Does it make more sense to rent or own?

The current break-even horizon* in the Seattle metro area is 1.6 years!

*The amount of time you need to own your home in order for owning to be a superior financial decision.

With rising rental rates, historically low interest rates, and home prices on the rise, the advantage of buying vs. renting is becoming clearer each month.

In fact, Seattle has seen some of the sharpest rent hikes in the country over the last year! Snohomish County has seen a huge increase in apartment growth and rising rental rates as well. There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. Zillow Research has determined the break-even point for renting vs. buying in our metro area. In other words, the amount of time you need to own your home in order for owning to be a superior financial decision. Currently in Seattle the break-even point is 1.6 years – that is quick! What is so great about every month that ticks away thereafter is that your nest egg is building in value.

We are happy to help you or someone you know assess your options; please contact us anytime.

These assumptions are based on a home buyer purchasing a home with a 30-year, fixed-rate mortgage and a 20 percent down payment; and a renter earning five percent annually on investments in the stock market.

Does it Make More Sense to Rent… or Own?

*The amount of time you need to own your home in order for owning to be a superior financial decision.

With Seattle’s robust job market and high housing costs, there has been a lot of talk lately about the cost of living in the Greater Seattle area. In fact, Seattle is now the 5th most expensive city to rent in the country according to a new study from Nested.com. The average monthly rental price for a one bedroom apartment in the city of Seattle is $1,790 according to Zumper.com, up 8.5% year-over-year; and a two bedroom is $2,470, up 6% year-over-year! With rising rental rates, still historically low interest rates, and home prices on the rise, the advantage of buying versus renting has become clear for folks who have a down payment saved, good debt-to-income ratios and strong credit. Currently, the breakeven horizon (the amount of time you need to own your home in order for owning to be a superior financial decision vs. renting) in the Greater Seattle area is 2.4 years according to Zillow research.

An additional study by Nested.com outlines the monthly rental costs for a single person or a family of four, as well as the yearly income required. In Seattle, it costs the average single person $1,288.76 a month to rent, which requires an annual income of $53,328.00. The average family of four costs $2,665.34 for monthly rent, and an annual income of $101,186.48. That is a lot of money one would be paying towards someone else’s investment.

There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. One of the biggest factors is interest rates! Currently, the rate for a 30-year fixed, conventional, conforming loan is hovering around 4.25%. That is amazingly and historically low, making the advantage of securing a mortgage huge. What is nice about having a mortgage is that the payment stays the same over the term of the loan. With renting, rates can be increased at any time, and you are paying down someone else’s asset, not your own. Owning gives the homeowner control over their overhead while getting to make their house their home. What is also so great about owning, is that once you have hit the breakeven horizon, every month that ticks away thereafter is building your nest egg in value. The long-term benefits of owning are abundant, including the stability of not being asked to move. These are important factors to consider for everyone, but especially the younger folks who are enjoying the benefits of Seattle’s attractive job market.

There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. One of the biggest factors is interest rates! Currently, the rate for a 30-year fixed, conventional, conforming loan is hovering around 4.25%. That is amazingly and historically low, making the advantage of securing a mortgage huge. What is nice about having a mortgage is that the payment stays the same over the term of the loan. With renting, rates can be increased at any time, and you are paying down someone else’s asset, not your own. Owning gives the homeowner control over their overhead while getting to make their house their home. What is also so great about owning, is that once you have hit the breakeven horizon, every month that ticks away thereafter is building your nest egg in value. The long-term benefits of owning are abundant, including the stability of not being asked to move. These are important factors to consider for everyone, but especially the younger folks who are enjoying the benefits of Seattle’s attractive job market.

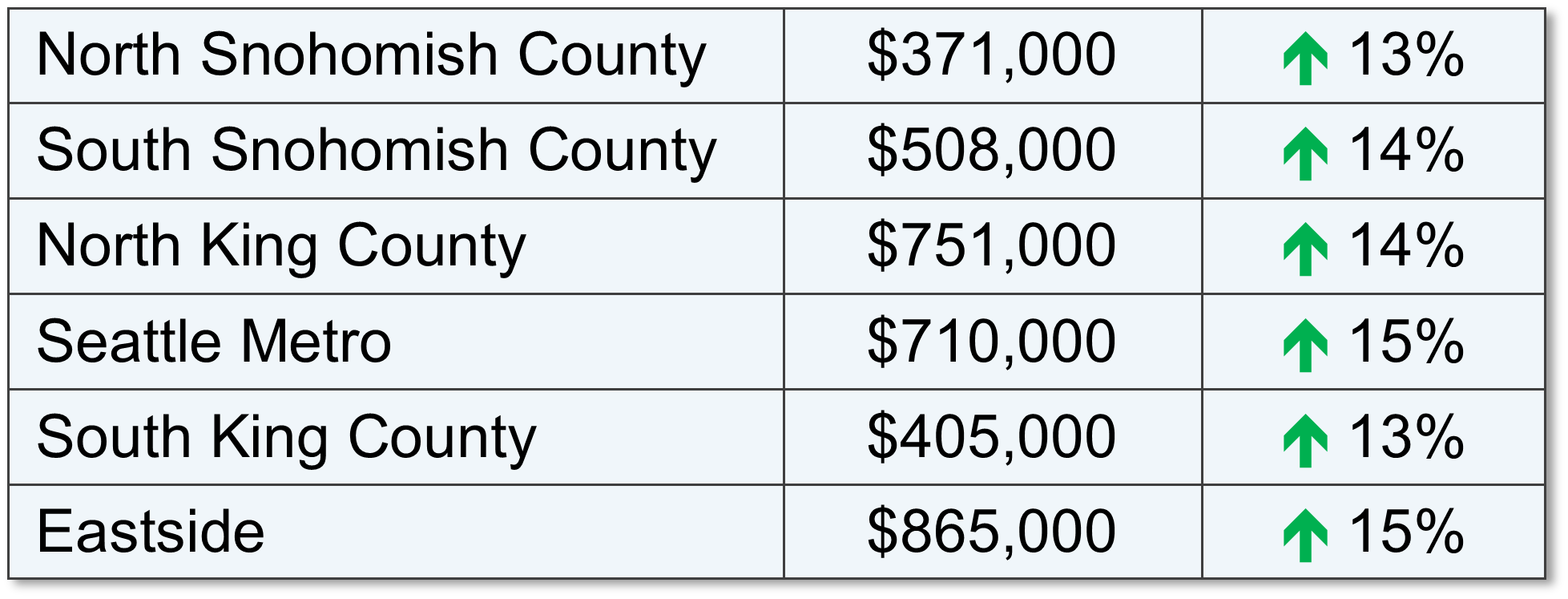

Where folks are having to compromise most due to affordability is commute times, and settling in less urban neighborhoods. Worth pointing out, is the average home price in South Snohomish County is 46% less than Seattle Metro – that is a huge savings! Some people, mainly millennials, have not been willing to give up living in the more core urban neighborhoods that have high walk scores and shorter commute times. That should be apt to change as rents are rising fastest in those areas. The advantages of moving out a little further and securing a home will start people on the track of building long term wealth.

If you or anyone you know is currently renting and is considering a change, please let us know as we would be happy to get their questions answered to help them make an informed decision.

Many Factors to Consider When Choosing to Rent vs. Own

*The amount of time you need to own your home in order for owning to be a superior financial decision.

There has been a lot of talk lately about the cost of living in the Greater Seattle area. Whether it has to do with home prices or rental rates the story is the same: it is becoming more and more expensive by the month. With rising rental rates, historically low interest rates, and home prices on the rise, the advantage of buying vs. renting has become clear for folks that have a down payment saved, good debt to income ratios and strong credit. In fact, Seattle is now the 10th most expensive city to rent in the country according to a new study from Zumper.com. The average monthly rental price for a one-bedroom apartment in the city of Seattle is $1,740! Snohomish County has seen an increase in apartment growth and rising rental rates as well. Currently, the breakeven horizon in the Greater Seattle area (the amount of time you need to own your home in order for owning to be a superior financial decision versus renting) is 1.6 years according to Zillow research.

There are several factors to consider that will lead you to make the best decision for your lifestyle and your financial bottom line. One of the biggest factors is interest rates! Currently, the rate for a 30-year fixed, conventional, conforming loan is hovering around 3.5%. That is amazingly and historically low, making the advantage of securing a mortgage huge. What is nice about having a mortgage is that the payment stays the same over the term of the loan. With renting, rates can be increased at any time, and you are paying down someone else's asset, not your own. Owning gives the homeowner control over their overhead while getting to make their house their home. What is also so great about owning is that once you have hit the breakeven horizon, every month that ticks away thereafter is building your nest egg in value. Did you know that American homeowners’ net worth is 36 times the amount of renters? The long term benefits of owning are abundant. These are important factors to consider for everyone, but especially the younger folks that are enjoying the benefits of Seattle’s attractive job market and competitive wages.

Where folks are having to compromise most due to affordability is commute times and settling in less urban neighborhoods. Some people, mainly millennials, have not been willing to give up living in the more core urban neighborhoods that have high walk scores and shorter commute times. That should be apt to change as rents are rising fastest in those areas. The advantages of moving out a little further and securing a home will start people on the track of building long term wealth. If you or anyone you know is currently renting and is considering a change, please let us know, as we would be happy to get your questions answered to help you make an informed decision.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link

A happy family of five just moved in to this house in mid-May. Two hard working parents, Brandy and Juan, with three teenagers were renting a 3-bedroom, 1-bath rambler in Edmonds and needed more space. It was time to make a move, and they had saved up a 3% down payment for a new home. Their budget was $400,000.

A happy family of five just moved in to this house in mid-May. Two hard working parents, Brandy and Juan, with three teenagers were renting a 3-bedroom, 1-bath rambler in Edmonds and needed more space. It was time to make a move, and they had saved up a 3% down payment for a new home. Their budget was $400,000. The first step in the home buying process was sitting down with their agent for the initial buyer consultation. This is where they discussed market conditions, desired features such as bedrooms, bathrooms and garage, and their budget. This lead them to explore which locations had the inventory that met their needs in order to stay within their budget. They had to marry these three key points – we like to call this the Triangle of Buyer Clarity. They then identified a few workable locations that had inventory which supported their desired features and their budget and went for it. This upfront research and partnership with their agent lead to Brandy and Juan finding success rather quickly, saving them money in an appreciating market, and a whole lot of strife.

The first step in the home buying process was sitting down with their agent for the initial buyer consultation. This is where they discussed market conditions, desired features such as bedrooms, bathrooms and garage, and their budget. This lead them to explore which locations had the inventory that met their needs in order to stay within their budget. They had to marry these three key points – we like to call this the Triangle of Buyer Clarity. They then identified a few workable locations that had inventory which supported their desired features and their budget and went for it. This upfront research and partnership with their agent lead to Brandy and Juan finding success rather quickly, saving them money in an appreciating market, and a whole lot of strife. First, how cool is this house? Super cool! That’s just how Paul and Ange feel about their newly purchased home in the Highland Park neighborhood of West Seattle. They just closed in early April and have already attended two neighborhood BBQ’s, received gifts from their new neighbors, discovered new parks and restaurants and, wait for it…shortened their commute.

First, how cool is this house? Super cool! That’s just how Paul and Ange feel about their newly purchased home in the Highland Park neighborhood of West Seattle. They just closed in early April and have already attended two neighborhood BBQ’s, received gifts from their new neighbors, discovered new parks and restaurants and, wait for it…shortened their commute. The point of these two stories is to debunk the sentiment we hear from time to time, that first-time home buyers cannot find success in our market. With a well-laid-out plan strategically constructed by the agent and client, we are seeing many happy stories for first-timers. The end result is putting these new homeowners on the path to building wealth, growing thriving communities, and making their house their home.

The point of these two stories is to debunk the sentiment we hear from time to time, that first-time home buyers cannot find success in our market. With a well-laid-out plan strategically constructed by the agent and client, we are seeing many happy stories for first-timers. The end result is putting these new homeowners on the path to building wealth, growing thriving communities, and making their house their home.

Dear Greater Seattle Home Buyer,

Dear Greater Seattle Home Buyer,

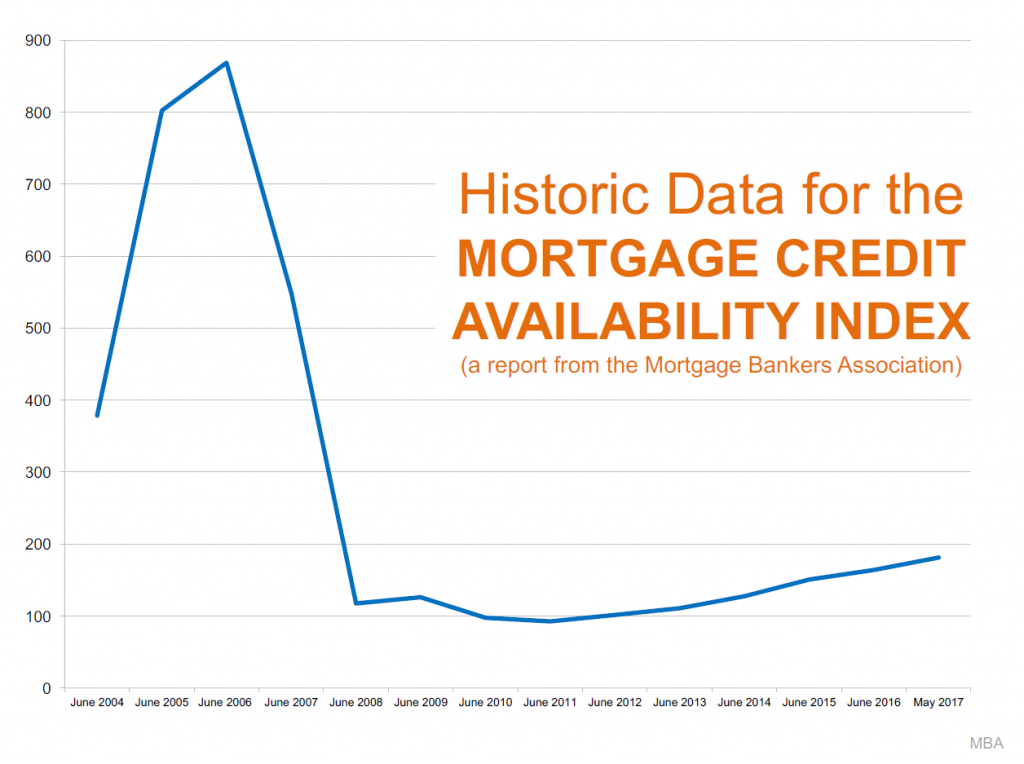

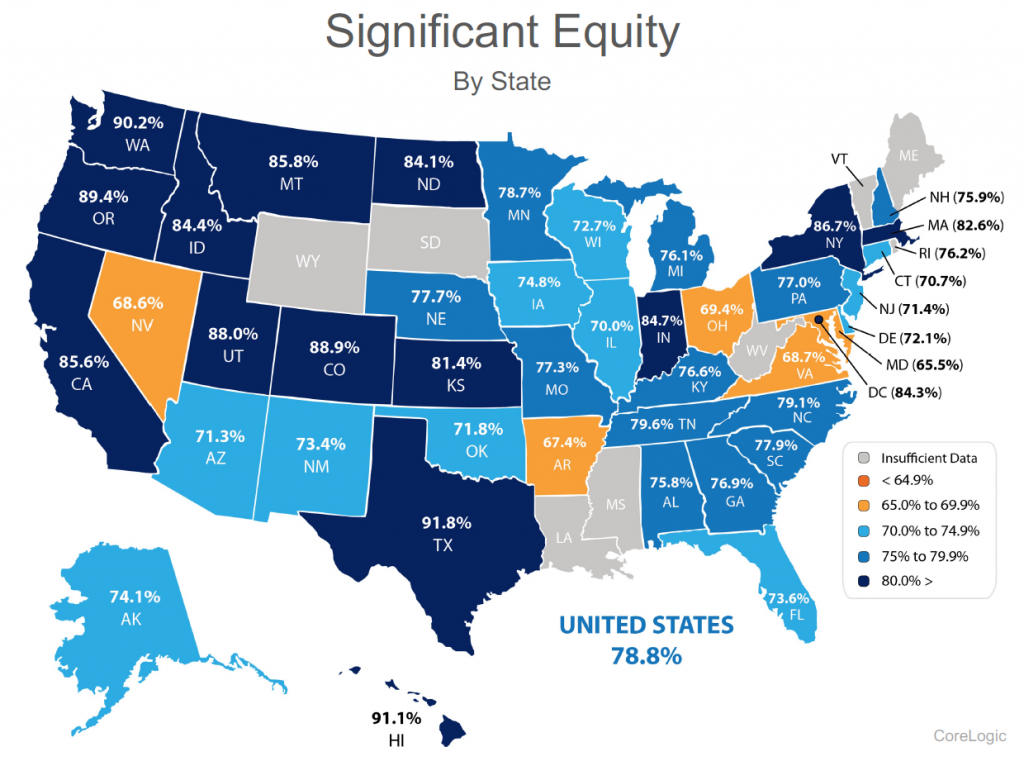

We understand that the recent increase in home prices has been big and that it might remind you of the previous up market before the crash. Hopefully digging into the topics above has shed some light on how it is different. According to

We understand that the recent increase in home prices has been big and that it might remind you of the previous up market before the crash. Hopefully digging into the topics above has shed some light on how it is different. According to