New Construction in Bothell: Developments to Keep Your Eye On

Bothell’s long list of excellent amenities, city conveniences, and central location ensures that it’s a highly desirable place to live. As a result, Bothell is also currently home to a myriad of new developments and new construction!

“There’s lots of new homes in Bothell ranging from $499,000 to over a million,” shares Tonya Tye. And according to Lauren Pulfer and Jen Bowman, in addition to new construction, you can also expect to find a range of entry-level townhomes, split-levels, ramblers, older homes, and homes on lots of land as well.

Here are a couple of new construction developments in Bothell to keep your eye on:

Toscana by Village Life

Toscana by Village Life

Homes range from $900,000 to $1M

Located near Country Village, Toscana is brimming with luxury Craftsman-style homes that offer large floor plans (ranging from 2,832 to 3,860 square feet) and quality, modern finishes. The neighborhood includes 23 homes with 7 floorplans to choose from, and residents get to enjoy sidewalk-lined streets, a community park, a picnic shelter, and Northshore Schools.

Normandie Woods by Sundquist Homes

Homes begin in the $600,000s

Conveniently located near Interstate-5 and 405 and the Mill Creek Town Center, Normandie Woods showcases gorgeous homes that blend classic details and modern elements. There are 54 homes in Normandie Woods, and residents live in the Edmonds School District.

Here are several examples of new construction in Bothell:

Want to keep searching for new construction in Bothell?

We recommend starting your search here!

For more homes in Bothell in a variety of price points, the Bothell search on NewHomeSource.com features several current new construction listings.

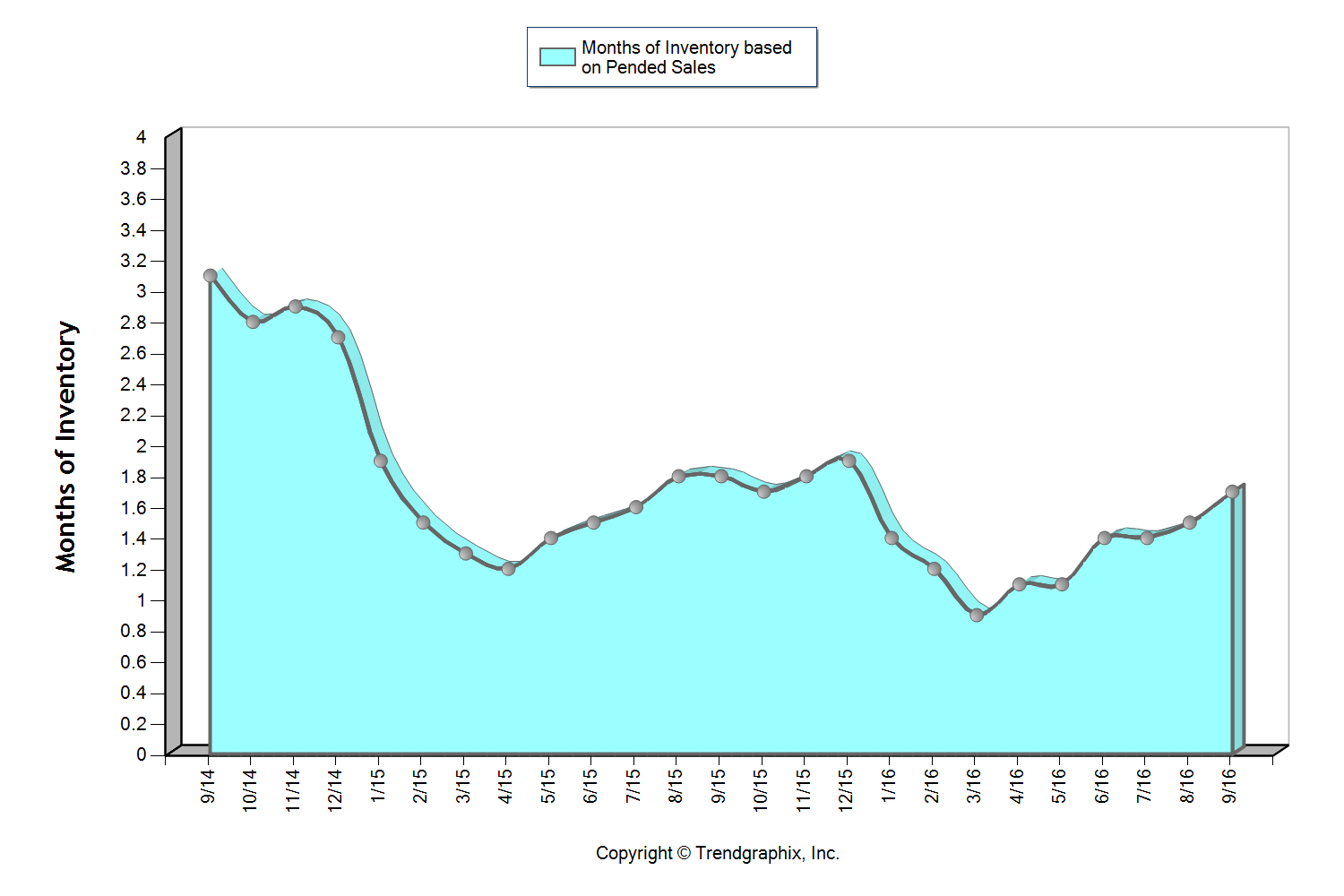

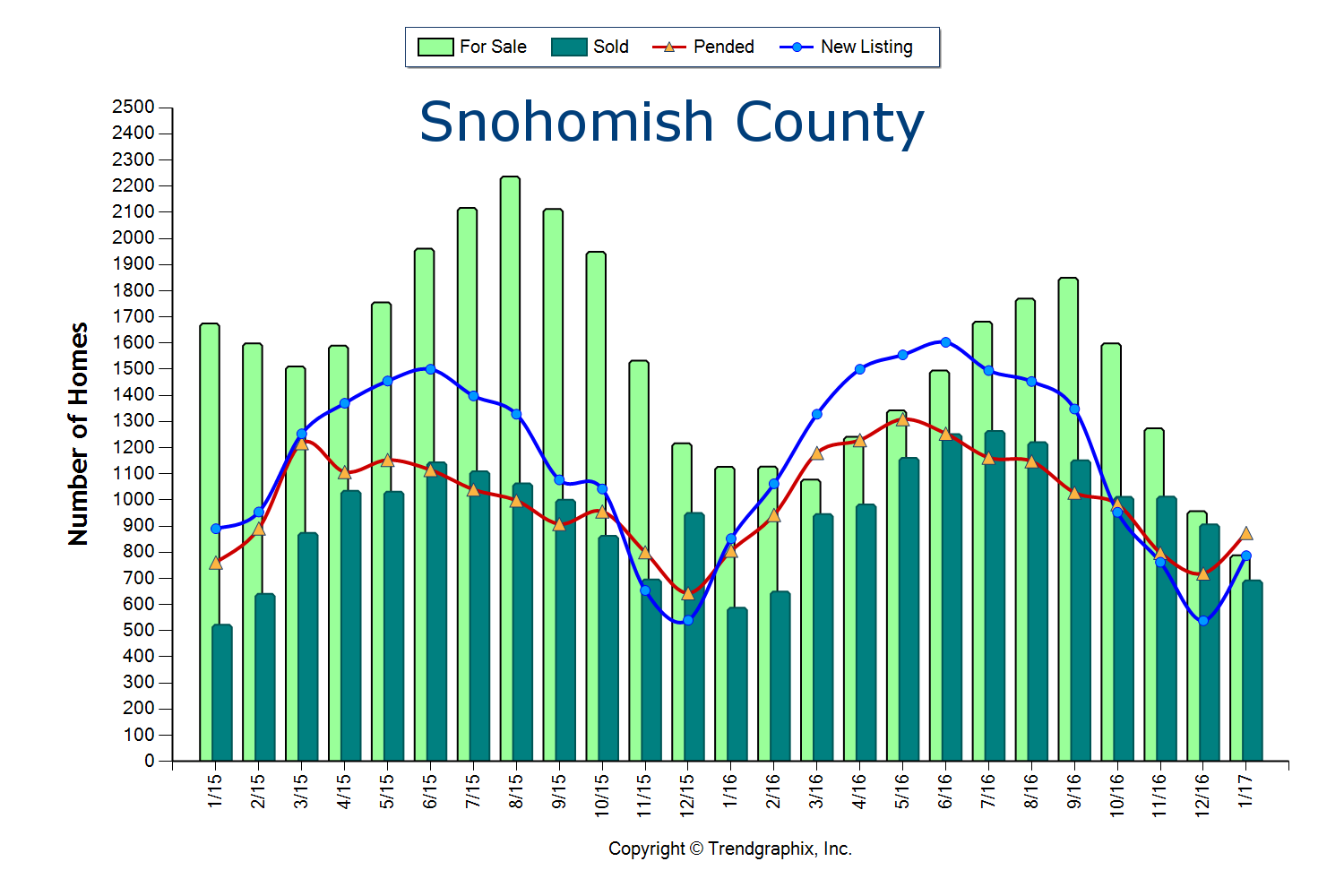

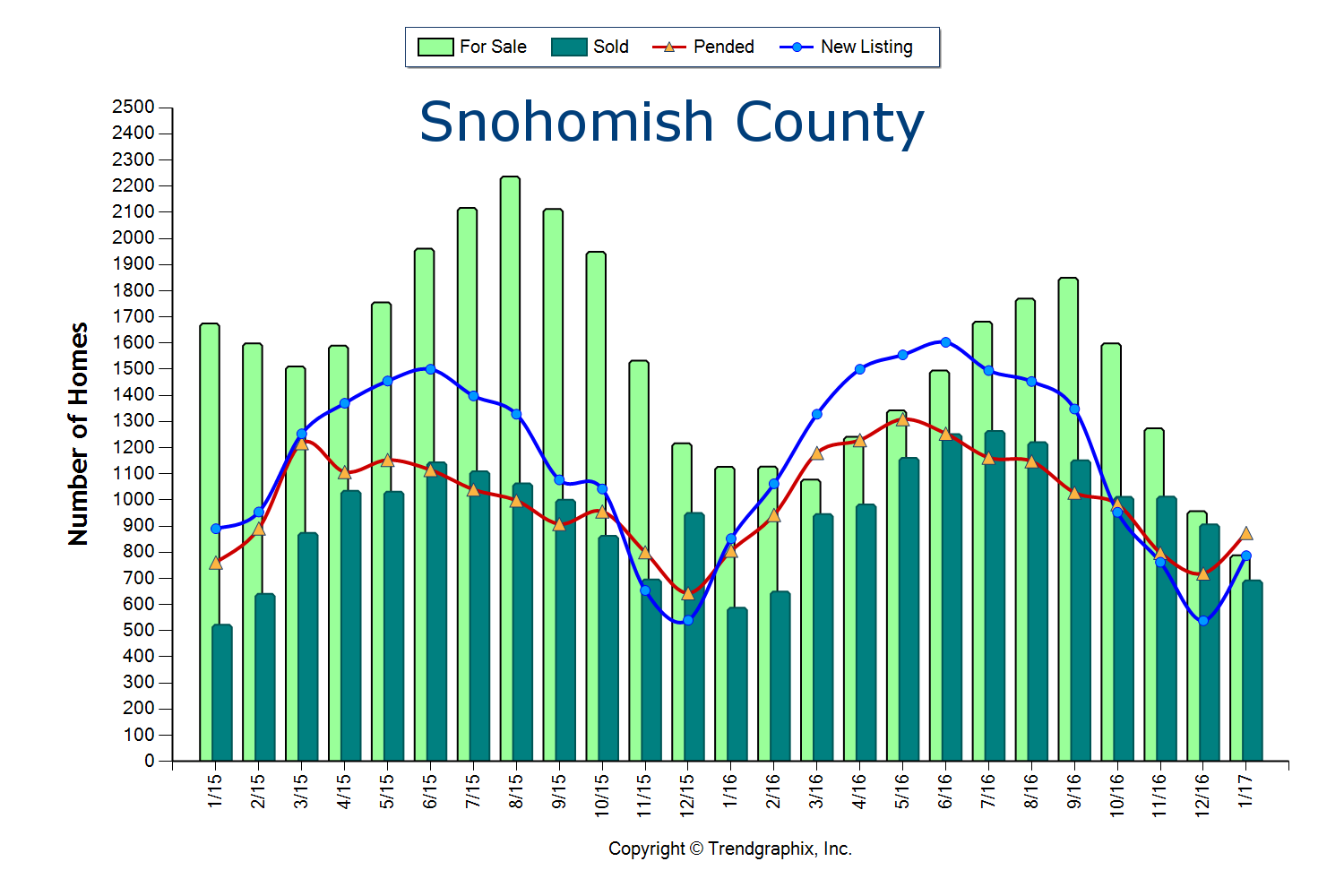

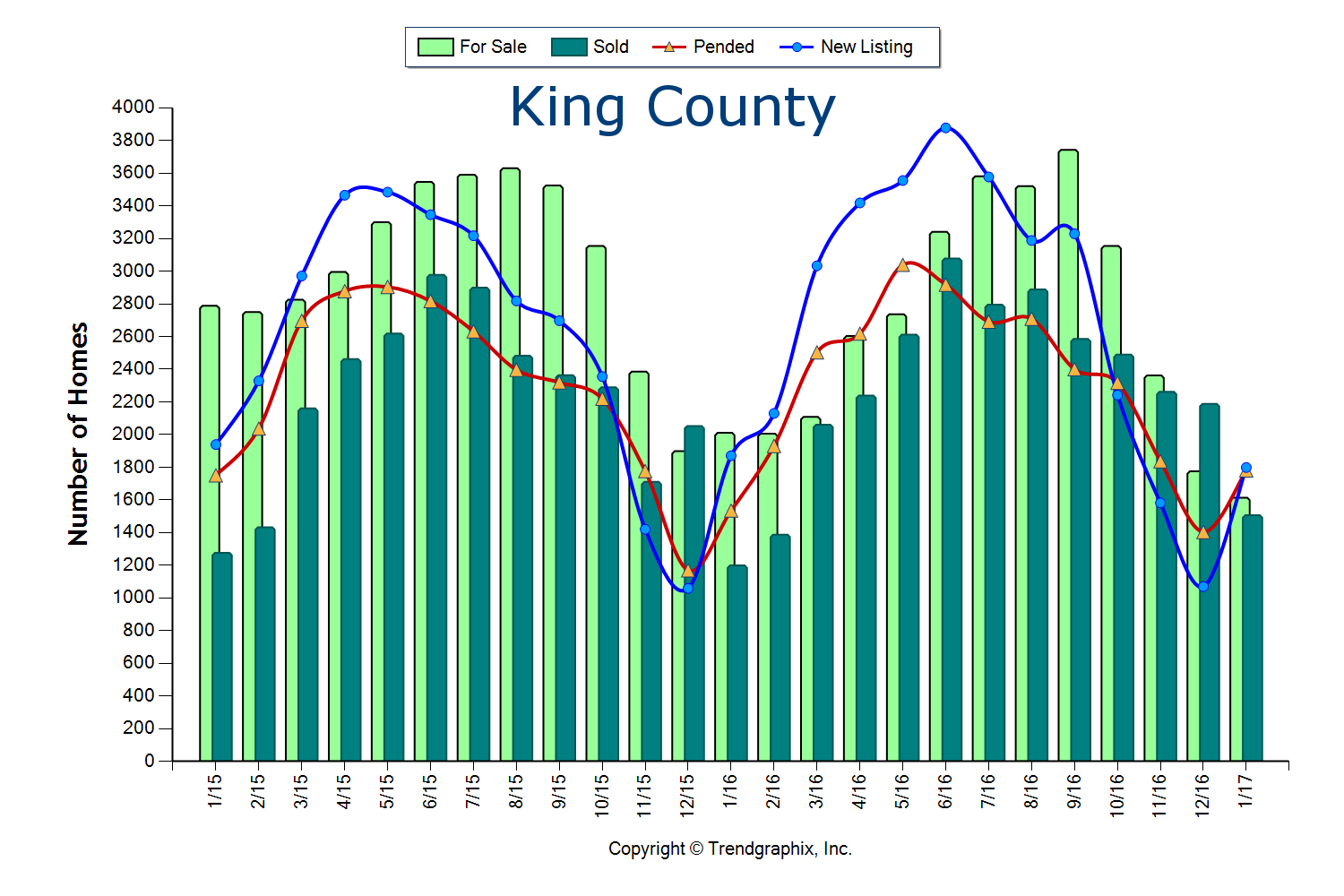

Demand is High, Inventory Low… Here we Go!

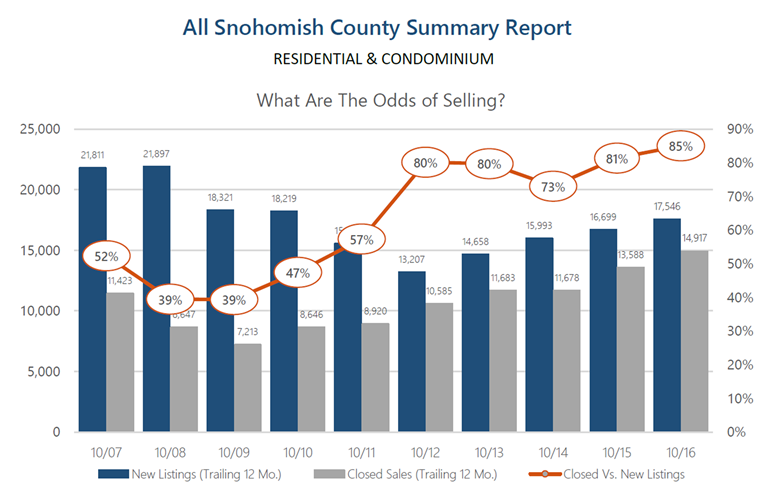

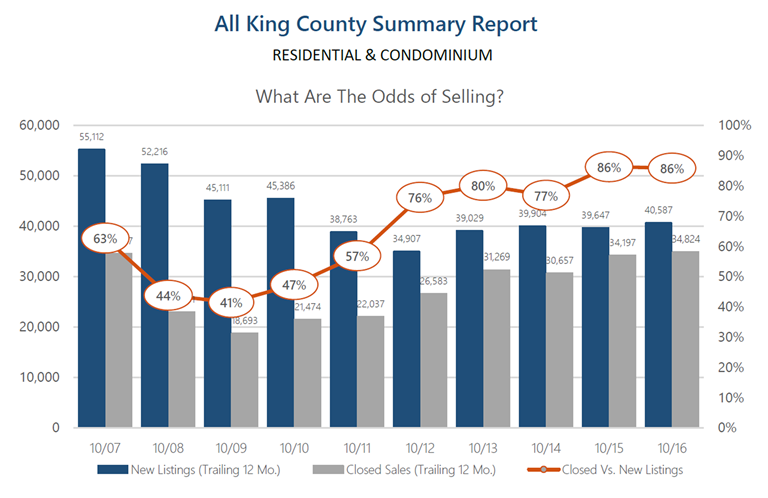

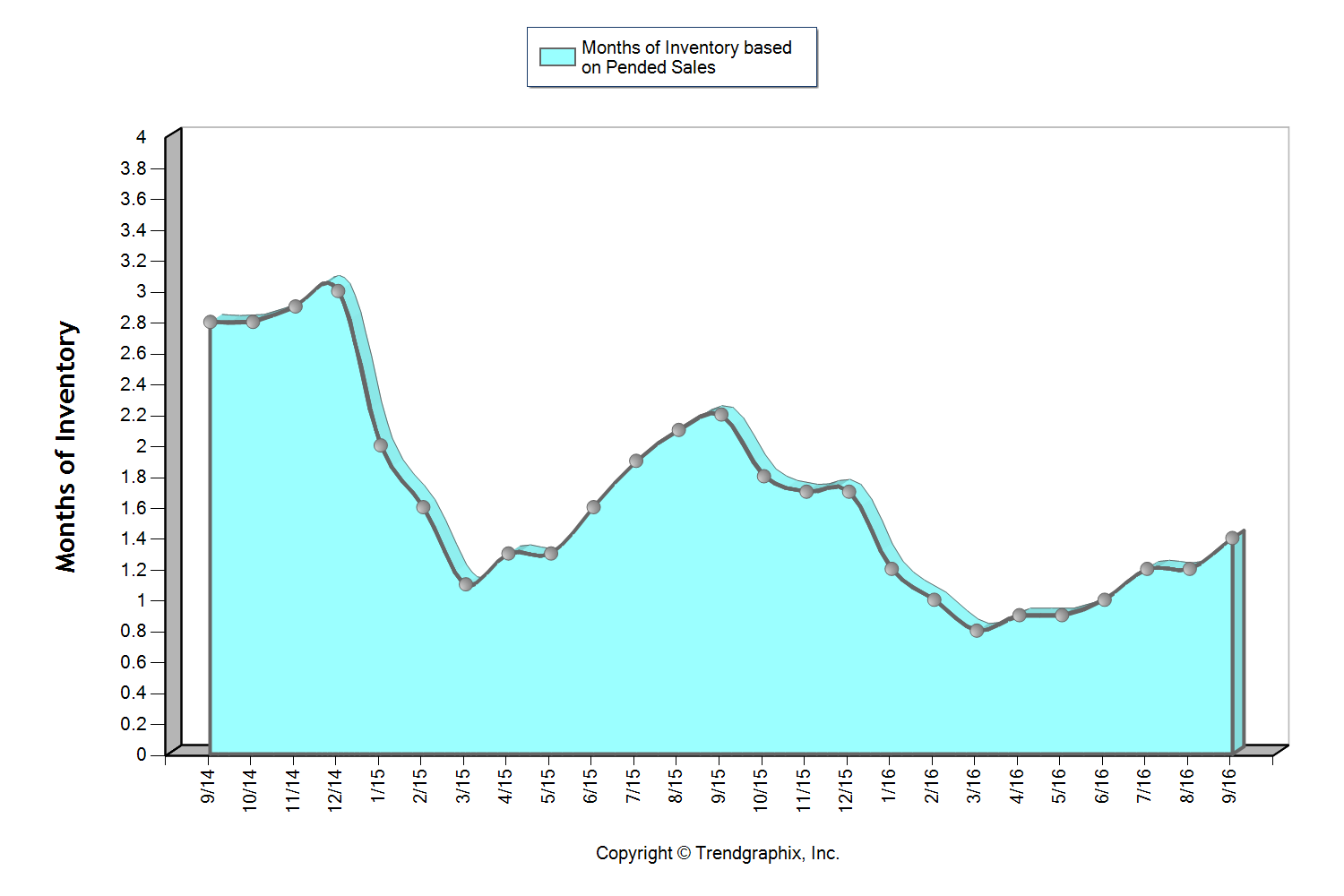

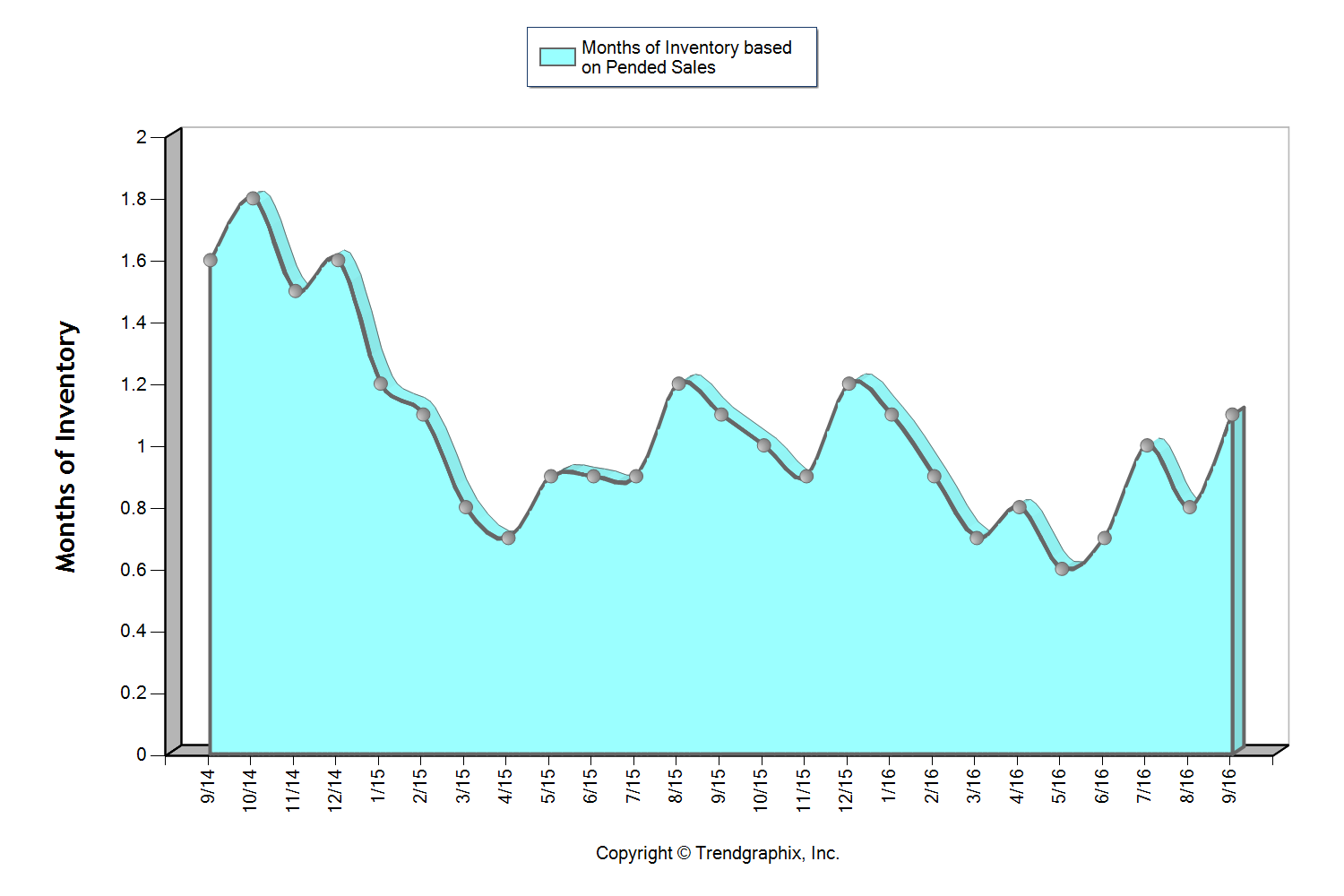

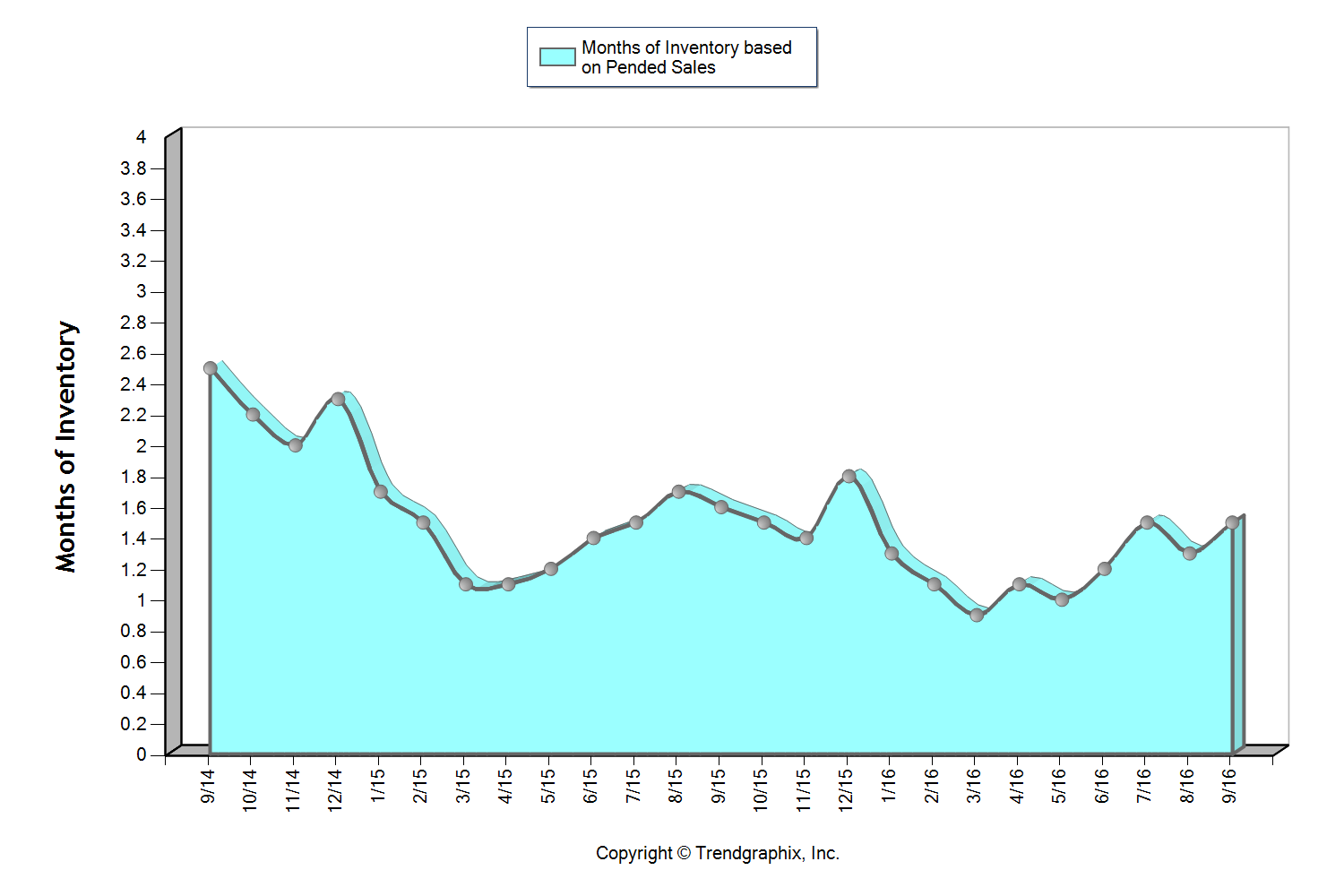

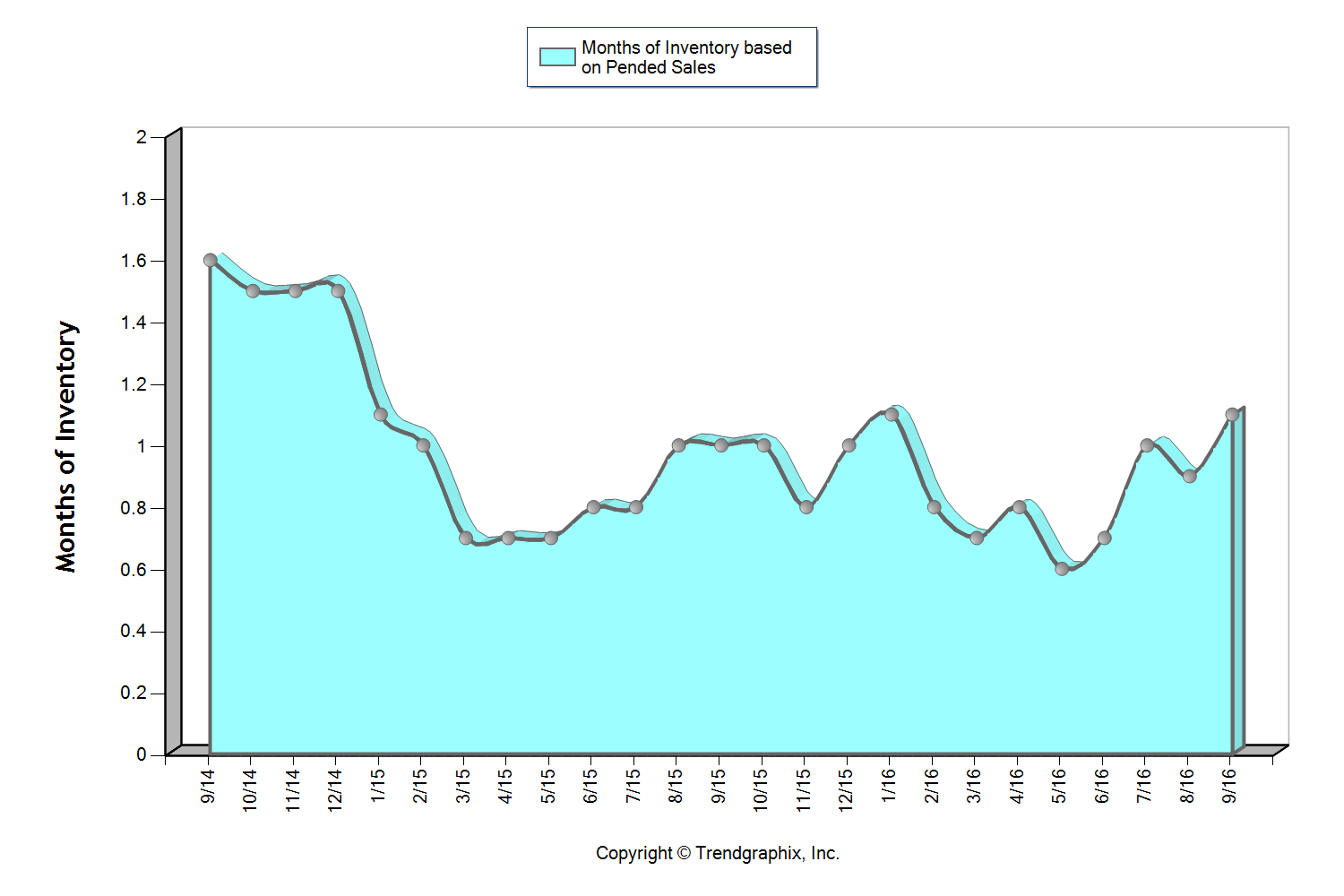

The two graphs here illustrate the amount of homes for sale, the amount of homes that sold, pending sales and new listings over the past two years in King and Snohomish Counties. This gives us a good look at the simple principle of supply and demand. We are currently experiencing one of the strongest Seller’s markets in recent history. A Seller’s market is defined by having three or less months of available inventory. Currently, King and Snohomish counties have only 0.9 months of inventory based on pending sales. This means that if no new homes came to market, we would be sold out of homes in less than a month. What is crazy is that this inventory count is down 30% from the year prior, which was also an extreme Seller’s market!

Where this particular Seller’s market is unique, is that a decrease in new listings is not creating this environment, but very high buyer demand is. In fact, King County new listings were up 5% over the last year, but so were sales. In Snohomish County new listings were up 7% over last year, but sales were up 11%! Despite the increase in homes coming to market, demand has matched or outpaced, leaving us with the lowest inventory levels ever.

Where this particular Seller’s market is unique, is that a decrease in new listings is not creating this environment, but very high buyer demand is. In fact, King County new listings were up 5% over the last year, but so were sales. In Snohomish County new listings were up 7% over last year, but sales were up 11%! Despite the increase in homes coming to market, demand has matched or outpaced, leaving us with the lowest inventory levels ever.

We can thank our local, thriving job market. So much so, that many people from out-of-state are relocating here to be a part of our economy and the quality of life the Greater Seattle area has to offer. We also have poised move-up buyers ready to cash in on their equity and first-timers ready for action. Combine the healthy local economy with strong equity levels and still historically low interest rates, and the audience for homes that come to market is huge!

Multiple offers are very common and prices are increasing. Median price is up complete year over year in King County by 13% and Snohomish County by 10%. This growth in equity has provided home owners the option to make the moves they have been waiting for, such as a move-up, right-size or relocating out of the area for retirement.

These graphs predict that we will see an increase in new listings as we head into the Spring and Summer months, which is needed to meet demand. If you are considering putting your home on the market this year I would advise the sooner the better, as buyers did not hibernate for the winter and will not be worried about flowers blooming in your front yard. Sellers that beat the second quarter increase in listings will enjoy a larger audience due to less competition.

The importance of both buyers and sellers aligning with a knowledgeable, well-researched and responsive broker is paramount. One might think that it is “easy” to sell a house in this market, but how the preparation, exposure, marketing, management of all the communication and negotiations are handled can make or break a seller’s net return on the sale. While market times are short, they are intense! Negotiations are starting as soon as the property hits the market by educating buyers and their brokers on exactly what a seller would like by the time offers are due. The goal is to bring the sellers I work with not only the highest price, but the best-termed offer that I know is going to close.

The importance of both buyers and sellers aligning with a knowledgeable, well-researched and responsive broker is paramount. One might think that it is “easy” to sell a house in this market, but how the preparation, exposure, marketing, management of all the communication and negotiations are handled can make or break a seller’s net return on the sale. While market times are short, they are intense! Negotiations are starting as soon as the property hits the market by educating buyers and their brokers on exactly what a seller would like by the time offers are due. The goal is to bring the sellers I work with not only the highest price, but the best-termed offer that I know is going to close.

If you’re a buyer, it is overwhelmingly important that you are aligned with an agent that knows how to win in this market. Terms, negotiations, financial preparation, communication, responsiveness and market knowledge are what set a highly capable selling agent apart, and are required to prevail. While the market for buyers is fierce, we can assure you that with a well thought out and executed plan, we have helped buyers win.

If you have any curiosities or questions regarding the value of your current home or purchase opportunities in today’s market, please contact us. It is my goal to help keep you informed and empower strong decisions.

7 Breweries for Beer Lovers Just North of Seattle

You don’t have to drive all the way to Seattle for premium microbrews and cool glasses of crafts beers—just north of Seattle, our beer scene is brimming with local options that any craft connoisseur will appreciate. Whether you want to fill up a growler, go on a weekend beer tour, or just grab a pint with friends, these 7 breweries just north of Seattle in Mountlake Terrace, Lynnwood, Edmonds, and Kenmore all offer the perfect place to start!

MOUNTLAKE TERRACE

Diamond Knot Brewpub at MLT

- Located at 5602 232nd Street SW Mountlake Terrace, WA 98043

- Hours: Monday-Thursday 11am – 11pm, Friday 11am – Midnight, Saturday 8am – Midnight, Sunday 8am – 11pm

Recommended by both REALTOR® Brian Hayter and Shelly Katzer, the Diamond Knot Brewpub is a local favorite. Started by Bob Maphet and Brian Sollenberger as a hobby, Diamond Knot Craft Brewing now makes over 600 barrels of beer every single month! Diamond Knot mainstays include their India Pale Ale, Industrial IPA, Blonde Ale, Pipe Down Brown Ale, Above Board Pale Ale, E.S.B. Steamer Glide Stout, Possession Porter, and Hefeweizen.

TIP: You can also grab breakfast, lunch or dinner here, plus they’re family- and dog-friendly!

Learn more about Diamond Knot here:

LYNNWOOD

Big E Ales

- Located at 5030 208th St SW Suite A. Lynnwood, WA 98036

- Hours: Tuesday – Thursday 1pm – 10pm, Friday & Saturday 11am – 10pm

Brewing since 1997, Big E Ales serves up hand-crafted ales alongside a full, mouthwatering menu of delicious appetizers and entrees. You can stop by for a refreshing beer with friends, or even book the Brew Room for events like wedding receptions and company parties.

TIP: Their blog is packed with interesting beer history!

EDMONDS

Salish Sea Brewing Company

- Located at 518 Dayton St. #104 Edmonds, WA 98020

- Hours: Monday – Wednesday 3pm – 9pm, Thursday 3pm – 10pm, Friday – Saturday 12pm – 11pm, Sunday Noon – 8pm

Home to a variety of carefully crafted brews, Salish Sea Brewing Company is a staple of the region. Beer lovers can choose from their Drop Anchor IPA, Salish IPA Dayton Street (3 SEAS) Session ISA, Driftwood Pale, Honey Golden, NW “Wildfire” Red, Expansion Amber, Kodiak Brown Porter, Prior Porter, Big Chocolate Love: A Robust Porter, and the seasonal Blackfish Stout and Blizzzaak Winter Ale. In addition to grabbing an ice-cold brew, you can enjoy an evolving menu of sandwiches, soups, and appetizers.

TIP: Families are welcome, and dogs are allowed on the outside patio.

American Brewing Company

- Located at 180 W. Dayton St. Warehouse 102 Edmonds, WA 98020

- Hours: Monday – Thursday 3pm – 9pm, Friday 3 – 10pm, Saturday Noon – 10pm, Sunday Noon – 8pm

At American Brewing Company, craftsmanship and science are at the forefront of everything they do and create. Started in 2010 by Adam Frantz, American Brewing Company benefits from Adam’s years of practice and his worldwide travels that have influenced his craft beers. Their consistent offerings include an India Pale Ale, Pale Ale, Kolsch Ale, Stout, and a selection of seasonal and specialty beers.

TIP: These guys also brew 6 flavors of kombucha!

Gallagher’s Where-U-Brew

- Located at 180 W. Dayton St. #105 EDMONDS, WA

- Hours: Tuesday – Friday 2pm – 8pm, Saturday and Sunday 10am – 5pm

Ready to DIY your own brew?! Gallaghers Where-U-Brew offers an amazing opportunity to create your very own craft beer! They provide you with everything you need to brew a batch of beer… and it only takes 2 hours! They’re guide you through the different types of brews you can create, help you select what you’re most interested in, and assign you to a professional brewing kettle with instructions on how to get started. Then, you set a date (usually 2 weeks later) for you to go in a bottle your beer! Learn more about the process here.

TIP: You can also brew ciders, root beer, and make your own wine at Gallagher’s!

KENMORE

Nine Yards Brewing

- Located at 7324 NE 175th St., Suite A Kenmore, WA 98028

- Hours: Monday – Thursday 2pm – 10pm, Friday 2pm – midnight, Saturday 11am – midnight, Sunday 11am-10pm

Located right off the Burke Gillman trail in Kenmore, Nine Yards is a popular local establishment. Stop by for hand-crafted brews, food trucks, pinball machines, Skee ball… this happening place has it all, and is great for group gatherings or parties.

TIP: This establishment is open to all ages!

Cairn Brewing

- Located at 7204 NE 175th St. Bldg A, Kenmore, WA 98028

- Hours: Wednesday and Thursday 4pm – 9pm, Friday 3pm – 10pm, Saturday 11:30am – 10pm, Sunday 11:30am – 6pm

Cairn Brewing is a hub for beer drinkers and beer brewers alike. Stop by to enjoy a pint of the many on-tap offerings, 5 of which are always served directly from the tank! (There will also often be a food truck parked outside for your convenience!) Or, for those who are interested in learning the craft straight from the masters, sign up for a homebrewing class! Learn about the beer-making process, and actually brew a batch in class.

TIP: The Cairn Brewing taproom is family- and dog-friendly!

4 Things You Need to Know About the Mountlake Terrace Transit Center

As a local hub of transit and convenience, Mountlake Terrace is a popular choice for those who want to live in a smaller city that’s still close to Seattle and the Eastside. The Mountlake Terrace Transit Center makes this all possible by connecting local, commuter, and regional busses with passengers.

“Mountlake Terrace has a great transit center!” confirms Shelly Katzer. “[Mountlake Terrace also offers] convenient access to the freeway, [and] commuting to work is easy.”

REALTOR® Brian Hayter agrees; “[The] transit center is used by tons of commuters on 6101 236th Street SW, [and] provides easy access to Seattle. Light Rail is eventually going to be coming to Mountlake Terrace,” Brian added.

If you’re moving to Mountlake Terrace or already live here and need some commuting tips, read on! Here are 5 things we think you need to know about the Mountlake Terrace Transit Center:

The Transit Center has the capacity for over 1,000 cars.

This include a 5-level parking garage with 900 spaces. Plus, there’s bike lockers and racks available as well! This means 1,000 fewer cars on the streets during rush hour. (Thank you, Transit Center!) Helping 40,000 passengers commute each day is an amazing feat, and as our region grows, the Transit Center will become an even more crucial part of our community.

Light Rail is coming to Mountlake Terrace in 2023!

This is a BIG deal for the community. Construction on the new light rail station and route is slated to begin in 2018, and expected to begin servicing the area in 2023. Take a look at this interactive map for a better understanding of the upcoming Link Light Rail expansion!

You can take a bus to Downtown Seattle, Everett, and beyond from the Transit Center.

For those who have to commute for work, the Transit Center is served by several commuter buses and express bus services. You can take a look at schedules and specific routes here.

DART (Dial-A-Ride-Transportation) offers those with disabilities transportation access.

Specially designed for those with health conditions and disabilities this service offers those who wouldn’t ordinarily have access to public transit the opportunity to get out and about in the community. Learn more about how to use this excellent service here.

3 Places That Mountlake Terrace Dog Owners Need to Know About

Whether you’re looking for a city that welcomes you and your furry best friend, or you already live in the Mountlake Terrace area and want to start exploring, you’re in luck! The Mountlake Terrace area has some excellent amenities for dog owners and their canine companions to enjoy, all while getting some exercise and enjoying the outdoors!

If you’re a dog owner in Mountlake Terrace, here are 3 places you need to know about:

Mountlake Terrace Off-Leash Dog Park

Recommended by REALTOR® Brian Hayter and Shelly Katzer, the Mountlake Terrace Off-Leash Dog Park is located just northeast of the MLT Recreation Pavilion. Offering just under an acre of space in the shaded woods of Terrace Creek Park, this fenced area is a haven for dogs!

“We love to take our dog Dash for walks and let him run off leash in the park!” shares Shelly Katzer. Dogs can run and play within the double-gate system, and owners are welcome to relax on benches (or run and play, too!). Learn more about the park and read rules for visiting the dog park here.

Marina Beach Off-Leash Park

While this park technically isn’t in Mountlake Terrace, it is in the neighboring city of Edmonds (498 Admiral Way Edmonds WA 98020) and well worth the short 10-20 minute drive from MLT. As part of the larger Marina Beach Park on the Edmonds waterfront, this park offers a long list of amenities in addition to the off-leash area. A loop trail, playground, restroom, picnic tables, barbecue area, and much more set the scene.

As for the dog park portion, furry friends can frolic in the sand, splash in the surf, and stretch their legs as they meet other dogs in the cool ocean breeze. Click here to learn more about this Edmonds off-leash area.

Photo courtesy of the Pet Adventure Facebook page

Pet Adventure Shop

Located in the Cedar Plaza Shopping Center (22803 44th Ave. West Suite E-5 Mountlake Terrace, WA 98043), Pet Adventure Shop is a must-visit destination for local pet owners! Established in 2010 and owned and operated by locals, Pet Adventure Shop stocks its shelves with a huge range of food and supplies. Even the pickiest of pets are bound to find something delicious here—check out a list of the brands of cat and dog foods Pet Adventure Shop carries here.

In addition to supplies for cats and dogs, they also carry an eclectic variety of products for other animals including hamsters, birds, bunnies, fish, chickens, and horses.

Our 5 Favorite Things About the Mountlake Terrace Recreation Pavilion

Nestled between Terrace Park School and the Mountlake Terrace Off-Leash Dog Park, the Mountlake Terrace Recreation Pavilion (5303 228th Street SW, Mountlake Terrace, WA 98043) is an incredible multi-purpose facility packed with amenities to take advantage of! When we asked REALTOR® Brian Hayter what people in MLT like to do for fun, the Recreation Pavilion was at the top of the list, and it also came highly recommended by Shelly Katzer as well!

“The MLT Pavilion offers great programs for all ages, including a great swimming program,” shares Shelly. “My kids enjoyed the pre-school programs, before and after school Kids Krew and summer camps.”

This dynamic community center offers so many amenities to the MLT community, and we wanted to share a few of our favorite things about the community center that are not to be missed!

The multi-purpose swimming pool.

This warm-water pool not only is home to swimming lessons and a range of classes, but it also includes a lazy river with a current, spray toys, a beach-like entry leisure pool, a therapy pool, handicapped access, a sauna, and more. Plus, you can even rent out the pool for parties!

Kids programs, like preschool, before & after school care, and summer camps!

Keeping kids busy is easy with this community center in your city’s backyard! There are 3 preschool options for kids ages 3 to 5, each program providing a unique set of offerings. Kids Krew offers before and after school care for kids ages 5 to 12, and a huge variety of summer camps include themes like swimming, dance, basketball, tennis, and general youth camps.

The huge variety of fitness classes and sports leagues.

Whether you’re into something super upbeat (like Turbo kick or Zumba) or something a little more low-key (like yoga and Tai Chi), the recreation pavilion has a large selection to choose from. If playing on a team is more your style, adults can participate in basketball, racquetball, softball, volleyball, and racquetball sports. Sign up with a friend and meet your neighbors!

The MLT Recreation Pavilion is open 7 days a week.

Whether you want a workout before work or the kids need to burn off some energy on a rainy Sunday, the pavilion is open and waiting to be used! Hours include Monday – Thursday 6am – 9:30pm, Friday 6am – 7:15pm, Saturday 7am – 8pm, and Sunday 8:30am – 7pm.

Mountlake Terrace residents get a discount.

Whether you’re using the pool, buying a pass, or taking a class, all MLT residents receive a discount on using this facility. You can view all 2017 fees here.

Check out the complete Recreation Program Guide here!

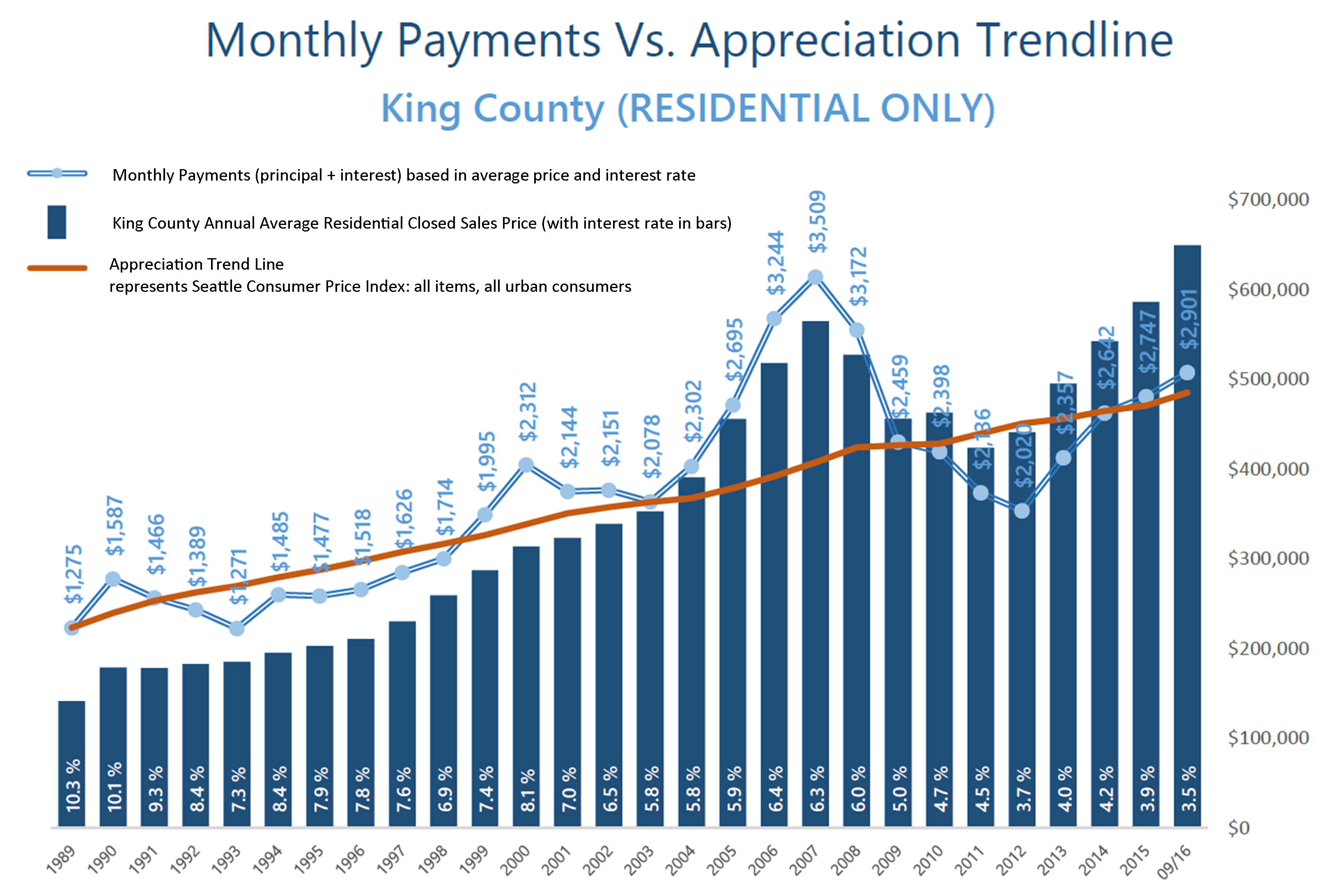

Affordability: Commute Times & Interest Rates

These graphs illustrate the brass tacks of affordability between King and Snohomish Counties, measured by the average monthly payment. Most recently in September, the average monthly payment was 35% higher in King County compared to Snohomish County. What is fascinating, though, is comparing today’s average monthly payment to peak monthly payments back in 2007! In King County, monthly payments are currently 21% less than during the peak, and in Snohomish County, 36% less. That is a lot of saved monthly overhead. Note that this has everything to do with today’s historical interest rates, as average prices are higher now than in 2007. When one buys or refinances a house, they are not only securing the property, but securing the rate for the life of the loan.

These graphs illustrate the brass tacks of affordability between King and Snohomish Counties, measured by the average monthly payment. Most recently in September, the average monthly payment was 35% higher in King County compared to Snohomish County. What is fascinating, though, is comparing today’s average monthly payment to peak monthly payments back in 2007! In King County, monthly payments are currently 21% less than during the peak, and in Snohomish County, 36% less. That is a lot of saved monthly overhead. Note that this has everything to do with today’s historical interest rates, as average prices are higher now than in 2007. When one buys or refinances a house, they are not only securing the property, but securing the rate for the life of the loan.

Close proximity to the work place and affordability is often near the top of a buyer’s list of preferred features. 2016 has continued to be a year when commute times to major job centers widened the price divide between key market areas in the greater Seattle area. Over the last 12 months, the average sales price for a single-family residential home in the Seattle Metro area was $696,000! In south Snohomish County (Everett to the King County line), the average sales price for a single-family residential home was $471,000 – 48% less than Seattle Metro. Further, if you jump across Lake Washington to the Eastside, the average sales price for a single-family residential home was $881,000 – 27% more than Seattle Metro!

The “drive to qualify” mentality has been proven by the pending sales rate in south Snohomish County over the last 12 months. Pending sales are up 7% complete year-over-year, whereas in Seattle Metro pending sales are down 1%, and down 2% on the Eastside. We believe this is a result of affordability, more inventory choices in south Snohomish County, new construction options, lower taxes, strong school district choices, and manageable commute times. Newer transit centers and telecommuting have also opened up doors to King County’s little brother to the north as well. If you are curious about possible commute times, you can search for properties on our website based on commutes times, which is a feature provided by INRIX Drive Time. Also, we track the market in several ways, so if the graphs here are interesting to you, any of our agents would be happy to provide additional information relative to your specific neighborhood. Please contact us anytime, as it is our goal to help keep you informed and empower you to make strong real estate decisions.

Market Update – Q3

Inventory levels providing more choices for buyers; is the market starting to stabilize?

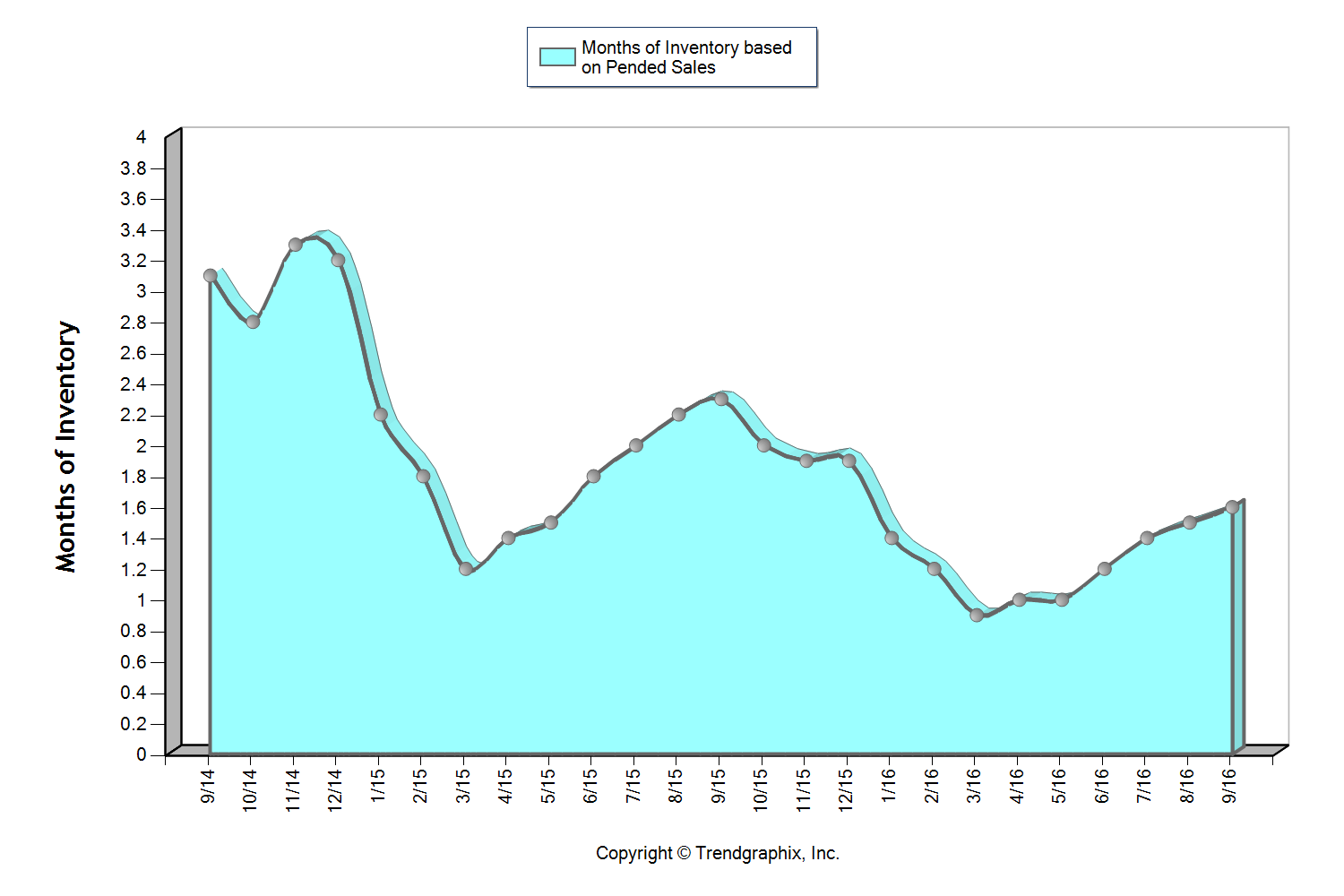

As we head into the fall and winter months after an incredibly eventful spring and summer, available inventory levels are starting to ease. It is still a seller’s market (3 months of inventory or less) in most areas, but one that is providing buyers increased options. The increase in available inventory is due to pent-up seller demand starting to come to market. The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! Additionally, lending requirements remain stringent and down payments are bigger, unlike the dreaded bubble market we experienced in 2007/2008. Educated pricing and sound condition is what will drive a buyer’s interest in a home. As the market stabilizes, it will be important for consumers to partner with a broker who closely follows the market to help them make informed decisions and develop winning strategies.

Read below for market details from Snohomish County down through south King County.

This graph shows that we currently sit at 1.6 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is providing buyers increased options. The average cumulative days on market reached 28 days in September, which was up 8% over August. Median price peaked in August at $401,000 and settled at $397,000 in September after hovering between $380,000 and $400,000 since April. For the first time since February, the average list to sale price ratio was 99% after sitting at 100-101% over the last six months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown just over 20% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.4 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (three months or less), but one that is providing buyers increased options. The average cumulative days on market reached 24 days in September, which was up 14% over August. Median price peaked in August at $453,000 and settled at $440,000 in September after hovering between $440,000 and $450,000 since March. For the first time since February, the average list to sale price ratio was 99% after sitting at 100-101% over the last six months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown just over 20% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.1 months of inventory based on pending sales, which is the highest level we have seen since January! It is certainly still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. In fact, we saw a 13% jump in new listings month-over-month. The average cumulative days on market reached 20 days in September, which was up 18% over August. Median price peaked in June at $650,000 and settled at $600,000 in September after hovering between $605,000 and $650,000 since March. In June, there were 95% more home sales above $1M over September. For the first time since February, the average list to sale price ratio was 101% after sitting at 102-104% over the last seven months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 21% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.5 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. The average cumulative days on market reached 31 days in September which was up 24% over August. Median price peaked in August at $770,000 and settled at $750,000 in September after hovering between $737,000 and $770,000 since March. In June, there were 18% more home sales above $1M over September. Over the last two months, the average list to sale price ratio was 99% after sitting at 101-102% over the five months prior.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 25% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.1 months of inventory based on pending sales, which is the highest level we have seen since January! It is certainly still a seller’s market (3 months or less), but one that is starting to provide buyers increased options. In fact, we saw a 16% jump in new listings month-over-month. The average cumulative days on market reached 21 days in September, which was up 31% over August. Median price peaked in June at $650,000 and settled at $605,000 in September after hovering between $608,000 and $650,000 since March. In June, there were 23% more home sales above $1M over September. For the first time since February, the average list to sale price ratio was 101% after sitting at 102-104% over the last seven months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 22% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

This graph shows that we currently sit at 1.7 months of inventory based on pending sales, which is the highest level we have seen in all of 2016! It is still a seller’s market (3 months or less), but one that is providing buyers increased options. The average cumulative days on market reached 27 days in both August and September, which was up 23% over July. Median price peaked in June at $371,000 and settled at $360,000 in September after hovering between $350,000 and $371,000 since March. For the first time since March, the average list to sale price ratio was 99% in August and September after sitting at 100-101% the prior four months.

The return of strong equity levels have brought sellers to market that have been waiting to jump in for some time. In fact, average prices have grown 16% over the last two years, freeing up sellers to make the moves they have been waiting for. Continued buyer demand due to our flourishing job market and historically low interest rates have steadily absorbed new inventory, but we are finally starting to see a trend toward some more balance. This is good news! We are still seeing multiple offers and quick market times, but not quite the frenzy that we experienced earlier this year.

All of these factors indicate that we may finally be headed towards a more stabilized market with positive attributes for both buyers and sellers.

These are only snapshots of the trends in our area; please contact one of our agents if you would like further explanation of how the latest trends relate to you.

Interest Rates and Your Bottom Line

Wow, just wow! The interest rate levels that we have experienced in 2016 are seriously unbelievable. Currently we are hanging around 3.5% for a 30-year fixed conventional mortgage, almost a half a point down from a year ago. This is meaningful because the rule of thumb is that for every one-point increase in interest rate a buyer loses ten percent in buyer power. For example, if a buyer is shopping for a $500,000 home and the rate increases by a point during their search, in order to keep the same monthly payment the buyer would need to decrease their purchase price to $450,000. Conversely, for every decrease in interest rate, a buyer can increase their purchase price and keep the same monthly mortgage payment.

Wow, just wow! The interest rate levels that we have experienced in 2016 are seriously unbelievable. Currently we are hanging around 3.5% for a 30-year fixed conventional mortgage, almost a half a point down from a year ago. This is meaningful because the rule of thumb is that for every one-point increase in interest rate a buyer loses ten percent in buyer power. For example, if a buyer is shopping for a $500,000 home and the rate increases by a point during their search, in order to keep the same monthly payment the buyer would need to decrease their purchase price to $450,000. Conversely, for every decrease in interest rate, a buyer can increase their purchase price and keep the same monthly mortgage payment.

Why is this important to pay attention to? Affordability! If you take the scenario I just described and apply it to the graph on the right, you can see that the folks who jumped into the market this year enjoyed an interest cost savings when securing their mortgage. This cost savings is doubly important because we are in a price appreciating market. In fact, the median price in King County has increased by 13% complete year-over-year and 10% in Snohomish County. Interest rates are helping to keep payments more manageable in our appreciating market. Most recently we have started to see a slight increase in inventory compared to the spring/summer market, which is a plus for buyers and something to be taken advantage of.

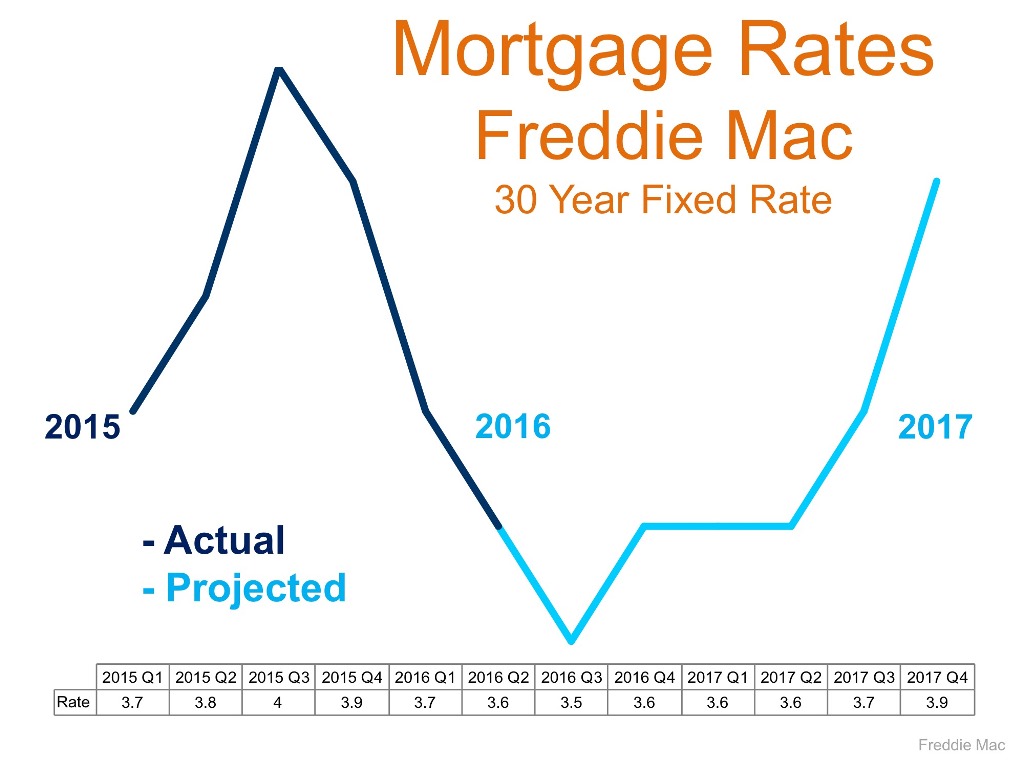

Will these rates last forever? Simply put, no! The graph above provided by Freddie Mac shows a prediction for rates to start rising. While still staying well below the 30-year average of 7.65%, increases are increases, and securing these rates could be downright historical. Just like the 1980’s when folks were securing mortgages at 18%, the people that lock down on a rate from today will be telling these stories to their grandchildren. Another factor to consider is that it is an election year, and rates historically remain level during these times. What 2017 and beyond hold for rates will likely not mirror these historical lows under 4%. Note the 30-year average – one must think that rates closer to that must be in our future at some point.

So what does this mean for you? If you have considered making a move, or even your first purchase, today’s rates are a huge plus in helping make that transition more affordable. If you are a seller, bear in mind that today’s interest rate market is creating strong buyer demand, providing a healthy buyer pool for your home. As a homeowner who has no intention to make a move, now might be the time to consider a refinance. What is so exciting about these refinances, is that it is not only possible to reduce your monthly payment, but also your term, depending on which rate you would be coming down from.

If you would like additional information on how today’s historical interest rates pertain to your housing goals, please contact any of our agents. We would be happy to educate you on homes that are available, do a market analysis on your current home, and/or put you in touch with a reputable mortgage professional to help you crunch numbers. Real estate success is rooted in being accurately informed, and it is our goal to help empower you to make sound decisions for you and your family.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Toscana by Village Life

Toscana by Village Life