estate, and help you manage these investments.

Home Price Affordability Driven by Commute Times

Close proximity to the work place is often near the top of a buyer’s list of preferred features. 2015 proved to be the year that commute times to major job centers widened the price divide between key market areas in the Greater Seattle area. Seattle proper has always been more expensive than its neighboring suburbs, but the most current prices tell a tale of two different markets. In 2015 the average sales price for a single-family residential home in the Seattle Metro area was $632,000! In South Snohomish County (Everett to the King County line) the average sales price for a single-family residential home in 2015 was $433,000 – 46% less than Seattle Metro. Further, if you jump across Lake Washington to the Eastside, the average sales price for a single-family residential home in 2015 was $787,000 – 19% more than Seattle Metro! In December, pending sales in Snohomish County were up 12% and closings were up 29%, whereas in King County pending sales were down 9% and closings were up only 4%. We believe this is a result of more inventory choices in Snohomish County, as well as lower prices, new construction, lower taxes, strong school district options and manageable commute times. Newer transit centers and telecommuting have also opened up doors to King County's little brother to the north.

If you are curious about possible commute times, you can search for properties here on our website based on commute times, which is a feature provided by INRIX Drive Time. No matter which neighborhood you are interested in learning about in either King or Snohomish County, any of our agents would be happy to provide a 2015 re-cap of that market. 2015 was an outstanding year in real estate and we are looking for that to continue in 2016. We hope to see more homes coming to market due to the market's strong price position, which should help to increase inventory levels, in turn helping temper price growth and giving buyers more options.

If you are curious about possible commute times, you can search for properties here on our website based on commute times, which is a feature provided by INRIX Drive Time. No matter which neighborhood you are interested in learning about in either King or Snohomish County, any of our agents would be happy to provide a 2015 re-cap of that market. 2015 was an outstanding year in real estate and we are looking for that to continue in 2016. We hope to see more homes coming to market due to the market's strong price position, which should help to increase inventory levels, in turn helping temper price growth and giving buyers more options.

How Much is Your Home Worth?

A Look at Local Home Value Growth Since 2012

Since 2012, home values have grown by around 10% each year, resulting in substantial return in pricing. Below are some examples of actual homes sold in 2012 and again in 2015 that were not remodeled or significantly improved in between sales. These examples show the return in home values that we have experienced since the economic downturn. We pulled these examples to show you actual pound-for-pound market data versus the statistical percentages often quoted in market updates. We think these examples are pretty telling and quite exciting!

As you can see in the current economic update from Matthew Gardner, inventory has been a challenge. Many folks have been waiting for their current home values to return in order to make big moves involving their retirement, upgrading homes, investing or even buying a second home. If you are one of those people, we hope these examples provide you insight on the increase in home values and how they might pertain to you. As we head into the New Year, if you'd like a Comparable Market Analysis (CMA) on your home so you have a better understanding of your home's value, any one of our agents would be happy to do that. This would be an important component in charting your 2016 financial goals, and what a great time of year to gather that information.

3 bedroom 3200 sq ft Edmonds home: |

|

|

|

Sold in August 2012

|

Sold in July 2015

|

$185,050 INCREASE IN HOME VALUE: 32%! |

|

4 bedroom 2100 sq ft Bothell home: |

|

|

|

Sold in February 2012

|

Sold in February 2015

|

$114,872 INCREASE IN HOME VALUE: 36%! |

|

3 bedroom 1400 sq ft Shoreline home: |

|

|

|

Sold in June 2012

|

Sold in March 2015

|

$102,250 INCREASE IN HOME VALUE: 33%! |

|

3 bedroom 1800 sq ft Lynnwood home: |

|

|

|

Sold in December 2011

|

Sold in May 2015

|

$95,000 INCREASE IN HOME VALUE: 43%! |

|

We are currently working on more examples in surrounding communities… check out our Price Appreciation Study for more. And contact any one of our agents for a Comparable Market Analysis on your home.

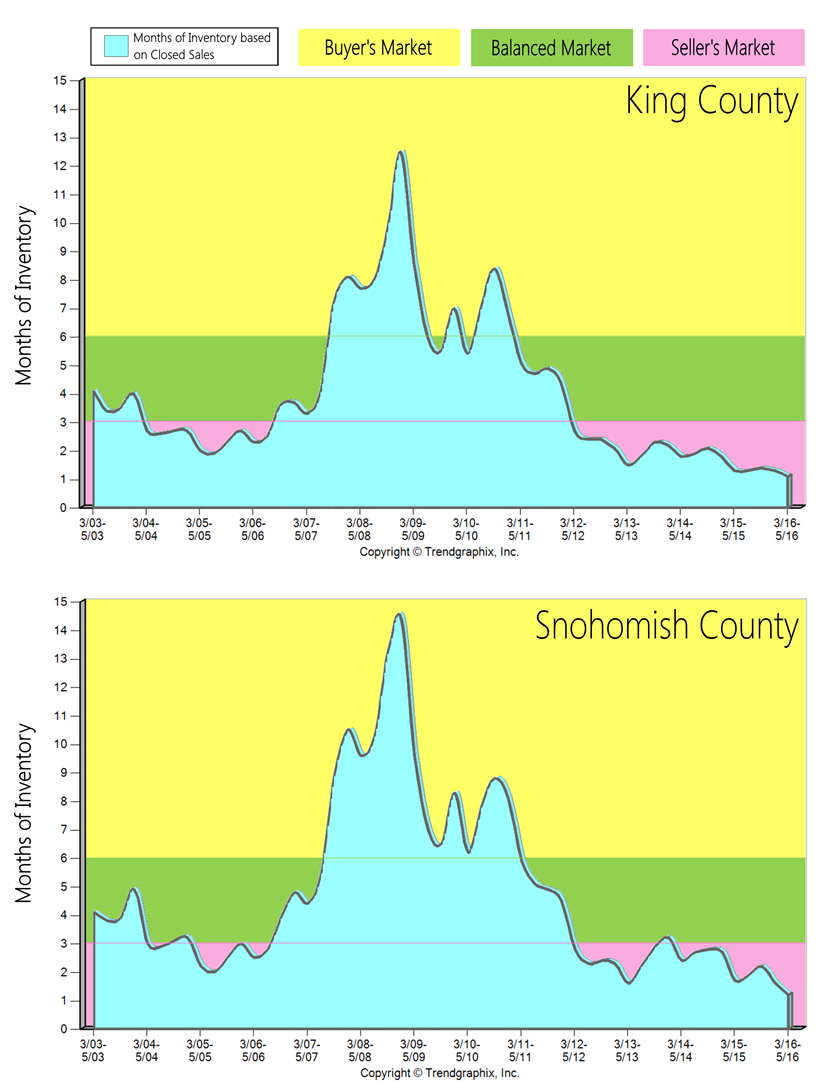

Housing Demand Defined

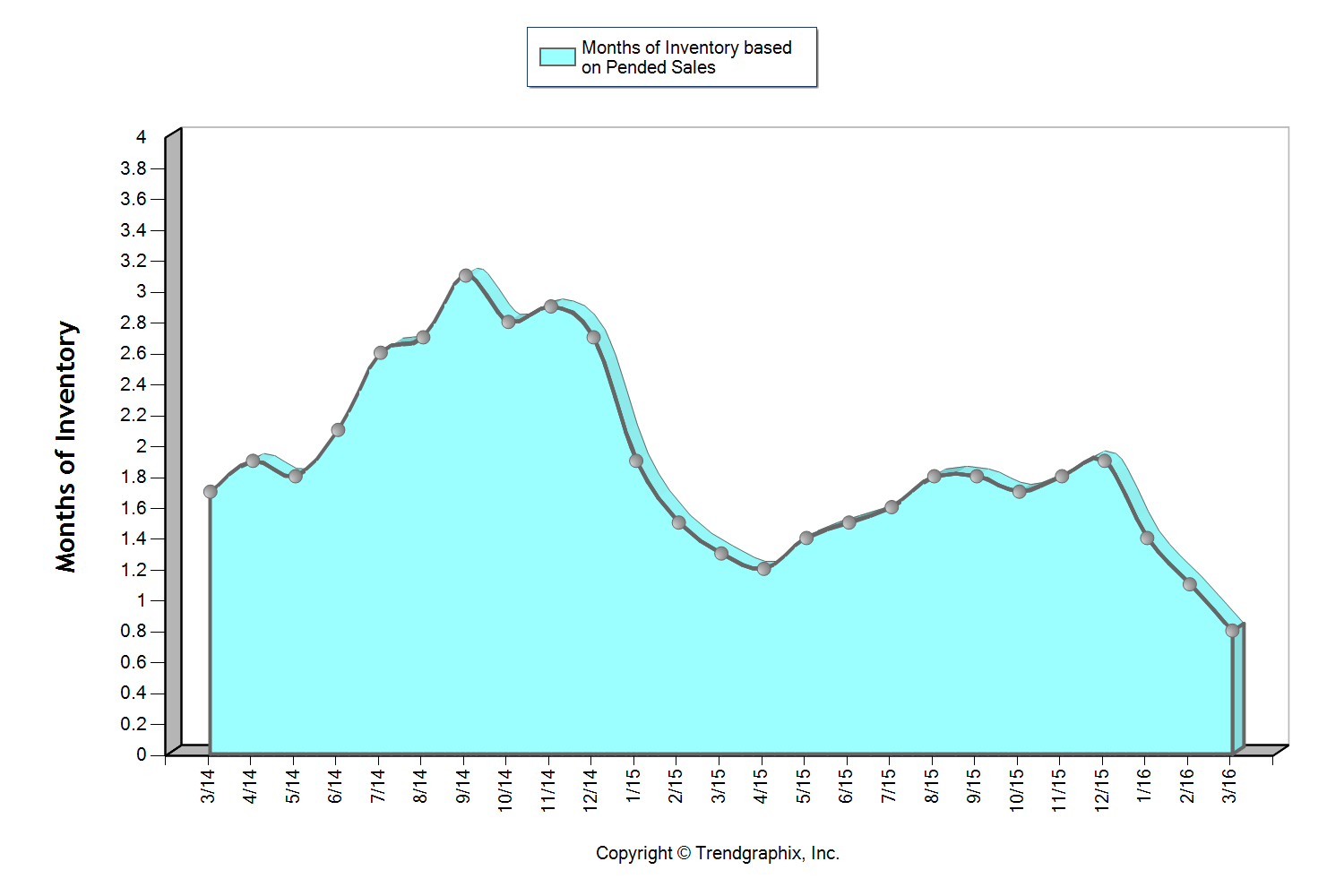

What defines a housing market? We have had many different markets over the years that have been defined by certain identifiable factors. Will the last person leaving Seattle- turn out the lights, do you remember that billboard from 1971? Or the global housing boom of 2005-2007 that was driven by sub-prime credit lending options (which no longer exist, thank goodness!). Our current market is defined by strong demand and low inventory – the basic economic principle of supply and demand – Economics 101! A market with 0-3 months of inventory is a seller's market, 4-6 a balanced market and 6+ months a buyer's market. The route of the 2007-2011 economic down-turn, where months of available inventory favored buyers and was as high as 13 months, seems like ancient history. Since the Summer of 2012, months of inventory has favored sellers in both King and Snohomish counties, with an average of two months of available inventory between the two counties over the last three years. There is a market divergence going on between King and Snohomish County due to some unique factors each county possesses.

What defines a housing market? We have had many different markets over the years that have been defined by certain identifiable factors. Will the last person leaving Seattle- turn out the lights, do you remember that billboard from 1971? Or the global housing boom of 2005-2007 that was driven by sub-prime credit lending options (which no longer exist, thank goodness!). Our current market is defined by strong demand and low inventory – the basic economic principle of supply and demand – Economics 101! A market with 0-3 months of inventory is a seller's market, 4-6 a balanced market and 6+ months a buyer's market. The route of the 2007-2011 economic down-turn, where months of available inventory favored buyers and was as high as 13 months, seems like ancient history. Since the Summer of 2012, months of inventory has favored sellers in both King and Snohomish counties, with an average of two months of available inventory between the two counties over the last three years. There is a market divergence going on between King and Snohomish County due to some unique factors each county possesses.

First, King County's lack of inventory has been drastic. Year-to-date, it has hovered at one month of available inventory, which means that each month we are nearly selling out of homes! This is due to the fact that demand is high and inventory is down. In the last 12 months, Seattle has had 27% less homes for sale than the previous 12 months, and closed sales are up 6%. In fact, Auction.com just named Seattle the number one housing market in the nation. This is due to the city's large technology sector driving employment, low interest rates and an increase in household formation. The housing premium in Seattle is rooted in shorter commute times to job centers, high walk scores and hip urban centers. The premium is real though, with the median home price over the last 12 months in Seattle reaching $528,000 – up 13% from the previous 12 months.

In Snohomish County inventory is still tight, with an average of two months of available inventory this year. Inventory has been somewhat supported by new construction and improved equity levels for re-sale properties. The median home price over the last 12 months was $347,000 – 34% less than Seattle. Median price growth is up 9% complete year-over-year.

What should we expect going forward into 2016? In both counties there was an increase in inventory in the third quarter. This is a promising indicator that folks are feeling more comfortable coming to market due to price increases after a booming spring market and healthier overall economic environment. Where this market is different from the bubbly market of 2007 are the drivers of the strong local economy, low interest rates and job growth, versus the unsustainable lending standards of the sub-prime loan movement. I believe we will see more homes come to market, especially as we head into the spring 2016 market. Folks are ready to move on to what is next for them, and recouped prices are enabling those choices. This increase will be welcomed as it will provide more options for buyers and will start to temper price growth, which is a good thing.

Where this market has gotten a bit tricky, is where one goes once their home sells. The low inventory has made this challenging, but with any market challenge you find creative and strategic ways to maneuver through and find success for your clients. Windermere has a great Bridge Loan product to utilize, temporary moves have solved these transitions, and longer closings with seller rent-backs have also been widely used to help make seamless transitions. This an exciting market to participate in, and creative strategy is the name of the game. Please contact one of our agents if you would like to know more about the current market conditions and how they relate to your bottom line and lifestyle decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link