Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Buyers: Keep Your Head Down, This May be Your Time

The first five months of 2017 have been a grind for buyers in our area. Inventory has been quite limited and demand has been off the charts. However, in the month of May we started to see things loosen up, with the highest rate of new listings coming to market in some time. Below are two market samplings from the Greater Seattle area: north King County and south Snohomish County which are reflective of our entire market.

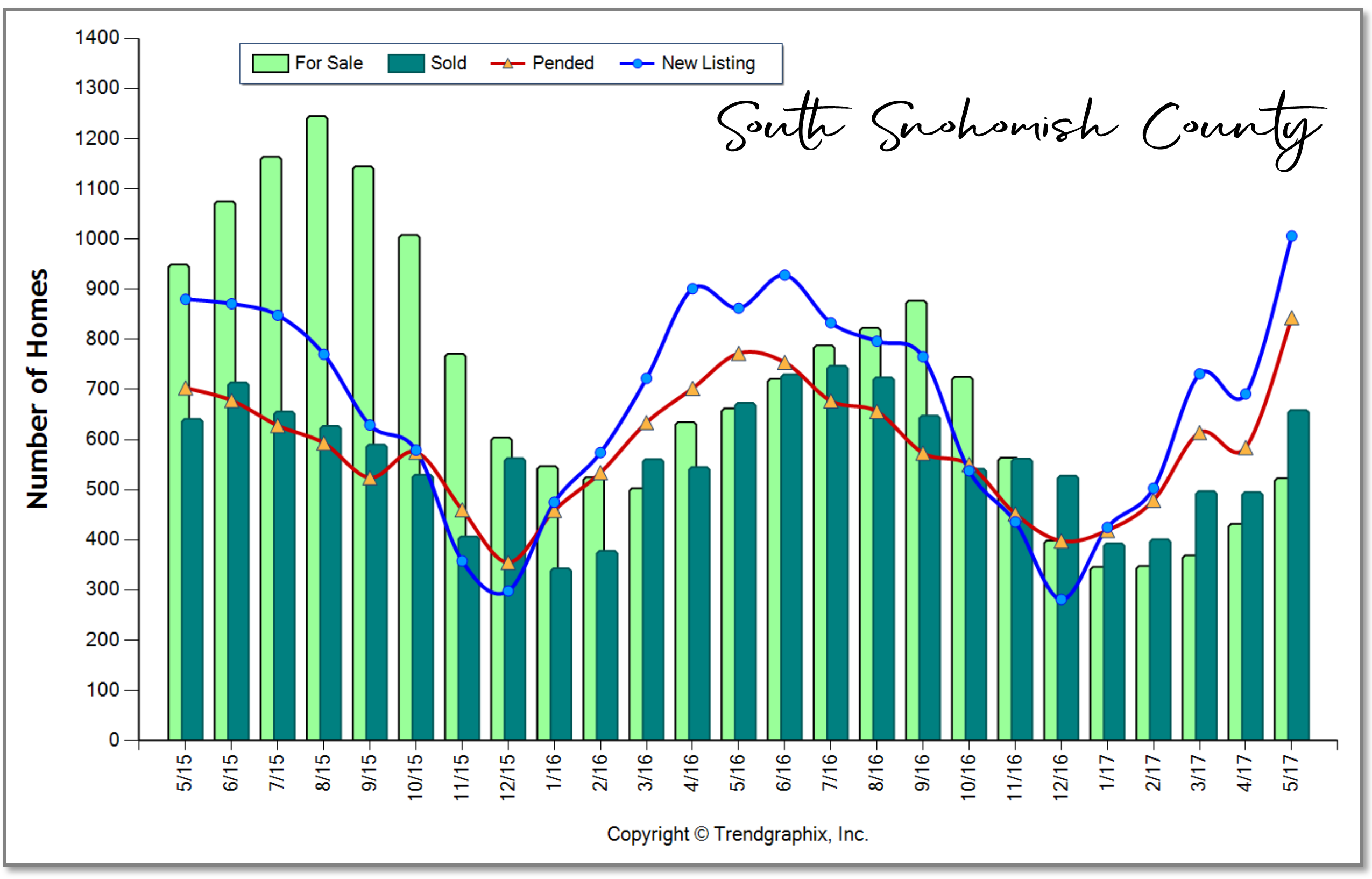

South Snohomish County:

South Snohomish County:

In May we saw just over 1,000 new listings come to market in south Snohomish County; the highest inventory push in one given month in over five years! In fact, it was a 46% increase over the previous month, and a 17% increase from the same month a year ago. This is good news for buyers, finally! One should note, however, that pending sales nearly mirrored the number of new listings, illustrating that demand is still very strong.

I think we will see that opportunities have loosened up for buyers in the list-to-sale price ratios that will post in June closings (May pendings). My prediction is that they will have tempered a bit from the 103% posting in May, purely based on buyers having more selection.

Demand surely met the new surge of inventory, but from what I am observing in the market, not all homes are getting multiple offers. When there are multiple offers, smaller groups of buyers may be vying for one house. We have even seen more price reductions in May with overzealous sellers not paying close attention these slight shifts in the market.

Don’t get me wrong, the good houses that are well-priced and looking good are seeing great price escalation and competition, but some are simply selling with a one-buyer audience. There are just more opportunities when there is more inventory, and this is good news for all of us as tempered price growth is needed after a 51% increase in median price over the last four years.

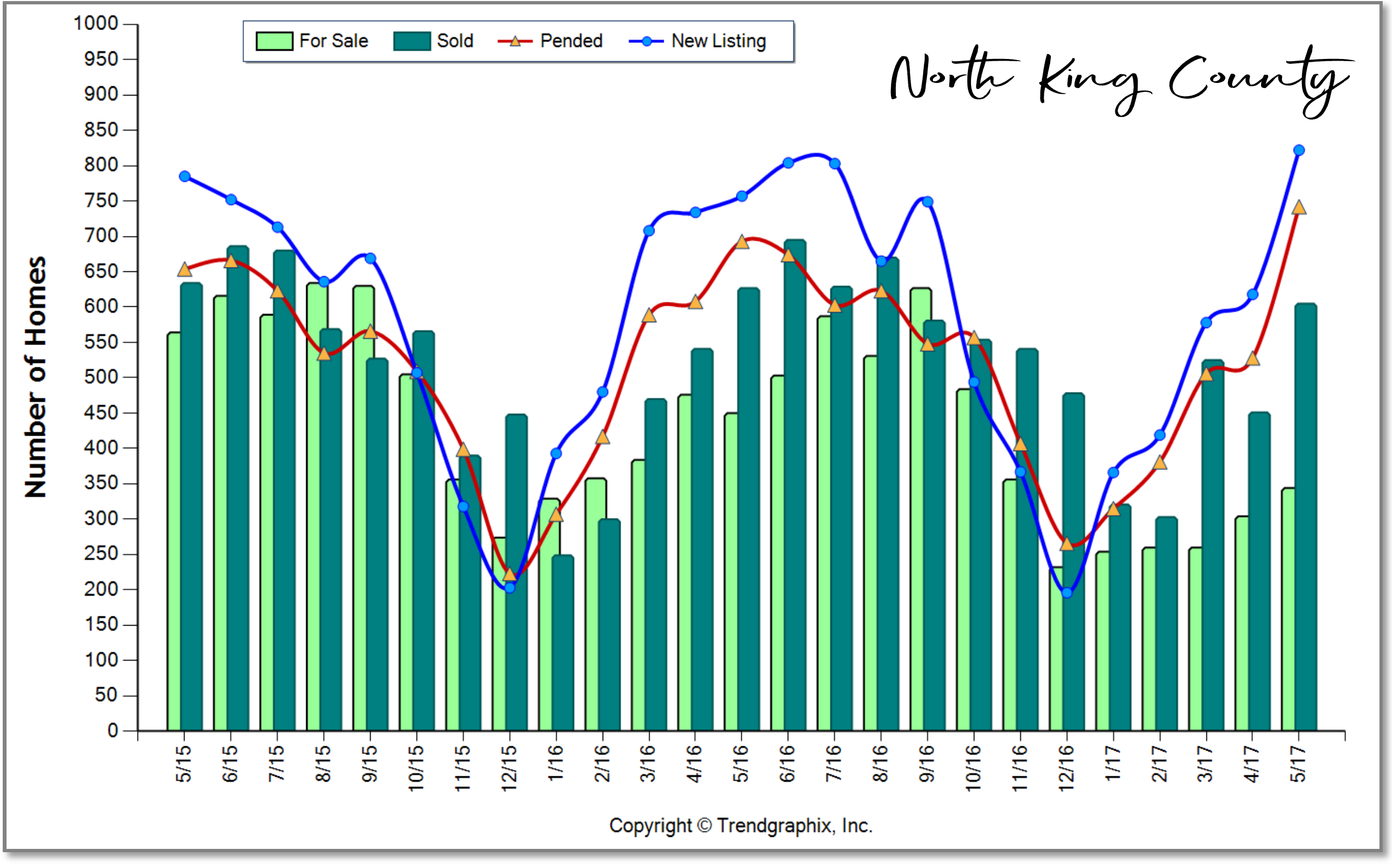

North King County:

North King County:

In May, we saw just over 800 new listings come to market in north King County; the highest inventory push in one given month in over three years! In fact, it was a 33% increase over the previous month and a 9% increase from the same month a year ago. Pending sales also met demand here, but more buyers were able to land a home, which is good news. List-to-sale price ratios recorded at an average of 107% in this area, so definitely a needed tempering as we head into June.

When you are closer to jobs centers demand is higher, so the in-city market will continue to present a hustle for buyers, but more listings will equal a better chance of landing a house close to work. Prices in this area have increased 60% over the last four years.

Interest Rates:

Currently, interest rates are a buyer’s dream come true! We started the year at 4.25%, bumped up to 4.375% in early spring, and we have inched down to 4% most recently. This reduction in rate is saving buyers thousands of dollars over the course of their mortgage on their monthly payments, somewhat offsetting the increase in prices since the first of the year. This is something to pay attention to, and could not come at a better time as it is coupled with more inventory. Inventory in June and July should continue to be strong as the long winter delayed folks getting to market, and many sellers are taking advantage of the prices.

If you have thought about making a move or even your first purchase, now may be the time to not just dip your toe in the pool, but to jump in. It is summer and who doesn’t like a nice swim? Especially if that pool has more homes than we’ve seen in some time and cheap money. If you or anyone you know is interested in learning more about our market please contact one of our agents, as it is our goal to keep our clients informed and empower strong decisions.

You’d Like to Sell Your Home, but Where to Next… and How?

Homeowners across our region are enjoying very healthy equity levels due to an upswing in the real estate market over the last five years. In fact, the median price in King County is up 50% over the last five years and up 47% in Snohomish County. This growth in equity has given homeowners the exciting option to sell their home for a high price and move on to their next chapter, such as a move-up, down-size or second home. This price growth is great news and provides many opportunities, however we have also faced some challenges in how to make these transitions.

Our biggest challenge in the marketplace right now is inventory levels; sometimes requiring a buyer to compete in multiple offers for their next home. Currently King County sits at 0.7 months of inventory and 0.8 in Snohomish. Historically, buyers that are also sellers would commonly secure a new home contingent on the sale of their current home. Meaning the seller of the new home they are buying would give them a month or so to get their current house sold in order to buy theirs. Well in this market, that is only rarely an option. So, the million-dollar question is this: how does one who has gained so much equity, now itching to get that bigger house, different location, or perfect rambler for settling into retirement, make this transition without having to move twice? We need to get creative and have a strategy. Two options that have recently proved to be successful, are negotiating a rent-back for sellers or using the Windermere Bridge Loan program.

First, negotiating a rent-back has become a great option for someone who needs to first sell their current home in order to buy. The way it works is we put their home on the market, price it competitively to create demand, and ask for a rent-back as one of the preferred terms. If this rent-back is successfully negotiated, then the seller closes on their home and collects their funds, but gets to stay in the house anywhere from 30-60 days. This enables the seller, who is now a buyer, to have their cash in-hand, time to find a new house, get it under contract and close the sale when their rent-back is ending. This eliminates the need to move twice. There is a bit of calculated risk in this plan, but we’ve seen it work several times, always with a plan B ready just in case. Rarely has plan B needed to be executed, and often times we’ve even been able to pay little to no rent during this time.

The second option is the Windermere Bridge Loan program. This is an amazing tool for homeowners that own their homes free and clear, or have paid down their debt quite a bit. This is a low-cost alternative to pull the equity out of one’s house prior to selling it in order to make a non-contingent offer. The way it works is we take the market value of the house the homeowner current lives in, established by a comparative market analysis completed by your Windermere agent and signed off by the Broker. We then take 65% of that value and subtract any debt owed, and that is the maximum amount the homeowner can borrow for their next down payment. They can then make a non-contingent offer on a new home. What is really great about this, is that it doesn’t require an appraisal (like a HELOC does), and these can easily be turned around in 3-5 business days. This tool provides the opportunity to quickly and inexpensively pull your equity out, be competitive, and eliminates the double move.

The fees associated with this program are a 1% loan fee on the equity that is pulled, a title report, and interest that is incurred between the loan funding and being paid off once the subject home is sold. That interest is conveniently wrapped up in the closing costs when they close the sale of their home, eliminating the need to make monthly interest payments. In a strategy that is somewhat mind blowing- we can sometimes use these bridge loans and never have to actually fund them. For example, if we secure a property non-contingent with the bridge loan and immediately get the subject home on the market, we can often secure a sale with a simultaneous closing, and never have to fund the loan. This eliminates the loan fee, interest, and the need to carry two mortgages.

If you are excited about equity levels and today’s low interest rates and have thought about making that move you’ve been waiting for, but have been fearful of how to do it all – we can help. These two options, along with great attention to detail, hand-holding, and careful planning have helped many people make these exciting transitions. It is our goal to help keep our clients informed and empower strong decisions. Please contact any one of our agents if you would like further information on how this might work for you or someone you know.

You Don’t Need Tulips for a Strong Home Sale

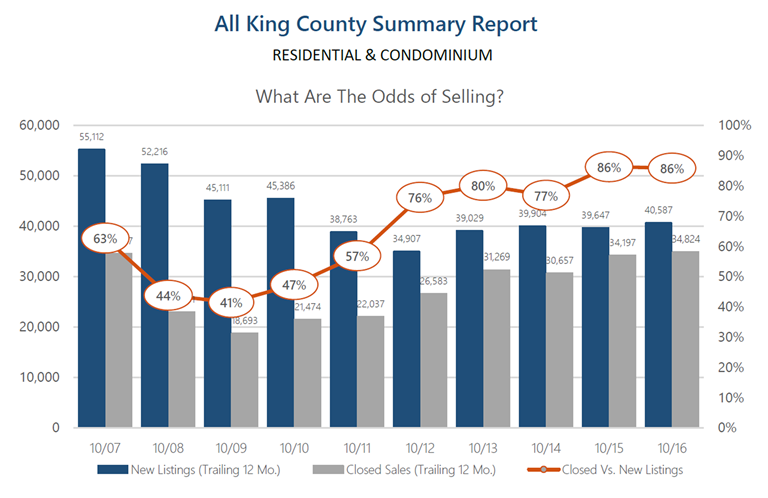

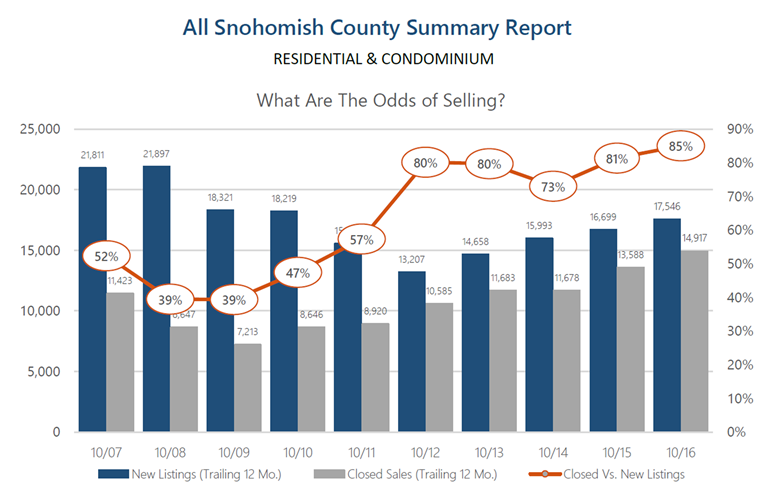

These graphs (click to view larger) above provide a 10-year history of the odds of selling in the month of October for both King and Snohomish Counties. As you can see, the odds of selling are at a 10-year high, hitting 86% in King and 85% in Snohomish. These are quite favorable odds for sellers and indicate what one might expect moving toward 2017.

These graphs (click to view larger) above provide a 10-year history of the odds of selling in the month of October for both King and Snohomish Counties. As you can see, the odds of selling are at a 10-year high, hitting 86% in King and 85% in Snohomish. These are quite favorable odds for sellers and indicate what one might expect moving toward 2017.

Buyer demand remains very strong! In fact, pending sales reached peak levels in May of this year and continued with steady momentum throughout the summer and fall. Every month this year recorded a higher pending level than the same month the previous year. This illustrates strong buyer demand and is coupled with lower inventory levels than the year before. This combination has created very low months of available inventory, and we anticipate this continuing as we complete 2016 and head into 2017. For a potential seller, this means the market is in your favor, and waiting until the tulips bloom in April might have you lined up against more competition. Historically, we see inventory peak April through June, however pending sales have closely matched supply all throughout the year. With that said, one might consider bringing their home to market in the first quarter of the year versus the second, because they will have less competition, but still enjoy an engaged buyer audience.

Most recently we have seen interest rates bump up a bit, and this has created more urgency in the market. While still historically low, buyers are smart enough to know that cheap money is a huge long-term savings. Paying attention to all of these market factors will empower one to make the best real estate decisions. Please reach out if you are considering a move over the next year, and I’d be happy to apply this research and weigh in on your options.

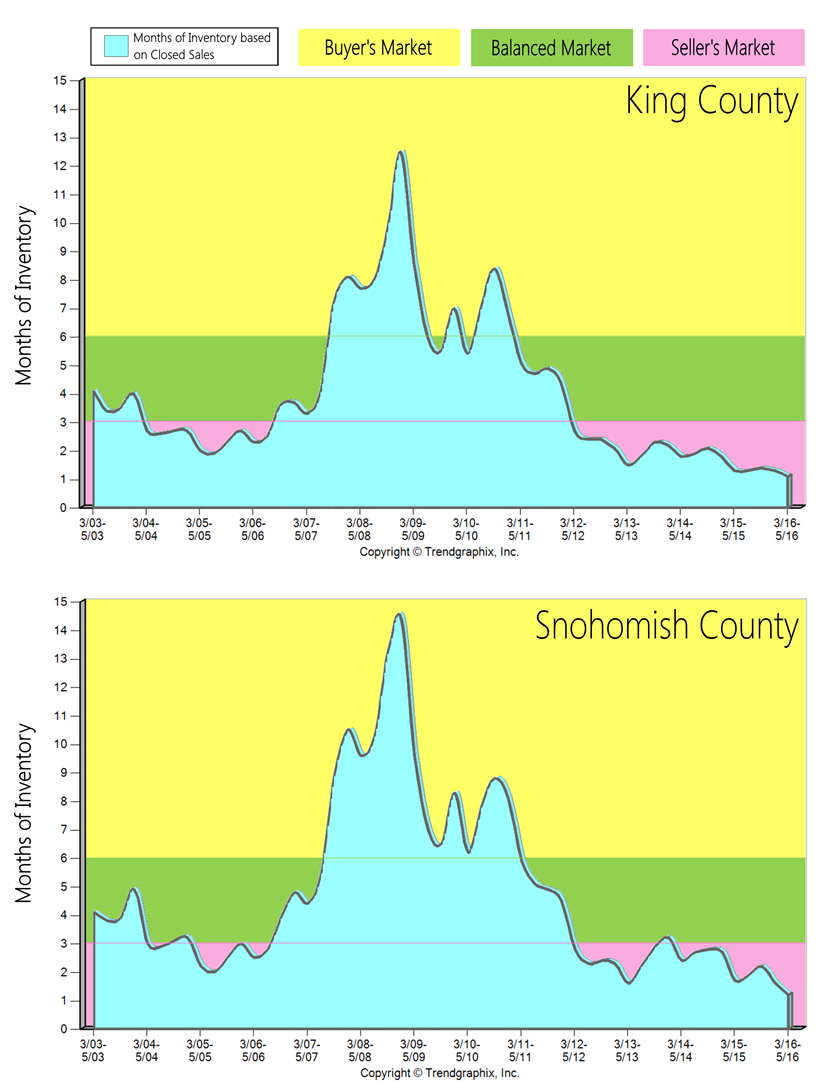

A Thirteen-Year Overview of Inventory Levels- Where’s the Balance?

The two graphs here illustrate a thirteen-year overview of inventory levels in both King and Snohomish Counties, highlighting the 2007 crash. Inventory levels are measured by the months of available inventory. For example, if there were 60 homes available in July and 30 homes sold in July, you would be left with two months of inventory; meaning that if no new homes came to market, the demand of 30 homes per month would absorb the 60 available homes in two months. A buyer's market is defined by 6+ months of inventory, a balanced market, 3-6 months and a seller's market, 0-3 months. From March to June of this year we averaged 1.1 months of inventory in King County and 1.2 months in Snohomish County, both extreme seller's markets.

In King County over the last 13 years we saw three years of a buyer's market, which happened during the biggest economic downturn since the Great Depression, after the crash of the housing market in 2007. This economic fallout was a result of predatory lending practices, which created a large population of buyers who were not truly qualified to purchase a home. This oversaturated the market and then led it to its crash when those lending practices were shut down. These severe influences on the market led to quick jumps from a seller's to a buyer's market and then a buyer's to a seller's market. It only took one short year to transition from the seller's market of 2004-2006 to the three-year long buyer's market after the housing crash. Once the sub-prime lending options were shut down in July 2007, it eliminated many buyers, creating an extreme buyer's market. It also only took one short year to transition out of the downturn and back to a seller's market as the economy started to recover. It has been a seller's market in King County since May of 2012 – four years!

In King County over the last 13 years we saw three years of a buyer's market, which happened during the biggest economic downturn since the Great Depression, after the crash of the housing market in 2007. This economic fallout was a result of predatory lending practices, which created a large population of buyers who were not truly qualified to purchase a home. This oversaturated the market and then led it to its crash when those lending practices were shut down. These severe influences on the market led to quick jumps from a seller's to a buyer's market and then a buyer's to a seller's market. It only took one short year to transition from the seller's market of 2004-2006 to the three-year long buyer's market after the housing crash. Once the sub-prime lending options were shut down in July 2007, it eliminated many buyers, creating an extreme buyer's market. It also only took one short year to transition out of the downturn and back to a seller's market as the economy started to recover. It has been a seller's market in King County since May of 2012 – four years!

In Snohomish County over the last 13 years we saw four years of a buyer's market. Snohomish County was hit a bit harder by the Great Recession than our neighbor to the south, as it took longer to recover. It has been a seller's market in Snohomish County since May of 2012, except for one quarter of a balanced market in the beginning of 2014, when we saw a surge of new construction come to market due to the national builders releasing some neighborhoods they had acquired in the downturn.

Interestingly, the market shifts were brief because the downturn was so severe, which changed the market environment quickly. In order to clean up the predatory lending mistakes of 2004-2007, the market essentially had to come to a standstill and flush out all of the bad loans via foreclosure and short sales, which took five years. The only time we found ourselves in such an extreme buyer's market, was after one of the biggest economic fallouts of the last century. Once that corrected itself we quickly returned to a seller's market due to many positive factors.

Our available housing stock is affected by the limited land left to build on, a thriving job sector (especially in tech), historically low interest rates and the Greater Seattle area being a nice place to live. All four of these indicators have shrunk inventory and put upward pressure on prices. Sellers continue to enjoy great market returns, and buyers continue to fight to secure a home with a 4% interest rate, and not too far from their workplace. Additional inventory would be more than welcomed, it is very clear that we have the demand to absorb it. If you are curious about the value of your home in today's market or securing a purchase please contact one of our agents. We are always happy to help educate you on how this market can benefit your bottom line.

Strategy is Key in an Extreme Market

The beginning of 2016 has been quite the ride so far in our local real estate market. It has been the most extreme seller's market we've ever seen. At the end of February, both King and Snohomish Counties ended the month with only one month of inventory based on pending sales. Pending numbers (the amount of homes going under contract) were up 35% in King County from the previous month and up 24% in Snohomish over the previous month. Demand is strong! How we manage that demand is critical. Every type of market calls upon different skills to achieve the best outcome for our clients. In this extreme seller's market the strategy one creates for their sellers to gain the best possible outcome is a fine-tuned, high-effort approach.

The beginning of 2016 has been quite the ride so far in our local real estate market. It has been the most extreme seller's market we've ever seen. At the end of February, both King and Snohomish Counties ended the month with only one month of inventory based on pending sales. Pending numbers (the amount of homes going under contract) were up 35% in King County from the previous month and up 24% in Snohomish over the previous month. Demand is strong! How we manage that demand is critical. Every type of market calls upon different skills to achieve the best outcome for our clients. In this extreme seller's market the strategy one creates for their sellers to gain the best possible outcome is a fine-tuned, high-effort approach.

First, market research and price positioning not only takes studying the history of the market, but anticipating what is next, so no opportunities are missed. Second, properly bringing the home to market is still paramount. Even though there are less homes to choose from in this market, how a home "shows up" could make a difference of thousands of dollars in return for a seller. An investment in professional photography, staging and marketing only adds to the exposure, increasing interest from the buying public. Third, managing the demand – this is huge! This is where communication and being the calm in the storm is key. It is always our goal to harness control and bring calm during the intense initial market time. It is not our goal to take the first offer that comes our seller's way. Instead it is our goal to massage what the home has to offer over a set period of time in order to garner a great price for our Sellers, but also superior terms, such as waived contingencies. Fourth, it is our goal to end with a contract that has a great price, but also one that will make it to the closing table. There are obstacles in this accelerating market, such as passing appraisal, which we anticipate up front to insure a smooth journey through closing.

By completing extensive market research, studying upcoming trends, highlighting a property's features with superior marketing, executing a strategy to manage the demand and negotiating the best terms for our sellers, we are creating above market-average results! In the first two months of 2016, the average cumulative days on market in King County was 40.5 days and Snohomish County was 50.5. My office averaged 23 days and 25 days respectively. In those same two months the list to sale price ratio in King County was 100.5% and 99.5% in Snohomish County. My office averaged 101.2% and 103.1% respectively. Saved market time and higher price acceleration is resulting in a better bottom line for our clients.

By completing extensive market research, studying upcoming trends, highlighting a property's features with superior marketing, executing a strategy to manage the demand and negotiating the best terms for our sellers, we are creating above market-average results! In the first two months of 2016, the average cumulative days on market in King County was 40.5 days and Snohomish County was 50.5. My office averaged 23 days and 25 days respectively. In those same two months the list to sale price ratio in King County was 100.5% and 99.5% in Snohomish County. My office averaged 101.2% and 103.1% respectively. Saved market time and higher price acceleration is resulting in a better bottom line for our clients.

These results do not come without a refined, strategic approach. Understanding the nuances that each market brings equals results in the best interest of our clients. If you or any one you know is contemplating participating in this extreme seller's market please contact one of our agents. It would be our honor to have the opportunity to help create and navigate a successful strategy resulting in a win.

Looking Towards the 2016 Real Estate Market

As we round out a very strong 2015 in the real estate market, it is time to look towards 2016 and what it may bring. After two straight years of inventory challenges, multiple offer madness and steep price appreciation, will things start to temper? Below is a list of my predictions for what 2016 might hold for the real estate market. These are fun, educated guesses based on studying the market and paying attention to important indicators. I hope you enjoy and I welcome your questions or discussions.

As we round out a very strong 2015 in the real estate market, it is time to look towards 2016 and what it may bring. After two straight years of inventory challenges, multiple offer madness and steep price appreciation, will things start to temper? Below is a list of my predictions for what 2016 might hold for the real estate market. These are fun, educated guesses based on studying the market and paying attention to important indicators. I hope you enjoy and I welcome your questions or discussions.

1. Interest Rates: They have been saying for a few years now that interest rates are going to go up, and they really haven't. Since 2012 they have ebbed as low as 3.375% and as high as 4.25%, and are currently leveled out at 4% on a 30-year fixed conventional loan. By the end of 2016, I predict that they will be just under 5%. As the economy continues to improve and consumer confidence grows, an increase in rates will be important for the health of our overall economy and the public should be able to handle this rise. Plus, we must not lose sight that the average interest rate over the last 30 years has been 6.959% and we are still WAY below that.

2. Listing Inventory: Inventory has been the biggest challenge this year, with King County hovering between one and two months of inventory and Snohomish Country hovering between two and three months of inventory in 2015. That is LOW!! There are two reasons it has been that way; we have had 21% less homes come to market in King County year-over-year, and 15% less in Snohomish County. There have also been more buyers in the market, causing demand to heavily outweigh supply. In 2016 I think we will see more homes come to market, due to the fact that as prices have appreciated, homeowners have gained much more favorable equity positions, giving them options to make the moves they've been dreaming of and waiting for. Folks are ready to upgrade their lifestyle, whether that means buying a bigger home or transitioning to a "right" size home due to retirement. Pent up seller demand due to these equity and lifestyle factors will lead to an increase in homes coming to market.

3. Buyer Demand: Buyer demand will remain strong! This is largely related to our booming job market and the expanding tech sector. Our unemployment rate is 4%, meaning jobs are more abundant than they have been in years, and wages are growing in every county. Couple this with low interest rates, and it equals a more-than-plentiful pool of buyers. One factor to look out for as we head into 2016, is if the strong buyer demand we have will quickly absorb any increase in inventory, keeping months of inventory basically the same as 2015. This will be a fun one to watch.

4. Prices: We will indeed continue to see price appreciation due to the factors above. Year-to-date, median price appreciation in King County is up 8% complete year-over-year and up 9% in Snohomish County. A year from now I anticipate price appreciation to slow to 6% in King and 5% in Snohomish, due to a bit more inventory, and meet peak levels. This is still higher than the normal 3-4% year-over-year appreciation, but it is below the double-digit appreciation we saw in 2013 and 2014, thank goodness! As we have dug out of the Great Recession's hole and regained equity levels after the fall of the sub-prime mortgage fiasco it is important to retreat back to more sustainable appreciation levels.

5. First-Time Home Buyers: The big talk of 2015 was the Millennial generation, and when they would jump into the housing market. They have started to make their play as they are getting some of those great tech sector jobs, but many are limited in purchasing due to high student loan debt. We are starting to see FICO scores loosen up a bit for this reason. Interestingly enough, the average FICO score for a denied borrower for a conventional loan was 700, and 754 for an approved borrower. Average FICO score for a FHA borrower who was denied was 635, and 687 for an approved borrower. These are important factors to pay attention to along with debt-to-income ratios. Also important to note is that rents are extremely high in the Greater Seattle area, so the cost of owning over the long term is more favorable. Once the Millennials decide that they are ready to settle down, what they are willing to have their commute look like and pay down some of that debt they will be ready to start building household wealth by buying vs. renting.

If you or anyone you know has any questions about real estate, please don't hesitate to contact any one of our agents. We are here to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link